How high will the Medicare Part B deductible get?

Jun 14, 2020 · The Cost of the Part B Deductible. How much will this deductible cost you? Most seniors pay $198 a year for their deductible. This is only due once each year, and then after that you can start to receive benefits for Medicare Part B services.

What is the maximum premium for Medicare Part B?

A $5 deductible is also imposed under Medicare Part B and is doubled to $203 in 2021. Medicare Part C Changes for 2021: Fees for Plan B vary, and you must select a private plan provider. Medicare Part C combines Medicare Parts A and B elements and adds coverage for benefits not included in other plans.

Who pays part B Medicare?

Sep 01, 2021 · To be clear, Medicare premium tax deductions don’t only apply to Original Medicare. If the amount of your total medical and dental deductions is greater than 7.5% of your gross income, you can deduct premiums for your Medicare Part A (if applicable), Part B, Part D, Medicare Advantage, or Medicare Supplement plan as well.

How much is the late enrollment penalty for Part B?

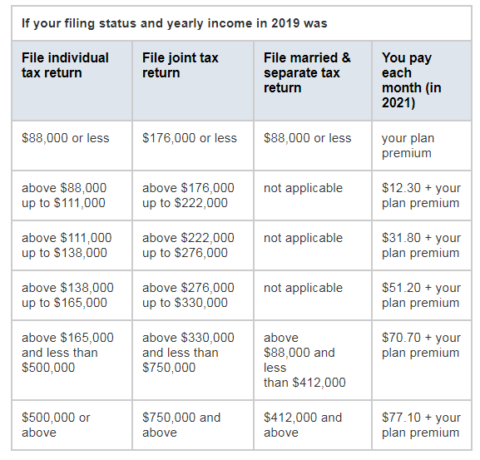

Jul 29, 2019 · Does Medicare Part B go by income? Medicare premiums are based on your modified adjusted gross income, or MAGI. If your MAGI for 2019 was less than or equal to the “higher-income” threshold — $88,000 for an individual taxpayer, $176,000 for a married couple filing jointly — you pay the “standard” Medicare Part B rate for 2021, which is $148.50 a month.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

What is the Medicare Part B deductible for 2021?

The Medicare Part B deductible 2021 is an expense that seniors need to be aware of before they enroll in Part B or Original Medicare. It is an expense they will be responsible for and that can add to their overall medical expenses for the year.

How much does Medicare pay for seniors?

Most seniors pay $198 a year for their deductible. This is only due once each year, and then after that you can start to receive benefits for Medicare Part B services. That means you’ll be covered for anything that falls under the Part B umbrella of coverage according to your Original Medicare plan. The price of the annual deductible is completely ...

Does Medicare cover coinsurance?

Your insurance plan Original Medicare will cover you for the majority of these costs, but you have to pay some of the cost as well. The coinsurance tends to be 20% of the total cost of the service. Keep in mind that Part B costs and other Medicare costs will change from year to year. They tend to increase slightly every year.

Is a senior health plan considered essential?

This is a wide-ranging plan, covering many different medical expenses for you, and it is easy to see how it can be considered essential medical coverage. For most seniors, these are expenses that are very common for them and that will need to be covered if they are going to save some serious money on healthcare.

Does Part B deductible increase?

You may have to pay a monthly premium for your Advantage plan that is determined by the insurance company, but the Part B deductible remains the same. The deductible changes in price every so often. Usually, once a year it will increase. The increase is not significant, though. It tends to be a few dollars, and that is what we expect ...

PinPoints

Medicare made some modifications to the 2021 deductible. The rising cost of healthcare necessitates an increase in Medicare premiums and deductibles.

What changes are made to Medicare Part A in 2021?

Medicare Part A covers hospitalization, nursing home care, and a portion of home healthcare.

The adjustments to Medicare Part B for 2021 are as follows

Part B of Medicare covers physician costs, outpatient treatments, some home health care services, medical equipment, and medications.

Medicare Part D will have the following changes in 2021

Medicare prescription medication coverage is another name for Medicare Part D.

What changes are coming to Medigap in 2021?

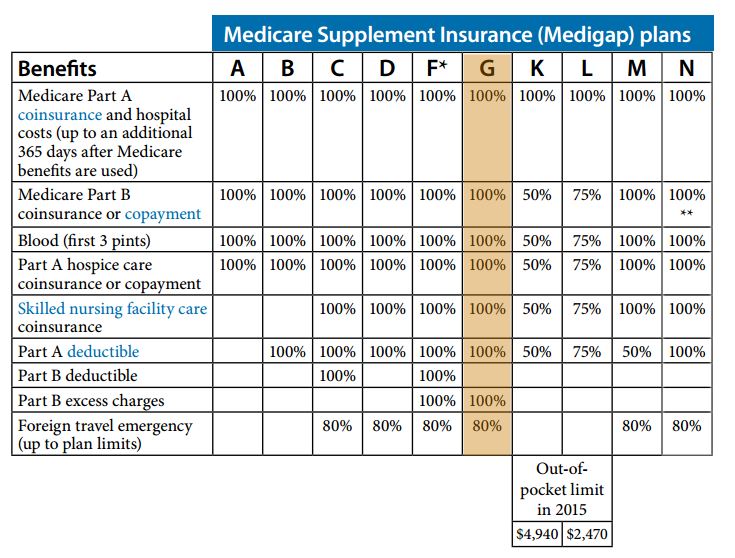

Supplemental Medicare or Medigap insurance covers a portion of your Medicare premiums. Supplements to Medicare can help pay the cost of premiums and deductibles.

To fight the coronavirus (COVID-19)

On March 20, 2020, Medicare was modified to fulfil the needs of enrollees.

Conclusion

Apart from increased Medicare premiums and deductibles, there are more ways to save money on healthcare.

What is deductible medical expenses?

Any costs associated with the treatment or diagnosis of a medical condition or an injury can be deducted. This includes preventive care and the cost of any medical equipment or supplies. The IRS provides a list of deductible medical expenses. The list includes some items you might not expect.

What are the different types of deductions?

What Are the Four Major Categories of Tax Deductions? 1 Business Deductions 2 Standard Deductions 3 Above the Line Deductions 4 Below the Line Deductions

What is the purpose of standard deductions?

The purpose of standard tax deductions is to allow taxpayers to claim the standard amount set by the IRS. They can claim this amount for the deduction if they haven’t itemized deductible expenses. This amount changes by year, and the IRS website has a tool you can use to calculate your standard deduction.

Can Medicare be deducted from taxes?

Your Medicare and Medigap premiums can be deducted from your taxes as a below the line deduction. This requires you to itemize the premiums. If they, along with your other medical costs, exceed 7.5% of your Adjusted Gross Income (AGI), you qualify for the deduction.

Is Medicare premium tax deductible?

The answer is yes; some Medicare premiums are tax-deductible. Most insurance premiums qualify for Form 1040’s Schedule A deductions but only over a certain threshold, including some Medicare premiums. This amount will be subtracted from your gross income. Your taxable income (after the deductions are made) will ultimately be used to determine ...

Is Medicare free?

Medicare isn't free and we understand your desire to save money wherever you can. If you've been considering a Medigap plan but have been hesitant because of the price, we can help you compare plans and rates. Please call us at the number above or fill out our online rate form to get started.

Can Medicare expenses be deducted?

Therefore, not all regularly incurred costs are eligible for deduction. These federal deductions decrease the amount of income subject to federal income tax and reduce the burden during tax season. Therefore, many American citizens — including Medicare beneficiaries, are always on the lookout for appropriate tax deductions.

Does Medicare Part B go by income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. If your MAGI for 2019 was less than or equal to the “higher-income” threshold — $88,000 for an individual taxpayer, $176,000 for a married couple filing jointly — you pay the “standard” Medicare Part B rate for 2021, which is $148.50 a month.

At what income level do Medicare premiums increase?

If you file your taxes as “married, filing jointly” and your MAGI is greater than $170,000, you’ll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $85,000, you’ll pay higher premiums.

Does Social Security count as income for Medicare?

All types of Social Security income, whether taxable or not, received by a tax filer counts toward household income for eligibility purposes for both Medicaid and Marketplace financial assistance.

Does income affect Medicare?

Medicare is available to all Americans who are age 65 or older, regardless of income. However, your income can impact how much you pay for coverage. If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change.

Why is Medicare Part B so expensive?

Part B deductible & coinsurance Find out what you pay for Part B covered services.

Does Medicare Part B get deducted from Social Security check?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Is Medicare Part B premium tax deductible?

Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction. Since it’s not mandatory to enroll in Part B, you can be “rewarded” with a tax break for choosing to pay this medical expense.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

What is 20% coinsurance?

In this instance, you’d be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%. The coinsurance amount you pay is 20% of the amount Medicare approved. This approved amount is the maximum amount your healthcare provider is allowed to charge you for an item or service. If you refer back to your broken arm example.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

How much does Medicare cover if you have met your deductible?

If you already met your deductible, you’d only have to pay for 20% of the $80. This works out to $16. Medicare would then cover the final $64 for the care.

Does Medicare Advantage have coinsurance?

They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage.