Can I deduct my Medicare premiums on my tax return?

· The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019. The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs.

Is Medicare Part B payments tax deductible?

· For the 61st through 90th days of a hospitalization, beneficiaries will pay $352 per day, up from $341 in 2019, and then $704 per day for 60 “lifetime reserve” days, up from $682 …

Are there deductibles for Medicare?

For new Part B enrollees, the premium in 2020 is $144.30 a month if you earn up to $85,000 as a single tax filer. The hold harmless provision still applies, though, and a small percentage of Part …

What is the monthly premium for Medicare Part B?

In 2020, plans cannot set their deductible higher than $435. Medicare does not limit the amount plans can require for copayments and coinsurance amounts. Medicare also does not …

What will 2022 Medicare deductible be?

What is the Medicare deductible for 2022? The Part A deductible for 2022 is $1,556 for each benefit period. The Part B deductible is $233. You will usually then pay 20 percent of the cost for anything covered by Part B after you have met your deductible.

What is the Medicare annual deductible for 2020?

(Note: Most Medicare beneficiaries are exempt from paying the Medicare Part A premium since they or their spouse paid into Medicare while working.) The 2020 Part A deductible is $1,408 — $44 more than in 2019.

What is the Medicare deductible going to be for 2021?

$203Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is the projected increase for Medicare Part B 2022?

Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.

How much does Social Security deduct for Medicare?

You will pay no monthly premium for Medicare Part A if you are older than age 65 and any of these apply: You receive retirement benefits from Social Security....Is Medicare Part A free?Amount of time worked (and paid into Medicare)Monthly premium in 2021< 30 quarters (360 weeks)$47130–39 quarters (360–468 weeks)$259Dec 1, 2021

What is the Medicare deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in. For example, if your Medicare plan has a $200 annual deductible, you must pay for the first $200 worth of covered services or items yourself.

What is the new Part B premium for 2021?

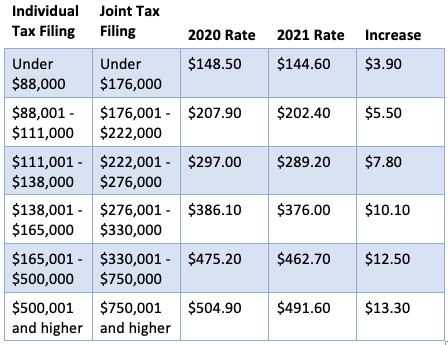

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Will Social Security get a $200 raise in 2022?

In 2022, some Social Security recipients will see an additional $200 following the 5.9% COLA increase. Checks started going out Jan. 12, and everyone receiving benefits have seen some sort of boost in their payments. The average increase following the COLA was $92.

How much is the Medicare increase for 2022?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.

Is your Medicare premium based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What is the 2021 CMS Defined Standard Medicare Part B deductible?

CMS also announced that the annual deductible for Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from $198 in 2020.

What is yearly deductible for Medicare Part A?

Part A Deductible: The deductible is an amount paid before Medicare begins to pay its share. The Part A deductible for an inpatient hospital stay is $1,556 in 2022. The Part A deductible is not an annual deductible; it applies for each benefit period.

Are Medicare Part B premiums going up in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.

How much is the 2020 Part B deductible?

Just to outline how accurate some of these numbers have been, in the 2019 meeting, they estimated the 2020 Part B deductible would be $197. Ultimately, when released, it was $198. So, as you can see, though it isn't perfect, it is a good indicator of things to come.

Do deductibles rise or fall with higher cost sharing?

One thing that I think is extremely important to note is that though deductibles may rise, sometimes the premiums associated with higher cost-sharing are low enough to make up for the difference. Below, I will make recommendations about how we can mitigate our overall costs, and prepare for higher out-of-pocket costs, and I’ll dive into what cost-of-living adjustments mean when it comes to increasing out-of-pocket costs and healthcare cost inflation.

Is Medicare Advantage an option?

Of course, Medicare Advantage is also an option, but it should only be looked at with a nonbiased professional who will explain the provider's freedom and potential out of pocket associated with a plan in this category.

How much is the 2020 Part D deductible?

Part D Costs. Part D premiums vary depending on the plan you choose, with an average of $33. The maximum Part D deductible for 2020 is $435 per year (though some plans waive the deductible completely).

How much is Medicare Part B premium in 2020?

If you first enroll in Medicare Part B during 2020, or you are not collecting Social Security benefits, your premium will be $144.60 per month. Also, if your adjusted gross income is over $87,000 (or $177,000 for a couple), the monthly premium is higher. These premiums have increased for 2020, as follows: Yearly Income. Monthly Premium.

How much is Medicare Part B?

The standard Medicare Part B premium is $144.60 per month in 2020. But some people who were enrolled in Medicare in 2020 or earlier will pay slightly less (about $135 per month) because of a hold harmless provision that doesn't allow Social Security payments to be reduced from year to year for Medicare premiums.

How much is part B therapy for 2020?

The caps on the following Part B services for 2020 remain have increased, though if your therapist tells Medicare that more care is medically necessary and Medicare approves, you can go over the caps: outpatient physical therapy and speech-language pathology combined: $2,040. occupational therapy: $2,040.

How much does Part A cost in 2020?

In 2020, you'll also pay a $1,408 deductible for each benefit period in which you use hospital or skilled nursing inpatient care, ...

What is the amount of Part D for 2020?

Here are the Part D additional amounts for individuals making over $87,000 and married couples making over $174,000: The donut hole (coverage gap) for Part D has changed for 2020. You no longer have to pay the full amount of your drug costs while in the donut hole.

Is there a subsidy for Part D?

There are subsidies available to pay for Part D for those with low income (called Extra Help). See Nolo's article on Extra Help for Part D for more information.

How many people will be on Medicare in 2020?

The maze that is Medicare includes some higher costs for 2020 that beneficiaries might want to factor into their health-care budgets. For the program’s 61 million beneficiaries — most of whom are 65 or older — certain costs are adjusted by the government from year to year and can affect premiums, deductibles and other cost-sharing aspects ...

How much is Advantage Plan 2020?

Also, while Advantage Plan premiums vary among plans — the average for 2020 is $23 , down from about $27 this year — any monthly charge would be on top of your Part B premium. And, some of those options either have no monthly charge or will pay your Part B premium.

How much is the maximum deductible for Part D?

Also, while not everyone pays a deductible for Part D coverage — some plans don’t have one — the maximum it can be is $435 in 2020, up from $415 in 2019.

How much is Part B deductible?

The annual deductible for Part B will rise to $198, up from $185 in 2019. Once you meet that deductible, you typically pay 20% of covered services. Keep in mind that beneficiaries in Advantage Plans might pay a different amount through copays, and Medigap policies either fully or partially cover that coinsurance.

What is Advantage Plan?

Those plans typically also include Part D prescription drug coverage, as well as extras such as dental or vision. They also limit what you pay out of pocket for Parts A and B services.

Why won't Social Security pay Part B premium?

Some recipients won’t pay the full standard premium due to a “hold harmless” provision that prevents their Part B premiums from rising more than their Social Security cost-of-living adjustment, or COLA. Others, however, will pay more than the standard due to income-adjusted surcharges (see tables below).

How much is the average monthly premium for a drug plan?

The average monthly premium for a standalone drug plan in 2020 will be $30, according to the Centers for Medicare and Medicaid Services, down from $32.50 in 2019. As with Part B premiums, higher earners pay extra (see chart below).

How much will Medicare cost in 2021?

In 2021, it costs $259 or $471 each month, depending on how long you paid Medicare taxes. 2 . That doesn’t mean you aren’t charged a deductible. For each benefit period, you pay the first $1,484 in 2021. A benefit period begins when you enter the hospital and ends when you haven’t received any inpatient hospital services for 60 consecutive days.

How much does Medicare pay for a hospital stay in 2021?

Part A also charges coinsurance if your hospital stay lasts more than 60 days. In 2021, for days 61 to 90 of your hospital stay, you pay $371 per day; days 91 through the balance of your lifetime reserve days, you pay $742 per day. 3 Lifetime reserve days are 60 days that Medicare gives you to use if you stay in the hospital for more than 90 days.

What does Medicare cover?

What you pay for Medicare depends on the type of enrollment you have: Parts A, B, C, and/or D. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. It doesn't generally charge a premium. Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium ...

What is Medicare Part A 2021?

Medicare Part A Costs in 2021. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. 1 For most people, this is the closest thing to free they’ll get from Medicare, as Medicare Part A (generally) doesn't charge a premium. 2 . Tip: If you don't qualify for Part A, you can buy Part A coverage.

What is the Medicare Advantage premium for 2021?

The average plan premium is about $21.00 a month in 2021. 7 . But coinsurance, copayments, premiums, and deductibles may still vary depending on your plan of choice. 3 .

How much is Part D insurance in 2022?

Like Part C, each plan has different coverage, deductible, and copayment options. Part D is generally included in your plan premium, but those with reported incomes of more than $88,000 will pay an additional amount. 6 The average Part D premium is expected to be $33 per month in 2022, up from $31,47 in 2021. 9

How long does a hospital benefit last?

A benefit period begins when you enter the hospital and ends when you haven’t received any inpatient hospital services for 60 consecutive days . If you re-enter the hospital the day after your benefit period ends, you’re responsible for the first $1,484 of charges again. 3 .

What is the Medicare deductible for 2020?

Members also qualify for countless other services and benefits, including: Screenings (for things like alcoholism, cardiovascular disease, cancer, depression, diabetes, HIV, obesity and sexually transmitted infections) The 2020 Medicare deductible for Part B is $197, which covers the whole year; in 2019, it was $185.

What is the average Medicare premium for 2020?

It’s projected that that average base premium for Medicare Part D will be $33.80 in 2020. The Part D annual deductible will increase by $20 to $435 in 2020. Income brackets will also change again in 2020, leading Medicare enrollees in the highest income tiers with higher costs next year as well.

How much was the 2016 Part B premium increase?

However, Congress passed the Bipartisan Budget Act of 2015 (Public Law 114-74) into law on November 2, 2015. The result was that these enrollees only had a 16 percent increase in their 2016 Part B premiums and deductibles; $121.80, compared to $104.90 in 2015.

What is Medicare Part B?

Medicare Part B is used by most beneficiaries, most often for doctors’ visits. Part B provides medical insurance, including those services and supplies considered medically necessary, which are considered essential for the prevention, diagnosis or treatment of various conditions, illnesses, injuries or diseases and their symptoms. These services and supplies must also meet accepted medical standards. But Part B also applies to preventive services and supplies, those required to prevent or detect illness at an early stage when treatments are most likely to work.

How much is Medicare Part D deductible?

With the way it’s structured, no PDP may have a deductible more than $435 in 2020; in 2019, it was $415. While there is a cap in place that’s set by the government, some drug plans have no deductible at all. That’s why it’s important to shop and compare plans each year.

What happens after you meet your Medicare deductible?

After you meet the deductible, your plan begins to pay. But as to what you’re actually paying for your 2019 Medicare deductibles, and why, the following will help to illustrate what each portion covers and the costs associated with each. Part A and Part B are together known as original Medicare.

How to contact Medicare for 2020?

For more information on Medicare, please call the number below to speak with a healthcare specialist: 1-800-810-1437 TTY 711 . Use the form below to obtain real time pricing for 2020 Medicare Supplement and Medicare Advantage Plans and Review 2020 Plan Deductibles. HN Forms.

How much does Medicare pay for prescriptions in 2020?

In 2020, the catastrophic coverage threshold is $6,350. Once you are eligible for catastrophic coverage, you will only pay 5% ...

What is the deductible for Part D?

Changes to the Part D Annual Deductible in 2020. The annual deductible is the amount you must pay before your insurer begins to cover the costs of your prescriptions. While individual plans can set different deductible amounts, Medicare imposes a maximum limit.

What factors determine how much the monthly premium will be?

Factors that determine how much the monthly premium will be include the copay the insurer requires for each prescription, the deductible recipients are obligated to pay and the list of drugs available on the carrier’s formulary.

What is a Part D plan?

Part D plans are offered by private insurers as stand-alone plans or as part of a Medicare Advantage plan. These carriers determine the monthly premium recipients pay and carriers may offer a selection of plans at different monthly price points. Factors that determine how much the monthly premium will be include the copay ...

How long does Medicare have to enroll in a Part D plan?

Medicare recipients who do not enroll in a Part D prescription drug plan or have creditable coverage with another plan for 63 days or more past their Initial Enrollment Period may be charges a late enrollment penalty if they choose a Part D plan later on.

What is the IRMAA for 2020?

In addition to a monthly premium, recipients with certain incomes may be required to pay extra for their Part D plan; this is called the Part D income-related monthly adjust amount (IRMAA). For 2020, this amount is based on the recipient’s tax filing status for 2018.

What is the penalty for not having insurance for 10 months?

If you are without coverage for a full 10 months, you would multiply 10 by $0.3274, which would make your penalty payment $3.27.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is Part B for 2021?

The 2021 Part B total premiums for high-income beneficiaries are shown in the following table: Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, ...

How much is coinsurance for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

What is Medicare Part B?

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.