How much are Social Security and Medicare taxes?

You will pay tax on only 85 percent of your Social Security benefits, based on Internal Revenue Service (IRS) rules. If you: file a federal tax return as an "individual" and your combined income* is between $25,000 and $34,000, you may have to pay income tax on up to …

What is the percentage for Social Security and Medicare tax?

Feb 23, 2020 · Officially, it is known as the Unearned Income Medicare Contribution Surtax, NIIT. It is a 3.8% Medicare tax that applies to income from investments and regular income above specific thresholds....

Why do I pay Social Security and Medicare tax?

Dec 23, 2021 · Social Security taxes in 2018 are 6.2% of gross wages up to $128,400. The tax rate for Social Security changes yearly and is mostly paid through FICA.

What percentage is Social Security and Medicare?

Apr 21, 2022 · Social Security Tax and Medicare Tax, combined, are known as FICA. The total rate of FICA is 15.3%, distributed as social security tax and medicare tax. If we talk about the portion paid by the employee, it comprises 6.2% Social Security Tax and 1.45% Medicare tax on earnings.

Do you pay Social Security and Medicare tax on retirement income?

Any income you earn from regular employment and self-employment sources is subject to Social Security, Medicare, and income taxes. If you receive Social Security benefits and continue to work and earn income, you will have to pay Social Security and Medicare taxes on that earned income.

What percentage is Social Security taxed when you retire?

between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

How much is Medicare tax after retirement?

The current Medicare tax rate is 1.45 percent of your wages and is withheld from your paycheck. Your employer matches your contribution by paying another 1.45 percent. If you are self-employed, you have to pay the full 2.9 percent of your net income as the Medicare portion of your FICA taxes.

What is the Social Security and Medicare tax rate for 2021?

FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings. In 2021, only the first $142,800 of earnings are subject to the Social Security tax ($147,000 in 2022).Jan 13, 2022

How can I avoid paying taxes on retirement income?

3 Ways to Avoid Taxes on BenefitsKeep Some Retirement Income in Roth Accounts. Contributions to a Roth IRA or Roth 401(k) are made with after-tax dollars. ... Withdraw Taxable Income Before Retirement. ... Buy an Annuity Contract.

Do I have to pay taxes on retirement income?

You have to pay income tax on your pension and on withdrawals from any tax-deferred investments—such as traditional IRAs, 401(k)s, 403(b)s and similar retirement plans, and tax-deferred annuities—in the year you take the money. The taxes that are due reduce the amount you have left to spend.

What are the Social Security and Medicare tax rates for 2020?

7.65 percentThe FICA tax rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2020 (or 8.55 percent for taxable wages paid in excess of the applicable threshold).

What is the Medicare tax limit for 2020?

2020 Payroll Taxes Will Hit Higher IncomesPayroll Taxes: Cap on Maximum EarningsType of Payroll Tax2020 Maximum Earnings2019 Maximum EarningsSocial Security$137,700$132,900MedicareNo limitNo limitSource: Social Security Administration.

How much of your Social Security benefits are taxable?

more than $34,000, up to 85 percent of your benefits may be taxable. between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits. more than $44,000, up to 85 percent of your benefits may be taxable. are married and file a separate tax return, you probably will pay taxes on your benefits.

Can I get a replacement for my Social Security 1099?

If you currently live in the United States and you misplaced or didn't receive a Form SSA-1099 or SSA-1042S for the previous tax year, you can get an instant replacement form by using your online my Social Security ...

Do I pay taxes on my Social Security benefits if I am married?

are married and file a separate tax return, you probably will pay taxes on your benefits. Each January, you will receive a Social Security Benefit Statement (Form SSA-1099) showing the amount of benefits you received in the previous year. You can use this Benefit Statement when you complete your federal income tax return to find out ...

What is the income threshold for Social Security?

For singles, those income thresholds are between $25,000 and $34,000 for 50%, and more than $34,000 for 85%. Some states will also tax Social Security income separate from what the IRS demands.

How to have taxes withheld from Social Security?

It is possible to have taxes withheld from Social Security benefit payments by filling out IRS Form W-4V or requesting a Voluntary Withholding Request Form online. 5 6 There are currently 13 states in which your Social Security benefits may also be taxable at the state level, at least to some beneficiaries.

Do I have to pay taxes on my Social Security?

Whether or not you need to pay taxes on your Social Security benefits, however, depends on your modified adjusted gross income (MAGI). If your MAGI is above a certain threshold for your filing status (e.g. single or married filing jointly), then your benefits would be taxable. Up to 85% of a taxpayer’s Social Security benefits are taxable.

Does continuing to work lower Social Security?

Continuing to work, however, may lower current payments, if any, taken during the year full retirement age is reached, according to a Social Security Administration limit, which changes every year. 2

Can you contribute to Social Security if you are working past retirement age?

Everyone must make applicable Social Security contributions on income, even those working past full retirement age. 1 Working past full retirement age may also increase Social Security benefits in the future because Social Security contributions continue to be paid in. 2 .

What are the other sources of income for Social Security?

Other earning sources include things like distributions from your 401 (k) or IRA, wages from work, pensions, royalties or even rental income.

What is the maximum adjusted gross income for 2020?

For 2020, if you have Modified Adjusted Gross Income (MAGI) above $200,000 ($250,000 for married couples filing jointly), you will be subject to NIIT. I mention this because it is typically a surprise to many people when filing their taxes.

Do you pay taxes if you are retired?

Once retired and living on unearned income, you will no longer be paying Social Security and Medicare payroll taxes. You will still be subject to income taxes at the federal state levels. That assumes you don’t live in a state without an income tax. Currently, federal income tax rates range from 10 to 37 percent, ...

Do you have to pay Social Security taxes on retirement withdrawals?

He was confusing taxes taken from his paycheck with only the payroll taxes. While it is true you won’t have to pay Social Security and Medicare taxes on withdrawals from retirement accounts, you will still be subject to income taxes at the state and federal levels.

Does Medicare still apply in retirement?

Medicare Surtax Still Applies in Retirement. You may have heard it called the Medicare Surtax or Obamacare Surtax. Officially, it is known as the Unearned Income Medicare Contribution Surtax, NIIT. It is a 3.8% Medicare tax that applies to income from investments and regular income above specific thresholds.

Do you pay sales tax on retirement?

Retirement will not get you out of paying sales taxes. While the amount you will pay depends on your shopping habits and state of residence, it is something that can’t be ignored. Similarly, homeowners will still be subject to property taxes. For many retirees, property taxes can be one of their largest expenses. If you choose to itemize your deductions, property taxes could help to reduce your income taxes.

Do you have to have a Roth 401(k) to retire?

If you have money in a Roth, Roth 401 (k), or the Rich Person Roth , you will have some tax-free retirement income. While that is a great piece of a well-rounded retirement plan, few people have all of their assets in Roth accounts. If they do, they have not accumulated enough assets to fully fund a comfortable retirement.

How much of your income goes to Medicare?

Another 1.45 percent of your gross wages helps fund Medicare. There’s no income maximum there; $1.45 of every $100 you earn goes to Medicare. Again, your employer matches that, and again, people who work for themselves pay both shares, or 2.9 percent of their net income from self-employment. Updated December 24, 2020.

What is the Social Security tax rate for 2021?

What is the Social Security tax rate? En español | Social Security taxes in 2021 are 6.2 percent of gross wages up to $142,800. (Thus, the most an individual employee can pay this year is $8,853.60.) Most workers pay their share through FICA (Federal Insurance Contributions Act) taxes withheld from their paychecks.

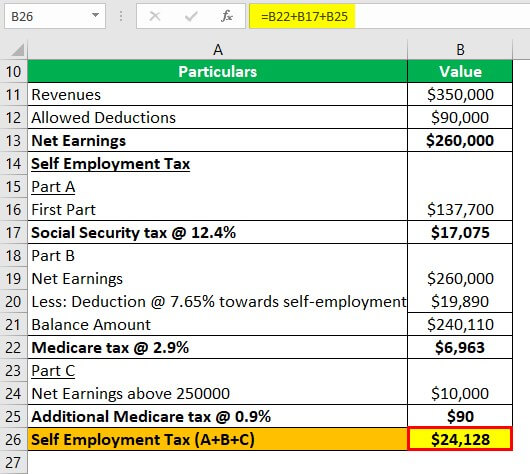

How much of your net earnings does self employed cover?

The contributions are matched by their employers. People who are self-employed cover both shares — that is, 12.4 percent of their net earnings — in the form of SECA (Self-Employment Contributions Act) taxes, paid through federal tax returns.

Does retirement cut your taxes?

Retirement doesn't cut your responsibility to pay income tax or Social Security and Medicare -- known as FICA taxes. If your sources of income change in retirement however, you may be able to leave FICA behind. Social Security benefits, for example, aren't subject to FICA taxes.

Is severance pay subject to FICA?

One possible exception is if you get the pay because your company went out of business. The Sixth Circuit Court ruled in 2012 that in that case, severance pay wasn't subject to FICA.

Is self employment tax the same as FICA?

Self-employment tax is twice the regular FICA tax . Employers normally match the employee tax rate but when you're self-employed, you're both employer and employee, so you pay both halves.

How much of your Social Security income is taxable?

If your Social Security income is taxable, the amount you pay in tax will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income. If you file as an individual with a total income that’s less than $25,000, you won’t have to pay taxes on your social security benefits in 2020, ...

How many states have Social Security taxes?

There are 13 states that collect taxes on at least some Social Security income. Four of those states (Minnesota, North Dakota, Vermont or West Virginia) follow the same taxation rules as the federal government.

How much to withhold from Social Security?

The only withholding options are 7%, 10%, 12% or 22% of your monthly benefit . After you fill out the form, mail it to your closest Social Security Administration (SSA) office or drop it off in person.

How to find out if you will pay taxes on Social Security?

According to the IRS, the quick way to see if you will pay taxes on your Social Social Security income is to take one half of your Social Security benefits and add that amount to all your other income , including tax-exempt interest. This number is known as your combined income (combined income = adjusted gross income + nontaxable interest + half of your Social Security benefits).

How much tax do you pay on your income if you live in one of the states?

So if you live in one of those four states then you will pay the state’s regular income tax rates on all of your taxable benefits (that is, up to 85% of your benefits). The other nine states also follow the federal rules but offer deductionsor exemptions based on your age or income.

How to file Social Security income on federal taxes?

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this part is easy. First, find the total amount of your benefits. This will be in box 3 of your Form SSA-1099.

Do you pay taxes on Roth IRA?

With a Roth IRA, you save after-tax dollars. Because you pay taxes on the money before contributing it to your Roth IRA, you will not pay any taxes when you withdraw your contributions.

Income and Taxation of Benefits

Taxpayer Bracket

- However, taking Social Security benefits while continuing to work may have the unexpected negative consequence of bumping a taxpayer into a higher tax bracket. Most people forget that a certain percentage of Social Security benefits may be taxed—up to 85%—depending on filing status and combined income, including half of Social Security benefits.1 Some states also tax S…

How to Lower Your Social Security Taxes

- There are several remedies available for those who are taxed on their Social Security benefits. Perhaps the most obvious solution is to reduce or eliminate the interest and dividendsthat are used in the provisional income formula. Therefore, the solution could be to convert the reportable investment income into tax-deferred income, such as from an annuity, which will not show up o…

The Bottom Line

- If you continue to work after the retirement age, you will need to contribute to Social Security. When you start receiving Social Security benefits, you may also be taxed on them, depending on your income. It is possible to be taxed on either 50% or 85% of your benefits.1There are plenty of strategies to avoid being taxed, such as reducing your inc...