The term “payroll taxes” refers to FICA taxes, which is a combination of Social Security and Medicare taxes. These taxes are deducted from employee paychecks at a total flat rate of 7.65 percent that’s split into the following percentages: Medicare taxes – 1.45 percent Social Security taxes – 6.2 percent

Do tax brackets include social security?

Mar 15, 2022 · Social Security and Medicare Withholding Rates. The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

When are Medicare premiums deducted from Social Security?

Dec 04, 2021 · NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion is 6.20% on earnings up to the applicable taxable maximum amount . The Medicare portion is 1.45% on all earnings. How much does Medicare an and B cost?

Are Medicare premiums deducted from Social Security payments?

Apr 08, 2019 · 1.45 percent of your paycheck will be deducted and routed toward Medicare. Much like Social Security, this is a non-negotiable element of taxation that cannot be dodged through the use of a W-4.

What is the current Social Security tax rate?

The payroll taxes required for the Federal Insurance Compensation Act (FICA) are to support both your Social Security and Medicare benefits programs. Your employer makes a matching contribution to the Medicare program. Currently, the FICA tax is 7.65 percent of your gross taxable income for both the employee and the employer.

What percentage (%) is withheld from your paycheck for Medicare?

What percentages do both you and your employer pay into Social Security and Medicare?

What percent of your paycheck goes to taxes and Social Security?

| Gross Paycheck | $3,146 | |

|---|---|---|

| Details | ||

| Social Security | 6.20% | $195 |

| Medicare | 1.45% | $46 |

| State Disability Insurance Tax | 0.04% | $1 |

What is the payroll tax rate for 2021?

...

2021 Federal Payroll Tax Rates.

| 2021 Current Year | 2020 Prior Year | |

|---|---|---|

| FUTA Employer rate Wage limit | 0.6% $7,000 | 0.6% $7,000 |

What percentage of Social Security is taxable in 2021?

Does the federal tax rate include Social Security and Medicare?

How is Medicare tax calculated?

How do you calculate Social Security tax withheld?

What percentage of payroll is taxes?

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

How much tax do you pay on Medicare?

There are no tax limits for Medicare. You will pay taxes at a rate of 1.45% on all of your taxable wages. In addition, employers are required to withhold Additional Medicare tax of 0.9% once taxable wages are over $200,000 for the year.

How much does Bob earn?

Bob is paid semi-monthly. On this paycheck, he earned $8,000 in salary. Bob gets a semi-monthly auto allowance of $1,000. He has a medical deduction of $1,500, and he contributes 10% of his income to his 401k.

Who is Matthew Keller?

Matthew Keller is a Senior Payroll Specialist at Zenefits who authors our "Money Matters" column. With 20+ years of experience in payroll and accounting, Matt wants to help customers navigate frequent law changes, taxes, and more.

How much is deducted from paycheck for Medicare?

In every paycheck, 1.45 percent is deducted and routed toward Medicare programs. When it comes to federal taxes, the amount being taken from each paycheck will depend not only on the amount of income being earned by the employee but also the specific withholdings they have requested on their employer W-4.

What percentage of your paycheck goes to Medicare?

1.45 percent of your paycheck will be deducted and routed toward Medicare. Much like Social Security, this is a non-negotiable element of taxation that cannot be dodged through the use of a W-4.

Who is Ryan Cockerham?

Ryan Cockerham is a nationally recognized author specializing in all things business and finance. His work has served the business, nonprofit and political community. Ryan's work has been featured on PocketSense, Zacks Investment Research, SFGate Home Guides, Bloomberg, HuffPost and more. Related Articles.

What is payroll tax?

The term “payroll taxes” refers to FICA taxes, which is a combination of Social Security and Medicare taxes. These taxes are deducted from employee paychecks at a total flat rate of 7.65 percent that’s split into the following percentages: These percentages are deducted from an employee’s gross pay for each paycheck.

What is health insurance?

Health insurance – Based on the plans offered and which of those plans your employees choose. Retirement – Based on how much each employee opts to have withheld from each paycheck. Life insurance – Based on whether employee opts to have deductions to go toward a life insurance premium.

What is third party administration?

Third Party Administration. As an employer, you have a responsibility to handle every step of your business’ payroll. One of the more notable steps is handling the tax deductions that are withheld from every employee’s gross wages. To help, we’ve put together some pointers on how you can calculate the various deductions found on each paycheck.

What is the responsibility of an employer?

As an employer, you have a responsibility to handle every step of your business’ payroll. One of the more notable steps is handling the tax deductions that are withheld from every employee’s gross wages. To help, we’ve put together some pointers on how you can calculate the various deductions found on each paycheck.

What is the tax rate for Medicare?

The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income. Your employer also pays a matching Medicare tax based on your paycheck. There are two ways that you may see the Medicare payroll deduction applied to your paycheck.

What is the Social Security tax rate?

The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax. This means that the total FICA paid on your earnings is 12.4 percent for Social Security, up to the earnings limit of $137,000 ...

What is Medicare tax?

The Medicare tax is an automatic payroll deduction that your employer collects from every paycheck you receive. The tax is applied to regular earnings, tips, and bonuses. The tax is collected from all employees regardless of their age.

When was Medicare enacted?

When Medicare was enacted as a federal law in 1965, the funds to support the program became a payroll tax on earned income. The payroll taxes required for the Federal Insurance Compensation Act (FICA) are to support both your Social Security and Medicare benefits programs.

How to pay payroll taxes?

Don't Forget Employer Payroll Taxes 1 Pay the federal income tax withholding from all employees 2 Pay the FICA tax withholding from all employees, and 3 Pay your half of the FICA tax for all employees.

Do you have to deposit taxes withheld from employee pay?

You must make deposits with the IRS of the taxes withheld from employee pay for federal income taxes and FICA taxes and the amounts you owe as an employer. Specifically, after each payroll, you must

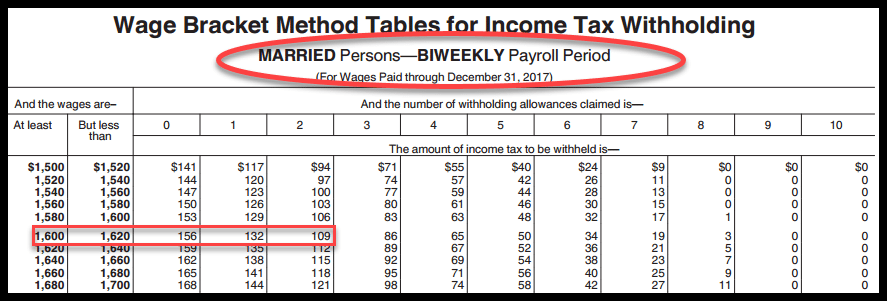

How to calculate federal withholding?

To calculate Federal Income Tax withholding you will need: 1 The employee's adjusted gross pay for the pay period 2 The employee's W-4 form, and 3 A copy of the tax tables from the IRS in Publication 15: Employer's Tax Guide ). Make sure you have the table for the correct year.

When was the W-4 changed?

IRS Form W-4 has been changed effective January 1, 2020. This form is used to record employee information for calculating withholding and deductions. Be sure you are using the correct form, titled "Employee's Withholding Certificate" with "2020" in the upper right. This article on the new W-4 form has information on how to use ...

What is gross pay?

Gross pay is the total amount of pay before any deductions or withholding. For the purpose of determining income tax and FICA tax (for Social Security and Medicare), use all wages, salaries, and tips. 1 .

How many hours can you work overtime?

All hourly employees are entitled to overtime if they work over 40 hours in a week. 2 Some salaried employees are exempt from overtime, depending on their pay level. Lower-paid salaried employees must receive overtime if their salary is equal to or less than $455 a week ($23,660 annually), even if they are classified as exempt. 3

Do you have to sign a W-4?

The IRS requires that all workers in the U.S. sign IRS Form W-4 at hire. This form includes important information you will need to pay the employee and to make sure withholding and deductions are correctly calculated on the employee's pay.

How much did the employee contribute to Social Security in 2011?

For 2011 and 2012 only, the employee's "half" didn't equal the employer's "half" for Social Security: they contributed 4.2% and 6.2% respectively. For 2013, both contribute 6.2%. For 2017, there is a very large increase in the Social Security income limit, from $118,500 to $127,200.

What is the Medicare tax rate for 2013?

Starting in 2013, people with high salaries will pay a new additional Medicare tax of 0.9%. Unlike the rest of Medicare, this new tax depends on your filing status:

What is FICA tax?

The FICA (for Federal Insurance Contributions Act) tax (also known as Payroll Tax or Self-Employment Tax, depending on your employment status) is your contribution to Social Security and Medicare as a percentage of your salary: If you're an employee, then you pay one half of this total (probably as a withholding on your paycheck);