How much will Medicare cost this year?

6 rows · Nov 03, 2021 · 2021 Medicare Part B Costs. The standard Part B premium in 2021 is $148.50 per month. That's ...

How much is monthly premium for Medicare?

Nov 22, 2020 · If you're signed up for Social Security, you'll have your monthly part B premiums deducted directly from your benefits. If you're not yet on …

When do Medicare payments increase?

7 rows · Sep 30, 2021 · While the average Medicare Advantage (or Medicare Advantage prescription drug) premium in 2021 ...

Are Medicare costs based on your income?

The spousal discount can be as much as 14 percent. 2021 rates for cities are added regularly. Click the link to see the 2020 Medicare insurance price reporting for nearly 100 major markets. MEDIA: Reporters or bloggers who want information for a specific area may call the Association at 818-597-3205.

What is the new monthly Medicare premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What will Medicare cost in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

Is Medicare cost increasing in 2021?

The increase in the standard monthly premium—from $148.50 in 2021 to $170.10 in 2022—is based in part on the statutory requirement to prepare for expenses, such as spending trends driven by COVID-19, and prior Congressional action in the Continuing Appropriations Act, 2021 that limited the 2021 Medicare Part B monthly ...Nov 12, 2021

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

Is Medicare Part B going up 2022?

Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

Do Medicare premiums increase every year?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare.

What changes are coming to Medicare in 2021?

What are the 2021 proposed changes to Medicare?Increased eligibility. One of President Biden's campaign goals was to lower the age of Medicare eligibility from 65 to 60. ... Expanded income brackets. ... More Special Enrollment Periods (SEPs) ... Additional coverage.Nov 22, 2021

Why did I get an extra Social Security payment this month 2021?

According to the CMS, the increases are due to rising prices and utilization across the healthcare system, as well as the possibility that Medicare may have to cover high-cost Alzheimer's drugs like Aduhelm.Jan 12, 2022

Is Social Security going up 2022?

Cost-of-Living Adjustment (COLA) Information for 2022 Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase 5.9 percent in 2022.

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Will Social Security get a $200 raise in 2021?

Which Social Security recipients will see over $200? If you received a benefit worth $2,289 per month in 2021, then you will see an increase worth over $200. People who get that much in benefits worked a high paying job for 35 years and likely delayed claiming benefits.Jan 9, 2022

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

How much is Medicare Part B 2021?

2021 Medicare Part B Costs. The standard Part B premium in 2021 is $148.50 per month. That's an increase of $3.90 from the 2020 Part B premium. While most people pay the standard Part B premium, other beneficiaries may pay more if they had a higher reported income two years prior (2019).

How much is the 2021 deductible?

The Part A deductible in 2021 is $1,484 per benefit period, which is an increase of $76 from the 2020 Part A deductible. The Part A deductible amount may increase each year, and it will likely be higher in 2022.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, or Medigap, provides coverage for certain Medicare Part A and Part B out-of-pocket expenses like deductibles, coinsurance and copayments . This cost figure is weighted, which means that some Medigap plans in some areas may offer lower premiums than what is listed above.

What are the factors that affect the cost of a Medigap plan?

Other factors such as age, gender, smoking status, health and where you live can also affect Medigap plan rates. Medigap premiums can increase over time due to inflation and other factors, so you can typically expect Medigap plan premiums to be higher in 2022 than they will be in 2021.

Is Medigap 2021 higher than 2021?

This cost figure is weighted, which means that some Medigap plans in some areas may offer lower premiums than what is listed above. Some 2021 Medigap plan premiums may also be higher. Each type of Medigap plan offers a different combination of standardized benefits. Plans with fewer benefits may offer lower premiums.

How much is the Part B premium for 2021?

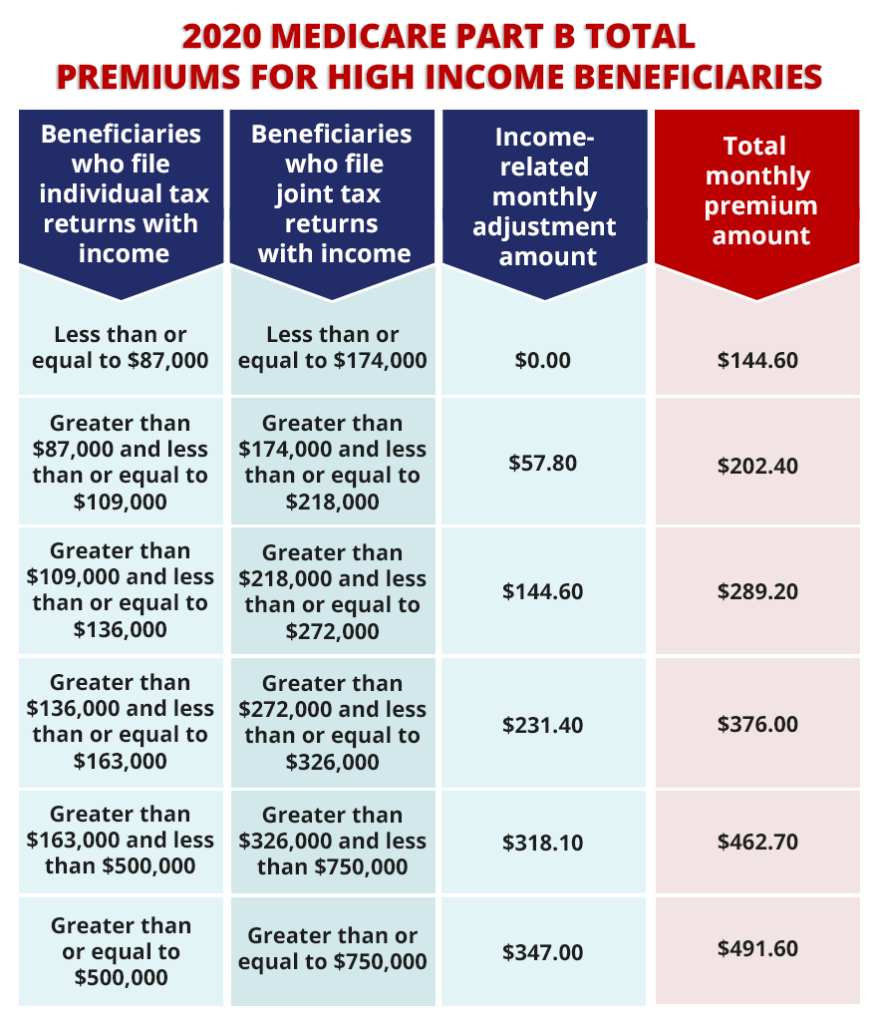

The standard monthly Part B premium in 2021 will be $148.50. However, if you're a higher earner, you'll pay more, as follows: Keep in mind that these numbers are based on the income you reported on your 2019 taxes. In addition, you'll be subject to an annual Part B deductible of $203.

How much is Part A coinsurance?

Most enrollees don't pay a premium for it. However, you'll still face other costs under Part A: A $1,484 deductible for each hospital stay per benefit period (a benefit period begins the day you're admitted to a hospital or skilled nursing facility and ends when you've been out for 60 days in a row) $371 per day in coinsurance for days 61-90 of ...

What is Medicare Part B?

Medicare Part B covers outpatient services like diagnostic tests and doctor visits. If you're signed up for Social Security, you'll have your monthly part B premiums deducted directly from your benefits.

Is there a lot of money out of pocket for Medicare?

Clearly, there's the potential to spend a lot of money out of pocket on Medicare in the coming year, so it's crucial to know what to expect in advance. You'll also need to think about where the money to pay your healthcare costs will come from. If you have funds in a health savings account, that's a good start.

Will Medicare be used in 2021?

Otherwise, you may need to rely heavily on your retirement savings and Social Security income to keep up with your medical bills. The amount you'll spend in 2021 will ultimately depend on how extensively you need to use Medicare, but it's best to know what expenses you could potentially be in for. The Motley Fool has a disclosure policy.

Original Medicare Part A Premiums and Costs

Most people do not pay a monthly premium for Part A, as their work history qualifies them to receive this coverage for free. However, if you have worked in the United States and have paid taxes for less than 10 years (or 40 quarters), you may need to pay a premium for Part A coverage.

Original Medicare Part B Premiums and Costs

The standard Part B premium amount for 2021 is $148.50, although you may have to pay more depending on your income. To find out exactly how much you will pay, reference the chart below.

Medicare Part C Premiums and Costs

Medicare Advantage (Part C) plans are sold by private insurance companies as an optional replacement to Original Medicare. Regulated by the federal government, these plans are required to provide the same standard benefits covered under Parts A and B. However, these plans often include coverage for additional benefits, including:

Medicare Part D Premiums and Costs

Medicare Part D plans are sold by private insurance companies as an optional addition to Original Medicare. These plans provide their members with coverage for the prescription drugs they need to survive. Each Part D plan has a unique formulary, which is the list of drugs it covers.

Medicare Supplement Premiums and Costs

Medicare Supplement plan benefits are standardized by the government, but the prices for these plans can vary depending on which insurance company you purchase a plan from. Ten Medicare Supplement plans are available, lettered A through N, and each of these plans offers a different combination of benefits.

How Can I Reduce My Medicare Premiums and Costs?

The best way to save money on Medicare is to enroll in the right plan when you first sign up for an additional coverage option. Prices for similar coverage can vary widely between carriers, and doing your research beforehand can end up saving you a lot of money over the course of the year.

Ready to Enroll?

If you are ready to explore coverage options in your area, chat with a licensed Medicare professional who can help you find the coverage you need at a price that fits your budget.

How much is the spousal discount for 2021?

The spousal discount can be as much as 14 percent. 2021 rates for cities are added regularly. Click the link to see the 2020 Medicare insurance price reporting for nearly 100 major markets. MEDIA: Reporters or bloggers who want information for a specific area may call the Association at 818-597-3205.

What age is Metro Area 2021?

SCROLL DOWN TO SEE THE 2021 TOP-10 METRO AREA PRICES. Prices are for an age 65 Male and an age 65 Female (non-tobacco use). Rates assume a first-time Medicare eligible applicant. They do NOT include a spousal or partner discount which can vary based on the insurance company.

What does "appointed" mean in insurance?

Appointed is insurance industry jargon that means they can actually sell that policy and earn a commission from the insurance company. Agents often don’t recommend companies if they cannot earn a commission.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much is the Part D premium in 2021?

The figures below apply to whatever your income was two years before now, or 2019 for premiums paid in 2021: For individuals with this income: Or joint filers with this income: The Part D premium surcharge in 2021 is: $88,000 to $111,000.

How much is the deductible for Part D in 2021?

Some Part D plans charge deductibles, and the annual limit on that amount in 2021 will go up by $10 to $445. However, a plan can charge a smaller deductible, or no deductible at all. There are limits on how much you'll have to pay for drugs.

What is Medicare Part D?

One of the newer elements of the Medicare program is prescription drug coverage, added under what's known as Medicare Part D. Part D coverage is an optional add-on that participants can use regardless of whether they have traditional Medicare coverage under Parts A ...

Do Part D plans charge a monthly premium?

With those coverage differences in mind, some Part D plans don't charge a monthly premium at all. Others can be quite expensive.

Is Medicare Part D good for retirement?

Prescription drugs play a vital role in keeping people healthy, but paying for them in your retirement years can be challenging. Medicare Part D offers a valuable way to control healthcare costs, but it's important to know the ins and outs of the program to make sure that you get everything you can out of it.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is respite care in 2021?

You might also be charged a 5 percent coinsurance for inpatient respite care costs. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

How long do you have to work to get Medicare in 2021?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters).

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.