For every month when you don’t have Medicare Part D or creditable coverage, a penalty of 1% of the national base beneficiary premium will be assessed. Those who enroll in Part D too late will pay the penalty indefinitely. The penalty can be avoided by signing up for Part D during the initial enrollment period.

What are Medicare surcharges for Part B and Part D?

You’ll pay Medicare surcharges on top of your normal Original Medicare premiums for Part B and Part D coverage if your household makes more than $176,000 combined, or $88,000 if you’re single. These surcharges are also called "Income-Related Monthly Adjustment Amounts" (IRMAA). 1

What are Medicare surcharges and how can you avoid them?

But it’s an unfortunate expenditure for households that are forced to pay extra premiums on top of their usual Medicare costs, and it that can sometimes be avoided. You’ll pay Medicare surcharges as well as premiums for Part B and Part D coverage if your household has more than $176,000 in income combined, or $88,000 if you’re single.

What happens if I don't sign up for Medicare Part D?

If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

How much does Medicare Plan D cover?

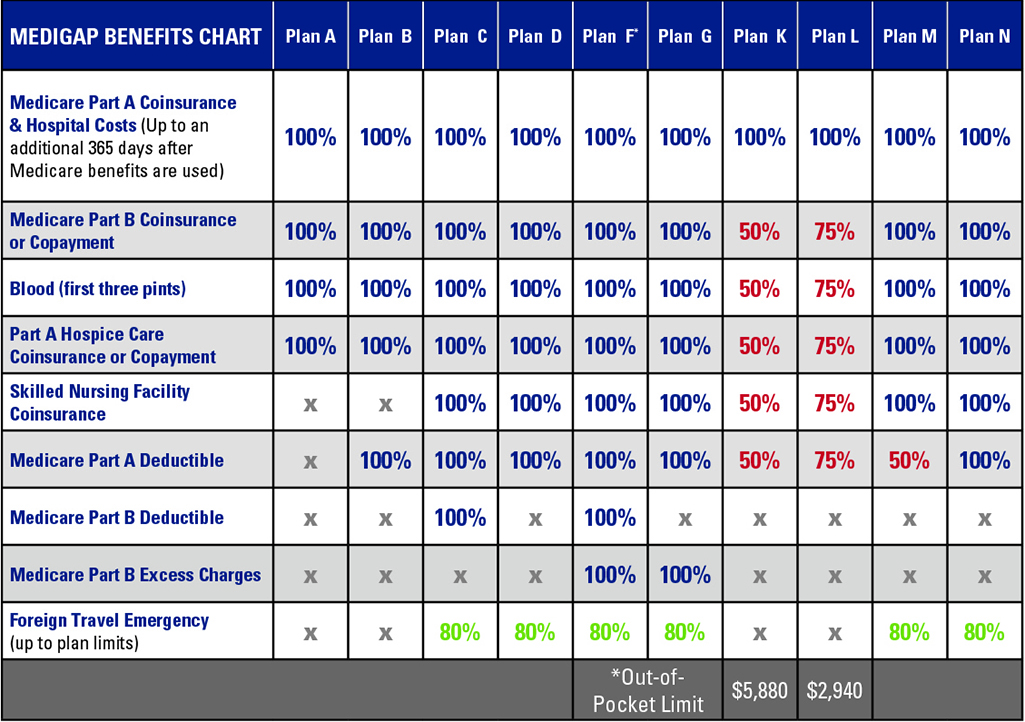

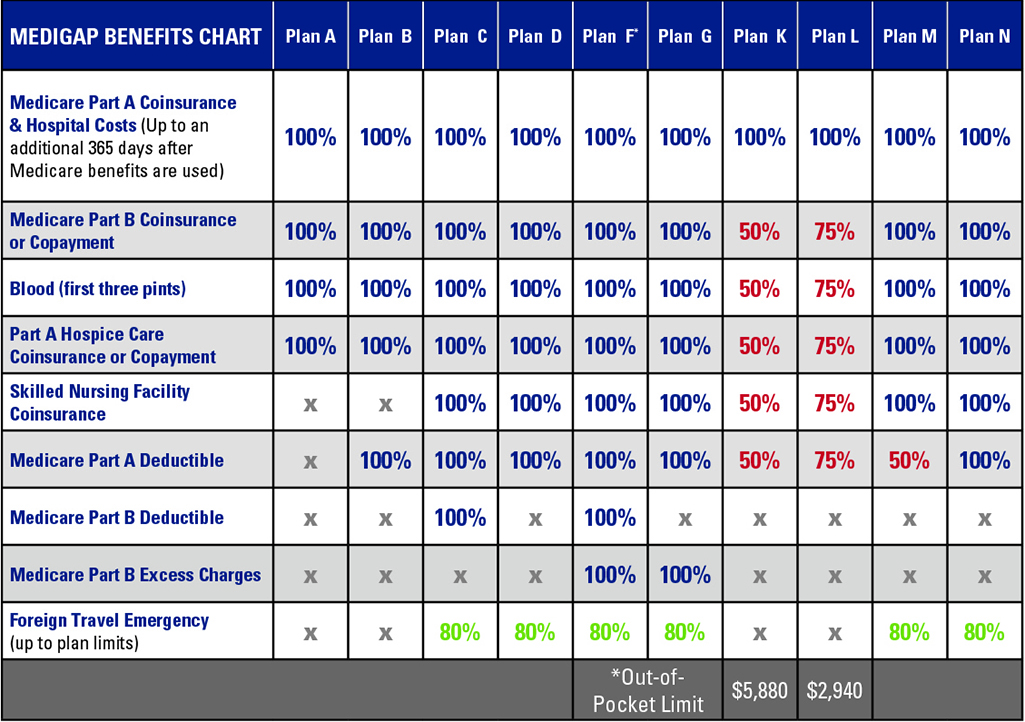

With Medicare Plan D, you pay a monthly premium each month, and the plan covers your Part B coinsurance at 100%. 2 Here are some other reasons to get Medigap Plan D:

What happens if I don't have Medicare Part D?

If you don't sign up for a Part D plan when you are first eligible to do so, and you decide later you want to sign up, you will be required to pay a late enrollment penalty equal to 1% of the national average premium amount for every month you didn't have coverage as good as the standard Part D benefit.

How do I get rid of Medicare Part D Penalty?

3 ways to avoid the Part D late enrollment penaltyEnroll in Medicare drug coverage when you're first eligible. ... Enroll in Medicare drug coverage if you lose other creditable coverage. ... Keep records showing when you had other creditable drug coverage, and tell your plan when they ask about it.

Do I need Medicare Part D if I don't take any drugs?

No. Medicare Part D Drug Plans are not required coverage. Whether you take drugs or not, you do not need Medicare Part D.

How far back does the Part D Penalty go?

63 consecutive daysSince then, Medicare has enforced the penalty policy for anyone who goes beyond 63 consecutive days without similar drug coverage after their Part D initial enrollment period.

When did Medicare Part D become mandatory?

The MMA also expanded Medicare to include an optional prescription drug benefit, “Part D,” which went into effect in 2006.

Can you opt out of Medicare Part D?

To disenroll from a Medicare drug plan during Open Enrollment, you can do one of these: Call us at 1-800 MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Mail or fax a signed written notice to the plan telling them you want to disenroll.

What is the cost of Part D Medicare for 2022?

$33Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

What is the Part D penalty?

Medicare calculates the penalty by multiplying 1% of the "national base beneficiary premium" ($33.37 in 2022) times the number of full, uncovered months you didn't have Part D or creditable coverage. The monthly premium is rounded to the nearest $. 10 and added to your monthly Part D premium.

How long does Medicare Part D penalty last?

Since the monthly penalty is always rounded to the nearest $0.10, she will pay $9.70 each month in addition to her plan's monthly premium. Generally, once Medicare determines a person's penalty amount, the person will continue to owe a penalty for as long as they're enrolled in Medicare drug coverage.

Can I add Part D to my Medicare at any time?

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

Are you automatically enrolled in Medicare Part D?

You'll be automatically enrolled in a Medicare drug plan unless you decline coverage or join a plan yourself.

At what income level do Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

Why did Medicare never reach my pocket?

You watched as somewhere around 15% of your paycheck never reached your pocket, because the federal government took it for Social Security and Medicare payments. 1.

How much does Medicare cost for retirees?

That drives monthly healthcare costs higher, but for most people, standard Medicare costs just $148.50 per month. For your Part B premiums, the federal government—thanks in part to your decades of deductions—pays 75% of the cost.

What is MAGI on Social Security?

According to the Social Security Administration, your modified adjusted gross income (MAGI) from two years ago is what counts. This means that benefits for the current period are based on calculations from income earned two years prior. Most poeple's MAGI and adjusted gross income (AGI) will be the same, but if you’re paying student loan interest, ...

How much extra do you pay for a part B?

Paying extra is something you might be able to avoid, but there’s good news hidden in these extra charges. First, here’s how the charges break down: If you’re married and make $176,000 to $222,000 jointly or $88,000 to $111,000 as an individual, you’ll pay an extra $59.40 monthly for Part B and $12.30 extra for Part D.

Does Medicare cover all of your medical expenses?

Once you reach retirement, you’re a little more accepting of those decades of deductions, because you'll receive full health insurance at next to no cost—especially compared to what you may have paid while you were working. To be fair, Original Medicare alone likely isn’t enough to cover all of your healthcare needs.

What to do if Social Security says you owe a surcharge?

In the meantime, if you receive a letter from Social Security saying that you owe the higher-income surcharge, call your retiree plan to ask whether it receives a drug subsidy from the government or contracts with Medicare to provide coverage under Part D — and, if the latter, whether it will pay the surcharge for you.

Do Medicare beneficiaries have to pay more for Part D?

See also: Select the best Part D prescription plan for you. Medicare beneficiaries with higher incomes are now required to pay more for Part D prescription drug coverage as well as pay higher premiums for Part B.

Does Medicare cover retirees?

According to Medicare officials, "a lot of people think they have [purely] retiree drug coverage, but the employer actually contracts with a Part D plan.". That means people are not always aware that they are in a Medicare employer group plan where the Part D surcharge would apply. Here's how to tell whether the surcharge applies in your retiree ...

Does Medicare send a memo to Part D?

Medicare officials say they've sent a memo to Part D plans so that "they could help provide information to employers to relay to their retirees about the Part D surcharge.". So eventually, if your retiree drug coverage actually comes under Part D, you may receive details about the surcharge from your retiree plan.

Medicare Surcharge

Medicare surcharge is a fee that people pay if their adjusted gross income (plus tax-exempt interest) is higher than $85,000 if you’re single or $170,000 if you’re married filing jointly. The vast majority will pay $104.90 every month for Medicare Part B premiums.

Medicare Comes With a Cost

Medicare Part A which pays for healing center administrations, is free if it is possible that you or your life partner paid Medicare finance charges for no less than ten years, however in the event that individuals are not qualified with the expectation of complementary Part A can pay a month to month premium of a few hundred dollars.

You Can Fill the Gap

Recipients of customary Medicare will probably need to agree to accept a Medigap supplemental protection design offered by private insurance agencies to help cover deductibles, co-installments, and different holes.

There Is an All-in-One Option

Recipient can agree to accept conventional Medicare - Parts A, B, and D, and a supplemental medigap arrangement. Another choice for recipient is to go an option course by agreeing to accept Medicare Advantage, which gives restorative and physician recommended medicate scope through private insurance agencies.

High Incomers Pay More

In the event that recipient picks customary Medicare and his or her wage is over a specific edge, he or she will pay more for Parts B and D.

At the Point When to Sign Up

Somebody effectively taking Social Security advantages will be naturally enlisted in Parts A and B. There is a choice to turn down Part B, since it has a month to month cost; if kept, the cost will be deducted from Social Security if there were benefits as of now guaranteed.

A Quartet of Enrollment Periods

On the off chance that a man missed agreeing to accept Part B amid the underlying enlistment time frame and he or she is not working or not secured by life partner's managers scope, that individual can agree to accept Part B amid the general enlistment time frame that keeps running from January 1 to March 31 and scope will start on July 1.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

Does Social Security pay Part D?

Social Security will contact you if you have to pay Part D IRMAA, based on your income . The amount you pay can change each year. If you have to pay a higher amount for your Part D premium and you disagree (for example, if your income goes down), use this form to contact Social Security [PDF, 125 KB].

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or. Medicare Cost Plan. A type of Medicare health plan available in some areas. In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for ...

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Do you have to pay extra for Part B?

This doesn’t affect everyone, so most people won’t have to pay an extra amount. If you have Part B and you have a higher income, you may also have to pay an extra amount for your Part B premium, even if you don’t have drug coverage. The chart below lists the extra amount costs by income.

Do you pay extra for Medicare?

If you have questions about your Medicare drug coverage, contact your plan. The extra amount you have to pay isn’t part of your plan premium. You don’t pay the extra amount to your plan. Most people have the extra amount taken from their Social Security check.

What is Medicare Part D?

1 The law created what we now know of as Medicare Part D, an optional part of Medicare that provides prescription drug coverage. Part D plans are run by private insurance companies, not the government.

How much does a generic cost for Part D?

For a generic drug, you will pay $25 and your Part D plan will pay $75. In all Part D plans in 2020, after you've paid $6,550 in out-of-pocket costs for covered medications, you leave the donut hole and reach catastrophic coverage, where you will pay only $3.70 for generic drugs and $9.20 for brand-name medications each month or 5% the cost ...

What is the donut hole in Medicare?

In fact, it has a big hole in it. The so-called donut hole is a coverage gap that occurs after you and Medicare have spent a certain amount of money on your prescription medications.

What is the maximum deductible for 2021?

A deductible is the amount of money you spend out-of-pocket before your prescription drug benefits begin. Your plan may or may not have a deductible. The maximum deductible a plan can charge for 2021 is set at $445, 2 an increase of $10 from 2020.

What is NBBP in Medicare?

The NBBP is a value used to calculate how much you owe in Part D penalties if you sign up late for benefits. Your best bet is to avoid Part D penalties altogether, so be sure to use this handy Medicare calendar to enroll on time.

What is a Part D premium?

Part D Premiums. A premium is the amount of money you spend every month to have access to a health plan. The government sets no formal restrictions on premium rates and prices may change every year. 3 Plans with extended coverage will cost more than basic-coverage plans.

How much will a generic drug cost in 2020?

The remaining costs will be paid by the pharmaceutical manufacturer and your Part D plan. 6 . For example, if a brand-name drug costs $100, you will pay $25, the manufacturer $50, and your drug plan $25. For a generic drug, you will pay $25 and your Part D plan will pay $75. In all Part D plans in 2020, after you've paid $6,550 in out-of-pocket ...

What is a Part D plan?

Unlike Medicare Part B, which the federal government provides, Part D prescription drug plans are provided by private health insurance companies that Medicare approves . Part D monthly premiums can vary a great deal from one health insurance company to another. to get the latest monthly premium costs for Part D plans.

What is the difference between Medicare Part B and Part D?

Medicare is made up of several parts. Most have monthly premiums, which is the amount you pay each month for coverage. Part B has a standard premium amount that most people pay each month. That amount changes from year to year , but it's generally consistent for most Medicare enrollees .

Do you get a quarterly bill if you don't take Social Security?

If the amount isn't taken from your payment, you should receive a quarterly bill in the mail. And if you're not taking Social Security retirement benefits, you'll get a bill in the mail for the standard Part B premium amount, plus any IRMAA you owe.

Is MSA tax exempt?

An MSA is like a health savings account (HSA). Contributions made to an MSA are tax-exempt, and withdrawals are tax-free, if the money taken out is spent on qualified health care expenses. Moving money into an MSA could potentially lower your taxable income.

Is it important to get Medicare?

So as part of your retirement income planning, it's important to get the Medicare decisions right. Many older Americans are working longer and continuing to earn income well into their 60s and 70s. This income can help boost their retirement security, but it may also mean they face higher Medicare premiums.

Do people with higher incomes pay higher Medicare premiums?

Key takeaways. While most people pay the standard monthly premium amounts for Medicare Part B and Part D, those with a higher income level will likely face higher premiums.

Why do you pay for Part D insurance?

You pay premiums to protect yourself from the high costs of fire and accidents in the future, even if you never expect to make a claim. Part D plays a similar role: It’s there if and when you need it. The difference is that as you get older your chances of needing prescription drugs are far higher than the chances of totaling your car ...

When will Part D coverage begin?

And if that should happen, you can’t get immediate coverage from Part D. Instead, you’d have to wait until the next annual open enrollment period (Oct. 15 to Dec. 7) and coverage wouldn’t begin until Jan. 1. Still, when you take no or very few medications, paying monthly premiums to a Part D drug plan can seem like a waste of money.

What happens if you don't enroll in Part D?

If you have no comparable drug coverage from elsewhere (such as from an employer, COBRA, retiree benefits or the Veterans Affairs health system) and if you don’t enroll in a Part D plan when you’re first eligible, you risk permanent late penalties when you do finally sign up.

What is Medicare Plan D?

Medicare Plan D is a Medicare Supplement plan, also known as a Medigap plan. Plan D is one of the 10 standardized Medicare Supplement plans available in most states: A, B, C, D, F, G, K, L, M, and N. The names “Medicare Plan D”, “Medicare Supplement Plan D”, and “Medigap Plan D all mean the same thing. But these plans are not the same thing as ...

What is Medicare Supplement Plan D?

Medicare Supplement Plan D. Medicare Part D. Helps play some of the costs original Medicare doesn’t cover, which are mostly copays, coinsurance, and deductibles. Only works with Original Medicare. Must have both Parts A and B to enroll. Provides prescription drug coverage to Medicare beneficiaries.

How long does Medigap Plan D last?

The best time to get Medigap Plan D (or any Medicare Supplement plan) is during your Medigap Open Enrollment Period (OEP) because you won’t have to go through medical underwriting. 4. Your Medigap OEP last for six months and begins ...

How much is coinsurance for Part B?

For example, Part B charges a 20% coinsurance for covered services after you’ve met your Part B deductible ($203 in 2021). 1 If you have total medical charges are $20,000, for instance, your coinsurance would be $4,000. The higher your total charges, the higher your coinsurance, and there’s no limit to how much you can be charged ...

How much is the cost of a Plan D in 2021?

The average monthly premiums can vary, depending on your state of residence. In 2021, it ranged between $192-265 for Plan D and $202-280 for Plan C for a nonsmoking male living in Orlando, Florida. 6.

What is Plan D?

Plan D covers 80 percent of the cost for qualified emergency care you receive in a foreign country after you pay a $250 deductible. You’re covered for the first 60 days of foreign travel with a lifetime limit of $50,000. 3. No networks. You can visit any provider nationwide who accepts Medicare. Guaranteed renewable.

Can you keep Plan C?

If you do, you will be “grandfathered in,” which means you can keep Plan C for as long as you continue to pay the premiums. Plan C was one of the guaranteed issue plans insurance companies offered. But starting 2020, Medicare Plan D replaced Plan C as one of the guaranteed issue plans for new enrollees.

How long does Medicare cover a break?

When a person joins a Medicare drug plan, the plan will review Medicare’s systems to see if the person had a potential break in creditable coverage for 63 days or more in a row. If so, the Medicare drug plan will send the person a notice asking for information about prior prescription drug coverage. It’s very important that the person complete this form and return it by the date on the form, because this is the person’s chance to let the plan know about prior coverage that might not be in Medicare’s systems.

Is Mrs Martinez on Medicare?

Mrs. Martinez is currently eligible for Medicare, and her Initial Enrollment Period ended on May 31, 2016. She doesn’t have prescription drug coverage from any other source. She didn’t join by May 31, 2016, and instead joined during the Open Enrollment Period that ended December 7, 2018. Her drug coverage was effective January 1, 2019

Does Mrs Kim have Medicare?

Mrs. Kim didn’t join a Medicare drug plan before her Initial Enrollment Period ended in July 2017. In October 2017, she enrolled in a Medicare drug plan (effective January 1, 2018). She qualified for Extra Help, so she wasn’t charged a late enrollment penalty for the uncovered months in 2017. However, Mrs. Kim disenrolled from her Medicare drug plan effective June 30, 2018. She later joined another Medicare drug plan in October 2019 during the Open Enrollment Period, and her coverage with the new plan was effective January 1, 2020. She didn’t qualify for Extra Help when she enrolled in October 2019. Since leaving her first Medicare drug plan in June 2018 and joining the new Medicare drug plan in October 2019, she didn’t have other creditable coverage. However, she was still deemed eligible for Extra Help through December 2018. When Medicare determines her late enrollment penalty, Medicare doesn’t count: