Will you be penalized for not getting Medicare at 65?

If you didn’t get Medicare at 65, you would not be later charged with late-enrollment penalties, so long as your employer signed this form indicating you’ve had insurance coverage. The form would...

Is it mandatory to go on Medicare at 65?

In this circumstance, it is mandatory to sign up for Medicare unless you are one of the few people who pay premiums for Part A. You’ll still want to sign up for Medicare at age 65 to avoid late penalties, delayed coverage, and loss of Social Security benefits.

What to do before you turn 65 Medicare?

at least 3 months BEFORE you turn 65. EVERYONE WHO IS TURNING 65 should complete these tasks: Get familiar with Medicare and its “parts” To learn about Medicare, see the “ Introduction to Medicare ” fact sheet. You can also visit Medicare.gov or call 1-800-MEDICARE (1-800-633-4227); TTY users should call 1-877-486-2048.

Does Medicare cover all medical expenses after age 65?

The short answer is “no”; however, it will cover a significant portion of a person’s medical expenses. Thus, the challenge for the patient is to understand what Medicare, Medigap, prescription plans, and other plans will cover. Medicare is a federal insurance program that guarantees health coverage for people 65 and older, those with extreme disabilities and infants who have significant medical problems at birth.

What happens if you don't enroll in Medicare Part A at 65?

The Part A penalty is 10% added to your monthly premium. You generally pay this extra amount for twice the number of years that you were eligible for Part A but not enrolled. For example, suppose that: You were eligible for Medicare in 2019, but you didn't sign up until 2021.

Can you enroll in Medicare without penalty any time after you turn 65?

You can sign up for Part A any time after you turn 65. Your Part A coverage starts 6 months back from when you sign up or when you apply for benefits from Social Security (or the Railroad Retirement Board). Coverage can't start earlier than the month you turned 65.

How do I avoid Medicare Part B penalty?

If you don't qualify to delay Part B, you'll need to enroll during your Initial Enrollment Period to avoid paying the penalty. You may refuse Part B without penalty if you have creditable coverage, but you have to do it before your coverage start date.

Does Medicare penalize you for not signing up?

If you have to buy Part A, and you don't buy it when you're first eligible for Medicare, your monthly premium may go up 10%. You'll have to pay the higher premium for twice the number of years you didn't sign up.

What if I miss the Medicare deadline?

If you miss the deadline for your IEP or SEP (or if you don't qualify for a SEP), you can enroll in Medicare only during a general enrollment period, which runs from Jan. 1 to March 31 each year, with coverage not beginning until July 1 of the same year.

What happens if you decline Medicare Part B?

Declining Part B Coverage If you don't have other insurance, you'll have to pay an additional 10% on your premium for every full year that you decline Part B coverage. In 2022, the Medicare Part B premium is $170.10 or a bit less per month, depending on your situation. It's higher if your annual income is over $91,000.

Do most federal retirees enroll in Medicare Part B?

About 70% of federal retirees enroll in Part B, which means paying two premiums and in essence two duplicative insurance programs. A portion of the retirees that join Part B might do so as a hedge against the elimination of FEHB retiree benefits.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Do you have to go on Medicare at 65?

Medicare will not force you to sign up at 65, and you'll get a special enrollment period to sign up later as long as you have a group health plan and work for an employer with 20 or more people.

How long is a member responsible for a late enrollment penalty for Medicare?

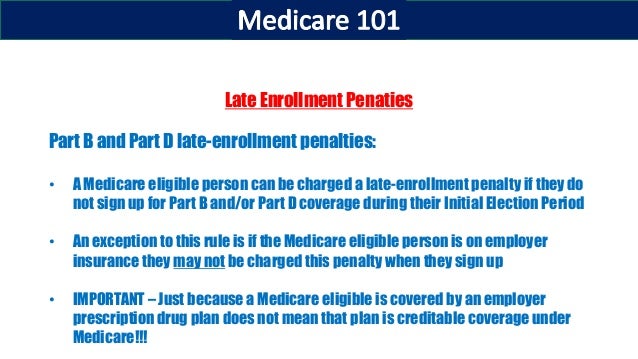

63 daysMedicare beneficiaries may incur a late enrollment penalty (LEP) if there is a continuous period of 63 days or more at any time after the end of the individual's Part D initial enrollment period during which the individual was eligible to enroll, but was not enrolled in a Medicare Part D plan and was not covered under ...

What is Lifetime late enrollment penalty?

The late enrollment penalty is an amount that's permanently added to your Medicare drug coverage (Part D) premium. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over, there's a period of 63 or more days in a row when you don't have Medicare drug coverage or other.

Is there a grace period for Medicare premiums?

Under rules issued by the Centers for Medicare and Medicaid Services (CMS), consumers will get a 90-day grace period to pay their outstanding premiums before insurers are permitted to drop their coverage.

What happens if you don't sign up for Medicare?

Penalties for not signing up for Medicare: automatic enrollment. If you’re already receiving Social Security benefits when you turn 65, you’re typically enrolled in Medicare automatically. That is – you’re enrolled in Original Medicare, Part A and Part B. If this is the case for you, you don’t have to worry about a late enrollment penalty ...

How much is the late enrollment penalty for Medicare Part D?

Take 1% of the current “national base beneficiary premium” ($33.06 in 2021) – that’s about 33 cents ($.33) . Round to the nearest $.10, and you get $.30. Multiply that by the number of months you were eligible for coverage under Medicare Part D, but didn’t have it. Just count the full months, so in the example above, count October 2019 as the first month and September 2021 as the last full uncovered month. That makes 24 months without coverage.

What is Medicare Part D?

Medicare Part D is prescription drug coverage that you get from private, Medicare-approved insurance companies. It’s optional, yet there’s a late enrollment penalty if you don’t sign up when you’re first eligible for Medicare, and decide at some later date that you want this coverage.

How much does Medicare add to your premium?

Your Medicare prescription drug plan will add $7.20 to your premium, and you’ll pay the penalty as long as you have Medicare prescription drug coverage. Be aware that the Part D national base beneficiary premium can change from year to year, so your penalty amount might also change.

How long is the Medicare enrollment period?

It’s a seven-month period altogether. You could face a late enrollment penalty for Medicare Part A if both of these are true for you: You didn’t sign up for Part A during your IEP. You have to pay a Part A monthly premium.

How long do you have to be on Medicare to qualify for it?

If you qualify for Medicare by disability, in most cases you’re automatically enrolled in Part A and Part B after 24 straight months of receiving Social Security disability benefits. See Getting Medicare Under the Age of 65 for more information.

What is the penalty for Part B?

The Part B penalty is 10% added to your monthly premium. You generally pay this extra amount multiplied by the number of years (12-month periods) that you were eligible for Part B, but not enrolled.

How much is the penalty for Part B?

Your Part B premium penalty is 20% of the standard premium, and you’ll have to pay this penalty for as long as you have Part B. (Even though you weren't covered a total of 27 months, this included only 2 full 12-month periods.) Find out what Part B covers.

When will Part B coverage start?

You waited to sign up for Part B until March 2019 during the General Enrollment Period. Your coverage starts July 1, 2019. Your Part B premium penalty is 20% of the standard premium, and you’ll have to pay this penalty for as long as you have Part B. (Even though you weren't covered a total of 27 months, this included only 2 full 12-month periods.)

What happens if you don't get Medicare at 65?

If you didn’t get Medicare at 65, you would not be later charged with late-enrollment penalties, so long as your employer signed this form indicating you’ve had insurance coverage. The form would be presented when you later needed Medicare. There is an eight-month special enrollment period that begins on the date a person aged 65 ...

How long does Medicare cover after you stop working?

It sounds like you will have retiree coverage and Medicare for five years after you stop working. It would be a good idea for you to find out exactly what your retiree plan covers and how it and Medicare would coordinate payment of any covered insurance claims.

What happens if you apply for spousal benefits at 66?

If it’s larger than her survivor benefit, she’d receive an additional payment equal to the difference. If not, her benefit would stay the same.

How long does it take to get Medicare?

There is an eight-month special enrollment period that begins on the date a person aged 65 or older loses employer coverage. However, your intuition is correct – you should apply for Medicare early enough so that it will have taken effect by the time your employer coverage ends.

How old do you have to be to qualify for unemployment if you die?

If he died at age 60 or younger, she would qualify for benefits because the agency would adjust the hours needed. Thirty-eight quarters of so-called covered earnings would be enough to qualify for someone who died two years before reaching the earliest age at which benefits normally are available.

Why should I not wait six months for my insurance?

It was suggested that it would be better not to wait the six months because if I had a catastrophic illness, my city insurance would only pay 80 percent of my covered expenses, leaving me with a huge bill. If Part B was in place, it would be my primary insurance and the city’s insurance would be secondary.

Can my wife file for spousal benefits at 62?

Under new rules passed in late 2015, there is no way she can file for a spousal benefit while deferring her own retirement filing.

When do you need to sign up for Medicare?

If the employer has less than 20 employees: You might need to sign up for Medicare when you turn 65 so you don’t have gaps in your job-based health insurance. Check with the employer.

What happens if you don't sign up for Part A and Part B?

If you don’t sign up for Part A and Part B, your job-based insurance might not cover the costs for services you get.

What is a Medicare leave period?

A period of time when you can join or leave a Medicare-approved plan.

Does Medicare work if you are still working?

If you (or your spouse) are still working, Medicare works a little differently. Here are some things to know if you’re still working when you turn 65.

Do you have to tell Medicare if you have non-Medicare coverage?

Each year, your plan must tell you if your non-Medicare drug coverage is creditable coverage. Keep this information — you may need it when you’re ready to join a Medicare drug plan.

Why don't people sign up for Medicare at 65?

The most common reason for people not signing up for Medicare when they turn 65 is because they are still working. Because they’re still working, they’re likely covered under their employer’s health insurance plan and are also unlikely to be collecting Social Security retirement benefits.

When do you sign up for Medicare at 65?

When you near your 65th birthday, you will enter what is called your Initial Enrollment Period (IEP). This seven-month period begins three months before you turn 65, includes the month of your birthday and continues for three additional months. This is your first opportunity to sign up for Medicare.

Is it mandatory to sign up for Medicare at 65?

Technically, it is not mandatory to sign up for Medicare at 65 or at any age, for that matter. But it’s important to consider the situations in which you might decide not to enroll in Medicare at 65 so that you can make sure not to have any lapse in health insurance coverage or face a Medicate late enrollment penalty.

Does Medicare cover health insurance?

Being covered under your employer-provided health insurance plan has no bearing on your Medicare eligibility. Medicare works in conjunction with several other types of health insurance – including health insurance provided by employers or unions – and won’t prevent you from enrolling.

Does Medicare have a late enrollment penalty?

Medicare Part D, which provides coverage for prescription medications, is optional but can also come with a late enrollment penalty if you don’t sign up when you’re supposed to. This penalty is a little more complex to calculate but remains in place for as long as you have Part D coverage. The Part D late enrollment penalty applies if you experience a stretch of at least 63 consecutive days without creditable drug coverage following your IEP and then later enroll in a Part D plan.

Though Medicare eligibility begins at 65, that's not necessarily the ideal age to sign up

For many people, turning 65 is a big milestone, and understandably so. In fact, age 65 is when you're first allowed to get coverage under Medicare.

1. You're still working and have access to a group health plan

Just because you're turning 65 doesn't mean you're on the cusp on retirement. You may still have plans to work another few years -- or longer.

2. You're retired but are still covered under your spouse's group health plan

The penalties that come with not enrolling in Medicare on time only apply if you don't have access to an eligible group health plan. It may be the case that you're retired and don't have employer benefits at all.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

What is the late enrollment penalty for Medicare?

Part D late enrollment penalty. The late enrollment penalty is an amount that's permanently added to your Medicare drug coverage (Part D) premium. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over, there's a period of 63 or more days in a row when you don't have Medicare drug coverage or other.

What happens if Medicare decides the penalty is wrong?

What happens if Medicare's contractor decides the penalty is wrong? If Medicare’s contractor decides that all or part of your late enrollment penalty is wrong, the Medicare contractor will send you and your drug plan a letter explaining its decision. Your Medicare drug plan will remove or reduce your late enrollment penalty. ...

What happens if Medicare pays late enrollment?

If Medicare’s contractor decides that your late enrollment penalty is correct, the Medicare contractor will send you a letter explaining the decision, and you must pay the penalty.

How much is Medicare penalty in 2021?

Medicare calculates the penalty by multiplying 1% of the "national base beneficiary premium" ($33.06 in 2021, $33.37 in 2022) times the number of full, uncovered months you didn't have Part D or creditable coverage. The monthly premium is rounded to the nearest $.10 and added to your monthly Part D premium.

What is Medicare program?

A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs, like premiums, deductibles, and coinsurance.

How often does the national base beneficiary premium change?

The national base beneficiary premium may change each year, so your penalty amount may also change each year.

How long does it take for Medicare to reconsider?

In general, Medicare’s contractor makes reconsideration decisions within 90 days. The contractor will try to make a decision as quickly as possible. However, you may request an extension. Or, for good cause, Medicare’s contractor may take an additional 14 days to resolve your case.

What happens if you don't buy Medicare?

If you have to buy Part A, and you don't buy it when you're first eligible for Medicare, your monthly premium may go up 10%. You'll have to pay the higher premium for twice the number of years you didn't sign up.

How long do you have to pay for Part A?

If you were eligible for Part A for 2 years but didn't sign up, you'll have to pay the higher premium for 4 years. Usually, you don't have to pay a penalty if you meet certain conditions that allow you to sign up for Part A during a special enrollment period.

Can you get Medicare if you have limited income?

If you have limited income and resources, your state may help you pay for Part A, and/or Part B. You may also qualify for Extra Help to pay for your Medicare prescription drug coverage. Find out when you're eligible for Medicare.