What is the Medicare tax on investment income?

The Net Investment Income Tax, also referred to as the "Unearned Income Medicare Contribution Tax," is another surtax that's imposed at 3.8% when investment income, combined with other income, surpasses the same thresholds that apply to the Additional Medicare Tax. 6

Can NETnet income be less than zero for additional Medicare tax?

Net self-employment income can't be less than zero for purposes of calculating the Additional Medicare Tax, so business losses can't reduce the tax owed on wage compensation. The Additional Medicare Tax also applies to Railroad Retirement Tax Act compensation for employees and employee representatives.

What is the additional Medicare tax?

The Additional Medicare Tax applies to people who make more than a set income level for the year. As of 2013, the IRS requires higher-earning taxpayers to pay more into Medicare. The extra tax was announced as part of the Affordable Care Act and is known as the Additional Medicare Tax. The tax rate for the Additional Medicare Tax is 0.9 percent.

How much will you pay in Medicare taxes this year?

For example, if you’re a single tax filer with an employment income of $250,000, you’d pay the standard 1.45 percent on $200,000 of your income, and then 2.35 percent on the remaining $50,000. So, in this example, you’d pay $4,075 in Medicare taxes for the year.

What is the 3.8 surtax on investment income?

The net investment income tax is a 3.8% tax on investment income that typically applies only to high-income taxpayers. 1 It applies to individuals, families, estates, and trusts, but certain income thresholds must be met before the tax takes effect. Net investment income can be capital gains, interest, or dividends.

What is the Medicare surtax rate for 2021?

0.9 percentThe tax rate for the Additional Medicare Tax is 0.9 percent. That means you'll pay 2.35 percent if you receive employment wages.

What is the Medicare surtax rate for 2020?

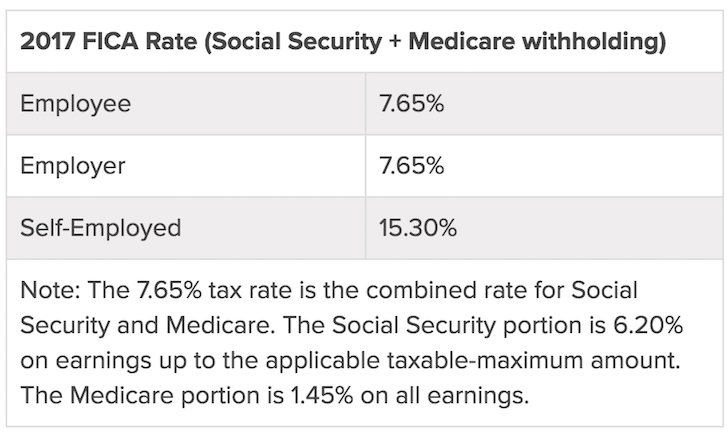

1.45 percentThe FICA tax rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2020 (or 8.55 percent for taxable wages paid in excess of the applicable threshold).

Is NIIT the same as the Medicare surtax?

The Net Investment Income Tax (“NIIT”) or Medicare Tax is a 3.8% Surtax imposed by Section 1411 of the Internal Revenue Code on investment income....What are the statutory thresholds amounts for the NIIT?Filing StatusThreshold AmountMarried filing jointly$250,000Married filing separately$125,0003 more rows

Do you pay Medicare tax on investment income?

The 0.9 percent Additional Medicare Tax applies to individuals' wages, compensation, and self-employment income over certain thresholds, but it does not apply to income items included in Net Investment Income. For additional information on Net Investment Income Tax, see our questions and answers posted on IRS.gov.

What is the NIIT tax rate?

3.8 percentA 3.8 percent Net Investment Income Tax (NIIT) applies to individuals, estates, and trusts that have net investment income above applicable threshold amounts.

How do you calculate additional Medicare tax?

It is paid in addition to the standard Medicare tax. An employee will pay 1.45% standard Medicare tax, plus the 0.9% additional Medicare tax, for a total of 2.35% of their income....What is the additional Medicare tax?StatusTax thresholdmarried tax filers, filing separately$125,0003 more rows•Sep 24, 2020

How is Medicare surtax 2022 calculated?

For 2022, the FICA tax rate for employers is 7.65% — 6.2% for Social Security and 1.45% for Medicare (the same as in 2021).

What is the Medicare surtax for 2022?

The 2022 Medicare tax rate is 2.9%. Typically, you're responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%. Your Medicare tax is deducted automatically from your paychecks.

How is NIIT calculated?

Net investment income is calculated by adding up all of the income you earned from investments in the past tax year and subtracting any related expenses.

How can we avoid the 3.8% Medicare surtax?

What Income Is Not Subject to Medicare Surtax? Generally speaking, you can exclude income from municipal bonds, partnership income, and S Corporations, if you are actively participating. There are also certain types of rental income and some capital gains for selling a business that may be excluded as well.