What is the maximum premium for Medicare Part B?

Nov 12, 2021 · The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021. The increases in the 2022 Medicare Part B premium and deductible are due to:

How to collect a part B deductible?

IRMAA is an extra charge added to your premium. Part B deductible & coinsurance In 2022, you pay $233 for your Part B deductible . After you meet your deductible for the year, you typically pay 20% of the Medicare-Approved Amount for these: Most doctor services (including most doctor services while you're a hospital inpatient) Outpatient therapy

Who pays part B Medicare?

Nov 24, 2021 · Views: 222002 The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less. This is because their Part B premium increased more than the cost-of-living increase for 2021 Social Security benefits.

Does Medicaid pay for Part B premium?

Oct 10, 2021 · In 2019 the standard deduction for single taxpayers and married individuals filing separately is $12,200. Lets say for example, that you pay $98 a month for your Medicare Advantage plan or $1,176 a year. If this is your only deduction, you may be able to claim a much higher deduction by opting for the standard deduction and not itemizing.

What is the standard Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

How much is normally deducted for Medicare Part B of you Social Security?

Medicare Part B Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022. However, you might have a higher or lower premium amount than the standard cost.Dec 1, 2021

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

What are the Medicare limits for 2021?

Medicare beneficiaries earning more than $88,000 and couples earning more than $176,000 were affected by the 2021 change. “Medicare's 2021 income limits and corresponding surcharges apply to all beneficiaries with part B and/or part D coverage,” Worstell tells Parade.Nov 1, 2021

Is Medicare Part B premium automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

What is deducted from your monthly Social Security check?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Will Social Security get a $200 raise in 2021?

Which Social Security recipients will see over $200? If you received a benefit worth $2,289 per month in 2021, then you will see an increase worth over $200. People who get that much in benefits worked a high paying job for 35 years and likely delayed claiming benefits.Jan 9, 2022

Are Medicare Part B premiums going up in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

Does Social Security count as income?

Unearned Income is all income that is not earned such as Social Security benefits, pensions, State disability payments, unemployment benefits, interest income, dividends and cash from friends and relatives. In-Kind Income is food, shelter, or both that you get for free or for less than its fair market value.

Is Medicare Part B going up 2022?

Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

What is Part B for 2021?

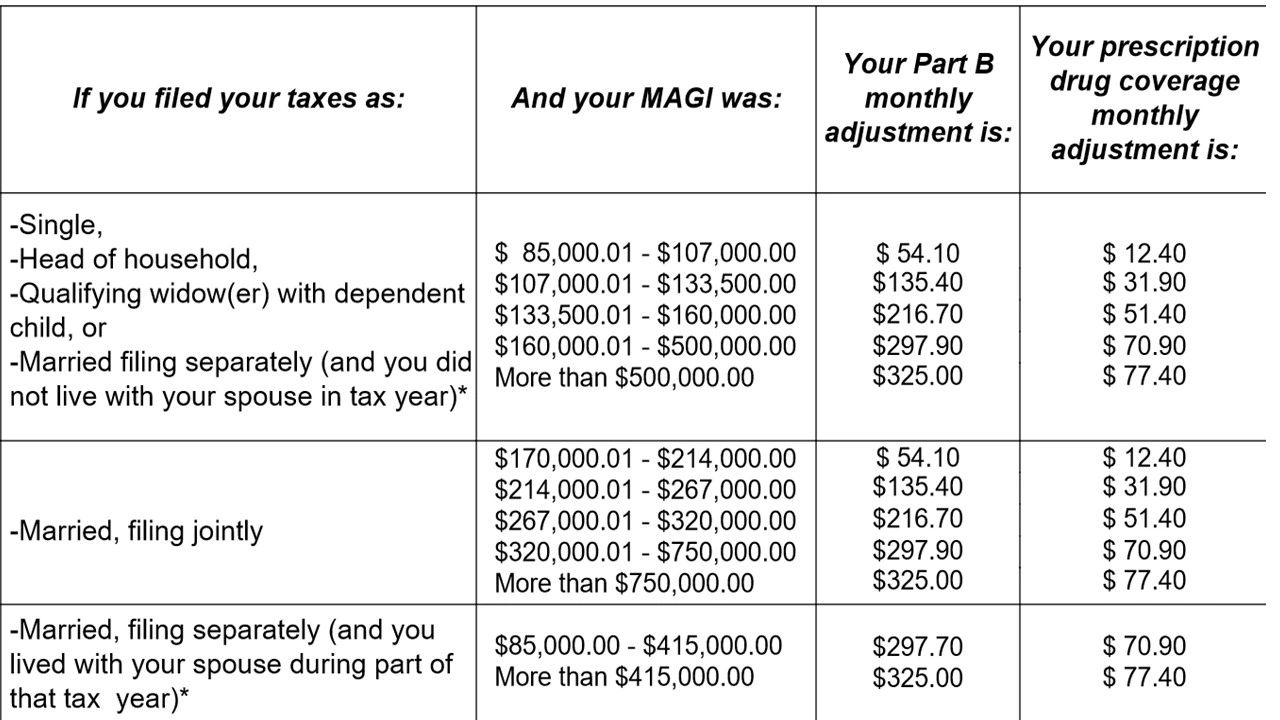

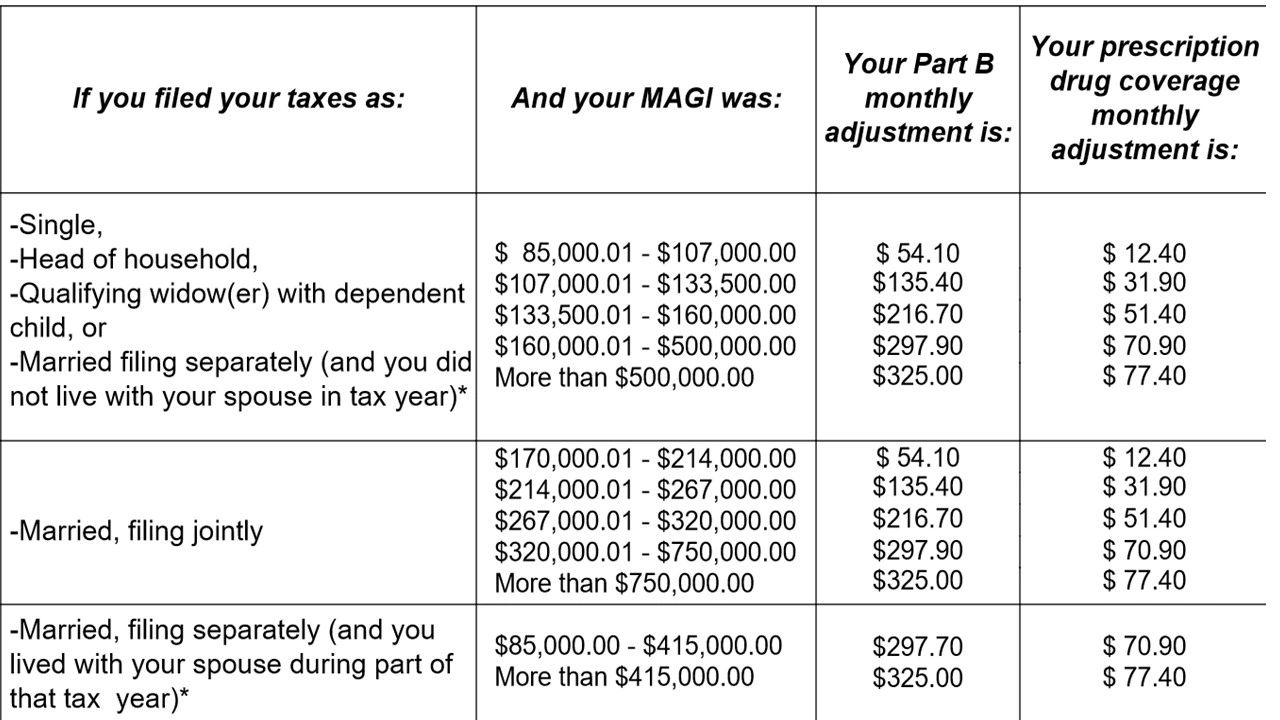

The 2021 Part B total premiums for high-income beneficiaries are shown in the following table: Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, ...

Is Medicare Advantage the lowest in 14 years?

The Medicare Advantage average monthly premium will be the lowest in fourteen years (since 2007). Premiums and deductibles for Medicare Advantage and Medicare Part D Prescription Drug plans are already finalized and are unaffected by this announcement.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

Tips On Saving For Retirement

The earlier you start saving for retirement, the better off youll be because of compounding interest rates. Consider the following tips to boost your savings for retirement:

What Is A Tax Deduction

According to the IRS, a tax deduction is something you subtract from your income before you figure out the amount of tax you owe. Tax deductions can be work related, itemized, or for education, health care, and investments.

If You Disagree With Our Decision

If you disagree with the decision we made about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal.

Other Ways To Lower Your Tax Bill

If youre not eligible to deduct your health insurance premiumseither because you dont meet the cost threshold or because you opt to take the standard deduction when you’re filing taxesthere are other ways to reduce your overall medical expenses.

Medicare Advantage Or Part C

Medicare Advantage , often referred to as Part C, encompasses Medicare-approved plans provided by private companies. The plans facilitate delivery of Medicare Parts A and B benefits, often include prescription drug coverage, and may have extra benefits such as vision, dental, and hearing services.

Another Alternative: Using Your Hsa Funds To Pay Medicare Premiums

If you have a health savings account , know that you can withdraw tax-free money from the account and use it to pay your premiums for Medicare Parts A, B, C, and D . This is an alternative to deducting your premiums on your tax return, since you cant do both.

Can I Deduct Medicare Part B On My Taxes

If you receive Social Security or railroad retirement benefits and are over age 65, or you qualify for Medicaid Part A due to having a disability, end-stage renal disease or amyotrophic lateral sclerosis, you automatically qualify to receive Medicare Part B medical insurance.

What is medical expense deduction?

A tax deduction – like the well-known medical expense deduction – reduces the amount of money that you have to pay taxes on. Choosing to take the medical expense deduction gives you a write-off that will reduce, but not erase, the taxes that you owe.

Is Medicare Part B tax deductible?

Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction. Since it’s not mandatory to enroll in Part B, you can be “rewarded” with a tax break for choosing to pay this medical expense. Considering a Medicare Plan?

Can you deduct medical expenses on taxes?

Follow the Rules to Deduct. However, you can only benefit from the medical expense deduction by following specific rules. You’ll need to file your taxes in a certain way, itemizing your deductions instead of choosing the standard deduction. Additionally, your medical expense deductions only begin to count after they surpass 10% ...

What is deductible medical expenses?

Any costs associated with the treatment or diagnosis of a medical condition or an injury can be deducted. This includes preventive care and the cost of any medical equipment or supplies. The IRS provides a list of deductible medical expenses. The list includes some items you might not expect.

What are the different types of deductions?

What Are the Four Major Categories of Tax Deductions? 1 Business Deductions 2 Standard Deductions 3 Above the Line Deductions 4 Below the Line Deductions

What is the purpose of standard deductions?

The purpose of standard tax deductions is to allow taxpayers to claim the standard amount set by the IRS. They can claim this amount for the deduction if they haven’t itemized deductible expenses. This amount changes by year, and the IRS website has a tool you can use to calculate your standard deduction.

What is considered self employed by the IRS?

To qualify as self-employed by the standards of the IRS, you must be one of the following: A sole proprietor or independent contractor in a trade or business. A member of a partnership in a trade or business. Otherwise in business for yourself.

Can Medicare be deducted from taxes?

Your Medicare and Medigap premiums can be deducted from your taxes as a below the line deduction. This requires you to itemize the premiums. If they, along with your other medical costs, exceed 7.5% of your Adjusted Gross Income (AGI), you qualify for the deduction.

Is Medicare premium tax deductible?

The answer is yes; some Medicare premiums are tax-deductible. Most insurance premiums qualify for Form 1040’s Schedule A deductions but only over a certain threshold, including some Medicare premiums. This amount will be subtracted from your gross income. Your taxable income (after the deductions are made) will ultimately be used to determine ...

Is Medicare free?

Medicare isn't free and we understand your desire to save money wherever you can. If you've been considering a Medigap plan but have been hesitant because of the price, we can help you compare plans and rates. Please call us at the number above or fill out our online rate form to get started.

How Are Medicare Part D Premiums Calculated

Medicare Part D prescription drug plans are also sold by private insurance companies, so premiums will vary from one plan to the next.

Medicare Part B Part D Irmaa Premium Brackets

Seniors age 65 or older can sign up for Medicare. The government calls people who receive Medicare beneficiaries. Medicare beneficiaries must pay a premium for Medicare Part B that covers doctors services and Medicare Part D that covers prescription drugs.

What Income Is Used To Determine Medicare Premiums

Did you know that not everyone pays the same amount for Medicare premiums? As you are planning for retirement or if you are already in retirement, it is important to understand the effects that your financial decisions can have on your Medicare premiums. It could be the difference of hundreds of dollars a month.

Medicare Part B Premium Appeals

OMHA handles appeals of the Medicare programs determination of a beneficiarys Income Related Monthly Adjustment Amount , which determines a Medicare beneficiarys total monthly Part B insurance premium.

How Record Social Security Cost

News that inflation rose to a historic high in November probably comes as no surprise to retirees.

How Does Medicare Part B Work

Before getting into the weeds of Medicare Part B premiums, lets do a quick review of Medicare Part B and its role in federal retirement health insurance.

How To Calculate Medicare Premiums

As you hit the retirement milestone, one of the items you’ll likely need to address is enrolling in Medicare. Medicare has many complexities and the calculation of premiums that you will pay is one of them. The questions and confusion can be endless.