Medicare Psych Reimbursement Rates by CPT Code:

| CPT Code | Description | Medicare Reimbursement Rate 2020 | Medicare Reimbursement Rate 2021 | Medicare Reimbursement Rate 2022 |

| 90791 | Psychological Diagnostic Evaluation | $140.19 | $180.75 | $195.46 |

| 90792 | Psychological Diagnostic Evaluation with ... | $157.49 | $201.68 | $218.90 |

| 90832 | Individual Psychotherapy, 30 Minutes | $68.47 | $77.81 | $85.07 |

| 90833 | Individual Psychotherapy with Evaluation ... | $71.00 | $71.18 | $77.88 |

How does Medicare calculate reimbursement?

According to the Centers for Medicare & Medicaid Services (CMS), Medicare’s reimbursement rate on average is roughly 80 percent of the total bill. 1 Not all types of health care providers are reimbursed at the same rate. For example, clinical nurse specialists are reimbursed at 85% for most services, while clinical social workers receive 75%. 1

How much does Medicare reimburse?

Nov 15, 2021 · Fee Schedules - General Information. A fee schedule is a complete listing of fees used by Medicare to pay doctors or other providers/suppliers. This comprehensive listing of fee maximums is used to reimburse a physician and/or other providers on a fee-for-service basis. CMS develops fee schedules for physicians, ambulance services, clinical ...

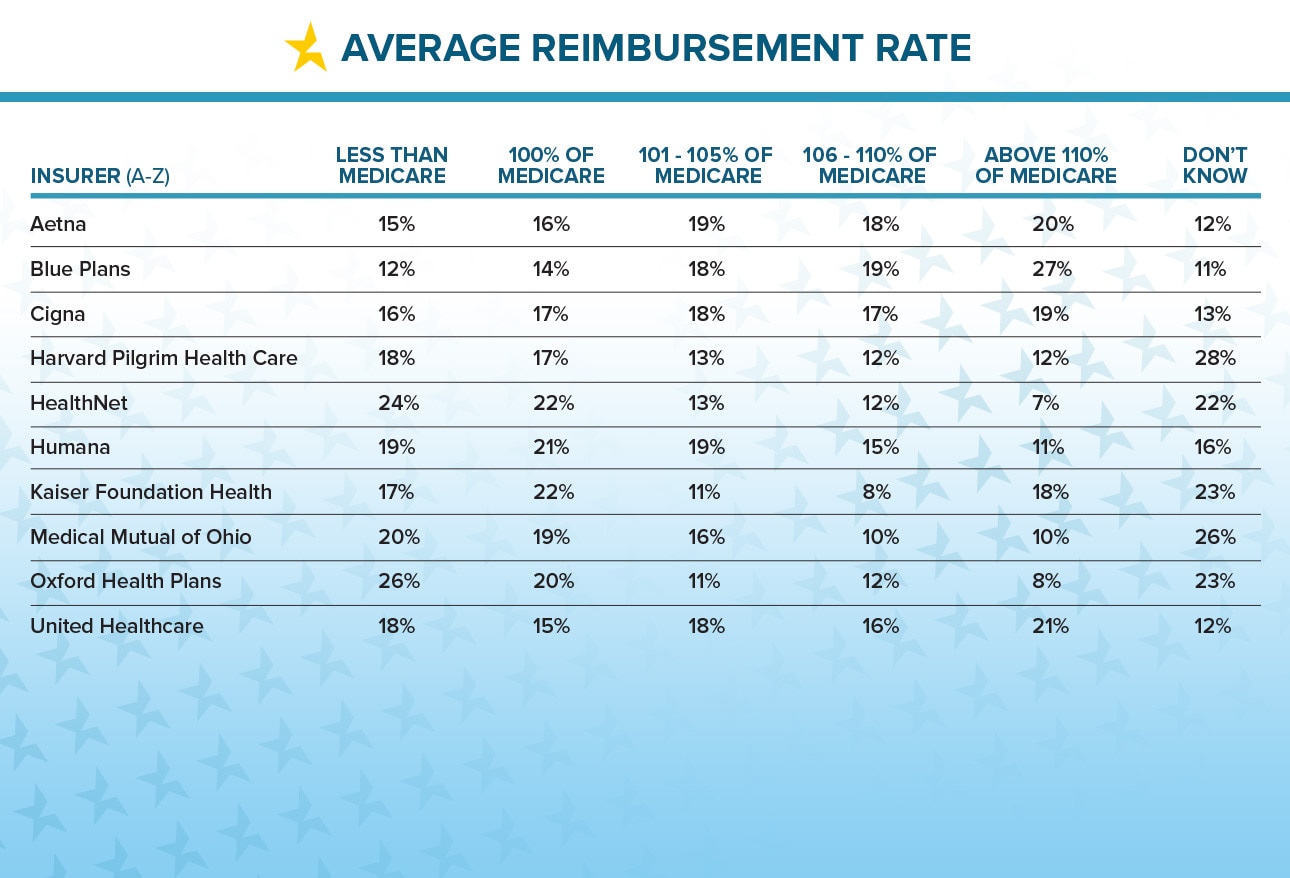

What is your average reimbursement rate?

The Medicare reimbursement rates for traditional medical procedures and services are mostly established at 80 percent of the cost for services provided. Some medical providers are reimbursed at different rates. Clinical nurse specialists are paid 85 percent for most of their billed services and clinical social workers are paid 75 percent for their billed services.

What are the Medicare premiums and coinsurance rates?

Dec 01, 2021 · Reimbursement is on a per-cost basis instead of the standard Medicare reimbursement rates; Learn more about critical access hospitals. Federally Qualified Health Center Rate. A Federally Qualified Health Center (FQHC) is a program that provides comprehensive healthcare to underserved communities and meets one of several standards …

Where can I find Medicare reimbursement rates?

You can search the MPFS on the federal Medicare website to find out the Medicare reimbursement rate for specific services, treatments or devices. Simply enter the HCPCS code and click “Search fees” to view Medicare's reimbursement rate for the given service or item.Jan 20, 2022

Is the 2021 Medicare fee schedule available?

The CY 2021 Medicare Physician Fee Schedule Final Rule was placed on display at the Federal Register on December 2, 2020. This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2021.

Did Medicare reimbursement go up in 2021?

Payment Policy Updates. Under the 2021 CAA, starting April 1, 2021, all RHCs are subject to an updated payment limit per visit, which will gradually increase annually until 2028. In 2022, the rate is $113 per visit. The CY 2022 MEI update is 2.1 percent.Nov 17, 2021

What is the 2021 Medicare conversion factor?

$34.8931This represents a 0.82% cut from the 2021 conversion factor of $34.8931. However, it also reflects an increase from the initial 2022 conversion factor of $33.5983 announced in the 2022 Medicare physician fee schedule final rule.Feb 7, 2022

What is the reimbursement rate for CPT?

For example, in 2020, use of evaluation CPT codes 97161-97163 resulted in a payment of $87.70; that payment increases to $101.89 in 2021. Similarly, payment for reevaluation CPT code 97164 will also increase this year, from $60.30 in 2020 to $69.79.Jan 6, 2021

How Much Does Medicare pay for 99214 in 2021?

$110.43By Christine Frey posted 12-09-2020 15:122021 Final Physician Fee Schedule (CMS-1734-F)Payment Rates for Medicare Physician Services - Evaluation and Management99214Office/outpatient visit est$110.4399215Office/outpatient visit est$148.3399417Prolng off/op e/m ea 15 minNEW CODE15 more rows•Dec 9, 2020

What is the Medicare Economic Index for 2021?

The 2021 MEI percentage released by CMS on October 29, 2020, lists RHCs at 1.4% while the 2021 MEI percentage released by CMS on December 4, 2020, lists FQHCs at 1.7%. Healthy Blue will update our systems to reflect the new rates by July 30, 2021.Jul 21, 2021

How much does Medicare reimburse per RVU?

On the downside, CMS set the 2022 conversion factor (i.e., the amount it pays per RVU) at $33.59, which is $1.30 less than the 2021 conversion factor.Nov 4, 2021

Do Medicare reimbursement rates vary by state?

Over the years, program data have indicated that although Medicare has uniform premiums and deductibles, benefits paid out vary significantly by State of residence of the beneficiary. These variations are due in part to the fact that reimbursements are based on local physicians' prices.

What is the Medicare premium for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What is the purpose of the information below?

The information below is intended to provide you with a basic understanding of the issue so that you can move forward with choosing the right approach to ensure a strong funding strategy for your program.

How many beds does a CAH have?

A qualified CAH: participates in Medicare, has no more than 25 inpatient beds, has an average length of patient stay that is 96 hours or less, offers emergency care around the clock, and is located in a rural setting. Learn more about critical access hospitals.

What is MA rate?

The Medical Assistance (MA) rate is a state's standard reimbursement for Medicaid-covered services. Each state sets how it will reimburse Medicaid recipients. For example, some states reimburse for each service provided during an encounter (a face-to-face interaction between the patient and the healthcare provider), rather than setting a flat fee for each encounter.

How does Medicaid work?

Many states deliver Medicaid through managed care organizations, which manage the delivery and financing of healthcare in a way that controls the cost and quality of services. More states are joining this trend because they think it may help manage and improve healthcare costs and quality.

What is capitated rate?

A capitated rate is a contracted rate based on the total number of eligible people in a service area. Funding is supplied in advance, creating a pool of funds from which to provide services. This rate can be more beneficial for providers with a larger client base because unused funds can be kept for future use.

What is a FQHC?

A Federally Qualified Health Center (FQHC) is a program that provides comprehensive healthcare to underserved communities and meets one of several standards for qualifying, such as receiving a grant under Section 330 of the Public Health Service Act. Health programs run by tribes or tribal organizations working under the Indian Self-Determination Act, or urban Indian organizations that receive Title V funds, qualify as FQHCs. The FQHC rate is a benefit under Medicare that covers Medicaid and Medicare patients as an all-inclusive, per-visit payment, based on encounters. Tribal organizations must apply before they can bill as FQHCs.

What is FQHC in Medicare?

The FQHC rate is a benefit under Medicare that covers Medicaid and Medicare patients as an all-inclusive, per-visit payment, based on encounters. Tribal organizations must apply before they can bill as FQHCs. Allowable expenses vary by state. Each tribe and state must negotiate the exact reimbursement rate.

Why do doctors accept Medicare?

The reason so many doctors accept Medicare patients, even with the lower reimbursement rate, is that they are able to expand their patient base and serve more people.

How does Medicare work?

When someone who receives Medicare benefits visits a physician’s office, they provide their Medicare information, and instead of making a payment, the bill gets sent to Medicare for reimbursement.

Does Medicare cover prescription drugs?

This process allows Medicare to individually review a recipient’s case to determine whether an oversight has occurred or whether special circumstances allow for an exception in coverage limits. Prescription medications may be covered under Medicare Part D.

How long does it take for Medicare to process a claim?

Medicare claims to providers take about 30 days to process. The provider usually gets direct payment from Medicare. What is the Medicare Reimbursement fee schedule? The fee schedule is a list of how Medicare is going to pay doctors. The list goes over Medicare’s fee maximums for doctors, ambulance, and more.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Does Medicare cover nursing home care?

Your doctors will usually bill Medicare, which covers most Part A services at 100% after you’ve met your deductible.

Does Medicare reimburse doctors?

Medicare Reimbursement for Physicians. Doctor visits fall under Part B. You may have to seek reimbursement if your doctor does not bill Medicare. When making doctors’ appointments, always ask if the doctor accepts Medicare assignment; this helps you avoid having to seek reimbursement.

Do you have to ask for reimbursement from Medicare?

If you are in a Medicare Advantage plan, you will never have to ask for reimbursement from Medicare. Medicare pays Advantage companies to handle the claims. In some cases, you may need to ask the company to reimburse you. If you see a doctor in your plan’s network, your doctor will handle the claims process.

Does Medicare cover out of network doctors?

Coverage for out-of-network doctors depends on your Medicare Advantage plan. Many HMO plans do not cover non-emergency out-of-network care, while PPO plans might. If you obtain out of network care, you may have to pay for it up-front and then submit a claim to your insurance company.

Commercial Insurance Reimbursement for Mental Health

Find out which insurance companies pay mental health providers the best in our interactive charts below:

Mental Health Credentialing Recommendations

In our experience, the higher the reimbursement rate, the higher your license level need be to become in-network with that company.

Tips on Avoiding Low Paying & Complex Plans

Avoid subcontracted plans if you don’t understand them. When a plan is subcontracted out to a different insurance provider, often times that network is smaller and offers different, lower rates. (This isn’t always the case!)

Medicare Psych Reimbursement Rates by CPT Code

Medicare pays well! Find the rate that Medicare pays per mental health CPT code in 2021 below.

Credentialing Advice for Mental Health Providers

Some companies require you to register a legal business, E-IN, and group NPI. You might decide you don’t want to bother with all of that added work.

Billing Advice

Try to avoid companies that require the use of taxonomy codes, license level modifiers, EDI enrollments, and prior authorizations. This does dramatically limit the companies you can work with, but it will save you time, headache, and frustration.

Reach Out

Consider hiring a service like TheraThink that exclusively does mental health insurance billing.

How to file a Medicare claim?

How do you file a Medicare reimbursement claim? 1 Once you see the outstanding claims, first call the service provider to ask them to file the claim. If they cannot or will not file, you can download the form and file the claim yourself. 2 Go to Medicare.gov and download the Patient Request of Medical Payment form CMS-1490-S. 3 Fill out the form by carefully following the instructions provided. Explain in detail why you are filing a claim (doctor failed to file, supplier billed you, etc.), and provide the itemized bill with the provider’s name and address, diagnosis, the date and location of service (hospital, doctor’s office) and description of services. 4 Provide any supporting information you think will be helpful for reimbursement. 5 Be sure to make and keep a copy of everything you are submitting for your records. 6 Mail the form to your Medicare contractor. You can check with the contractor directory to see where to send your claim. This is also listed by state on your Medicare Summary Notice, or you can call Medicare at 1-800-633-4227. 7 Finally, if you need to designate someone else to file the claim or talk to Medicare for you, you need to fill out the “ Authorization to Disclose Personal Health Information ” form.

What is Medicare reimbursement?

The Centers for Medicare and Medicaid (CMS) sets reimbursement rates for all medical services and equipment covered under Medicare. When a provider accepts assignment, they agree to accept Medicare-established fees. Providers cannot bill you for the difference between their normal rate and Medicare set fees.

How much does Medicare pay?

Medicare pays for 80 percent of your covered expenses. If you have original Medicare you are responsible for the remaining 20 percent by paying deductibles, copayments, and coinsurance. Some people buy supplementary insurance or Medigap through private insurance to help pay for some of the 20 percent.

Do opt out providers accept Medicare?

These providers do not accept Medicare and have signed a contract to be excluded. If you go to an opt-out provider, you must pay for all services. Rates may be higher than Medicare fees, and you cannot file a claim for these charges unless they are part of emergency medical care. You are responsible for paying the provider directly.

What does it mean when a provider is not a participating provider?

If the provider is not a participating provider, that means they don’t accept assignment. They may accept Medicare patients, but they have not agreed to accept the set Medicare rate for services.

Does Medicare pay for Part A and Part B?

Original Medicare pays for the majority (80 percent) of your Part A and Part B covered expenses if you visit a participating provider who accepts assignment. They will also accept Medigap if you have supplemental coverage. In this case, you will rarely need to file a claim for reimbursement.

What is Medicare Part D?

Medicare Part D or prescription drug coverage is provided through private insurance plans. Each plan has its own set of rules on what drugs are covered. These rules or lists are called a formulary and what you pay is based on a tier system (generic, brand, specialty medications, etc.).

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is the U0001 code?

Code U0001 identifies diagnostic testing performed by laboratories using a CDC-developed COVID-19 test. Code U0002 will be used for all non-CDC lab test for COVID-19, including those developed in-house according to new Federal Drug Administration (FDA) guidelines.

How much is Medicare reimbursement for 2020?

Reimbursements match similar in-person services, increasing from about $14-$41 to about $60-$137, retroactive to March 1, 2020. In addition, Medicare is temporarily waiving the audio-video requirement for many telehealth services during the COVID-19 public health emergency. Codes that have audio-only waivers during the public health emergency are ...

What is the CPT code for Telehealth?

Medicare increased payments for certain evaluation and management visits provided by phone for the duration of the COVID-19 public health emergency: Telehealth CPT codes 99441 (5-10 minutes), 99442 (11-20 minutes), and 99443 (20-30 minutes)

Does Medicare cover telehealth?

Telehealth codes covered by Medicare. Medicare added over one hundred CPT and HCPCS codes to the telehealth services list for the duration of the COVID-19 public health emergency. Telehealth visits billed to Medicare are paid at the same Medicare Fee-for-Service (FFS) rate as an in-person visit during the COVID-19 public health emergency.