What is the current tax rate for Social Security and Medicare?

Different rates apply for these taxes. Social Security and Medicare Withholding Rates. The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

What is the Social Security tax rate for federal employees?

Answer The employee tax rate for Social Security is 6.2% — and the employer tax rate for Social Security is also 6.2%. So, the total Social Security tax rate percentage is 12.4%. Only the employee portion of Social Security tax is withheld from your paycheck.

What is the Medicare tax on wages over 200K?

If you receive wages over $200,000 a year, your employer must withhold a .9% additional Medicare tax. This will apply to the wages over $200,000.

What is the additional Medicare tax withholding rate?

Additional Medicare Tax Withholding Rate. Employers are responsible for withholding the 0.9% Additional Medicare Tax on an individual's wages paid in excess of $200,000 in a calendar year, without regard to filing status. An employer is required to begin withholding Additional Medicare Tax in the pay period in which it pays wages in excess...

What was the Social Security tax rate in 2013?

6.2 percentIn 2013, with the higher income ceiling and the return to the 6.2 percent withholding rate, the maximum yearly Social Security tax withholding rises from $4,624.20 (4.2 percent on income up to $110,100) to $7,049.40 (6.2 percent on income up to $113,700).

What was the Social Security tax rate in 2012?

a. Recent legislation reduced the 2012 OASDI tax rates by two percentage points for employees (from 6.2 percent to 4.2 percent) and for the self-employed (from 12.4 percent to 10.4 percent).

What was the Medicare tax rate in 2014?

1.45 percentFor 2014, the social security tax rate is 6.2 percent, and the Medicare tax rate is 1.45 percent.

How much are Social Security taxes and Medicare taxes?

What is FICA tax? FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings. In 2021, only the first $142,800 of earnings are subject to the Social Security tax ($147,000 in 2022). A 0.9% Medicare tax may apply to earnings over $200,000 for single filers/$250,000 for joint filers.

What was the maximum Social Security benefit in 2013?

$2,533For 2013, the maximum Social Security benefit for someone reaching Full Retirement Age (FRA) in that year will be $2,533, an increase of $20 over 2012.

Does federal tax rate include Medicare and Social Security?

FICA is not included in federal income taxes. While both these taxes use the gross wages of the employee as the starting point, they are two separate components that are calculated independently. The Medicare and Social Security taxes rarely affect your federal income tax or refunds.

What is the Social Security limit for 2014?

For 2014, the maximum limit on earnings for withholding of Social Security (Old-Age, Survivors, and Disability Insurance) Tax is $117,000.00. The maximum limit is changed from last year. The Social Security Tax Rate remains at 6.2 percent. The resulting maximum Social Security Tax for 2014 is $7,254.00.

Did Social Security tax go up?

The Social Security tax limit has been increased in 10 of the last 11 years, with 2020 and 201 seeing increases of 3.6% and 3.7% respectively. The increase is less in 2022, however, as it will be 2.9%.

What percent is Social Security tax?

6.2 percentSocial Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $147,000 (in 2022), while the self-employed pay 12.4 percent.

How is Medicare tax withheld calculated?

The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you (the employer) don't have to pay the additional 0.9% For a total of 7.65% withheld, based on the employee's gross pay.

Why do I pay Social Security and Medicare tax?

If you work as an employee in the United States, you must pay social security and Medicare taxes in most cases. Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment.

How much tax is taken out of your Social Security check?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

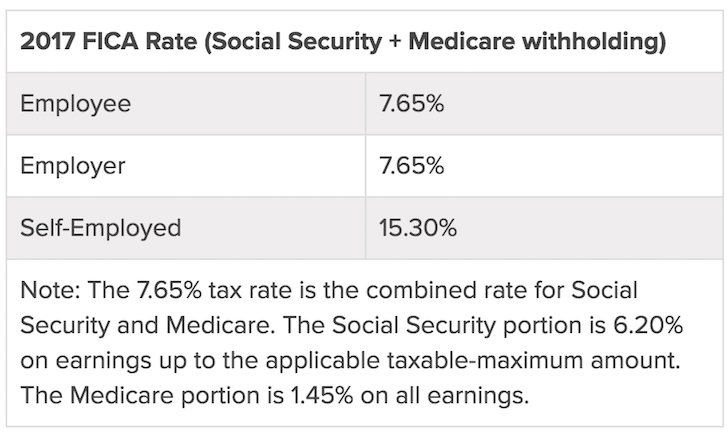

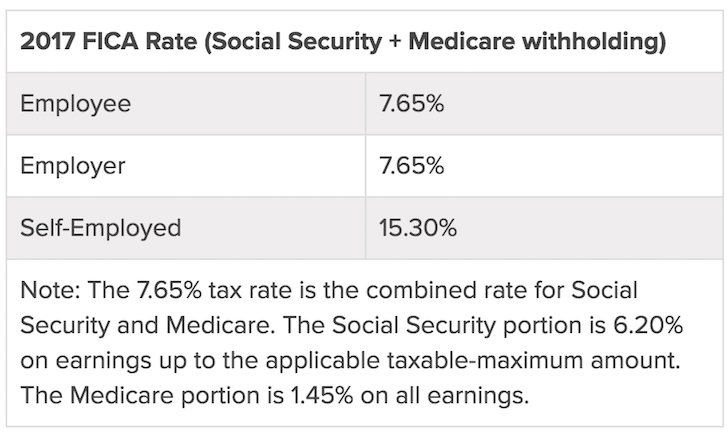

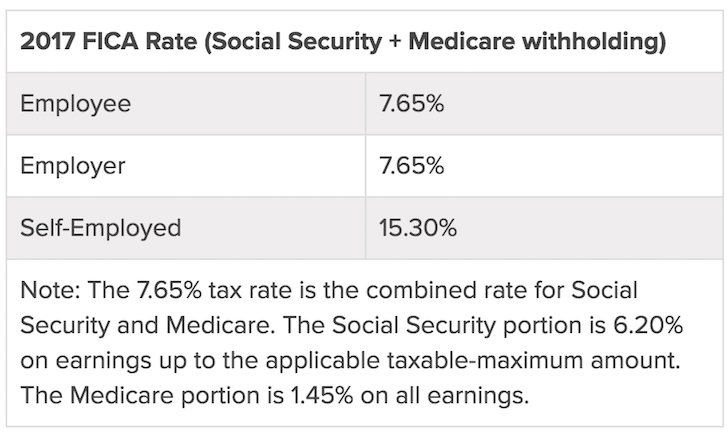

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

Tax Rates

FICA and Self-Employment Tax Rates: The FICA tax rate for employees and their employers is a combination of payments to the Old Age, Survivors, and Disability Insurance (OASDI) Trust Fund, and the Hospital Insurance (HI) Trust Fund, from which payments under Medicare are made.

Social Security Disability Insurance

Quarters of Coverage: Eligibility for Retirement, Survivors, and Disability Insurance (RSDI) benefits is partially based on the number of quarters of coverage earned by any individual during periods of work. Anyone may earn up to four quarters of coverage in a single year.

Supplemental Security Income

Standard SSI Benefit Increase: Beginning January 2013, the federal payment amounts for SSI individuals and couples are as follows: individuals, $710 a month; SSI couples, $1,066 a month.

Medicare

Medicare Deductibles and Coinsurance: Medicare Part A coverage provides hospital insurance to most Social Security beneficiaries. The coinsurance amount is the hospital charge to a Medicare beneficiary for any hospital stay. Medicare then pays the hospital charges above the beneficiary's coinsurance amount.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is the Medicare tax rate for 2013?

However, in 2013, the Medicare tax rate rises to 2.35 percent for single taxpayers with annual income of more than $200,000 and for married joint filers whose combined annual income exceeds $250,000, under a provision of the Patient Protection and Affordable Care Act. Medicare Premium Hike May Offset Benefit Increase.

How much did Social Security increase in 2013?

In addition, the SSA announced that monthly Social Security and Supplemental Security Income (SSI) benefits paid to nearly 62 million Americans will increase by 1.7 percent in 2013.

What is the FICA tax rate?

This results in a total FICA tax of 15.3 percent (Social Security plus Medicare), half of which is paid by employees and half by employers. Those who are self-employed are responsible for the entire FICA tax rate of 15.3 percent (12.4 percent Social Security + 2.9 percent Medicare).

How many people will pay higher taxes in 2013?

Of the estimated 163 million workers who will pay Social Security FICA taxes in 2013, nearly 10 million will pay higher taxes as a result of the increase in the taxable maximum, according to the SSA, which has published FAQs about these changes.

Why did the take home pay shrink in 2013?

Instead of a raise, some employees will see their take-home pay shrink in 2013 due to higher Social Security and Medicare taxes. The maximum amount of earnings subject to the Social Security tax (taxable maximum) increasedto $113,700 from $110,100 as of January 2013, the U.S. Social Security Administration (SSA) announced on Oct. 16, 2012.

When will payroll be adjusted for FICA?

By January 1, U.S. employers should have adjusted their payroll systems to account for the higher taxable maximum under the Social Security portion of FICA, and notified affected employees that more of their paychecks will be subject to FICA.

Does Social Security increase with Medicare?

For many beneficiaries, however, their Social Security increase will be partially or completely offset by increases in Medicare Part B premiums, which typically are deducted from Social Security benefits.

What is the percentage of Social Security tax?

So, the total Social Security tax rate percentage is 12.4%. Only the employee portion of Social Security tax is withheld from your paycheck.

How much Medicare tax is withheld from paycheck?

There’s no wage-based limit for Medicare tax. All covered wages are subject to Medicare tax. If you receive wages over $200,000 a year, your employer must withhold a .9% additional Medicare tax. This will apply to the wages over $200,000.

Do you have to file Medicare taxes if you are married?

If you’re married, you might not have enough Medicare taxes withheld. If you’re married filing jointly with earned income over $250,000, you’re subject to an additional tax. This also applies to married filing separately if your income is over $125,000.