What is the Medicaid budget and Expenditure System?

Currently state expenditures are tracked through the Medicaid Budget and Expenditure System (MBES). CMS is planning for the migration of the MBES to a newly redesigned MACBIS Financial system in the near future.

How much of the federal budget is spent on Medicare?

In 2018, Medicare spending (net of income from premiums and other offsetting receipts) totaled $605 billion, accounting for 15 percent of the federal budget (Figure 1). In 2018, Medicare benefit payments totaled $731 billion, up from $462 billion in 2008 (Figure 2) (these amounts do not net out premiums and other offsetting receipts).

How is Medicare and Medicaid funded?

Medicaid is funded by the federal government and each state. Both programs received additional funding as part of the fiscal relief package in response to the 2020 economic crisis. Medicare is administered by the Centers for Medicare & Medicaid Services (CMS), a component of the Department of Health and Human Services.

What is the future of Medicare spending?

Medicare spending is a major driver of long-term federal spending and is projected to rise from 4 percent of gross domestic product (GDP) in fiscal year 2020 to about 6 percent in fiscal year 2051 due to the retirement of the baby-boom generation and the rapid growth of per capita healthcare costs. What Are the Components of Medicare?

What percentage of the budget is Medicare?

12 percentKey Facts. Medicare is the second largest program in the federal budget: 2020 Medicare expenditures, net of offsetting receipts, totaled $776 billion — representing 12 percent of total federal spending.

What is the Medicare budget for 2020?

Medicare spending totaled $829.5 billion in 2020, representing 20% of total health care spending. Medicare spending increased in 2020 by 3.5%, compared to 6.9% growth in 2019. Fee-for-service expenditures declined 5.3% in 2020 down from growth of 2.1% in 2019.

How much did the US spend on Medicaid in 2019?

around 639 billion U.S. dollarsMedicaid expenditure totaled around 639 billion U.S. dollars in 2019, increasing for the 13th consecutive year. The federal government paid approximately 60 percent of total Medicaid expenditures in 2019, with states picking up the other 40 percent.

How much did the US spend on Medicare in 2019?

$630 billionMedicare Spending Projections CBO projects net Medicare spending to increase from $630 billion in 2019 to $1.3 trillion in 2029 (Figure 6).

What is the largest portion of the US budget?

Social Security takes up the largest portion of the mandatory spending dollars. In fact, Social Security demands $1.046 trillion of the total $2.739-trillion mandatory spending budget. It also includes programs like unemployment benefits and welfare.

Where does most of the US budget go?

More than half of FY 2019 discretionary spending went for national defense, and most of the rest went for domestic programs, including transportation, education and training, veterans' benefits, income security, and health care (figure 4).

Is Obamacare federally funded?

Subtle Differences. The majority of people buying Obamacare health insurance get help paying for it in the form of subsidies from the federal government,6 so it can be confusing as to how government-subsidized private health insurance (Obamacare) is really all that different from government-funded Medicaid.

How much of US GDP is spent on healthcare?

19.7%In 2020, U.S. national health expenditure as a share of its gross domestic product (GDP) reached an all time high of 19.7%. The United States has the highest health spending based on GDP share among developed countries. Both public and private health spending in the U.S. is much higher than other developed countries.

How much has Covid cost the US government?

How is total COVID-19 spending categorized?AgencyTotal Budgetary ResourcesTotal OutlaysDepartment of Labor$726,058,979,281$673,702,382,650Department of Health and Human Services$484,524,400,000$279,893,610,481Department of Education$308,328,604,971$127,408,234,7359 more rows

How much does the US spend on Medicaid?

$671.2 billionHistorical NHE, 2020: Medicaid spending grew 9.2% to $671.2 billion in 2020, or 16 percent of total NHE. Private health insurance spending declined 1.2% to $1,151.4 billion in 2020, or 28 percent of total NHE.

Does Medicare run a deficit?

Last year, the Medicare Part A fund ran a deficit of $5.8 billion, and that excess of spending over revenue is expected to continue until it finally runs dry.

Is Medicare underfunded?

Politicians promised you benefits, but never funded them.

What is Medicare budget?

Budget Basics: Medicare. Medicare is an essential health insurance program serving millions of Americans and is a major part of the federal budget. The program was signed into law by President Lyndon B. Johnson in 1965 to provide health insurance to people age 65 and older. Since then, the program has been expanded to serve the blind and disabled.

How is Medicare funded?

Medicare is financed by two trust funds: the Hospital Insurance (HI) trust fund and the Supplementary Medical Insurance (SMI) trust fund. The HI trust fund finances Medicare Part A and collects its income primarily through a payroll tax on U.S. workers and employers. The SMI trust fund, which supports both Part B and Part D, ...

How is Medicare self-financed?

One of the biggest misconceptions about Medicare is that it is self-financed by current beneficiaries through premiums and by future beneficiaries through payroll taxes. In fact, payroll taxes and premiums together only cover about half of the program’s cost.

What are the benefits of Medicare?

Medicare is a federal program that provides health insurance to people who are age 65 and older, blind, or disabled. Medicare consists of four "parts": 1 Part A pays for hospital care; 2 Part B provides medical insurance for doctor’s fees and other medical services; 3 Part C is Medicare Advantage, which allows beneficiaries to enroll in private health plans to receive Part A and Part B Medicare benefits; 4 Part D covers prescription drugs.

What percentage of GDP will Medicare be in 2049?

In fact, Medicare spending is projected to rise from 3.0 percent of GDP in 2019 to 6.1 percent of GDP by 2049. That increase in spending is largely due to the retirement of the baby boomers (those born between 1944 and 1964), longer life expectancies, and healthcare costs that are growing faster than the economy.

How much did Medicare cost in 2019?

In 2019, it cost $644 billion — representing 14 percent of total federal spending. 1. Medicare has a large impact on the overall healthcare market: it finances about one-fifth of all health spending and about 40 percent of all home health spending. In 2019, Medicare provided benefits to 19 percent of the population. 2.

What percentage of Medicare is from the federal government?

The federal government’s general fund has been playing a larger role in Medicare financing. In 2019, 43 percent of Medicare’s income came from the general fund, up from 25 percent in 1970. Looking forward, such revenues are projected to continue funding a major share of the Medicare program.

What percentage of the federal budget is Medicaid?

Medicaid is the third largest mandatory program in the federal budget, accounting for 7 percent of federal spending in 2020, and represents a third of state budgets, on average. As such an important component of government spending and one of the largest payers of healthcare coverage, it has the unique opportunity to be a driver of change and innovation in healthcare.

What is Medicaid financed by?

Medicaid is a health insurance program targeted to lower-income recipients that is financed jointly by the federal government and the states . This budget explainer describes what Medicaid is, how it is funded, and who benefits from it.

What is the difference between medicaid and medicare?

Persons with disabilities and the elderly make up 23 percent of the program’s enrollees. While Medicare is the primary health insurance program for most people over the age of 65, certain people are eligible for both programs . Those dual- eligible beneficiaries tend to experience high rates of chronic illness. For example, 49 percent of those beneficiaries receive long-term care services, while 60 percent have multiple chronic conditions.

What percentage of Medicaid is children?

Even though children make up about 40 percent of Medicaid beneficiaries, they account for less than 20 percent of the program’s spending. Conversely, the elderly and people with disabilities make up one-quarter of beneficiaries but account for more than half of Medicaid spending.

What is the FMAP formula?

The formula that governs a majority of government funding is called the federal medical assistance percentage (FMAP), and takes into account differences in per capita income among the states. The FMAP ranges from a minimum of 50 percent in wealthier states such as Alaska to 78 percent in Mississippi. INTERACTIVE MAP.

How much did the US government spend on health insurance in 2020?

Provided health insurance for about 73 million Americans, or about 22 percent of the U.S. population. Cost the federal government $458 billion, though spending in 2020 spiked due to the coronavirus pandemic and legislation to mitigate its impact. Represented about one-fifth of all health spending in the United States.

How many children are covered by medicaid?

Medicaid provides health insurance for vulnerable populations. Approximately one-third of the nation’s 78 million children received their health insurance through Medicaid or CHIP, which extends Medicaid benefits to children of low-income families who make too much money to qualify for the traditional Medicaid program.

What is MBES in Medicaid?

The MBES is a web-based application the Medicaid and CHIP state agencies use to enter and report budgeted and actual expenditures for Medicaid and CHIP for each fiscal period in addition to the actual quarterly expenditures that occur .

What is CMS 37?

CMS-37 is a quarterly financial report submitted by the State which provides a statement of the state's Medicaid funding requirements for a certified quarter and estimates and underlying assumptions for two fiscal years (FYs) – the current FY and the budget FY. In order to receive Federal financial participation, the state must certify that the requisite matching state and local funds are, or will be, available for the certified quarter. This information is supplied to the Centers for Medicare & Medicaid Services electronically through the Medicaid Budget and Expenditure System (MBES) and is reviewed by CMS. See the Medicaid Program Budget Report (CMS-37) page for additional information.

What percentage of Medicare is spending?

Key Facts. Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the Medicare Hospital Insurance (Part A) trust fund is projected to be depleted in 2026, the same as the 2018 projection.

How much does Medicare cost?

In 2018, Medicare spending (net of income from premiums and other offsetting receipts) totaled $605 billion, accounting for 15 percent of the federal budget (Figure 1).

Why is Medicare spending so slow?

Slower growth in Medicare spending in recent years can be attributed in part to policy changes adopted as part of the Affordable Care Act (ACA) and the Budget Control Act of 2011 (BCA). The ACA included reductions in Medicare payments to plans and providers, increased revenues, and introduced delivery system reforms that aimed to improve efficiency and quality of patient care and reduce costs, including accountable care organizations (ACOs), medical homes, bundled payments, and value-based purchasing initiatives. The BCA lowered Medicare spending through sequestration that reduced payments to providers and plans by 2 percent beginning in 2013.

What is the average annual growth rate for Medicare?

Average annual growth in total Medicare spending is projected to be higher between 2018 and 2028 than between 2010 and 2018 (7.9 percent versus 4.4 percent) (Figure 4).

What has changed in Medicare spending in the past 10 years?

Another notable change in Medicare spending in the past 10 years is the increase in payments to Medicare Advantage plans , which are private health plans that cover all Part A and Part B benefits, and typically also Part D benefits.

What is excess health care cost?

Over the next 30 years, CBO projects that “excess” health care cost growth—defined as the extent to which the growth of health care costs per beneficiary, adjusted for demographic changes, exceeds the per person growth of potential GDP (the maximum sustainable output of the economy)—will account for half of the increase in spending on the nation’s major health care programs (Medicare, Medicaid, and subsidies for ACA Marketplace coverage), and the aging of the population will account for the other half.

How much did Medicare increase in 2018?

As a share of total Medicare benefit spending, payments to Medicare Advantage plans for Part A and Part B benefits increased by nearly 50 percent between 2008 and 2018, from 21 percent ($99 billion) to 32 percent ($232 billion) of total spending, as enrollment in Medicare Advantage plans increased over these years.

What is the purpose of Medicare trustees report?

The primary purpose of the report is to analyze whether each of the two trust funds has sufficient income and assets to enable the payment of Medicare benefits and administrative expenses. The MedicareTrusteesReport necessarily has a trust fund perspective. In contrast, the annual budget of the United States includes estimates of projected Medicare incomeand expenditures,but reports on how all three parts of the program

Is Medicare a financial or actuarial issue?

The evaluation of Medicare’s financial status is a technical, actuarial issue . Medicare’s impact on the Federal budget is a similarly narrow and straightforward calculation. In contrast, assessingthe long-range sustainability of Medicare is anything but straightforward. Sustainabilityis much more difficult to assess because it is a very broad issue and ultimately one that involves societal values. There is no agreed-upon standard by which to measure the sustain-ability of Medicare—indeed, there is considerable confusion about the differences betweentheconceptsof sustainability, financial status, and budget impact.

What is the FY 2022 HHS?

The FY 2022 targets and most recent activity for key CMS performance measures are included in the FY 2022 Congressional Justification , as required by the Government Performance and Results Act (GPRA) of 1993 and the GPRA Modernization Act of 2010. CMS GPRA performance measures are included and officially reported in the FY 2022 HHS Annual ...

Is the CMS FY 2022 budget finalized?

The CMS FY 2022 budget request has been finalized and submitted to Congress. This Congressional Justification of the budget presents the resource requests for programs, focuses on key performance measures, and summarizes program results.

How does the Budget improve the long term sustainability of Medicare and Medicaid?

Other proposals in the Budget will improve the long-term sustainability of Medicare and Medicaid by increasing the efficiency of health care delivery without compromising the quality of care for the elderly, children, low-income families, and people with disabilities.

How much money did the Medicare budget save?

Most notably, the Budget saves $77.2 billion by reforming Medicare Advantage payments to improve efficiency and achieve sustainability of the program. Other proposals increase the value of Medicare payments to providers and address the rising costs of pharmaceuticals.

What is the budget for program management?

The Budget for Program Management enables reforms in health care delivery, while continuing to support the ongoing Medicare, Medicaid, and CHIP programs in CMS, as well as the Health Insurance Marketplaces. The request includes investments to address growing Medicare appeals workloads and improve the capacity and security of CMS’ information systems.

How much is the CMS budget for 2017?

The FY 2017 Budget estimate for the Centers for Medicare & Medicaid Services (CMS) is $1.0 trillion in mandatory and discretionary outlays, a net increase of $26 billion above the FY 2016 level.

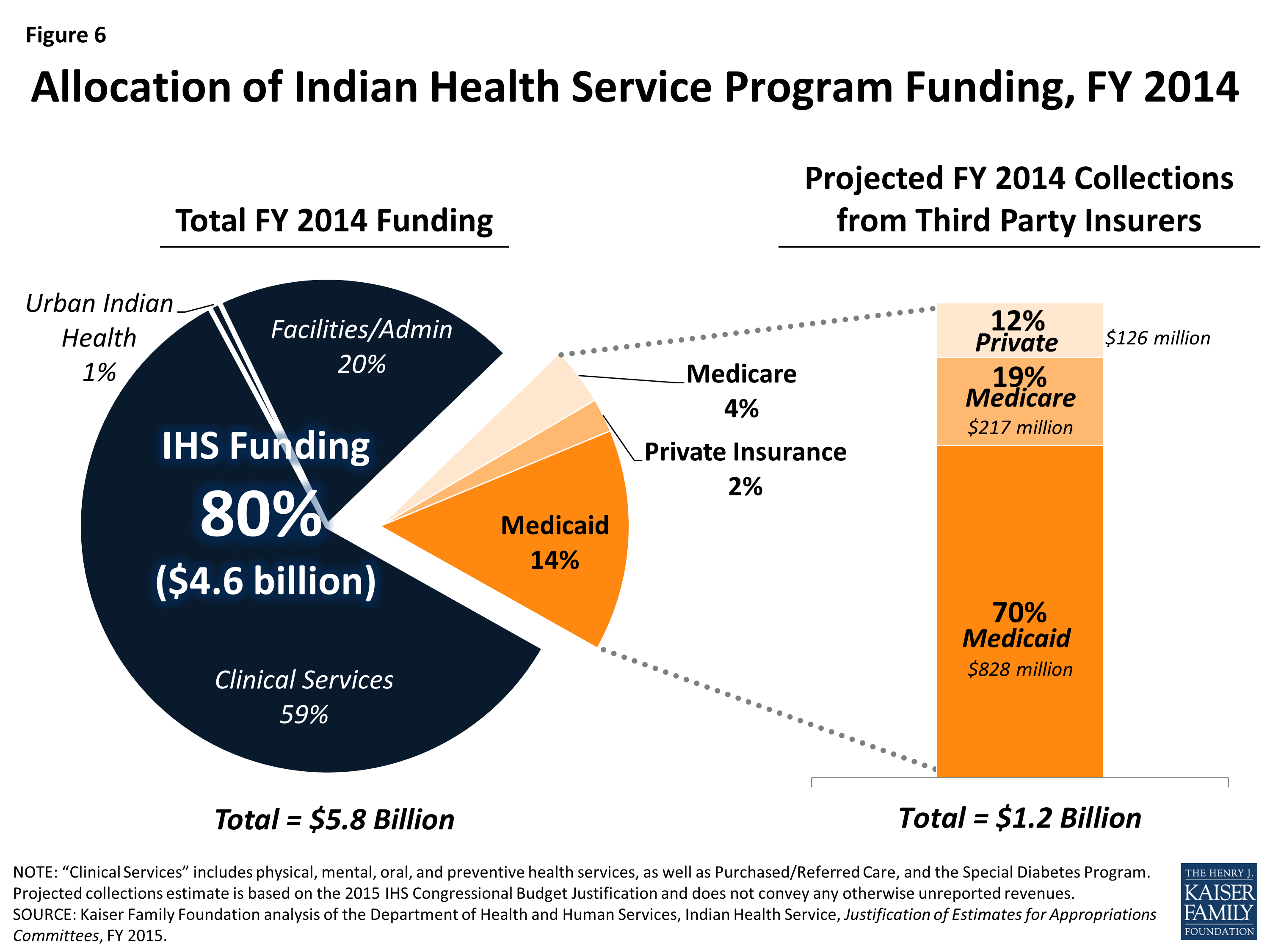

What is the budget proposal for private insurance?

The Budget proposes a series of private insurance proposals to promote transparency in health care and implement technical fixes to improve the administration of the Affordable Care Act. The Budget strengthens consumer protections, enhances CMS’ ability to verify Marketplace eligibility, and provides for a consistent definition of “Indian” to ensure all American Indian and Alaska Natives eligible for IHS services will be treated equally with respect to the Act’s coverage provisions, including access to qualified health plans without cost‑sharing requirements.