What are the tax rates for Social Security and Medicare for 2020?

The FICA tax rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2020 (or 8.55 percent for taxable wages paid in excess of the applicable threshold).

What is the federal payroll tax rate for 2021?

For Social Security, the tax rate is 6.20% for both employers and employees. (Maximum Social Security tax withheld from wages is $8,853.60 in 2021). For Medicare, the rate remains unchanged at 1.45% for both employers and employees....2021 Federal Payroll Tax Rates.2021 Current Year2020 Prior YearFUTA Employer rate Wage limit0.6% $7,0000.6% $7,0003 more rows•Dec 15, 2020

What is the payroll tax rate for Social Security?

6.2 percentSocial Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $147,000 (in 2022), while the self-employed pay 12.4 percent.

How much of my Social Security is taxable in 2021?

50%For the 2021 tax year (which you will file in 2022), single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.Apr 6, 2022

What is standard deduction for 2021 for seniors?

Standard deduction amount increased. For 2021, the standard deduction amount has been increased for all filers. The amounts are: Single or Married filing separately—$12,550. Married filing jointly or Qualifying widow(er)—$25,100.

What is the maximum payroll deduction for Social Security?

Starting Jan. 1, 2022, the maximum earnings subject to the Social Security payroll tax will increase by $4,200 to $147,000—up from the $142,800 maximum for 2021, the Social Security Administration (SSA) announced Oct. 13. The SSA also posted a fact sheet summarizing the 2022 cost of living adjustments (COLAs).Oct 13, 2021

Do you pay Medicare tax on Social Security income?

There is no exemption for paying the Federal Insurance Contribution Act (FICA) payroll taxes that fund the Social Security and Medicare systems. As long as you work in a job that is covered by Social Security, FICA taxes will be withheld from your paycheck. The same goes if you remain actively self-employed.

What taxes are taken out of Social Security?

between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

How much tax do you pay on Medicare?

There are no tax limits for Medicare. You will pay taxes at a rate of 1.45% on all of your taxable wages. In addition, employers are required to withhold Additional Medicare tax of 0.9% once taxable wages are over $200,000 for the year.

Why do Medicare and Social Security go hand in hand?

Social Security and Medicare taxes go hand in hand. One reason for this is because the taxable wages for these two taxes are generally the same. The taxable wages for Social Security and Medicare taxes are defined below:

What is the Social Security tax limit for 2017?

Social Security tax limit for 2017 is $7,886.40. One of the differences between Social Security and Medicare is that Social Security is taxed only on the first $127,200 of taxable wages, or $7,886.40 in taxes. Once you hit that limit, you will no longer be taxed for Social Security in 2017.

What is a Section 125 deduction?

Less: Section 125 deductions (medical, dental, vision, dependent care, pre-tax commuter benefits, etc.) If you compare the definition of these taxable wages to the definition of federal income taxable wages, you’ll notice something is missing.

How much is Bob's semi monthly salary?

Example: Bob is paid semi-monthly. On this paycheck, he earned $8,000 in salary. Bob gets a semi-monthly auto allowance of $1,000. He has a medical deduction of $1,500, and he contributes 10% of his income to his 401k.

Is there a cap on Medicare taxes?

There is no Medicare cap, and employers are required to withhold an additional Medicare Tax of 0.9% for wages over $200,000. Now that we’ve covered Social Security and Medicare taxes, we’ll tackle state taxes in our next segment. Bookmark ( 0) Please login to bookmark. Username or Email Address.

How much is Medicare payroll tax?

Medicare Payroll Tax. The Medicare payroll tax is 1.45% and is based on each employee's earnings without limit. The Medicare tax is withheld from each employee's earnings and is also matched by the employer. This makes the total Medicare tax equal to 2.9% on every dollar of earnings.

What is the Social Security payroll tax rate for 2021?

In the calendar year 2021, the Social Security payroll tax rate of 6.2% is applied to each employee's earnings up to the maximum of $142,800. The 6.2% that is withheld from the employee is also matched by the employer. As a result, the total Social Security tax in 2021 for an employee is equal to 12.4% of each employee's annual earnings up ...

What is the FICA rate?

FICA Payroll Tax. The combination of Social Security taxes and Medicare taxes is referred to as FICA. We often refer to the FICA tax rate as 7.65% (6.2% Social Security + 1.45% Medicare) of each employee's first $137,700 of annual earnings in 2020 and the first $142,800 of annual earnings in 2021. Each employee's earnings in excess ...

What is Medicare tax?

Medicare taxes fund the nation’s hospital insurance (HI) program. This tax pays for hospital stays, some home health care, and hospice care for qualifying individuals. It’s expanded to Medicare Advantage plans and prescription drug costs since the tax’s inception. It contributed 36% to these programs in 2019.

How much did Medicare contribute to the economy in 2019?

It contributed 36% to these programs in 2019. There’s no salary or earnings cap on the Medicare tax. In fact, high earners are hit with an extra tax, known as the Additional Medicare tax. Payroll taxes raise significant revenue.

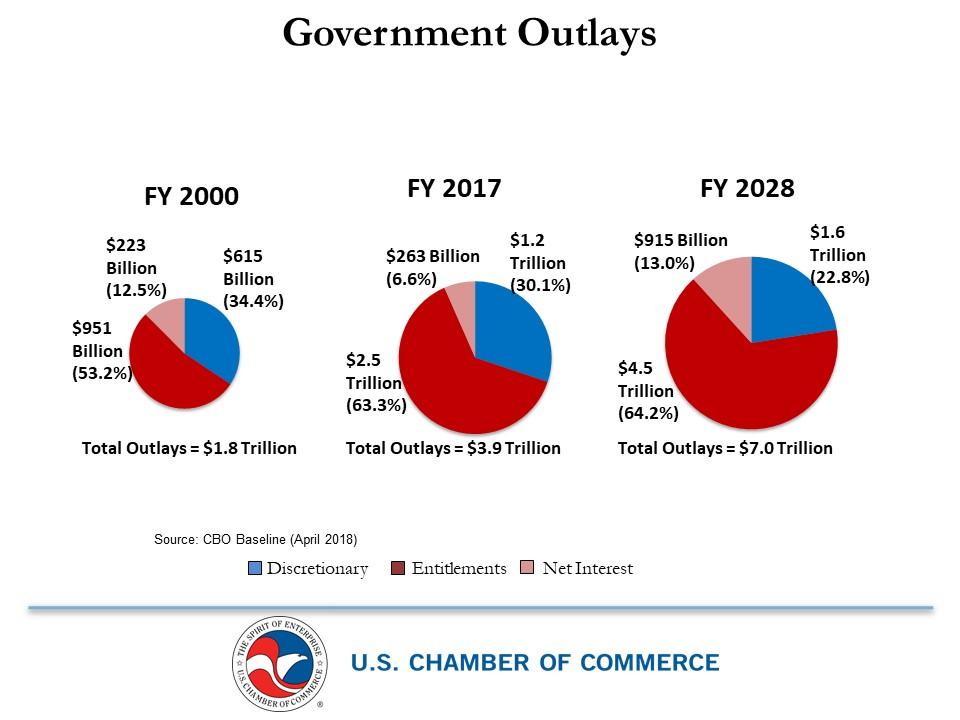

What is payroll tax 2021?

Updated May 20, 2021. Payroll taxes are amounts of pay withheld from an employee’s paycheck during the payroll process, and employers must usually match these amounts. Payroll taxes contributed a major part of the U.S. federal budget, particularly for social insurance programs.

What is the Medicare tax rate for 2021?

The Additional Medicare Tax is 0.9% as of 2021, and employers are obligated to withhold this from a worker’s paycheck as well, but they don’t have to match it. 5

What is the unemployment tax rate?

Employees don’t have to contribute to this payroll tax. The unemployment tax rate is 6% of earnings paid up to $7,000, but the federal government provides tax credits that can bring this down to just 0.6%.

How much tax is paid to OASDI?

The tax contributed 88% to OASDI in 2019. These programs are also funded by income taxes levied on Social Security benefits that are paid out. There’s a cap on the Social Security tax. You won’t have to pay it on any portion of your wages or salary that exceeds a certain threshold. 1.

How much is Social Security tax in 2021?

Of this 12.4%, 10.6% goes to an OASI fund for retirement benefits and survivors, and the other 1.8% goes to disability insurance. 4. The Social Security tax is payable only on annual earnings up to $142,800 in 2021.

What is the Medicare tax rate for 2013?

Starting in 2013, people with high salaries will pay a new additional Medicare tax of 0.9%. Unlike the rest of Medicare, this new tax depends on your filing status:

How much did the employee contribute to Social Security in 2011?

For 2011 and 2012 only, the employee's "half" didn't equal the employer's "half" for Social Security: they contributed 4.2% and 6.2% respectively. For 2013, both contribute 6.2%. For 2017, there is a very large increase in the Social Security income limit, from $118,500 to $127,200.

What is FICA tax?

The FICA (for Federal Insurance Contributions Act) tax (also known as Payroll Tax or Self-Employment Tax, depending on your employment status) is your contribution to Social Security and Medicare as a percentage of your salary: If you're an employee, then you pay one half of this total (probably as a withholding on your paycheck);

Do self employed people pay FICA?

And so, if you're self-employed, you don't have to pay FICA on all your salary, just on 92.35% of it (92.35 being 100 minus 7.65 - which is the contribution that your employer would have paid, if you had an employer, which you don't).

How much is Medicare tax for 2021?

The amount increased to $142,800 for 2021. (For SE tax rates for a prior year, refer to the Schedule SE for that year). All your combined wages, tips, and net earnings in the current year are subject to any combination of the 2.9% Medicare part of Self-Employment tax, Social Security tax, or railroad retirement (tier 1) tax.

What is the tax rate for self employment?

The self-employment tax rate is 15.3%. The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance). For 2020, the first $137,700 of your combined wages, tips, and net earnings is subject to any combination of the Social Security part of self-employment tax, ...

What is self employment tax?

Self-employment tax is a tax consisting of Social Security and Medicare taxes primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. You figure self-employment tax (SE tax) yourself using Schedule SE (Form 1040 or 1040-SR).

What is Schedule C for self employed?

If you are self-employed as a sole proprietor or independent contractor, you generally use Schedule C to figure net earnings from self-emplo yment. If you have earnings subject to self-employment tax, use Schedule SE to figure your net earnings from self-employment. Before you figure your net earnings, you generally need to figure your total ...

When do you have to use the maximum earnings limit?

If you use a tax year other than the calendar year, you must use the tax rate and maximum earnings limit in effect at the beginning of your tax year. Even if the tax rate or maximum earnings limit changes during your tax year, continue to use the same rate and limit throughout your tax year.

Does the 1040 affect self employment?

This deduction only affects your income tax. It does not affect either your net earnings from self-employment or your self-employment tax. If you file a Form 1040 or 1040-SR Schedule C, you may be eligible to claim the Earned Income Tax Credit (EITC).

Is self employment tax included in Medicare?

Self-Employment Tax (Social Security and Medicare Taxes) It should be noted that anytime self-employment tax is mentioned, it only refers to Social Security and Medicare taxes and does not include any other taxes that self-employed individuals may be required to file. The list of items below should not be construed as all-inclusive.

Definition and Examples of Payroll Taxes

How Payroll Taxes Work

- Payroll taxes are levied as a certain percentage of your earnings. Your employer typically pays half this percentage, and you pay the other half through paycheck withholdings. Employers are legally obligated to contribute to these taxes and report the amounts withheld from employees’ pay on Form W-2. Your employer sends the contribution information to the IRS after year’s end. Employ…

Types of Payroll Taxes

- There are four payroll taxes: Social Security, Medicare, Additional Medicare Tax, and Federal Unemployment Tax.

Drawbacks of Payroll Taxes

- All these taxes add up to a large amount of money, which has led to much debate over the years. It’s been argued that employers effectively pass on their share of Social Security and Medicare taxes by paying workers 7.65% less than they would have otherwise—half of that 15.3% total—to compensate for having to pay their own half of these taxes. Thei...