What does privatizing Medicare mean?

Trump’s Plan To Privatize Medicare

- A shift toward Medicare privatization. ...

- Expansion of private contracting would weaken Medicare’s financial safeguards. ...

- Restriction of seniors’ choice of doctors in Medicare Advantage. ...

- Savings accounts to benefit the wealthy and healthy. ...

- Trump sidesteps seniors’ most pressing concerns. ...

- Conclusion. ...

What would happen if Medicare was privatized?

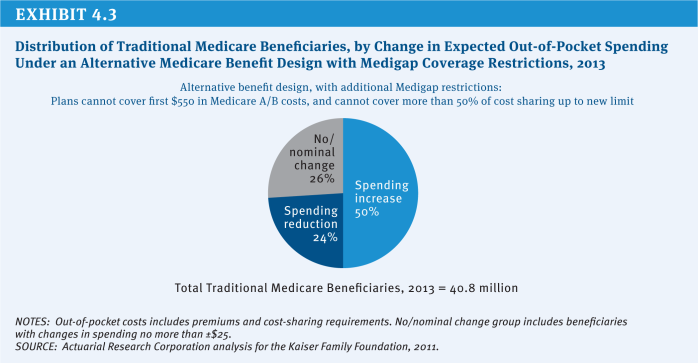

WASHINGTON A privatized health care system would cause 59 percent of Medicare recipients to pay higher premiums, a study released on Monday revealed. The research also discovered that there were stark regional differences leading to big hikes in some states and counties. Is a $5,000 salary too much for Medicaid?

What happens if Medicare is privatized?

What it means to pay primary/secondary

- The insurance that pays first (primary payer) pays up to the limits of its coverage.

- The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover.

- The secondary payer (which may be Medicare) may not pay all the uncovered costs.

Is Medicare being privatized?

Medicare is being privatized on Biden’s watch, insurance industry SALIVATES. Host Ryan Grim outlines the dangers of private equity taking over Traditional Medicare; the revolving door politics that allows stealth privatization to take root; and the urgent need to freeze Medicare Direct Contracting. “The name for this is managed care,” he says, “and it’s extremely unpopular with patients, which explains why the industry is doing it so quietly.”.

Who is Medicare owned by?

the Centers for Medicare & Medicaid ServicesMedicare is a federal program. It is basically the same everywhere in the United States and is run by the Centers for Medicare & Medicaid Services, an agency of the federal government.

Is Medicare at 60 Still Alive?

The Presidents Proposal for Medicare at 60 This was part of his health care reform platform during the presidential race. Currently, the age at which one becomes Medicare-eligible is 65. Individuals under 65 can obtain Medicare if they collect SSDI for 24 months or are diagnosed with ALS or ESRD.

Is Medicare Part A government or privately offered?

Medicare is the federal government program that provides health care coverage (health insurance) if you are 65+, under 65 and receiving Social Security Disability Insurance (SSDI) for a certain amount of time, or under 65 and with End-Stage Renal Disease (ESRD).

What is happening to Medicare Advantage plans?

A record 3,834 Medicare Advantage plans will be available across the country as alternatives to traditional Medicare for 2022, a new KFF analysis finds. That's an increase of 8 percent from 2021, and the largest number of plans available in more than a decade.

Can you get Medicare without Social Security?

Even if you don't qualify for Social Security, you can sign up for Medicare at 65 as long you are a U.S. citizen or lawful permanent resident.

Will the Medicare age be raised to 67?

3 The retirement age will remain 66 until 2017, when it will increase in 2-month increments to 67 in 2022. Several proposals have suggested raising both the normal retirement age and the Medicare eligibility age.

How is Medicare Part A funded?

While Part A is funded primarily by payroll taxes, benefits for Part B physician and other outpatient services and Part D prescription drugs are funded by general revenues and premiums paid for out of separate accounts in the Supplementary Medical Insurance, or SMI, trust fund.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

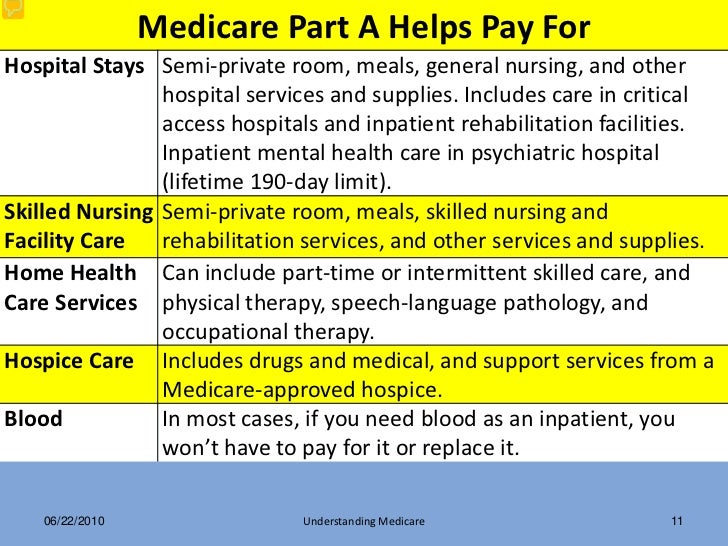

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What changes are coming to Medicare in 2021?

The Medicare Part B premium is $148.50 per month in 2021, an increase of $3.90 since 2020. The Part B deductible also increased by $5 to $203 in 2021. Medicare Advantage premiums are expected to drop by 11% this year, while beneficiaries now have access to more plan choices than in previous years.

What will Medicare cost in 2021?

The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

What changes are coming to Medicare in 2022?

Changes to Medicare in 2022 include a historic rise in premiums, as well as expanded access to mental health services through telehealth and more affordable options for insulin through prescription drug plans. The average cost of Medicare Advantage plans dropped while access to plans grew.

Why do Medicare Advantage plans charge per enrollee fee?

The reason for that government per enrollee fee – technically a pre-payment for the estimated average cost of care of each MA policy holder – is that what the Medicare Advantage insurers like Humana, Blue Cross/Blue Shield, Aetna and United Healthcare, etc., want is younger and healthier subscribers to their plans, leaving the genuinely sickest, costliest elderly and disabled to the public plans. The MA companies are required under the law to accept all comers who are Medicare eligible, regardless of condition, age, etc., and to charge everyone the same, but these companies have ways of getting around that. The theory is that if they can keep the cost of care for their subscribers down they can pocket more profits, but the flaw in that thinking, if it is a flaw of course, is that to keep those costs down, the MA companies, like the health insurance industry as a whole does, works hard to keep costly treatments and specialist visits to a minimum so as to stay under that annual amount for as many of their subscribers as possible.

When was Medicare Advantage introduced?

Medicare Advantage, originally called Medicare Choice, introduced in 1997 during the Clinton administration, got its even slipperier monicker in 2003. It deserved neither as it doesn’t improve choice nor is it an advantage.

Why do people get into Medicare Advantage Plans?

People get into Medicare advantage plans in large part because they are being advised to do so by expensive corporate marketing programs, large ad campaigns, and by both active promotion by government and by regulations that don’t allow Medicare to compete with the MA plans.

Why is Medicare Advantage fighting tooth and nail?

That’s something the private Medicare Advantage industry is fighting tooth and nail because they’d lose their ‘advantage’ in marketing themselves.”. He adds, “And AARP [the American Association of Retired Persons] is complicit, because they are offering Medicare Advantage plans themselves.”.

How much did Medicare cost in 2020?

The annual fees alone for signing up 24 million elderly and disabled people into MA plans and keeping them or luring them off the traditional government Medicare rolls came to $288 billion in 2020.

What is Medicare Advantage like?

Medicare Advantage, in fact, is like a Roach Motel, a cockroach trap with sticky glue-like adhesive on the inside that grabs any entering roach’s legs and renders it immobile, hence the slogan: “Roaches check in but they can’t check out.”.

Do doctors have to opt out of Medicare?

Only 7% of US physicians opt-out of Medicare assignment, meaning they don’t accept Medicare reimbursements as full payment, a requirement for qualifying for treating Medicare patients. If you are on a Medicare Advantage plan and go to a doctor outside your plan’s list of doctors, you’re on the hook for the bill.

Why Medicare Advantage Was Invented

Medicare’s sole purpose in 1965 was to extend health coverage to the elderly by paying their doctor and hospital bills. In a Faustian bargain, Congress sacrificed Medicare’s regulatory role in return for the support of the hospital-operated Blue Cross Association and physician-owned Blue Shield plans, which set payment policies.

How the MA Money Machine Churns

Unlike the Defense Department’s TRICARE and the Veterans Health Administration, Medicare is not a public health care system. It is public financing that relies on a joint public-private insurance arrangement.

Federal Regulators Lose the War

Over the past 30 years, laws were passed and regulations issued to contain costs and protect MA beneficiary access to care. Managed-care sponsors found ways around the rules.

Risk Adjustment and Star Bonuses

Insurance companies have consistently found innovative ways to protect their bottom lines. A major one involves claiming MA enrollees are sick, even if they aren’t.

Taking Medicare Public, Again

Last fall, 13 U.S. senators (eight Democrats and five Republicans) sent a letter promising to “stand ready to protect MA from payments cuts.” The letter was part of a long stream of such letters ritualistically issued by lawmakers at the urging of the industry, every time anyone announces consideration of MA cost control.

What does AARP say about Medicare Advantage plans?

For example, a brochure provided by AARP and United Health on Medicare Advantage plans claims that they “offer the same coverage as Original Medicare Parts A and B, plus extras that contribute to your health and wellness like annual physicals, vision care, and access to a nurse advice line.” The brochure does tell seniors that “each plan has its own rules for deductibles, copayments, and other cost sharing, all different from the cost sharing in Part A and Part B. Some Medicare Advantage plans will even limit your out-of-pocket spending, a feature not offered with Original Medicare.” The use of the word “even” implies that “different” cost sharing arrangements are always a plus (AARP and Secure Horizons by United Healthcare. 2008. Medicare Advantage Explained ). AARP made almost half a billion dollars in 2007 from insurance royalties, including those from Medicare Advantage plans marketed by AARP and United Health (Saul Friedman. 2009. New questions about AARP’s growing insurance business. Newsday, January 10).

Do private insurance plans cover seniors?

The problem is that they may not cover similar groups of seniors. This flexibility allows the private plans to structure cost-sharing and offer benefits, such as discounted fitness club memberships, designed to appeal to healthier seniors who are less costly to cover. This longstanding problem has only been partly addressed through the gradual introduction of risk-adjusted payments, 12 which are supposed to be based on the health status of enrollees. However, since payments are not based on actual health care expenditures, the insurance companies have an incentive to exaggerate the health problems of enrollees.

Do Medicare Advantage plans provide the same coverage as Medicare?

Not only do insurance companies mislead seniors by claiming that Medicare Advantage plans provide the “same” coverage as Medicare, they also mislead them about how they are able to provide extra benefits or reduce out-of-pocket costs. Because seniors might be put off to learn that they are benefiting at the expense of others, the plans pose as holistic healers who save both taxpayers and beneficiaries money through preventative medicine. For example, this is how United Health and AARP explain how its Florida plans are able to provide extra benefits with a $0 premium:

Do seniors get lower Medicare premiums?

Some seniors do enjoy lower premiums and other perks by enrolling in Medicare Advantage plans. But as Hackbarth noted in his testimony, each dollar’s worth of enhanced benefits in private fee-for-service (PFFS) plans costs the Medicare program over three dollars. 25 In other words, the same benefits could be provided to three times as many seniors if this were done through the public system rather than PFFS plans, which mimic Medicare’s fee-for-service structure, providing no efficiency gains. 26

Does Medicare Advantage have the same coverage as regular Medicare?

In fact, Medicare Advantage plans only provide “actuarially equivalent” coverage, meaning that the projected out-of-pocket cost per enrollee should be the same as or less than with regular Medicare if the public and private plans cover similar groups of seniors.

Did the Bush administration promote Medicare Advantage?

This kind of marketing was not just condoned but parroted by the Bush administration, which trumpeted that seniors would save “$100 a month, on average” with Medicare Advantage plans. 16 Well into the Obama presidency, the official Medicare Web site still says Medicare Advantage plans generally have “extra benefits and lower copayments” than Medicare, 17 a legacy of the Bush administration.

Is Medicare a public plan?

The history of Medicare Advantage plans shows that a public plan is a necessary but not sufficient component of real health care reform. For those tempted to think that a regulated health insurance industry without a public plan would be a workable compromise, try to imagine an industry powerful enough to block the public plan option yet not able to completely control the regulatory process now and in the future. Most scary of all: if fundamental health care reform does not pass under this administration, and attempts to rein in privatized plans are not successful, then we will find ourselves with one less viable public health plan than we had when Obama came into office, and an even more entrenched insurance industry.

What are the solutions to Medicare's problem?

Lobbying and campaign donations are the answers. Private companies promise to solve the fundamental problem of Medicare paying doctors and hospitals a fee for each service they perform rather than paying providers to keep people healthy.

How much will Medicare spend in 2028?

The business opportunity looks vast. Medicare spending is expected to rise from $800 billion in 2019 to $1.6 trillion in 2028 as Baby Boomers live longer. Wall Street considers Direct Contracting firms eight times more valuable per patient than Medicare Advantage firms, even though they are supposed to save money.

Why do doctors get paid so little?

Primary care doctors are paid very little to prevent chronic problems, such as obesity, diabetes and heart disease, the biggest financial burdens on the system . But the surgeons and specialists who treat these problems when they become life-threatening make fortunes.

Does Medicare Advantage drive up costs?

Medicare Advantage, though, drove up costs to taxpayers instead of reducing them. Depending on the program, patients also ended up paying more in deductibles and co-payments than they would have under traditional Medicare.

Is Medicare a sweetheart deal?

Medicare is also offering sweetheart deals that reduce these companies’ financial risk. In just 18 months, investor-backed funds seeking big profits have put $50 billion of new investment into health care firms involved in Direct Contracting, according to Health Affairs, a non-partisan research journal.

Will direct contracting kill Medicare?

Direct Contracting is also likely to kill any chance for progressive Democrats to make Medicare an option for any American who wants to enroll. If the government puts private companies in charge of all Medicare patients, it will eliminate any opportunity to overhaul our health care system truly.