Different rates apply for these taxes. The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

What percentage of your paycheck is Medicare?

Jan 04, 2022 · Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2022 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%. Your Medicare tax is deducted automatically from your paychecks.

How much do I pay for Medicare tax?

Jan 15, 2022 · The Medicare tax rate is 1.45%. But the Federal Insurance Contributions Act tax combines two rates. FICA taxes include both the Social Security Administration tax rate of 6.2% and the Medicare tax rate. Thus, the total FICA tax rate is 7.65%. The maximum Social Security tax amount for both employees and employers is $8,239.80.

How to calculate additional Medicare tax properly?

Mar 28, 2022 · In 2022, the Medicare tax rate is 1.45%. This is the amount you'll see come out of your paycheck, and it's matched with an additional 1.45% contribution from your employer for a total of 2.9% contributed on your behalf. 2022 Medicare tax rate. You pay. 1.45%.

How are your Medicare costs calculated?

Jan 08, 2022 · 2022 Medicare Tax Rates In 2022, the Medicare tax rate is 2.9%, which is split evenly between employers and employees. W-2 employees pay 1.45%, and their employer covers the remaining 1.45%....

How do I calculate Medicare tax payable?

What is the Medicare tax rate for 2021?

How do you calculate FICA and Medicare tax 2021?

What is the Medicare tax rate for 2020?

How do you calculate additional Medicare tax in 2020?

What is the Medicare tax rate for 2022?

What income is subject to the 3.8 Medicare tax?

What type of tax is Medicare?

Medicare tax is a required employment tax that's automatically deducted from your paycheck. The taxes fund hospital insurance for seniors and peopl...

What is the tax rate for Social Security and Medicare?

The FICA tax includes the Social Security tax rate at 6.2% and the Medicare tax at 1.45% for a total of 7.65% deducted from your paycheck.

What does it mean if you see a Medicare deduction on your paycheck?

This is a standard deduction, and it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital Insurance tax prov...

What happens if your employer did not withhold Social Security and Medicare taxes?

Employers that do not adhere to tax laws by withholding FICA taxes for Social Security and Medicare could be subject to criminal and civil sanction...

What is a Medicare benefit tax statement?

This evidence of coverage statement confirms that you have enrolled in Medicare Part A and have health insurance that meets the Affordable Care Act...

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

Is It Better To Withhold Taxes

Remember, one of the big reasons you file a tax return is to calculate the income tax on all of your taxable income for the year and see how much of that tax youve already paid via withholding tax. If it turns out youve overpaid, youll probably get a tax refund. If it turns out youve underpaid, youll have a tax bill to pay.

Other Payroll Tax Items You May Hear About

FUTA tax: This stands for Federal Unemployment Tax Act. The tax funds a federal program that provides unemployment benefits to people who lose their jobs. Employees do not pay this tax or have it withheld from their pay. Employers pay it.

Monitoring Ss And Medicare Status

The Research Foundation is solely responsible for processing the correct withholding or exemption of SS and Medicare taxes. Error where the RF has not withheld the taxes can result in significant risk of fines and penalties from the government. SS and Medicare status for all Research Foundation employees should be monitored periodically.

What Is The Fica Tax

The FICA tax is a U.S. federal payroll tax paid by employees and their employers. It consists of:

Before You Calculate Fica Tax Withholding

To calculate FICA taxes from an employee’s paycheck, you will need to know:

Pay Attention To Your Paycheck

Its important that you regularly track your paystub with your employer, particularly because of the temporary end-of-year changes. Calculate the dollar amount that you expect to see withheld every paycheck and make sure that the numbers are accurate. Mistakes happen, so its important to track things closely.

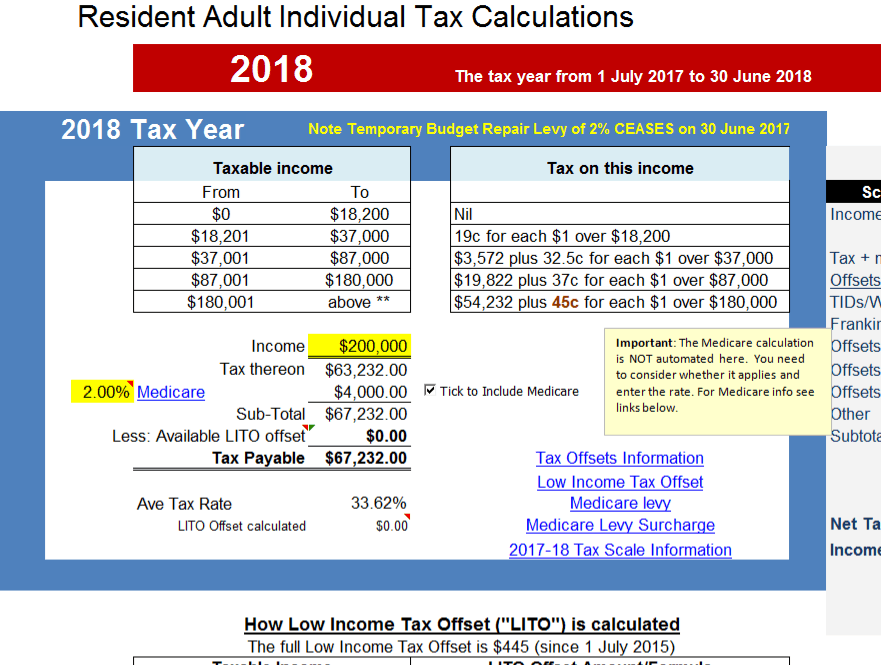

What Is The Medicare Tax Rate For 2021

The Medicare tax rate is 1.45%. But the Federal Insurance Contributions Act tax combines two rates. FICA taxes include both the Social Security Administration tax rate of 6.2% and the Medicare tax rate.

How much of Medicare is taxed?

The tax collected for Medicare accounts for 88% of the total revenue for Medicare Part A.

What is Medicare tax?

Medicare tax is a deduction from each paycheck to pay for Medicare Part A, which provides hospital insurance to seniors and people with disabilities. The total tax amount is split between employers and employees, each paying 1.45%. High-income earners pay a slightly higher percentage, and those who are self-employed pay the tax with their quarterly filings.

How much Medicare tax is deducted from salary?

For example, an individual with an annual salary of $50,000 would have a 1.45% Medicare tax deducted from their paycheck. That's about $60 each month. The employer would pay an additional $60 each month on their behalf, totaling $120 contributed to Medicare.

What is the additional Medicare tax paid by high income earners used for?

Even though it has Medicare in the name, the Additional Medicare Tax paid by high-income earners is used to offset the costs of the Affordable Care Act (ACA), according to the IRS.

What is Medicare taxable wages?

The tax is calculated off of what's called "Medicare taxable wages," which uses your gross pay and subtracts pretax health care deductions such as medical insurance, dental, vision or health savings.

What is the Medicare tax rate for 2021?

In 2021, the Medicare tax rate is 1.45% . This is the amount you'll see come out of your paycheck, and it's matched with an additional 1.45% contribution from your employer for a total of 2.9% contributed on your behalf.

What was the change in Medicare?

The Medicare program has many components, but a key change at the time was the working population would pay a new Medicare tax to support Medicare hospital insurance.

What is Medicare tax?

Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee’s paycheck or paid as a self-employment tax. 1.

What is the Medicare tax rate for a person earning $225,000 a year?

However, the additional 0.9% only applies to the income above the taxpayer’s threshold limit. 8 For example, if you earn $225,000 a year, the first $200,000 is subject to Medicare tax of 1.45% and the remaining $25,000 is subject to additional Medicare tax of 0.9%.

What is the Medicare contribution surtax?

The net investment income tax, also known as the “unearned income Medicare contribution surtax,” is an additional 3.8% tax applied to net investment income as of 2021. Like the additional Medicare tax, there is no employer-paid portion. 9

How much does a W-2 pay?

W-2 employees pay 1.45% and their employer covers the remaining 1.45%. Self-employed individuals, as they are considered both an employee and an employer, must pay the full 2.9%. Unlike Social Security tax, there is no income limit to which Medicare tax is applied. 7. An individual’s Medicare wages are subject to Medicare tax.

Where are Medicare and Social Security taxes put?

Medicare taxes and Social Security taxes are put into trust funds held by the U.S. Treasury . Medicare tax is kept in the Hospital Insurance Trust Fund and is used to pay for Medicare Part A. Costs of Medicare Part B (medical insurance) and Medicare Part D (prescription drug coverage) are covered by the Supplemental Medical Insurance Trust Fund, ...

Is Medicare a surtax?

In 2013, the Affordable Care Act (ACA) introduced two Medicare surtaxes to fund Medicare expansion: the additional Medicare tax and the net investment income tax. Both surtaxes apply to high earners and are specific to different types of income. It is possible for a taxpayer to be subject to both Medicare surtaxes.

Is Medicare income taxable?

An individual’s Medicare wages are subject to Medicare tax. This generally includes earned income such as wages, tips, vacation allowances, bonuses, commissions, and other taxable benefits up to $200,000.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

Is there a wage base limit for Medicare?

There's no wage base limit for Medicare tax. All covered wages are subject to Medicare tax.

How long do you have to be on Medicare to receive Part A?

People under age 65 may receive Part A with no liability for premiums under the following circumstances: Have received Social Security or Railroad Retirement Board disability benefits for two years.

What is the Medicare premium for 2020?

For 2020, the standard monthly rate is $144.60. However, it will be more if you reported above a certain level of modified adjusted gross income on your federal tax return two years ago. Any additional amount charged to you is known as IRMAA, which stands for income-related monthly adjustment amount. Visit Medicare.gov, point to “Your Medicare Costs,” and then click “Part B costs” to see a matrix of premiums corresponding to income ranges across different tax filing statuses.

How many years of work do you need to be eligible for Medicare?

Four is the maximum number of credits a person can earn per year, so it takes at least 10 years or 40 quarters of employment to be eligible for Medicare.

Is Medicare the same for everyone?

Medicare is a federal program that mandates standardization of services nationwide, so many people may assume the premiums would be the same for everyone. In reality, there are variations in the premiums people pay, if they pay any at all.

Can Medicare be charged at 65?

For Part A, most Medicare recipients are not charged any premium at all. Seniors at age 65 are eligible for premium-free Part A if they meet the following criteria: Currently collect retirement benefits from Social Security or the Railroad Retirement Board. Qualify for Social Security or Railroad benefits not yet claimed.

How is Medicare tax calculated?

How is the Additional Medicare Tax calculated? Medicare is paid for by taxpayer contributions to the Social Security Administration. Workers pay 1.45 percent of all earnings to the Federal Insurance Contributions Act (FICA). Employers pay another 1.45 percent, for a total of 2.9 percent of your total earnings.

How much tax do you pay on Medicare?

For example, if you’re a single tax filer with an employment income of $250,000, you’d pay the standard 1.45 percent on $200,000 of your income, and then 2.35 percent on the remaining $50,000. So, in this example, you’d pay $4,075 in Medicare taxes for the year.

What is the additional Medicare tax?

The Additional Medicare Tax is an extra 0.9 percent tax on top of the standard tax payment for Medicare. The additional tax has been in place since 2013 as a part of the Affordable Care Act and applies to taxpayers who earn over a set income threshold.

What are the benefits of the Affordable Care Act?

Notably, the Affordable Care Act provided some additional benefits to Medicare enrollees, including: lower premiums for Medicare Advantage (Part C) plans. lower prescription drug costs. closure of the Part D benefit gap, or “ donut hole ”.

What happens when you file Medicare taxes?

In some cases, you might owe more, and in other cases, you might have paid too much. Any payment owed or refund adjustment needed will be added to your overall required payment or refund amount.

How much Medicare do self employed people pay in 2021?

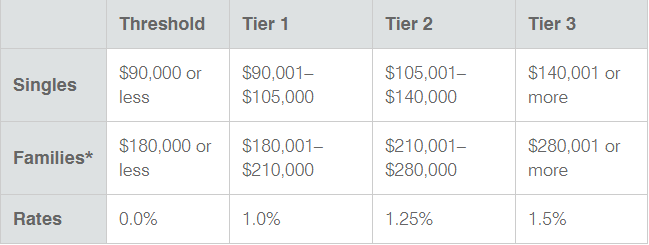

The Additional Medicare Tax applies to people who are at predetermined income levels. For the 2021 tax year, those levels are: Single tax filers: $200,000 and above. Married tax filers filing jointly: $250,000 and above.

Do you have to pay taxes on Medicare?

While everyone pays some taxes toward Medicare, you’ll only pay the additional tax if you’re at or above the income limits. If you earn less than those limits, you won’t be required to pay any additional tax. If your income is right around the limit, you might be able to avoid the tax by using allowed pre-tax deductions, such as:

How much is Medicare tax?

The Medicare Tax is an additional 0.9% in tax an individual or couple must pay on income thresholds above $200,000 for singles and $250,000 for couples. People who owe this tax should file Form 8959, with their tax return.

What is the threshold for net investment income tax?

The IRS states that the amount subject to the net investment income tax is the SMALLER of the net investment income or the difference between MAGI and the threshold ($200,000 for individuals, $250,000 for married couples).

What is net investment tax?

In addition to the Medicare Tax, there is also the Net Investment Income Tax an individual or couple must pay if their respective incomes are over $200,000 and $250,000. Net Investment Income Tax includes, but is not limited to: interest, dividends, capital gains, rental and royalty income, and non-qualified annuities.

What happens if you don't pay quarterly estimated taxes?

If an individual has too little withholding or fails to pay enough quarterly estimated taxes to also cover the Net Investment Income Tax, the individual may be subject to an estimated tax penalty. The Net Investment Income Tax is separate from the Additional Medicare Tax, which also went into effect on January 1, 2013.

How to be more flexible with your income?

One of the best ways to be more flexible with your income is to start and operate a business. You have more flexibility in terms of receiving payment, purchasing business equipment, and investing in your companies future to adjust your income accordingly.

Do you have to combine wages and self employment income to determine if your income exceeds the threshold?

You must combine wages and self-employment income to determine if your income exceeds the threshold. A loss from self-employment when you figure this tax is not considered. You must compare RRTA compensation separately to the threshold.

Is Medicare tax the same as net investment income?

The Net Investment Income Tax is separate from the Additional Medicare Tax, which also went into effect on January 1, 2013. You may be subject to both taxes, but not on the same type of income. The 0.9 percent Additional Medicare Tax applies to individuals’ wages, compensation, and self-employment income over certain thresholds, but it does not apply to income items included in Net Investment Income.