For social security, the tax rate is 6.2% each for the employee and employer, unchanged from 2018. The social security wage base limit is $132,900. The Medicare tax rate is 1.45% each for the employee and employer, unchanged from 2018.

How much is Social Security and Medicare tax?

Nov 27, 2017 · 15.30%. 15.30%. NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

What percentage is Social Security and Medicare?

Nov 17, 2017 · The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017. However, a statutory “hold harmless” provision applies each year to about 70 percent of enrollees. For these enrollees, any increase in Part B premiums must be lower than the increase in their Social Security benefits.

What is the current Social Security tax rate?

Social Security: Medicare: Employee: 6.2% of first $128,400 of income: 1.45%: Self-Employed: 12.4% of first $128,400 of income: 2.90%: Individuals with earned income of more than $200,000 ($250,000 for married couples filing jointly) pay an additional 0.9% in Medicare taxes. The tax rates shown above do not include the 0.9%.

How do you calculate Medicare taxes?

Official 2018 Part B premium rates have not yet been released, but current enrollees can expect to pay about $134 a month next year. Of course, higher-income enrollees are subject to even higher rates for Medicare Part B.

What percentage is the Social Security and Medicare tax?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.Mar 15, 2022

How much is Social Security and Medicare tax 2019?

7.65%The Federal Insurance Contributions Act (FICA) tax rate, which is the combined Social Security tax rate of 6.2% and the Medicare tax rate of 1.45%, will be 7.65% for 2019 up to the Social Security wage base. The maximum Social Security tax employees and employers will each pay in 2019 is $8,239.80.Dec 13, 2019

What was the Social Security cap in 2018?

$128,400Maximum Taxable Earnings Each YearYearAmount2016$118,5002017$127,2002018$128,4002019$132,9004 more rows

What is the Social Security and Medicare rate for 2021?

FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings. In 2021, only the first $142,800 of earnings are subject to the Social Security tax ($147,000 in 2022).Jan 13, 2022

How do I calculate Medicare tax 2019?

The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you (the employer) don't have to pay the additional 0.9% For a total of 7.65% withheld, based on the employee's gross pay.Nov 7, 2019

How is Medicare tax calculated?

For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party – employee and employer – pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%.Jan 12, 2022

At what age do you stop paying Social Security?

The full retirement age is 66 if you were born from 1943 to 1954. The full retirement age increases gradually if you were born from 1955 to 1960 until it reaches 67. For anyone born 1960 or later, full retirement benefits are payable at age 67.Jan 1, 2022

What is the max Social Security payment?

The maximum benefit depends on the age you retire. For example, if you retire at full retirement age in 2022, your maximum benefit would be $3,345. However, if you retire at age 62 in 2022, your maximum benefit would be $2,364.Dec 9, 2021

What is the additional Medicare tax for 2018?

The extra tax was announced as part of the Affordable Care Act and is known as the Additional Medicare Tax. The tax rate for the Additional Medicare Tax is 0.9 percent. That means you'll pay 2.35 percent if you receive employment wages. Self-employed taxpayers will pay 3.8 percent.

What is the current FICA rate for 2022?

7.65%For 2022, the FICA tax rate for employers is 7.65% — 6.2% for Social Security and 1.45% for Medicare (the same as in 2021). For 2022, an employee will pay: 6.2% Social Security tax on the first $147,000 of wages (6.2% of $147,000 makes the maximum tax $9,114), plus.Jan 12, 2022

What percentage of Social Security is taxable in 2021?

50%For the 2021 tax year (which you will file in 2022), single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.Apr 6, 2022

What are the 2021 tax brackets?

There are seven tax brackets for most ordinary income for the 2021 tax year: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent.Apr 7, 2022

How much will Social Security increase in 2018?

After several years of no or very small increases, Social Security benefits will increase by 2.0 percent in 2018 due to the Cost of Living adjustment.

How much is the Part B premium in 2018?

The 30 percent of all Part B enrollees who are not subject to the “hold harmless” provision will pay the full premium of $134 per month in 2018. Part B enrollees who were held harmless in 2016 ...

What is the deductible for Medicare Part B?

The annual deductible for all Medicare Part B beneficiaries will be $183 in 2018, the same annual deductible in 2017. Premiums and deductibles for Medicare Advantage and Medicare Prescription Drug plans are already finalized and are unaffected by this announcement. Since 2007, beneficiaries with higher incomes have paid higher Medicare Part B ...

What is the Medicare Part B premium?

Medicare Part B Premiums/Deductibles. Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and other items. The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017.

How much is Medicare Part A deductible?

The Medicare Part A annual inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,340 per benefit period in 2018, an increase of $24 from $1,316 in 2017. The Part A deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

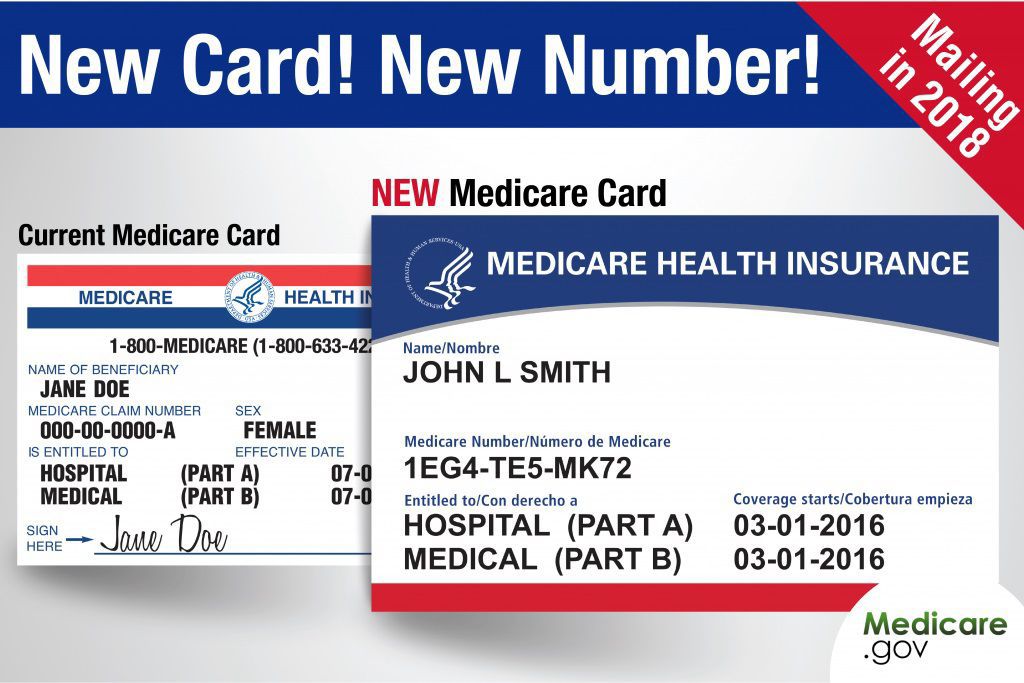

When did Medicare Part A and B premiums come out?

2018 Medicare Parts A & B Premiums and Deductibles. On November 17, 2017 , the Centers for Medicare & Medicaid Services (CMS) released the 2018 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A annual inpatient hospital deductible ...

How much is Social Security tax in 2018?

If you're an employee, the Social Security tax calculation is easy. If you earn less than $128,400 in 2018, simply multiply your earnings by 0.062 to find your Social Security tax. For example, if your salary is $50,000, your 2018 Social Security tax will be $3,100.

What percentage of Medicare is taxed?

Of the 7.65%, 1.45% goes to Medicare hospital insurance taxes and the other 6.2% goes to Social Security. The Social Security tax rate in the United States is 6.2%. And if you're curious, this can be further broken down into 5.015% for retirement and survivors benefits and 1.185% for Social Security disability.

What is the $128,400 cap on payroll taxes?

Finally, it's worth mentioning that the $128,400 taxable earnings cap applies only to the Social Security portion of the payroll tax. Medicare tax is assessed on all earned income -- in fact, high earners pay an additional 0.9% Medicare tax on earned income above a certain threshold.

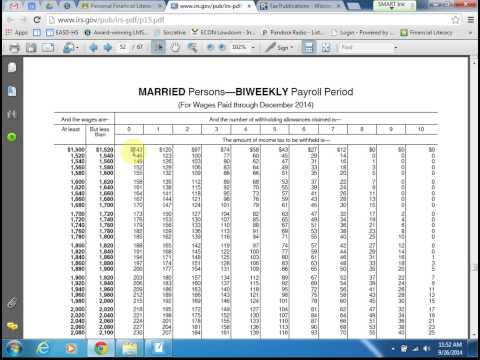

What is the payroll tax rate?

The payroll tax rate is currently 7.65% and is assessed on both employers and employees. In other words, the payroll tax rate assessed on ...

What is the earnings cap for Social Security?

This maximum amount, known as the Social Security tax "earnings cap," is adjusted annually to keep up with inflation. For 2018, the earnings cap is $128,400.

How much is self employment tax?

15.3% on self-employment income, up to $128,400. 2.9% for Medicare tax on self-employment income above $128,700. Collectively, this is known as the self-employment tax. If you're self-employed, you'll pay this tax on your net self-employment income.

Is Social Security income earned income?

However, Social Security is only assessed on earned income, such as salaries, bonuses, wages, tips, and income from a business you're actively running. Passive-income sources, such as dividends, rental income, and income from a business you own but don't participate in, are not subject to Social Security tax.

How much is Medicare premium in 2017?

The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

How much does Medicare Part B cost?

Medicare Part B covers medical care, including regular trips to the doctor and anything considered “medically necessary” for you. How much you pay for Part B coverage depends on different factors, such as when you enroll and your yearly income. The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

How much is the penalty for Medicare Part B?

For Part B, the penalty is 10 percent of your premium (charged on top of the premium rate) for each 12-month period that you didn’t have Part B coverage when you could have. The penalty lasts for as long as you have Part B. Medicare Part B has other costs as well.

What is Medicare Part A?

Medicare Part A is the hospital portion, covering services related to hospital stays, skilled nursing facilities, nursing home care, hospice and home healthcare. Under the Affordable Care Act, Part A alone counts as minimum essential coverage, so if this is all you sign up for, you’ll meet the law’s requirements. Most people don’t pay a premium for Part A because it’s paid for via work-based taxes. If, over the course of your working life, you’ve accumulated 40 quarter credits, then you won’t pay a premium for Part A. This applies to nearly all enrollees, but some do pay a premium as follows:

How much is Part D deductible for 2017?

In 2017, you can expect the following costs: The Part D deductible is $1,316 per benefit period. Once you meet the deductible, you’ll pay nothing out of pocket for the first 60 days of your stay. For days 61 to 90, you’ll pay $329 per day. For days 91 and beyond, you’ll pay $658 per day.

How much does it cost to get a quarter credit in 2017?

If you earn fewer than 30 quarter credits, the cost is $413 a month in 2017. Few people might pay the premium for Part A, but everyone with this coverage still must meet certain deductibles, and cost-sharing is still required. In 2017, you can expect the following costs:

Does Medicare Advantage cover Part B?

If you have Medicare Advantage, then you will pay the Part B premium as well as any premiums that your plan charges. Medicare Advantage must cover Part B services. Income thresholds will change in 2018.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is the average Social Security payment for 2018?

The SSA estimates that the average monthly Social Security benefits payable in January 2018 for all retired workers will be $1,404, up $27 from the 2017 average payment of $1,377. Medicare Premiums. Premiums for Medicare Part B, which primarily covers doctors' visits and other outpatient care, can also change annually.

How many people will pay more in Social Security taxes in 2018?

Of the estimated 175 million workers who will pay Social Security taxes in 2018, about 12 million will pay more because of the increase in the taxable-maximum amount, beginning on Jan. 1, 2018.

What is the taxable maximum for 2017?

The revised $128,400 taxable maximum is an increased of $1,200 over the $127,200 earnings maximum for 2017, rather than the $1,500 increase the SSA had announced on Oct. 13 (the SSA has also revised the online version of its October announcement).

What is the Medicare payroll tax rate?

For employers and employees, the Medicare payroll tax rate is a matching 1.45 percent on all earnings, bringing the total Social Security and Medicare payroll withholding rate for employers and employees to 7.65 percent each—with only the Social Security portion (6.2 percent) limited to the $128,700 taxable-maximum amount.

How much is the standard deduction for married filing separately?

The standard deduction for single taxpayers and married taxpayers filing separately rises to $12,000 from $6,350. The standard deduction for married taxpayers filing joint returns rises to $24,000 from $12,700. The standard deduction for heads of household rises to $18,000 from $9,350.

What is the maximum amount of Social Security earnings?

Starting Jan. 1, 2019, the maximum earnings that will be subject to the Social Security payroll tax will increase by $4,500 to $132,900—up from the $128,400 maximum for 2018, the Social Security Administration announced Oct. 11, 2018.

What is the tax rate for Medicare and Social Security?

Note: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion is 6.20% on earnings up to the applicable taxable-maximum amount. The Medicare portion is 1.45% on all earnings. Additional Medicare Tax.

What is the increase in Social Security in 2019?

The Social Security Administration (SSA) made a few other tweaks the program in 2019, including a 2.8% increase in retirement benefits due to a cost-of-living adjustment (COLA). The SSA will typically provide a COLA if there is a significant increase in the Consumer Price Index (CPI). Earning limits for retirement benefits also increased in 2019.

How much is Social Security tax?

social security tax limit. Most of us are familiar with the Social Security tax, since we see it right on our paychecks. There is a payroll tax of 6.20% that goes directly toward funding the program; if you’re self-employed, you’ll pay twice that (though you can deduct half). That money is your way of paying ...

What is the Medicare tax rate for OASDI?

Keep in mind that this income limit applies only to the old-age, survivors and disability (OASDI) tax of 6.2%. The other payroll tax is a Medicare tax of 1.45%, and you’ll have to pay that for all income you earn. In fact, for income over $200,000 ($250,000 for couples filing jointly), the Medicare tax rate rises to 2.35%.

How much do you lose if you earn over the FRA limit?

You’ll lose $1 in benefits for every $3 you earn over the limit. After you reach your FRA, there will be no penalty for working and receiving benefits concurrently. The Takeaway. social security tax limit.

What is the maximum amount you can earn in 2019?

For workers that have yet to reach their full retirement age (FRA), the 2019 earning limit is $17,640, up $600 from the 2018 amount. If your earnings exceed that limit, you’ll lose ...

Why is Social Security tax higher?

The Social Security tax is part of why your Social Security benefit is higher if you wait longer to retire. If you delay your retirement until you reach your full retirement age (FRA), then you will have been paying the tax for longer. (Furthermore, the later you start claiming benefits, the less time the system will have to pay you those benefits.)

Is Social Security a source of income?

Social Security isn’t intended to be your sole source of retirement income – you should also have retirement savings. To make sure these savings are on pace to meet your income needs, it’s a great idea to work with a financial advisor who can develop a financial plan and help you invest.