Who is eligible for Medicare Part D?

In 2018, however, average premiums for Medicare Advantage plans are expected to decrease slightly over 2017 rates. Enrollees in MA plans will pay around $30 a month, on average, which is nearly $2 less per month than last year. If you’d like to learn more about Advantage, check out our guide to the program. Medicare Part D In 2018

How to compare Medicare Part D plans?

Part D plans can't charge a deductible that's more than $405 in 2018, but you can find many plans that charge less. Some Part D plans don't have any deductible at all. You'll also typically pay...

What is the average cost of Part D?

Nov 17, 2017 · The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017. However, a statutory “hold harmless” provision applies each year to about 70 percent of enrollees. For these enrollees, any increase in Part B premiums must be lower than the increase in their Social Security benefits.

How much does Medicare Plan D cost?

The 2018 Part D plan premiums range from $12 to $198. The 2018 standard Part D plan deductible is $405, however the actual plan deductible can be anywhere from $0 to $405. Use our 2018 Part D Plan Finder to see plan premiums, deductibles, and features in your state

What were Medicare Part D premiums in 2018?

What were Medicare Part D premiums in 2019?

The average Part D plan premium in 2019 is around $41.21 per month, which is a 2 percent increase from the 2018 average premium. Part D plan premiums can also be subject to a Medicare IRMAA for higher income earners.

What is the cost of Part D for 2022?

What is the national average premium for Medicare Part D?

What are the Medicare Part D premiums for 2020?

What is the standard Medicare Part D premium for 2022?

What is the most popular Medicare Part D plan?

| Rank | Medicare Part D provider | Medicare star rating for Part D plans |

|---|---|---|

| 1 | Kaiser Permanente | 4.9 |

| 2 | UnitedHealthcare (AARP) | 3.9 |

| 3 | BlueCross BlueShield (Anthem) | 3.9 |

| 4 | Humana | 3.8 |

What is the max out of pocket for Medicare Part D?

What is yearly drug and premium cost?

How are Part D premiums determined?

How Does Medicare plan D work?

How Much Does Medicare Part D Cost?

Medicare participants typically have to pay several types of costs in order to be part of a Medicare Part D plan. However, the government agency th...

What Does Medicare Part D Cover?

The biggest challenge in selecting a Medicare Part D plan is that each one can have a different customized list of drugs that it covers. Often, you...

Don't Miss Out on The Prescription Drugs That You Need

Part D is the newest part of Medicare coverage, but it has quickly become an essential part of the program for seniors seeking to control their hea...

Summary

This analysis presents findings on Medicare Part D enrollment, premiums, and cost sharing in 2018 and key trends over time, based on data from the Centers for Medicare & Medicaid Services (CMS).

Findings

More than 43 million Medicare beneficiaries, or 72 percent of all Medicare beneficiaries nationwide, are enrolled in Part D plans.

Methodology

This analysis focuses on the Medicare Part D marketplace in 2018 and trends over time. Data on Part D plan availability, enrollment, and premiums were collected primarily from a set of data files released by the CMS on a regular basis:

Find out more about your Medicare prescription drug benefits

Dan Caplinger has been a contract writer for the Motley Fool since 2006. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool.com.

How much does Medicare Part D cost?

Medicare participants typically have to pay several types of costs in order to be part of a Medicare Part D plan. However, the government agency that oversees Medicare doesn't set fixed amounts for most of those costs.

What does Medicare Part D cover?

The biggest challenge in selecting a Medicare Part D plan is that each one can have a different customized list of drugs that it covers.

Don't miss out on the prescription drugs that you need

Part D is the newest part of Medicare coverage, but it has quickly become an essential part of the program for seniors seeking to control their healthcare expenses. By finding out what a Part D plan will cover and how much it will cost, you'll be in a better position to choose the right plan to meet your specific medical needs.

What is the Medicare premium for 2018?

The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017. However, a statutory “hold harmless” provision applies each year to about 70 percent of enrollees. For these enrollees, any increase in Part B premiums must be lower than the increase in their Social Security benefits.

What is the Medicare Part B premium?

Medicare Part B Premiums/Deductibles. Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and other items. The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017.

What is the deductible for Medicare Part B?

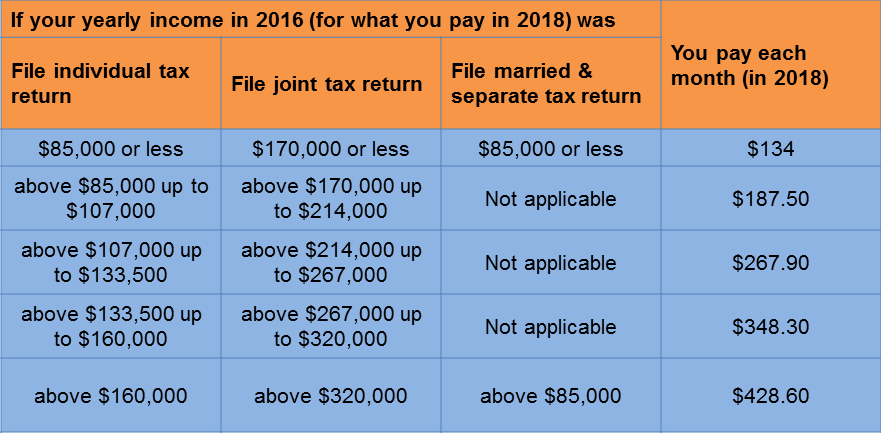

The annual deductible for all Medicare Part B beneficiaries will be $183 in 2018, the same annual deductible in 2017. Premiums and deductibles for Medicare Advantage and Medicare Prescription Drug plans are already finalized and are unaffected by this announcement. Since 2007, beneficiaries with higher incomes have paid higher Medicare Part B ...

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A annual inpatient hospital deductible ...

How much is Medicare Part A deductible?

The Medicare Part A annual inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,340 per benefit period in 2018, an increase of $24 from $1,316 in 2017. The Part A deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

How much will Social Security increase in 2018?

After several years of no or very small increases, Social Security benefits will increase by 2.0 percent in 2018 due to the Cost of Living adjustment.

2018 Medicare Advantage Premium & Deductible Averages By State

Florida was the low-cost leader when comparing average Medicare Advantage premiums among the states. Florida’s 2018 Medicare Advantage plans have an average monthly premium of $17.06. North Dakota, in contrast, is over six times that amount with an average premium of $116.25 for its Medicare Advantage plans.

2018 Medicare Part D Plans By State

When comparing state averages for monthly premiums among stand-alone Medicare Part D drug plans, Delaware, Maryland, and the Washington D.C. region tied for the lowest in 2018. The average Medicare Part D premium in these three regions was $40.98. This average was 22 percent lower than the national average of $52.36.

Conclusion

As Medicare beneficiaries prepare to shop this Open Enrollment Period for new insurance plans, they should remember that other plan attributes can be just as important as premiums and deductibles. For example, healthcare provider networks and caps on annual out-of-pocket costs are especially important to examine among Medicare Advantage plans.

Methodology

Premiums and deductibles for Medicare health and drug plans were obtained from the 2018 MA Landscape Source Files and 2018 PDP Landscape Source Files published by cms.gov on September 29, 2017 ( https://www.cms.gov/Medicare/Prescription-Drug-Coverage/PrescriptionDrugCovGenIn/index.html?redirect=/PrescriptionDrugCovGenIn/02_EnrollmentData.asp last accessed on October 2, 2017).

Author

This analysis was written by Kev Coleman, Head of Research & Data at HealthPocket with data collection performed by Michael Bass. Correspondence regarding this study can be directed to Mr. Coleman at [email protected].

What is the Medicare Part B deductible for 2018?

2018 Medicare Part B Deductible. CMS announced that the annual deductible for all Part B beneficiaries once again be $183, the same as in 2017.

How much is Medicare Part B premium?

The Social Security Administration announced a 2.2 percent cost-of-living adjustment (COLA) for 2018 Social Security benefits - which translates into about a $28 increase for the average Medicare Part B beneficiary.

Is Medicare Part B a hold harmless?

Medicare Part B beneficiaries not subject to the "hold harmless" provision are: those not collecting Social Security benefits, those who will enroll in Part B for the first time in 2018, dual eligible beneficiaries who have their premiums paid by Medicaid, and.

What is dual eligible Medicare?

dual eligible beneficiaries who have their premiums paid by Medicaid, and. beneficiaries who pay an additional income-related premium. These groups account for about 30 percent of the 52 million Americans expected to be enrolled in Medicare Part B in 2018.

What is Medicare Advantage 2018?

2018 Part C (Medicare Advantage) Monthly Premium & Deductible. Medicare Advantage plan premiums*, deductibles, and benefits will depend on the Medicare Advantage plans available in your service area (county or ZIP code). Along with your Medicare Advantage plan premium, you must continue to pay your Part B premium ...

How long do you have to pay for Part A?

For example, if you were eligible for Part A for 2 years but didn’t sign-up, you will have to pay the higher premium for 4 years. Usually, you don’t have to pay a penalty if you meet certain conditions that allow you to sign up for Part A during a Special Enrollment Period.

Do you pay late enrollment penalty?

Usually, you don’t pay a late enrollment penalty if you meet certain conditions that allow you to sign up for Part B during a special enrollment period. Example: Mr. Smith’s initial enrollment period ended September 30, 2014. He waited to sign up for Part B until the General Enrollment Period in March 2017.

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

Does Medicare cover emergency services?

In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for under Original Medicare (your Cost Plan pays for emergency services or urgently needed services ). with drug coverage, the monthly premium may include an amount for drug coverage.

What is the Medicare deductible for 2018?

CMS also announced that the annual deductible for all Medicare Part B beneficiaries will be $183 in 2018, the same annual deductible in 2017.

What is Medicare Part B premium?

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and other items. The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017. Some beneficiaries who were held harmless ...

What is the deductible for Medicare Part B?

CMS also announced that the annual deductible for all Medicare Part B beneficiaries will be $183 in 2018, the same annual deductible in 2017. Premiums and deductibles for Medicare Advantage and Medicare Prescription Drug plans are already finalized and are unaffected by this announcement.

How much is Medicare Part A deductible?

The Medicare Part A annual inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,340 per benefit period in 2018, an increase of $24 from $1,316 in 2017. ...

Will Part B premiums increase in 2018?

Some beneficiaries who were held harmless against Part B premium increases in prior years will have a Part B premium increase in 2018, but the premium increase will be offset by the increase in their Social Security benefits next year. “Medicare’s top priority is to ensure that beneficiaries have choices for affordable, ...

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

Do you have to pay late enrollment penalty for Medicare?

In general, you'll have to pay this penalty for as long as you have a Medicare drug plan. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Learn more about the Part D late enrollment penalty.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

How much is Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people will pay the standard Part B premium amount. If your Modified Adjusted Gross Income (MAGI) as reported on your IRS tax return from 2 years ago (i.e., 2019) is above a certain amount, you’ll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What is Part B premium?

Most people will pay the standard Part B premium amount. If your Modified Adjusted Gross Income (MAGI) as reported on your IRS tax return from 2 years ago (i.e., 2019) is above a certain amount, you’ll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

2018 Medicare Advantage Premium & Deductible Averages by State

2018 Medicare Part D Plans by State

Conclusion

Methodology

Author

- When comparing state averages for monthly premiums among stand-alone Medicare Part D drug plans, Delaware, Maryland, and the Washington D.C. region tied for the lowest in 2018. The average Medicare Part D premium in these three regions was $40.98. This average was 22 percent lower than the national average of $52.36. In 2016, the state of Hawaii ha...