What is the normal deductible for Medicare?

If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274. You pay: $1,556 deductible for each benefit period. Days 1-60: $0 coinsurance for each benefit period.

What is the average deductible for Medicare Part B?

Medicare B also has a deductible, which increased to $233 in 2022, up from $203 in 2021. The Medicare Part B deductible only has to be paid once per year, unlike the Part A deductible, which has to be paid once per benefit period.

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.

How much is the Medicare deductible for 2021?

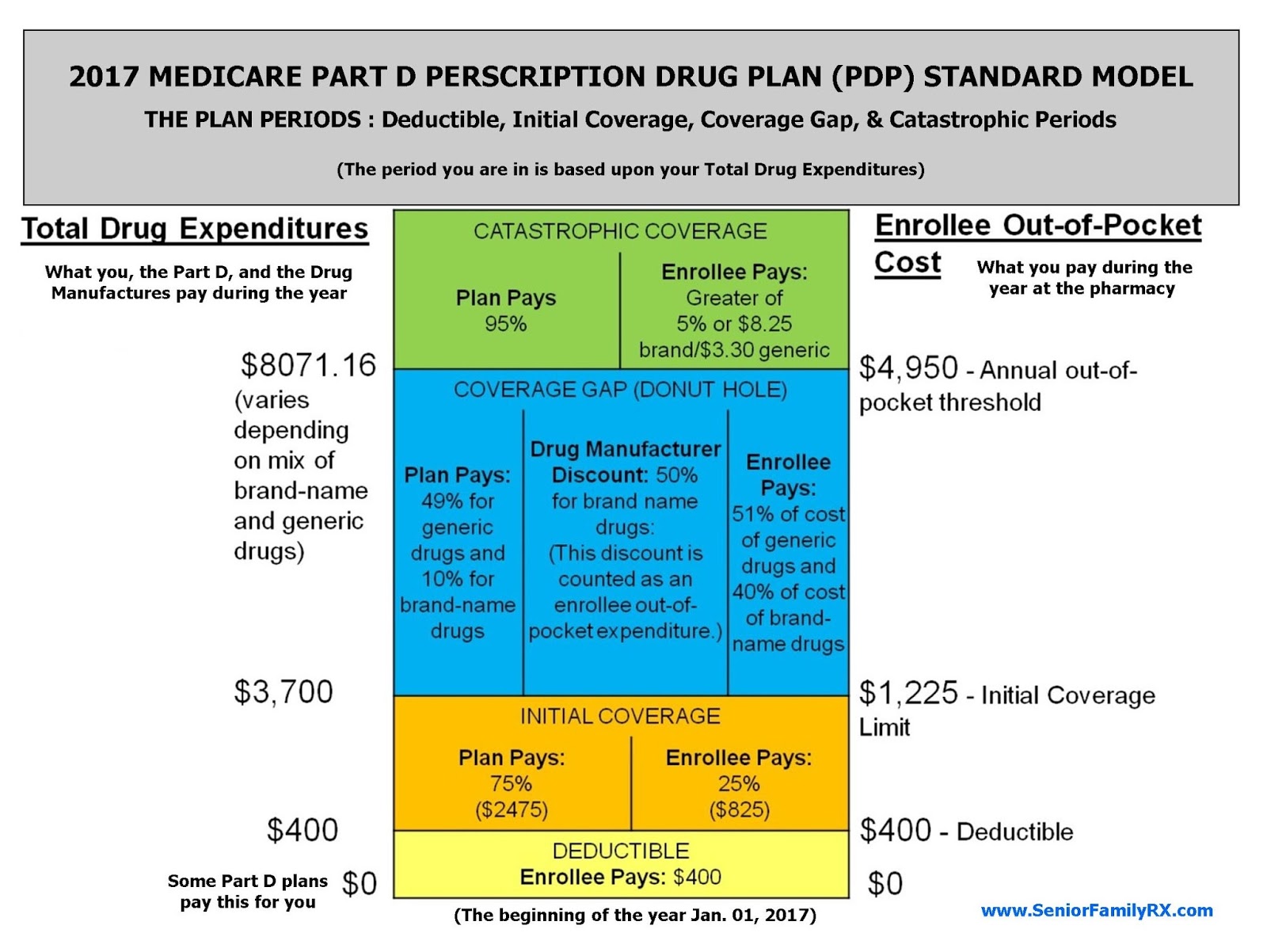

No Medicare drug plan may have a deductible more than $445 in 2021. Some Medicare drug plans don't have a deductible. Copayments or coinsurance.