When does open enrollment start for Medicare?

When’s the Medicare Open Enrollment Period? Every year, Medicare’s open enrollment period is October 15 - December 7. What’s the Medicare Open Enrollment Period? Medicare health and drug plans can make changes each year—things like cost, coverage, and what providers and pharmacies are in their networks. October 15 to December 7 is when all people with Medicare can change their Medicare ...

Does IRS require an open enrollment period?

Open enrollment is not required to be a certain length of time. Most employers have an open enrollment period of at least two to four weeks. ... the IRS has announced. During open enrollment ...

What to do during Medicare open enrollment?

• Screening for income guidelines, being mindful of programs that might help you pay for your Medicare, and helping with fraud and general complaints. • Talking to Medicare on your behalf. • Providing enrollment help when you first come onto Medicare and annually during open enrollment. • Making referrals to other agencies and programs.

How to change Medicare plans during open enrollment?

The period ends on December 7. During the Medicare Open Enrollment period, West Virginians can review their coverage options and make changes to their healthcare or prescription drug plans. “Medicare provides quality, affordable healthcare for West Virginia seniors across the state,” said Senator Manchin.

Can you enroll in Medicare Part D at any time?

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

Can you change Medicare Part D plans anytime?

When Can You Change Part D Plans? You can change from one Part D plan to another during the Medicare open enrollment period, which runs from October 15 to December 7 each year. During this period, you can change plans as many times as you want.

Is there a grace period for Medicare Part D?

A person enrolled in a Medicare plan may owe a late enrollment penalty if they go without Part D or other creditable prescription drug coverage for any continuous period of 63 days or more after the end of their Initial Enrollment Period for Part D coverage.

Can I add Part D during open enrollment?

If you do not enroll in Part D during your IEP, you can also enroll in or make changes to Part D coverage during the Fall Open Enrollment Period—but you may have a late enrollment penalty if you are using Fall Open Enrollment to enroll in Part D for the first time.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.

What is the cost of Part D Medicare for 2022?

$33Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

How do I avoid Part D Penalty?

3 ways to avoid the Part D late enrollment penaltyEnroll in Medicare drug coverage when you're first eligible. ... Enroll in Medicare drug coverage if you lose other creditable coverage. ... Keep records showing when you had other creditable drug coverage, and tell your plan when they ask about it.

Why was my Medicare Part D Cancelled?

Why was my Medicare plan coverage cancelled? Your Medicare Part D prescription drug plan (PDP) or Medicare Advantage plan (MA, MAPD, or SNP) coverage can be cancelled because of changes to the Medicare plan or because of something that you have done (or not done).

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

Are all Medicare Part D plans the same?

All Medicare drug coverage must give at least a standard level of coverage set by Medicare. However, plans offer different combinations of coverage and cost sharing. Plans offering Medicare drug coverage may differ in the drugs they cover, how much you have to pay, and which pharmacies you can use.

Do I need Medicare Part D if I have an advantage plan?

Nearly 90% of Medicare Advantage plans include Medicare Part D, but you can also purchase Part D separately if you have an Advantage plan that does not include it. About a third of Medicare beneficiaries had Medicare Advantage plans in 2019.

When Does Medicare Part D Open Enrollment Start?

Medicare Part D Open Enrollment 2018 started October 15. This date began the fall Open Enrollment for Medicare, also known as the Annual Election P...

When Does Medicare Part D Open Enrollment End?

The 2018 AEP for Medicare Part D ends December 7. From the AEP start date (October 15), this gives you about eight weeks to enroll in Medicare Part...

Options For Ending Your Part D Benefits

The Medicare Part D Enrollment Period also allows you to opt out of Part D drug benefits. You can: 1. Drop your PDP or MAPD coverage completely. 2....

When Am I Eligible For Medicare Part D?

The first time you’re eligible for Part D benefits is during your Medicare Part D Initial Enrollment Period (IEP). Your IEP for Part D is the same...

Requirements to Join A Medicare Part D Plan

To enroll in Part D during the fall Open Enrollment or other election period, you must live in a service area where plans are available. If you wan...

Switching to A Medicare Advantage Prescription Drug Plan (MAPD)

Whether you’re switching from Original Medicare or from a standalone drug plan to an MAPD, making the switch not only allows you to get drug benefi...

Switching from An Mapd to A PDP

If you’re currently enrolled in an MAPD and you switch to a standalone PDP during Medicare Part D Open Enrollment 2018, you will be disenrolled fro...

Get Help Choosing A Medicare Part D Plan

Because Medicare Part D plans are only available through private insurance companies, the cost, pharmacy network, and drug formulary can vary from...

How many enrollment periods are there for Medicare Part D?

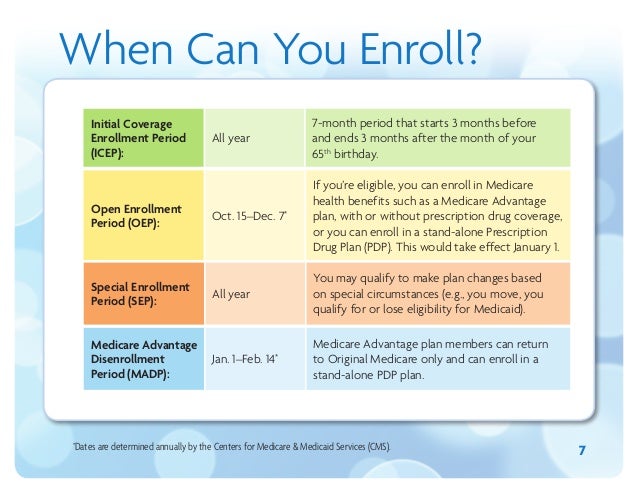

There are three different enrollment periods for Medicare Part D. Each one is unique to you, the beneficiary. It’s important to understand these enrollment periods to avoid late penalties that will stay with you forever.

What is a special enrollment period?

Life happens for everyone; Special Enrollment Periods are for when certain situations or events happen in life. SEPs give you chances to make changes to your Part D plan or Medicare Advantage plan.

When is the AEP period?

Each fall the Annual Election Period runs from October 15th through December 7th. AEP is commonly mistaken for the Open Enrollment Period.

When does IEP end?

Everyone’s Initial Enrollment Period is different, it’s specific to your 65th birthday month. Your IEP starts 3 months before your 65th birthday and ends 3 months after your birthday month.

What is an AEP?

AEP is commonly mistaken for the Open Enrollment Period. During AEP, members can openly make changes to their current coverage. This includes enrolling in a Part D drug plan or switching from one Part D plan to another Part D plan that better suits your medical needs.

When does Medicare change plans?

Medicare health and drug plans can make changes each year—things like cost, coverage, and what providers and pharmacies are in their networks. October 15 to December 7 is when all people with Medicare can change their Medicare health plans and prescription drug coverage for the following year to better meet their needs.

What is an ANOC in Medicare?

People in a Medicare health or prescription drug plan should always review the materials their plans send them, like the “Evidence of Coverage” (EOC) and “Annual Notice of Change” (ANOC). If their plans are changing, they should make sure their plans will still meet their needs for the following year.

What is Medicare's general enrollment period?

Medicare’s general enrollment period is for people who didn’t sign up for Medicare Part B when they were first eligible, and who don’t have access to a Medicare Part B special enrollment period. It’s also for people who have to pay a premium for Medicare Part A and didn’t enroll in Part A when they were first eligible.

When will Medicare open enrollment start in 2022?

Medicare open enrollment for 2022 coverage starts on October 15, 2021, and continues through December 7. Learn how you can change your Medicare coverage outside of the fall open enrollment period.

How much will Medicare cost in 2021?

The standard Part B premium for 2021 is $148.50 per month. The increase in the Part B premiums was limited by the short-term government spending bill that was signed into law on October 1, 2020. The Part B premium for most enrollees was $144.60/month in 2020, and the spending bill capped the increase for 2021 at a quarter of what it would otherwise have been. Earlier in 2020, the Medicare Trustees Report had projected a Part B premiums of $153.30 per month for most enrollees in 2021. The actual price that people pay can also also be limited by the Social Security cost of living adjustment (COLA) that beneficiaries receive, but the 1.3% COLA for 2021 was adequate to allow the full standard Part B premium to be deducted from most beneficiaries’ Social Security checks.

How much is coinsurance for skilled nursing in 2021?

After the first 20 days, your skilled nursing facility coinsurance in 2021 is $185.50 per day for days 21-100 (after that, Medicare no longer covers skilled nursing facility charges, so you’ll pay the full cost). Supplemental coverage, including Medigap plans, is designed to pay the Part A coinsurance on your behalf.

What is the Medicare Advantage Plan 2021?

$7,550 is the upper limit; the average Medicare Advantage plan tends to have an out-of-pocket cap below the maximum that the government allows.

When does Medicare coverage take effect?

If you enroll during the general enrollment period, your coverage will take effect July 1. Learn more about Medicare’s general enrollment period. Back to top.

Can you be denied Medigap coverage?

During your initial Medigap enrollment period (the six months starting with the month you’re at least 65 years old and enrolled in Medicare A and B) you can’t be denied Medigap coverage or be charged more for the coverage because of your medical history.

What is a CRL in Medicare?

Plan Sponsors are responsible for ensuring their Covered Retiree List (CRL) is always current as CMS' RDS Center verifies the Medicare Part D entitlement and enrollment for each retiree listed in the CRL against MBD. Remember, in order to receive subsidy, a retiree must be eligible for but not enrolled in Medicare Part D. When a Valid Initial Retiree List or a Monthly Retiree List is submitted and processed by CMS' RDS Center, the system sends the Plan Sponsor a Retiree Response File. The Retiree Response File contains all of the original fields sent by the Plan Sponsor plus the Determination Indicator, Subsidy Dates, and Reason Codes.

Does Medicare Part D have an open enrollment period?

That's right, Medicare Part D Open Enrollment Period (OEP) can have a significant impact on your ability to receive subsidy for a covered retiree. If a Plan Sponsor is already participating in the Retiree Drug Subsidy (RDS) Program or is considering submitting an RDS Application for the first time, it is crucial to understand the impact of OEP. Plan Sponsors should have a plan for educating retirees about creditable coverage prior to the start of OEP as well as a plan for establishing, monitoring, and managing Qualifying Covered Retirees (QCRs) during OEP and throughout the plan year.

When does Medicare open enrollment start?

Your Medicare Supplement Open Enrollment Period begins the 1st day of the month you turn 65 years old, and your Part B has become effective. Many beneficiaries take advantage of this Medicare sign up period.

How many enrollment periods are there for Medicare?

There are three enrollment periods for people signing up for benefits who are already enrolled in Original Medicare. During open enrollment, you can make changes to your Medicare plans and add additional coverage.

What is the ICEP period?

The ICEP is your first opportunity to choose a Medicare Advantage plan instead of Original Medicare. During the ICEP, you can also sign up for prescription drug coverage. If you enroll in Part B when you turn 65, your ICEP is the same as your IEP.

What is a SEP in Medicare?

A SEP is when you can make changes to your Medicare Advantage and Prescription Drug coverage when certain events happen in your life. Events include situations such as if you move or lose other insurance coverage. An example is losing health insurance ...

Why is Medicare enrollment confusing?

Medicare Enrollment Periods can be confusing because different enrollment periods have different dates for various purposes. There are many enrollment periods for people signing up for benefits for the first time. If you’re receiving Social Security or Railroad Retirement benefits when you turn 65, you’ll automatically be enrolled in Medicare.

What is open enrollment for Medicare 2021?

These enrollment periods fall into two categories. First, open enrollment is available to anyone eligible for Medicare. Then, Special Enrollment Periods. If you want to change the coverage you currently have, you can do so during one ...

How long does an OEP last?

Your OEP lasts for six months; you’ll be granted Medicare Supplement Guaranteed Issue Rights. During this time, you can sign up for a Medicare Supplement Plan, also known as Medigap. If you didn’t sign up for a Medicare Advantage or a drug plan during your IEP, the AEP is your next chance to make changes.

What happens if Medicare pays late enrollment?

If Medicare’s contractor decides that your late enrollment penalty is correct, the Medicare contractor will send you a letter explaining the decision, and you must pay the penalty.

What is the late enrollment penalty for Medicare?

Part D late enrollment penalty. The late enrollment penalty is an amount that's permanently added to your Medicare drug coverage (Part D) premium. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over, there's a period of 63 or more days in a row when you don't have Medicare drug coverage or other.

What happens if Medicare decides the penalty is wrong?

What happens if Medicare's contractor decides the penalty is wrong? If Medicare’s contractor decides that all or part of your late enrollment penalty is wrong, the Medicare contractor will send you and your drug plan a letter explaining its decision. Your Medicare drug plan will remove or reduce your late enrollment penalty. ...

What is creditable prescription drug coverage?

creditable prescription drug coverage. Prescription drug coverage (for example, from an employer or union) that's expected to pay, on average, at least as much as Medicare's standard prescription drug coverage. People who have this kind of coverage when they become eligible for Medicare can generally keep that coverage without paying a penalty, ...

How long do you have to pay late enrollment penalty?

You must do this within 60 days from the date on the letter telling you that you owe a late enrollment penalty. Also send any proof that supports your case, like a copy of your notice of creditable prescription drug coverage from an employer or union plan.

How long does it take for Medicare to reconsider?

In general, Medicare’s contractor makes reconsideration decisions within 90 days. The contractor will try to make a decision as quickly as possible. However, you may request an extension. Or, for good cause, Medicare’s contractor may take an additional 14 days to resolve your case.

Do you have to pay a penalty on Medicare?

After you join a Medicare drug plan, the plan will tell you if you owe a penalty and what your premium will be. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.