Medicare Part D

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs through prescription drug insurance premiums. Part D was originally propo…

Is there still a donut hole in Medicare?

Aug 09, 2010 · A number of visitors to www.HealthCare.gov have told us they’d like to know more about the Medicare “donut hole” in the Part D program. If you aren’t familiar with Medicare, it is a health insurance program for people 65 or older, people under 65 with certain disabilities, and people with End-Stage Renal Disease (permanent kidney failure). People with Medicare have …

Can you avoid falling into the Medicare Donut Hole?

Feb 10, 2022 · The Medicare Part D Donut Hole, or Coverage Gap, is one of four stages you may encounter during the year while a member of a Part D prescription drug plan. Specifically, the Donut Hole is the point in the year when your prescription benefits change because the total cost paid by you and the plan have reached the Initial Coverage Limit.

What is the Medicare Donut Hole definition?

The term “donut hole” refers to the point at which a drug plan’s coverage for medications reaches its limit. When you and your Medicare Part D plan spend a certain amount on covered prescriptions in a calendar year (around $4,130 in 2021), you have reached the coverage gap and are considered to be in the “donut hole.”.

What is the donut hole in Medicare Part D?

Thanks to the Affordable Care Act, the donut hole closed completely in 2020, leaving you paying the same 25% of prescription drug costs as you paid before you entered the coverage gap. The donut hole is the coverage gap that occurs when you and your Medicare drug plan have reached a pre-determined spending limit for covered drugs.

Why does the Medicare donut hole exist?

Why is there a donut hole in Medicare Part D? The donut hole was originally created to incentivize people to use generic drugs. This would keep beneficiary costs low and also reduce the expenses of Medicare on the program level.Feb 14, 2022

Can I avoid the donut hole?

If you have limited income and resources, you may want to see if you qualify to receive Medicare's Extra Help/Part D Low-Income Subsidy. People with Extra Help see significant savings on their drug plans and medications at the pharmacy, and do not fall into the donut hole.

What is the Part D donut hole for 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.Oct 1, 2020

How long do you stay in the donut hole with Medicare?

The donut hole ends when you reach the catastrophic coverage limit for the year. In 2022, the donut hole will end when you and your plan reach $7,050 out-of-pocket in one calendar year. That limit is not just what you have spent but also includes the amount of any discounts you received in the donut hole.

Is there insurance to cover the donut hole?

There is no Donut Hole Insurance but there are ways to reduce your overall Part D spending. Insurance to cover the Donut Hole in Medicare Part D does not exist. There is no Donut Hole insurance policy that you can buy just to cover the higher expenses during the coverage gap.Aug 8, 2014

Does the donut hole reset each year?

You will remain in the Catastrophic Coverage Stage until January 1. This process resets every January 1.

Will the donut hole go away in 2021?

En español | The Medicare Part D doughnut hole will gradually narrow until it completely closes in 2020. Persons who receive Extra Help in paying for their Part D plan do not pay additional copays, even for prescriptions filled in the doughnut hole.

Has the donut hole been eliminated?

The Medicare donut hole is closed in 2020, but you still pay a share of your medication costs. Your coinsurance in the donut hole is lower today than in years past, but you still might pay more for prescription drugs than you do during the initial coverage stage.

What is the catastrophic coverage amount for 2021?

$6,550Catastrophic coverage refers to the point when your total prescription drug costs for a calendar year have reached a set maximum level ($6,550 in 2021, up from $6,350 in 2020).

How does the Doughnut hole work?

Most plans with Medicare prescription drug coverage (Part D) have a coverage gap (called a "donut hole"). This means that after you and your drug plan have spent a certain amount of money for covered drugs, you have to pay all costs out-of-pocket for your prescriptions up to a yearly limit.

What happens when you reach the donut hole?

How does the donut hole work? The donut hole closed for all drugs in 2020, meaning that when you enter the coverage gap you will be responsible for 25% of the cost of your drugs. In the past, you were responsible for a higher percentage of the cost of your drugs.

How do you get out of the donut hole?

How to get out of the donut hole. In 2020, person can get out of the Medicare donut hole by meeting their $6,350 out-of-pocket expense requirement. However, there are ways to receive assistance for funding prescription drugs, especially if a person meets certain low income requirements.Mar 4, 2020

What is a donut hole?

What is the Donut Hole? The Medicare Part D Donut Hole, or Coverage Gap, is one of four stages you may encounter during the year while a member of a Part D prescription drug plan. Specifically, the Donut Hole is the point in the year when your prescription benefits change because the total cost paid by you and the plan have reached ...

What tiers are deductibles?

The deductible counts toward any combination of drugs on Tiers 3, 4, and 5. You will not pay a separate deductible for each tier. After you pay the deductible, you will pay only your copay for Tier 3, 4, and 5 drugs.

Does Tufts Medicare have a Part D deductible?

All other plans do not have a Part D deductible. If you are a member of Tufts Medicare Preferred HMO Value Rx, Basic Rx, or Saver Rx plan: There is no deductible for drugs on Tier 1 and Tier 2. The is a deductible for drugs on Tier 3, Tier 4, and/or Tier 5.

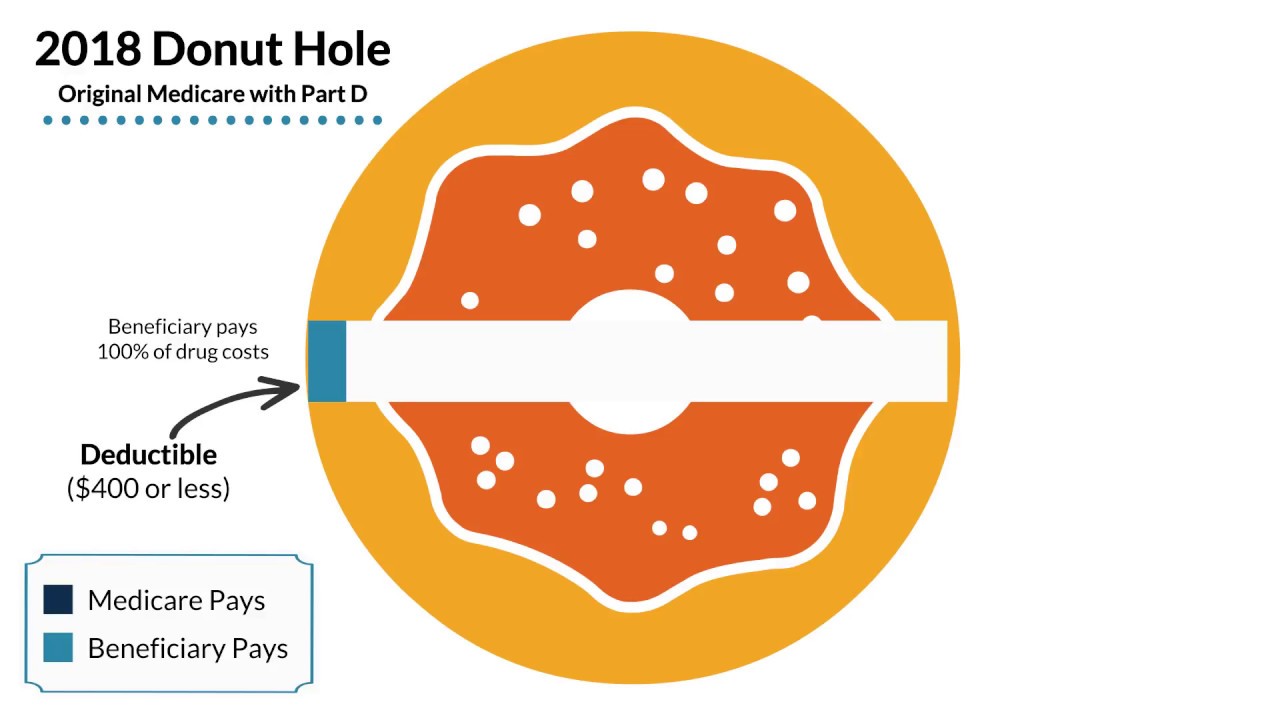

How does the Medicare Donut Hole Works

There are four stages of Medicare prescription coverage. It begins with your deductible and ends with a catastrophic coverage plan. Regular coverage begins after meeting your deductible and continues until you reach your out-of-pocket maximum of $4,130. It is where things get complicated.

Stages of Coverages

iii) Coverage gap (Donut hole) — begin when you reach the Medicare out-of-pocket maximum ($4,130 in 2021).

How much is My Deductible?

The deductible is the maximum amount of out-of-pocket costs you must pay before your insurance plan covers benefits. This amount varies depending on the program you select.

What is meant by Initial Coverage Period?

You will pay the stated coinsurance or copayment fees for generic or brand-name medications during the first year of coverage. Your specific plan details determine the exact amounts of these costs and vary based on your plan coverage.

What exactly is the Coverage Gap?

As previously stated, the coverage gap is the Medicare term commonly used to describe the donut hole. Each year, Medicare establishes a limit for out-of-pocket expenses that you can incur before reaching the donut hole.

What is the Catastrophic Coverage Stage?

If your out-of-pocket expenses are around $6,550 for the year, you enter the catastrophic coverage phase. After that, you only pay a low coinsurance or copayment for covered prescription drugs for the rest of the year.

What are the Medicare Donut Hole Rules for 2022?

Previously, being in the donut hole indicated you need to pay out-of-pocket costs until you reached the threshold value for more drug coverage. Nevertheless, the donut hole has been closing due to the introduction of the Affordable Care Act.

The Medicare Donut Hole Is Now Closed

The Medicare donut hole closed completely in 2020. This has led to some confusion, however, since there is still a coverage gap phase under Medicare Part D.

The Part D Initial Coverage Phase

Once you meet your Medicare Part D annual deductible, you enter the initial coverage phase. Your out-of-pocket costs during this stage are 25 percent of your plan's negotiated costs for covered medications. You pay this in the form of copays or coinsurance at the time of purchase.

The Part D Coverage Gap Phase

During the coverage gap phase, you continue paying 25 percent of prescription costs. And this is where the confusion seems to strike. Many people assumed "closing the donut hole" meant the coverage gap was ending.

How Does Cost-Sharing Work in the Coverage Gap Phase?

During the initial coverage phase, you pay 25 percent of prescription drug costs and your Part D plan pays the other 75 percent. Once you enter the coverage gap, you continue paying 25 percent. But, your plan's share changes depending on whether it's brand-name drugs or generic.

The Catastrophic Coverage Phase

You enter the catastrophic coverage phase once your total out-of-pocket spending reaches $7,050 in 2022. This includes money you paid for covered prescriptions during the deductible phase. In addition, the manufacturer discount on brand-name prescription drugs counts toward your total out-of-pocket for Part D coverage (i.e.

Drug Costs That Don't Count Toward Your Total Out-of-Pocket

When figuring your total out-of-pocket Part D spend, exclude the following:

Does Everyone Enter the Donut Hole?

No, most Medicare beneficiaries never enter the coverage gap. Even fewer ever reach the catastrophic coverage stage. Fewer than 5 percent of Part D beneficiaries will reach the donut hole.

What is the Medicare donut hole?

The Medicare donut hole is a coverage gap in Plan D prescription coverage. You enter it after you’ve passed an initial coverage limit. In 2021, you’ll have to pay 25 percent OOP from when you enter the donut hole until you reach the OOP threshold.

What is the donut hole?

The donut hole is a gap in prescription drug coverage during which you may pay more for prescription drugs. You enter the donut hole once Medicare has paid a certain amount toward your prescription drugs in one coverage year. Once you fall into the donut hole, you’ll pay more out of pocket (OOP) for the cost of your prescriptions ...

What is Medicare Part D?

Understanding Medicare Part D. Medicare Part D is an optional plan under Medicare for coverage of prescription drugs. Insurance providers approved by Medicare provide this coverage. Prior to Part D, many people received prescription drug coverage through their employer or a private plan. Some had no coverage.

What happens if you fall into a donut hole?

Once you fall into the donut hole, you’ll pay more out of pocket (OOP) for the cost of your prescriptions until you reach the yearly limit. Depending on the type of coverage you choose, when you hit this limit, your plan may help pay for your prescriptions again. Continue reading as we discuss more about the donut hole and how may it affect how ...

How much money do you have to spend to get out of the donut hole?

This is the amount of OOP money that you have to spend before you exit the donut hole. For 2021, the OOP threshold has increased to $6,550. This is up from $6,350 in 2020, meaning that you’ll have to pay more OOP than before in order to get out of the donut hole.

What is extra help for Medicare?

Individuals that have Medicare drug coverage and have limited income and resources may qualify for Extra Help. This helps to pay for premiums, deductibles, and copayments associated with a Medicare drug plan.

What is the initial coverage limit?

The initial coverage limit includes the total (retail) cost of drugs — what both you and your plan pay for your prescriptions.

What is Medicare Part D?

Medicare Part D is a program that helps pay for your prescription drug coverage.

Name-Brand Prescriptions

During this time you will be responsible for no more than 25% of the cost of your name-brand prescription medications.

When does the Donut hole end?

In order to get out of the “donut hole”, your total out-of-pocket costs must reach $6,550 in 2021 ( click here for the most up-to-date figure ).

Will the donut hole ever go away?

The Part D drug plan had a coverage gap when it was first implemented in 2006.

Summary

The Medicare “donut hole” refers to the 3rd payment stage of Part D drug plans.

About the Author: Eugene Marchenko

Eugene obtained his license in 2010 while working in the banking industry. After the decline of the economy in 2008 and countless conversations with folks about ways to keep their homes, Eugene realized it is time to focus on an industry that actually helps people.

What is a Medicare Part D gap?

When Medicare Part D prescription drug plans first became available, there was a built-in gap in coverage. This coverage gap opened after initial plan coverage limits had been reached and before catastrophic coverage kicked in. While in this gap, plan members had to pay the full cost of their covered drugs until their total costs qualified them ...

How much is a deductible for 2021?

The deductibles vary between plans and some Part D plans have no deductible. In 2021, the deductible can’t be more than $445.

What is the limit for Part D coverage in 2021?

If the combined amount you and your drug plan pay for prescription drugs reaches a certain level during the year—that limit is $4,130 in 2021—you enter the Part D coverage gap or “donut hole.”.

What is phase 3 coverage gap?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap, and it doesn’t apply to members who get Extra Help to pay for their Part D costs. Once in the gap, you’ll pay no more ...

Is the donut hole closed?

Where members once paid 100% of their costs in the gap, now their share of costs in the donut hole is limited to 25% for both brand-name and generic drugs. The donut hole has essentially closed. 2.

Do you pay coinsurance for Part D?

In this last phase of Part D plan coverage, you’ll only pay a small coinsurance amount or copayment for covered drugs for the rest of the year. When your new plan year begins, you start over at phase 1.

Why won't Medicare pay the $4,020 coverage gap?

Now that you know about the coverage gap (“donut hole”), here is some good news: Many Medicare beneficiaries won’t have to pay the increased prices during the coverage gap because their prescription drug costs won’t reach the initial coverage limit of $4,020 in 2020.

What is the Medicare Part D coverage gap?

The Medicare Part D Coverage Gap (“Donut Hole ”) Made Simple. Summary: When it comes to Medicare prescription drug coverage, you might have questions surrounding the Medicare Part D coverage gap, also known as the “donut hole.”. The coverage gap is a temporary limit on what most Medicare Part D Prescription Drug Plans or Medicare Advantage ...

What happens after you reach your Medicare deductible?

After you reach the deductible, the Medicare plan begins to cover its share of prescription drug costs. The deductible amount may vary by plan, and some plans may not have a deductible. If your Medicare plan doesn’t have a deductible, then you’ll start your coverage in the initial coverage phase (see below). Initial coverage phase: After you’ve ...

How to avoid coverage gap?

Managing your out-of-pocket prescription drug costs is a big part of avoiding the coverage gap. Here are some tips for how you can lower the amount you spend on medications: Many expensive prescription drugs have a generic or lower-cost alternative. Switching to lower-cost drugs may help you avoid entering the coverage gap.

How much is the coverage gap for 2020?

While in the coverage gap, you’ll typically pay up to 25% of the plan’s cost for both covered brand-name drugs and generic drugs in 2020. You’re out of the coverage gap once your yearly out-of-pocket drug costs reach $ 6,350 in 2020. Once you have spent this amount, you’ve entered the catastrophic coverage phase.

What is extra help?

Extra Help is a federal program that helps eligible individuals with limited income pay for Medicare Part D costs such as premiums, deductibles, and copayments/coinsurance. If you qualify for this assistance, you won’t enter the coverage gap.

When will the Medicare coverage gap end?

This gap will officially close in 2020 , but you can still reach this out-of-pocket threshold where your medication costs may change. Find affordable Medicare plans in your area.

What is Medicare Donut Hole?

Summary. The Medicare donut hole is a colloquial term that describes a gap in coverage for prescription drugs in Medicare Part D. For 2020, Medicare are making some changes that help to close the donut hole more than ever before. Medicare Part D is the portion of Medicare that helps a person pay for prescription drugs.

What is a donut hole?

The term donut hole refers to the way a person needs to pay for coverage. A person pays a specified amount for their prescription drugs, and once they meet this deductible, their plan takes over the funding. However, when the plan has paid up to a specified limit, the person has reached the donut hole.

What does closing the donut hole do?

Closing the donut hole can help a person reduce prescription drug costs. However, they will still be responsible for 25% of costs, once they reach the donut hole. If an individual has difficulty paying for medications, state, federal, and private organizations can assist. Public Health.

Why did the Donut Hole change?

The aim of these changes was to make drugs more affordable once a person reached the donut hole, which would encourage people to continue taking their medications and reduce the risk of a break in treatment . A person pays their co-payment for their prescription drugs, depending upon their drug plan.

What is Medicare Part D?

Medicare Part D is the portion of Medicare that helps a person pay for prescription drugs. A person enrolled in Medicare does not have to choose Medicare Part D. However, they must have some other prescription drug coverage, usually through private- or employer-based insurance. In this article, we define the donut hole and how it applies ...

Why do people stop taking drugs after reaching the donut hole?

The issue with the donut hole is that many people in the United States stop taking their medications upon reaching the donut hole because they cannot afford to pay the high costs for the drugs. They often have to pay thousands of dollars for prescription drugs until they cross this coverage gap.

How much does the insurance company add up to the donut hole?

The insurance company will add up what a person has paid out-of-pocket for medications in the donut hole. Once this total reaches $6,350, a person has crossed the donut hole. A person is now in the catastrophic coverage stage of their medication coverage.