How high will the Medicare Part B deductible get?

In 2021, the base cost is $148.50 per month for people earning less than $88,000 per year or couples earning less than $176,000 per year. So premiums increase in direct proportion to income. Deductible A $5 deductible is also imposed under Medicare Part B and is doubled to $203 in 2021. Medicare Part C Changes for 2021:

What is the maximum premium for Medicare Part B?

Jun 14, 2020 · Medicare Part B Deductible 2021. If you enroll in Medicare, either voluntarily or involuntarily, you have some expenses to pay. You have your monthly premium and the annual deductible to pay, as well as some copays and coinsurance costs. The Medicare Part B deductible 2021 is an expense that seniors need to be aware of before they enroll in Part B or Original …

Who pays part B Medicare?

Nov 12, 2021 · Each year the Medicare Part B premium, deductible, and coinsurance rates are determined according to the Social Security Act. The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the …

How much is the late enrollment penalty for Part B?

If you have questions about your Part B premium, call Social Security at 1-800-772-1213. TTY users can call 1-800-325-0778. If you pay a late enrollment penalty, these amounts may be higher. Part B deductible—$233 per year. Medicare Advantage Plans (Part C) & Medicare Drug Plans (Part D) Premiums. Visit Medicare.gov/plan-compare to get plan premiums.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What is the standard Part B premium for 2021?

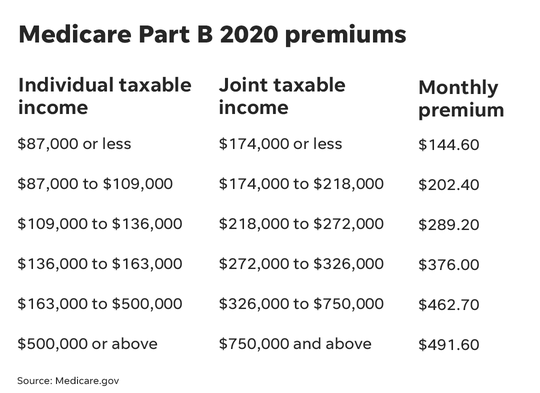

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

PinPoints

Medicare made some modifications to the 2021 deductible. The rising cost of healthcare necessitates an increase in Medicare premiums and deductibles.

What changes are made to Medicare Part A in 2021?

Medicare Part A covers hospitalization, nursing home care, and a portion of home healthcare.

The adjustments to Medicare Part B for 2021 are as follows

Part B of Medicare covers physician costs, outpatient treatments, some home health care services, medical equipment, and medications.

Medicare Part D will have the following changes in 2021

Medicare prescription medication coverage is another name for Medicare Part D.

What changes are coming to Medigap in 2021?

Supplemental Medicare or Medigap insurance covers a portion of your Medicare premiums. Supplements to Medicare can help pay the cost of premiums and deductibles.

To fight the coronavirus (COVID-19)

On March 20, 2020, Medicare was modified to fulfil the needs of enrollees.

Conclusion

Apart from increased Medicare premiums and deductibles, there are more ways to save money on healthcare.

What is the Medicare Part B deductible for 2021?

The Medicare Part B deductible 2021 is an expense that seniors need to be aware of before they enroll in Part B or Original Medicare. It is an expense they will be responsible for and that can add to their overall medical expenses for the year.

How much does Medicare pay for seniors?

Most seniors pay $198 a year for their deductible. This is only due once each year, and then after that you can start to receive benefits for Medicare Part B services. That means you’ll be covered for anything that falls under the Part B umbrella of coverage according to your Original Medicare plan. The price of the annual deductible is completely ...

Does Medicare cover coinsurance?

Your insurance plan Original Medicare will cover you for the majority of these costs, but you have to pay some of the cost as well. The coinsurance tends to be 20% of the total cost of the service. Keep in mind that Part B costs and other Medicare costs will change from year to year. They tend to increase slightly every year.

Is a senior health plan considered essential?

This is a wide-ranging plan, covering many different medical expenses for you, and it is easy to see how it can be considered essential medical coverage. For most seniors, these are expenses that are very common for them and that will need to be covered if they are going to save some serious money on healthcare.

Does Part B deductible increase?

You may have to pay a monthly premium for your Advantage plan that is determined by the insurance company, but the Part B deductible remains the same. The deductible changes in price every so often. Usually, once a year it will increase. The increase is not significant, though. It tends to be a few dollars, and that is what we expect ...

What is deductible medical expenses?

Any costs associated with the treatment or diagnosis of a medical condition or an injury can be deducted. This includes preventive care and the cost of any medical equipment or supplies. The IRS provides a list of deductible medical expenses. The list includes some items you might not expect.

What are the different types of deductions?

What Are the Four Major Categories of Tax Deductions? 1 Business Deductions 2 Standard Deductions 3 Above the Line Deductions 4 Below the Line Deductions

What is the purpose of standard deductions?

The purpose of standard tax deductions is to allow taxpayers to claim the standard amount set by the IRS. They can claim this amount for the deduction if they haven’t itemized deductible expenses. This amount changes by year, and the IRS website has a tool you can use to calculate your standard deduction.

Can Medicare be deducted from taxes?

Your Medicare and Medigap premiums can be deducted from your taxes as a below the line deduction. This requires you to itemize the premiums. If they, along with your other medical costs, exceed 7.5% of your Adjusted Gross Income (AGI), you qualify for the deduction.

Is Medicare premium tax deductible?

The answer is yes; some Medicare premiums are tax-deductible. Most insurance premiums qualify for Form 1040’s Schedule A deductions but only over a certain threshold, including some Medicare premiums. This amount will be subtracted from your gross income. Your taxable income (after the deductions are made) will ultimately be used to determine ...

Is Medicare free?

Medicare isn't free and we understand your desire to save money wherever you can. If you've been considering a Medigap plan but have been hesitant because of the price, we can help you compare plans and rates. Please call us at the number above or fill out our online rate form to get started.

Can Medicare expenses be deducted?

Therefore, not all regularly incurred costs are eligible for deduction. These federal deductions decrease the amount of income subject to federal income tax and reduce the burden during tax season. Therefore, many American citizens — including Medicare beneficiaries, are always on the lookout for appropriate tax deductions.

How much is Medicare Part A deductible for 2021?

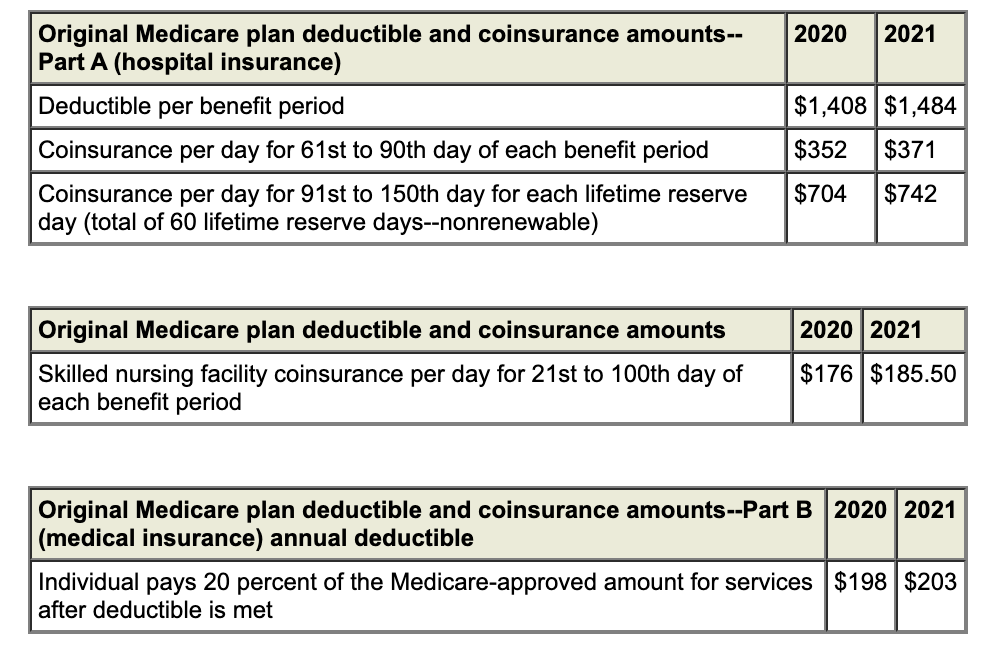

For 2021, the Medicare Part A deductible is $1,484 for each benefit period. If you re-enter the hospital or skilled nursing facility any time after your benefit period ends, you will have to pay the first $1,484 again as a new deductible.

What is the Medicare deductible for 2021?

In 2021, the deductible is $1,484 for Medicare Part A and $203 for Part B. Medicare Advantage and Part D deductibles vary based on your plan. Get Free Medicare Help.

What is the maximum out of pocket Medicare deductible for 2021?

This is a total spread across your deductibles, coinsurance and copayments. For 2021, the MOOP for Medicare Advantage plans is $7,550 for in-network care.

What is a Medigap plan?

Medigap, also known as Medicare Supplement plans, can help pay some of your out-of-pocket costs, including your Medicare Part A deductibles. These plans are sold through private insurers. There are eight standardized plans across 47 states and the District of Columbia.

What is a benefit period for Medicare?

The benefit period begins the day you enter the hospital or facility and ends after you have not needed inpatient care for 60 days in a row. Source: Centers for Medicare & Medicaid Services.

Does Medicare Part D have a deductible?

But once you hit your MOOP for the year, the plan has to cover 100 percent of all further costs. Some Medicare Part D prescription drug plans don’t have a deductible. Those that do may not have a deductible of more than $445 in 2021.

Does Medigap cover Part A?

Some of these plans may cover all or a portion of your Part A deductible. Medigap Plans C and F were the only two to cover the deductible for Medicare Part B. However, Plans C and F are available only to people who became eligible for Medicare before Jan. 1, 2020.