In 2018, 5.6 million Medicare beneficiaries in traditional Medicare– 1 in 10 beneficiaries overall (10%) or nearly 1 in 5 of those with traditional Medicare (17%) had no source of supplemental coverage. Beneficiaries in traditional Medicare with no supplemental coverage are fully exposed to Medicare’s cost-sharing requirements.

How many people in the US have retiree health insurance?

Of the total number of beneficiaries with retiree health coverage, nearly 10 million beneficiaries have retiree coverage to supplement traditional Medicare (29% of all beneficiaries in traditional Medicare), while 4.5 million beneficiaries are enrolled in Medicare Advantage employer group plans (see Medicare Advantage section below).

How many new Medicare beneficiaries are covered under traditional Medicare?

Most new beneficiaries (71 percent) were covered under traditional Medicare for their first year on Medicare. Figure 1: Less than one-third of new Medicare beneficiaries enrolled in Medicare Advantage plans during their first year on Medicare

How does Medicare pay for health care?

You generally pay a set amount for your health care (Deductible) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (Coinsurance / Copayment) for covered services and supplies. There's no yearly limit for what you pay out-of-pocket. You usually pay a monthly premium for Part B.

How many people have Medicare Advantage?

In 2018, Medicare Advantage covered about 4 in 10 Medicare beneficiaries (39%), or 21 million people with Medicare. (Based on more current enrollment data, the total number of Medicare Advantage enrollees increased to 24 million in 2020, but the MCBS, which we use here for demographic analysis of coverage sources, is not available beyond 2018.)

What percent of new Medicare beneficiaries are enrolling in Medicare Advantage?

Medicare served nearly 63 million beneficiaries in 2019. 62 percent were enrolled in Part A or Part B, and the rest (37 percent) were in Medicare Advantage (Part C).

How many seniors are on original Medicare?

Data represent weighted counts of beneficiaries, with approximately 34.1 million beneficiaries in traditional Medicare, 17.6 million beneficiaries in Medicare Advantage, and 2.6 million beneficiaries in SNPs. Data: Analysis of the Medicare Current Beneficiary Survey, 2018.

What percentage or portion of Medicare beneficiaries receive services through Medicare Advantage plans?

Enrollment in these other plan types is relatively low. In 2021, 43 percent of Medicare beneficiaries were enrolled in Medicare Advantage plans. By 2025, these plans are projected to account for half of total Medicare enrollment, or 35 million beneficiaries, up from 21.1 million in 2018.

Who are the beneficiaries of Medicare?

Medicare is available to most individuals 65 years of age and older. Medicare has also been extended to persons under age 65 who are receiving disability benefits from Social Security or the Railroad Retirement Board, and those having End Stage Renal Disease (ESRD).

How many people choose traditional Medicare?

Of this total, 6.6 million are enrolled in both traditional Medicare and Medicaid (20% of all beneficiaries in traditional Medicare), while 4.2 million are enrolled in Medicare Advantage and Medicaid (see Medicare Advantage section below).

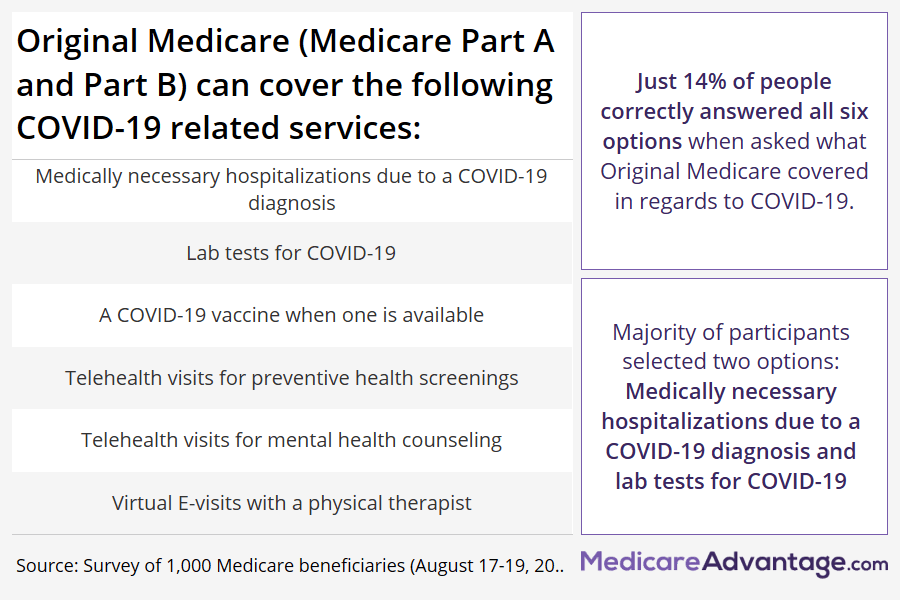

Is traditional Medicare the same as Original Medicare?

Original Medicare covers inpatient hospital and skilled nursing services – Part A - and doctor visits, outpatient services and some preventative care – Part B. Medicare Advantage plans cover all the above (Part A and Part B), and most plans also cover prescription drugs (Part D).

What is original Medicare coverage?

Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles).

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.

How many Medicare Part B beneficiaries are there?

Standard Monthly premiums: The standard Part B premium is $144.60....Number of People Receiving Medicare (2019): *Total Medicare beneficiaries • Aged • Disabled61.2 million • 52.6 million • 8.7 millionPart C (Medicare Advantage) beneficiaries22.2 millionPart D (Prescription Drug Benefit) beneficiaries47.2 million2 more rows•Aug 24, 2020

How many Medicare beneficiaries are there in 2022?

The Chartis Group released a study Friday that found total 2022 enrollment in Medicare grew by 1 million beneficiaries, a spike of 1.6% over 2021. MA plans added 2.3 million beneficiaries overall, with part of that growth coming at the expense of 1.3 million people transitioning from traditional Medicare to MA.

Does Medicare cover beneficiaries?

The Qualified Medicare Beneficiary (QMB) program provides Medicare coverage of Part A and Part B premiums and cost sharing to low-income Medicare beneficiaries. In 2017, 7.7 million people (more than one out of eight people with Medicare) were in the QMB program.

What percentage of Medicare beneficiaries receive employer or union-sponsored benefits?

So for low-income Medicare beneficiaries, public programs are available to fill in the gaps in Medicare coverage. And 30 percent of Medicare beneficiaries receive employer or union-sponsored benefits that supplement Medicare. But what about the rest of the population?

What percent of Medicare beneficiaries have no supplemental coverage?

Only 23 percent of Original Medicare beneficiaries have no supplemental coverage (either from Medicaid, an employer-sponsored plan, or Medigap). Louise Norris. January 10, 2020. facebook2.

How much does Medicare pay for hemodialysis?

Medicare Part B currently pays an average of about $235 per treatment for hemodialysis. That’s the 80 percent that Medicare pays, and the patient is responsible for the other 20 percent. Without supplemental insurance, that works out to a patient responsibility of about $60 per session.

Does Medicare have a cap on out of pocket costs?

There are certainly people who contend that even though Original Medicare has no cap on out-of-pocket costs, it is still plenty of coverage – and for the average enrollee, that’s probably true. But the purpose of insurance is to protect us against significant losses.

Is an MRI affordable with Medicare?

So although it’s true that normal-length hospital stays, regular office visits, and the odd MRI would be affordable for most people with just Original Medicare, there are certainly medical conditions that would be difficult for the average person to finance without supplemental coverage.

Can you get generic Medicare if you never get seriously ill?

If you never get seriously ill, and if you only ever need the occasional generic prescription, you’ll be fine with Original Medicare alone. But who among us can accurately predict whether or not a catastrophic medical condition will befall us at some point in the future?

What is Medicare Part B?

Medicare Part B medical insurance generally covers: 1 Preventative outpatient health services 2 Medically necessary and urgent care outpatient health services 3 Emergency or medical transportation services 4 Laboratory tests and other diagnostic services 5 Durable medical equipment (DME) 6 Mental health inpatient and outpatient services 7 Medications that must be administered by a health care professional

What is Medicare contract?

In an effort to provide Medicare beneficiaries with more choices when it comes to receiving their benefits and managing the cost of their care, Medicare contracts with private insurers to offer enhancement and expansion to the Original Medicare program.

What is coinsurance in Medicare?

This may be due as a copayment, which is a fixed dollar amount, or a coinsurance, which is a percentage of the Medicare-approved amount.

What was Medicare and Medicaid in 1965?

The Social Security Amendments of 1965 led to the establishment of Medicare and Medicaid. From the beginning, services covered by Medicare were split under two main categories: hospital insurance, which is called Part A, and medical insurance, which is called Part B.

How is the Part A program funded?

Part A is funded in large part from a specific payroll tax paid by employers and workers ; while some recipients may be obligated to pay a monthly premium for Part A, most receive Part A premium-free.

How many Medicare beneficiaries have employer sponsored retirement?

Employer-sponsored Retiree Health Coverage. In total, 14.3 million of Medicare beneficiaries – a quarter (26%) Medicare beneficiaries overall — also had some form of employer-sponsored retiree health coverage in 2018. Of the total number of beneficiaries with retiree health coverage, nearly 10 million beneficiaries have retiree coverage ...

How many people are covered by Medicare Supplement?

Medicare supplement insurance, also known as Medigap, provided supplemental coverage to 2 in 10 (21%) Medicare beneficiaries overall, or 34% of those in traditional Medicare (roughly 11 million beneficiaries) in 2018. As with other forms of supplemental insurance, the share of beneficiaries with Medigap varies by state.

What is Medicare Advantage?

Medicare Advantage plans provide all benefits covered by Medicare Parts A and B, often provide supplemental benefits, such as dental and vision, and typically provide the Part D prescription drug benefit. Many traditional Medicare beneficiaries also rely on other sources of coverage to supplement their Medicare benefits.

How is supplemental coverage determined?

Sources of supplemental coverage are determined based on the source of coverage held for the most months of Medicare enrollment in 2018. The analysis excludes beneficiaries who were enrolled in Part A only or Part B only for most of their Medicare enrollment in 2018 (n=4.7 million) and beneficiaries who had Medicare as a secondary payer ...

Does Medicare have supplemental coverage?

No Supplemental Coverage. In 2018, 5.6 million Medicare beneficiaries in traditional Medicare– 1 in 10 beneficiaries overall (10%) or nearly 1 in 5 of those with traditional Medicare (17%) had no source of supplemental coverage. Beneficiaries in traditional Medicare with no supplemental coverage are fully exposed to Medicare’s cost-sharing ...

Does Medigap increase with age?

While Medigap limits the financial exposure of Medicare beneficiaries and provides protection against catastrophic expenses for services covered under Parts A and B, Medigap premiums can be costly and can rise with age, depending on the state in which they are regulated.

Does Medicare Part B cover Part B?

As of January 1, 2020, Medigap policies are prohibited from covering the full Medicare Part B deductible for newly-eligible enrollees; however, older beneficiaries who are already enrolled are permitted to keep this coverage.

What do I need to know about Medicare?

What else do I need to know about Original Medicare? 1 You generally pay a set amount for your health care (#N#deductible#N#The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.#N#) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (#N#coinsurance#N#An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).#N#/#N#copayment#N#An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.#N#) for covered services and supplies. There's no yearly limit for what you pay out-of-pocket. 2 You usually pay a monthly premium for Part B. 3 You generally don't need to file Medicare claims. The law requires providers and suppliers to file your claims for the covered services and supplies you get. Providers include doctors, hospitals, skilled nursing facilities, and home health agencies.

What is Medicare Advantage?

Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans. .

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. ) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (. coinsurance.

What is a referral in health care?

referral. A written order from your primary care doctor for you to see a specialist or get certain medical services. In many Health Maintenance Organizations (HMOs), you need to get a referral before you can get medical care from anyone except your primary care doctor.

What is a coinsurance percentage?

Coinsurance is usually a percentage (for example, 20%). An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage.

Does Medicare cover assignment?

The type of health care you need and how often you need it. Whether you choose to get services or supplies Medicare doesn't cover. If you do, you pay all the costs unless you have other insurance that covers it.

Do you have to choose a primary care doctor for Medicare?

No, in Original Medicare you don't need to choose a. primary care doctor. The doctor you see first for most health problems. He or she makes sure you get the care you need to keep you healthy. He or she also may talk with other doctors and health care providers about your care and refer you to them.

When Original Medicare Might Be Sufficient

Most Don’T Rely on Original Medicare Alone

- So for low-income Medicare beneficiaries, public programs are available to fill in the gaps in Medicare coverage. And 30%of Medicare beneficiaries receive employer or union-sponsored benefits that supplement Medicare. But what about the rest of the population? Is Original Medicare enough coverage on its own? Most Medicare beneficiaries don’t think ...

Preventing Major Expenses

- There are certainly people who contendthat even though Original Medicare has no cap on out-of-pocket costs, it is still plenty of coverage – and for the average enrollee, that’s probably true. But the purpose of insurance is to protect us against significant losses. Although most hospitalizations last less than a week, my father was hospitalized for 136 days in 2004. With a si…

Feeling Lucky?

- If you never get seriously ill, and if you only ever need the occasional generic prescription, you’ll be fine with Original Medicare alone. But who among us can accurately predict whether or not a catastrophic medical condition will befall us at some point in the future? Although Original Medicare provides a solid insurance base, the lack of prescription coverage or an out-of-pocket …