What is the Medicare tax rate for 2021?

How do you calculate Oasdi and Medicare taxes?

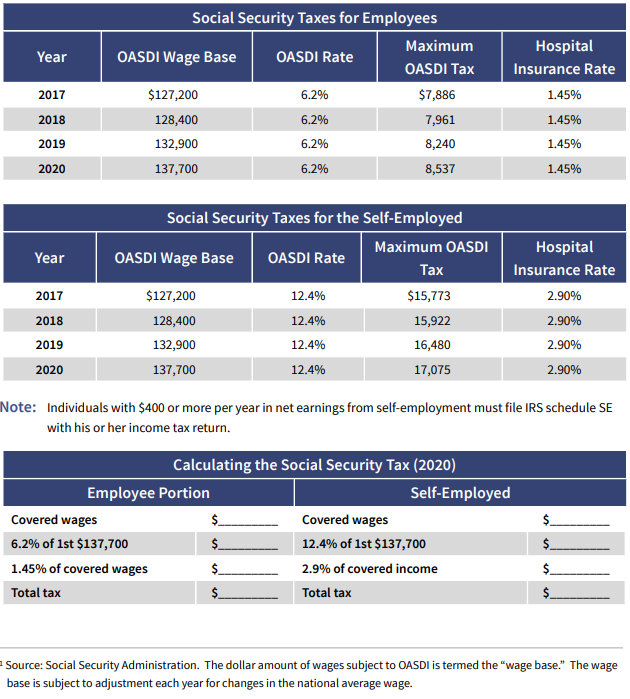

- The Social Security (OASDI) withholding rate is gross pay times 6.2% up to the maximum pay level for that year. ...

- The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. ...

- For a total of 7.65% withheld, based on the employee's gross pay.

What are the tax rates for Social Security and Medicare for 2020?

What is Medicare tax rate?

How much should my Oasdi be?

How much should I pay in Oasdi?

What are the Social Security and Medicare tax rates for 2022?

Do seniors pay taxes on Social Security income?

What is the maximum Social Security tax withholding for 2021?

How does the 3.8 Medicare tax work?

How is OASDI tax taken?

Because the OASDI tax is taken directly from payroll contributions, how much is paid by employees, employers, and self-employed workers vary. There are two ways in which people contribute to OASDI — through FICA or SECA.

What is an OASDI?

What Is OASDI Tax? OASDI is an acronym standing for Old Age, Survivors, and Disability Insurance. The OASDI tax funds a large portion of a program you’re likely already familiar with: Social Security. The money that employers collect from employee paychecks for the purposes of the OASDI tax, goes toward funding the Social Security program.

What is FICA tax?

Employers and employees contribute through FICA, which stands for the Federal Insurance Contributions Act. It taxes both parties, employers and employees, to contribute to Social Security and Medicare (aka the FICA tax). Employers pay matching contributions to the percentage of income that employees pay on a monthly basis.

What is the difference between Social Security Disability and Supplemental Security Income?

The Social Security Disability Insurance (SSDI) program provides benefits to qualifying contributors and their family members. And the Supplemental Security Income (SSI) program provides benefits to qualifying adults and their children.

Do self employed people pay FICA?

Instead of paying through FICA tax, self-employed people pay through SECA , also known as the Self-Employment Contributions Act.

What is the survivor benefit?

Survivors benefits. Survivors benefit amounts are based on the earnings of the deceased relative. The more the deceased relative paid into Social Security, the higher the survivors benefit would be. The monthly benefit amount is a percentage of the deceased’s basic Social Security benefit. Lump-Sum Death Payment.

What is the OASDI tax?

One common item you might find on your paycheck is OASDI tax. OASDI stands for old age, survivors, and disability insurance tax, and the money that your employer collects goes to the federal government in order to fund the Social Security program. Even for those who earn too little to owe income tax, OASDI tax usually gets deducted from ...

What is the maximum amount of Oasdi tax?

For 2020, the maximum amount on which OASDI tax gets applied is $137,700. That means that the most that you'll pay in OASDI tax is $8,537.40, or twice that if you're self-employed.

Who is Dan Caplinger?

Dan Caplinger has been a contract writer for the Motley Fool since 2006. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool.com.

What is the wage base limit for Social Security in 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers.

What is the FICA tax?

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.