What is the maximum premium for Medicare Part B?

The standard monthly premium for Part B, which covers outpatient care and durable equipment ... or offers a different copay and an out-of-pocket maximum (a Medicare Advantage Plan). The Aduhelm situation highlights the ripple effect that expensive drugs ...

How much are Medicare Part B premiums?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less. This is because their Part B premium increased more than the cost-of-living increase for 2021 Social Security benefits.

What determines your Medicare Part B premium?

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employer’s pension plan.

Who pays for Medicare Part B premiums?

Your Part B premium amount will be deducted from your monthly Social Security, Railroad Retirement Board or Civil Service benefit payment if you receive one of these. If you don’t receive any of these benefits, you’ll need to pay for Part B directly. In this case, Medicare will send you a bill for Part B coverage called the Medicare Premium Bill.

What is the Part B monthly premium for 2021?

$148.50Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is the Medicare Part B premium for 2022?

$170.102022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

Will Medicare Part B cost go up in 2022?

If you're on Medicare, chances are you had a bit of a shock when seeing the 2022 Medicare Part B premium amount. It went up by $21.60, from $148.50 in 2021 to $170.10 in 2022. That's a 14.5% increase, and is one of the steepest increases in Medicare's history.

How Much Is Medicare a month 2021?

$148.50In 2021, the standard monthly premium will be $148.50, up from $144.60 in 2020. But if you're a high earner, you'll pay more. Surcharges for high earners are based on adjusted gross income from two years earlier.

How much will Part B go up in 2022?

$170.10The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $170.10 in 2022, an increase of $21.60 from $148.50 in 2021.

How much will Social Security take out for Medicare in 2022?

NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

Will 2022 Part B premium be reduced?

About half of the larger-than-expected 2022 premium increase, set last fall, was attributed to the potential cost of covering the Alzheimer's drug Aduhelm.

Why did Medicare Part B go up so much for 2022?

Medicare Part B prices are set to rise in 2022, in part because the Biden administration is looking to establish a reserve for unexpected increases in healthcare spending. Part B premiums are set to increase from $148.50 to $170.10 in 2022. Annual deductibles will also increase in tandem from $203 to $233.

Why is Medicare Part B going up so much in 2022?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

How much will be deducted from my Social Security check for Medicare in 2021?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

What is the maximum charge for Medicare Part B?

The standard Part B premium amount is $170.10 (or higher depending on your income). In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid.

What changes are coming to Medicare in 2021?

The Medicare Part B premium is $148.50 per month in 2021, an increase of $3.90 since 2020. The Part B deductible also increased by $5 to $203 in 2021. Medicare Advantage premiums are expected to drop by 11% this year, while beneficiaries now have access to more plan choices than in previous years.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How Does Medicare Part B Work?

Before getting into the weeds of Medicare Part B premiums, let’s do a quick review of Medicare Part B and its role in federal retirement health insurance.

Medicare Part B Premiums

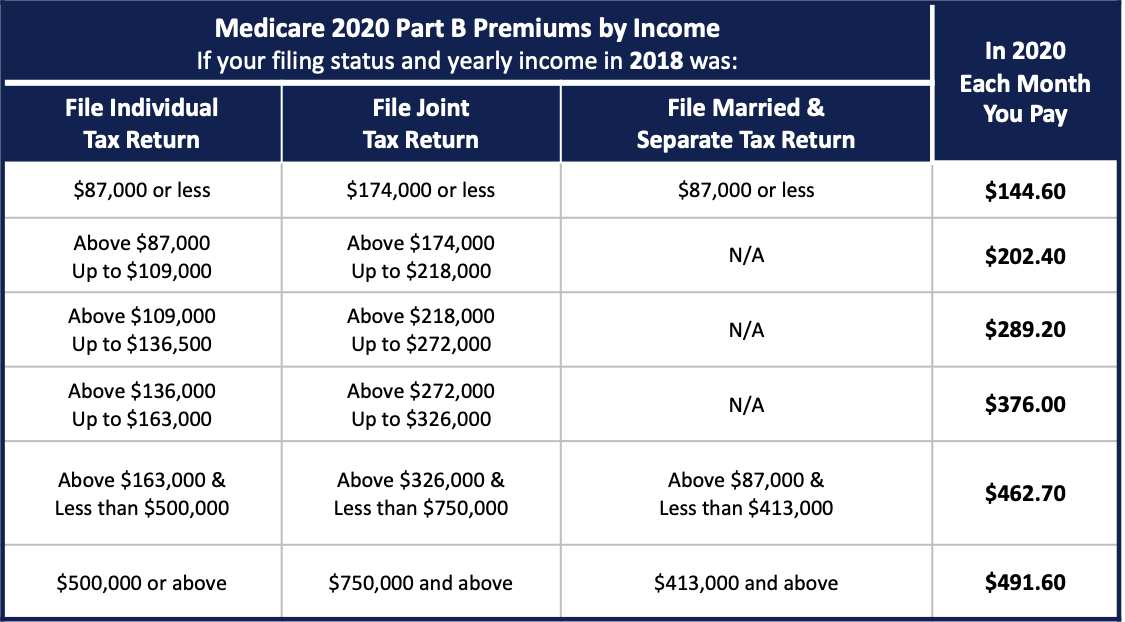

Medicare Part B premiums are calculated based on a person’s modified adjusted gross income (MAGI). For purposes of Part B premiums, your MAGI is the adjusted gross income you report on line 11 of your federal tax return, plus any tax-exempt interest income, such as municipal bonds (line 2a) earnings.

Who Pays More for Medicare Part B?

Each year the government crunches the numbers to determine total costs for providing Medicare Part B coverage. For most enrollees, the government agrees to cover 75% of the cost and charges enrollees the Medicare Part B premium to cover the other 25%.

How to Apply for Medicare Part B

If you are already receiving Social Security benefits when you turn 65, you will automatically be signed up for Medicare Part A and Medicare Part B by the Social Security program. Your Part B premium will be deducted from your retirement benefit each month.

The Bottom Line

Once you turn 65, the government agrees to cover the majority of your health insurance costs. But Medicare is not free. The Medicare Part B premium alone—irrespective of other Medicare out-of-pocket costs—is an important line-item expense you will want to plan for in retirement.

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

Medicare Part B Premiums For 2021

CMS, the Centers for Medicare & Medicaid Services, has just announced the Medicare Part B Premiums for 2021.

Medicare Costs For 2021

For 2021 the Medicare Part A premium for most people will be $0. If you have to buy part A then the premium will be up to $471 per month, compared to $458 in 2020.

Original Medicare Part A Premiums and Costs

Most people do not pay a monthly premium for Part A, as their work history qualifies them to receive this coverage for free. However, if you have worked in the United States and have paid taxes for less than 10 years (or 40 quarters), you may need to pay a premium for Part A coverage.

Original Medicare Part B Premiums and Costs

The standard Part B premium amount for 2021 is $148.50, although you may have to pay more depending on your income. To find out exactly how much you will pay, reference the chart below.

Medicare Part C Premiums and Costs

Medicare Advantage (Part C) plans are sold by private insurance companies as an optional replacement to Original Medicare. Regulated by the federal government, these plans are required to provide the same standard benefits covered under Parts A and B. However, these plans often include coverage for additional benefits, including:

Medicare Part D Premiums and Costs

Medicare Part D plans are sold by private insurance companies as an optional addition to Original Medicare. These plans provide their members with coverage for the prescription drugs they need to survive. Each Part D plan has a unique formulary, which is the list of drugs it covers.

Medicare Supplement Premiums and Costs

Medicare Supplement plan benefits are standardized by the government, but the prices for these plans can vary depending on which insurance company you purchase a plan from. Ten Medicare Supplement plans are available, lettered A through N, and each of these plans offers a different combination of benefits.

How Can I Reduce My Medicare Premiums and Costs?

The best way to save money on Medicare is to enroll in the right plan when you first sign up for an additional coverage option. Prices for similar coverage can vary widely between carriers, and doing your research beforehand can end up saving you a lot of money over the course of the year.

Ready to Enroll?

If you are ready to explore coverage options in your area, chat with a licensed Medicare professional who can help you find the coverage you need at a price that fits your budget.