2017 Social Security and Medicare Tax Withholding Rates and Limits

| Tax | 2016 Limit | 2017 Limit |

| Social Security Gross | $118,500.00 | $127,200.00 |

| Social Security Liability | $7,347.00 | $7,886.40 |

| Medicare Gross | No Limit | No Limit |

| Medicare Liability | No Limit | No Limit |

| 2017 FICA Rate (Social Security + Medicare withholding) | |

|---|---|

| Employee | 7.65% |

| Employer | 7.65% |

| Self-Employed | 15.30% |

What percent is Social Security and Medicare tax?

2016 2017. o . Tax Rate: Employee 7.65% 7.65% . Self-Employed 15.30% 15.30% . NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings. Also, as of January

What percent of US budget is Social Security and Medicare?

Nov 10, 2016 · Among this group, the average 2017 premium will be about $109.00, compared to $104.90 for the past four years. For the remaining roughly 30 percent of beneficiaries, the standard monthly premium for Medicare Part B will be $134.00 for 2017, a 10 percent increase from the 2016 premium of $121.80.

When you are eligible for Social Security and Medicare?

Dec 19, 2016 · Medicare Part B: Premium Per Month for Individuals with less than $85,000/year income: $134.00 / $109.00: Premium Per Month for Individuals making more than $85,000/year: $187.50 – $428.60: Yearly Deductible: $183.00: Social Security: Cost of Living Adjustment (COLA) 0.3%: Maximum Benefit at Full Retirement: $2,687.00: Maximum Taxable Earnings: $127,200.00

How to pay into Social Security and Medicare?

Dec 17, 2016 · Medicare Premiums in 2017. Posted on December 17, 2016. Medicare premiums, deductibles, and copays for the most part change from year to year and what you actually pay depends on your work history, income and inflation. Read article here…. Notice: The link provided in the text above connects readers to the full content of the referenced ...

What was the Social Security tax rate in 2017?

What was the Social Security tax rate in 2018?

What is the Social Security income limit for 2017?

What are Social Security and Medicare rates?

What is the Medicare premium for 2017?

For the remaining roughly 30 percent of beneficiaries, the standard monthly premium for Medicare Part B will be $134.00 for 2017, a 10 percent increase from the 2016 premium of $121.80. Because of the “hold harmless” provision covering the other 70 percent of beneficiaries, premiums for the remaining 30 percent must cover most ...

How much is Medicare Part A deductible?

The Medicare Part A inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,316 per benefit period in 2017, an increase of $28 from $1,288 in 2016. The Part A deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

What is the COLA for Social Security?

Because of the low Social Security COLA, a statutory “hold harmless” provision designed to protect seniors, will largely prevent Part B premiums from increasing for about 70 percent ...

Do you have to file a separate tax return for a spouse who is married?

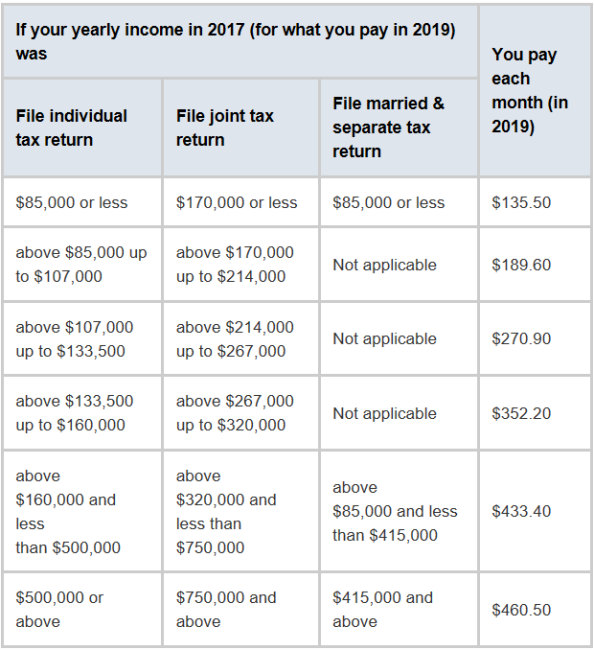

Premiums for beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouse at any time during the year, but file a separate tax return from their spouse:

Is Medicare Part B deductible finalized?

Premiums and deductibles for Medicare Advantage and prescription drug plans are already finalized and are unaffected by this announcement. Since 2007, beneficiaries with higher incomes have paid higher Medicare Part B monthly premiums. These income-related monthly premium rates affect roughly five percent of people with Medicare.

Latest News

Medicare premiums, deductibles, and copays for the most part change from year to year and what you actually pay depends on your work history, income and inflation. Read article here…

Medicare Premiums in 2017

Medicare premiums, deductibles, and copays for the most part change from year to year and what you actually pay depends on your work history, income and inflation. Read article here…

Why did Medicare premiums go up in 2016?

The Centers for Medicare & Medicaid Services (CMS) cited several reasons for the price hike, including paying off mounting debt from past years and ensuring funding for future coverage. But another important factor was that 2016 saw no cost-of-living adjustment (COLA) for Social Security benefits. For 70 percent of Medicare beneficiaries, this meant that premium rates would stay the same in 2016. The remaining 30 percent — about 15.6 million enrollees — faced higher monthly premiums. And everyone who signs up for Medicare in 2016, regardless of enrollment status or income, will pay a higher annual deductible.

How much does Medicare Part B cost?

Most recipients pay an average of $109 a month for coverage, but certain beneficiaries pay the standard premium of $134 a month. If you meet one of the following conditions, then you’ll pay the standard amount ($134) or more:

What is Part D insurance?

Part D covers prescription drug costs, and it was introduced in 2003 to help seniors afford medication. It’s a popular provision. How much you pay for Part D varies based on the type of coverage you choose, but there are standards in place to limit your out-of-pocket spending. Once again, higher-income enrollees will pay an income-based surcharge on top of their monthly premiums:

What is Medicare Advantage?

Medicare Advantage offers a bevy of benefits to seniors who are looking for more comprehensive coverage. These plans must include at least the same benefits offered through Parts A and B, and many (but not all) plans cover prescription drugs. Because these plans are sold through private insurers instead of directly through the federal government, Medicare Advantage has different costs that vary by plan. As with any insurance plan, costs rise each year. If you want to learn more about this type of coverage, then check out our guide to Medicare Advantage.

Is Medigap the same as Medicare?

In all but three states, Medigap plans are the same. They are organized into plans A through N. These plans are offered by private insurance companies and are not part of Medicare. They offer the same things Medicare does and then some.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What is the maximum Social Security benefit for 2017?

The maximum Social Security benefit for workers retiring at full retirement age in 2017 will be $2,687 per month, up from $2,639 per month in 2016. The SSA estimates that the average monthly Social Security benefits payable in January 2017 for all retired workers will be $1,360, up only $5 from the 2016 average payment of $1,355.

What is the maximum income for 2017?

The earnings limit for these individuals in 2017 will be $44,880 per year ($3,740 per month), up from $41,880 per year ($3,490 per month) in 2016. There is no limit on earnings beginning the month an individual attains full retirement age. 2017 Income Tax Brackets.

What is the tax rate for self employed?

Those who are self-employed must pay both the employer and employee portions of FICA taxes. Note: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion is 6.20% on earnings up to the applicable taxable-maximum amount. The Medicare portion is 1.45% on all earnings.

How much is Social Security financed?

Social Security is financed by a 12.4 percent tax on wages up to the taxable-earnings cap, with half (6.2 percent) paid by workers and the other half paid by employers. This taxable wage base usually goes up each year—it rose from $117,000 in 2014 to $118,500 in 2015, but stayed put at that level for 2016.

Will Social Security increase Medicare?

For many SSI recipients, their Social Security increase is likely to be offset by higher Medicare premiums, which could be even steeper for those covered by Medicare Part B if they have delayed taking Social Security because they are still working, for instance. Increases in Retirement Earnings Limit.

Should compensation budgets take into account the increased taxes that employers will pay for affected positions?

Consequently, compensation budgets should take into account the increased taxes that employers will pay for affected positions. At the same time, expect some pushback from employees who may want to be "made whole" for their share of the extended tax hit.

Is FICA tax set by law?

Social Security and Medicare payroll taxes are collected together as the Federal Insurance Contributions Act (FICA) tax. FICA tax rates are statutorily set and therefore require new tax legislation to be changed.

Finance

For 2017, the maximum limit on earnings for withholding of Social Security (Old-Age, Survivors, and Disability Insurance) Tax is $127,200.00. The Social Security Tax Rate remains at 6.2 percent. The resulting maximum Social Security Tax for 2017 is $7,886.40.

2017 Social Security and Medicare Tax Withholding Rates and Limits

For 2017, the maximum limit on earnings for withholding of Social Security (Old-Age, Survivors, and Disability Insurance) Tax is $127,200.00. The Social Security Tax Rate remains at 6.2 percent. The resulting maximum Social Security Tax for 2017 is $7,886.40.

How much is FICA tax?

How much are the current FICA tax rates? 1 The Social Security tax rate is 6.2% of earned income up to a certain cap. For 2017, the maximum amount of income that can be subject to Social Security tax is $127,200. No Social Security tax is assessed on income in excess of this amount. 2 The Medicare tax rate is much lower, at 1.45% of earned income. However, there is no wage cap -- every dollar of earned income is subject to Medicare taxes, even if the income is in the millions. High-income individuals pay an additional Medicare tax as part of the Affordable Care Act as well.

What is FICA payroll tax?

FICA is the U.S. federal payroll tax, designed to help fund the Social Security and Medicare programs. As of 2017, about 171 million people work and contribute FICA taxes. Image source: Getty Images. The basic idea behind FICA is that the current generation of workers is funding these programs for today's retirees, ...

What is FICA tax?

FICA, which stands for Federal Insurance Contribution Act, is a tax that is paid by employees as well as their employers, and is often referred to as the payroll tax. The purpose of the FICA tax is to fund the Social Security and Medicare programs, which provide benefits to American retirees.

Is Medicare taxed on income?

The Medicare tax rate is much lower, at 1.45% of earned income. However, there is no wage cap -- every dollar of earned income is subject to Medicare taxes, even if the income is in the millions. High-income individuals pay an additional Medicare tax as part of the Affordable Care Act as well. For both of these taxes, employers match their ...

Where is Matt from Motley Fool?

Matt is a Certified Financial Planner based in South Carolina who has been writing for The Motley Fool since 2012. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price.

Will Social Security run out of reserves?

Eventually -- in 2034 for Social Security and 2028 for Medicare -- both will be completely out of reserves and will need to make across-the-board benefit cuts.

Who is responsible for paying self employed taxes?

Self-employed individuals are considered to be both the employer and employee, and are therefore responsible for paying both parts of the tax, which is collectively known as the self-employment tax.