...

When are individuals liable for Additional Medicare Tax?

| Filing Status | Threshold Amount |

|---|---|

| Married filing jointly | $250,000 |

| Married filing separate | $125,000 |

| Single | $200,000 |

What is the maximum earnings amount for Medicare tax?

There is no maximum earnings amount for Medicare tax. You must pay Medicare tax on all of your earnings. See Retirement Benefits: Maximum Taxable Earnings for more information. Give us Feedback. Did this answer your question?

What is the Medicare tax rate for employers?

The Medicare tax rate is 2.9% of the employee's taxable wages, with 1.45% paid by the employee and 1.45% paid by the employer. The Additional Medicare Tax rate is 0.9% for the employee only. The employer doesn't have to pay this additional tax. 1

What is the Medicare tax that is withheld from my paycheck?

The Medicare tax that is withheld from your paychecks helps fund health care costs for people enrolled in Medicare. Medicare is financed through two trust fund accounts held by the United States Treasury:

How much Medicare tax do I pay if I'm self-employed?

In other words, 1.45% comes out of your pay and your employer then matches that, paying an additional 1.45% on your behalf, for a total of 2.9%. You'll take something of a double hit on the Medicare tax if you're self-employed. You must pay both halves of the tax because you're the employee and the employer.

Is there a limit on employer Medicare tax?

What is the Medicare Tax Limit? There is no wage limit for Medicare tax, which is currently 1.45% and applied to all covered wages paid. Both employees and employers must pay this rate—the self-employed owe all 2.9%.

What is the Medicare tax cap for 2020?

The Social Security tax rate remains at 6.2 percent. The resulting maximum Social Security tax for 2020 is $8,537.40. There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax.

Is there a cap on Medicare tax 2021?

FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings. In 2021, only the first $142,800 of earnings are subject to the Social Security tax ($147,000 in 2022). A 0.9% Medicare tax may apply to earnings over $200,000 for single filers/$250,000 for joint filers.

What is the 3.8 Medicare surtax?

The Medicare tax is a 3.8% tax, but it is imposed only on a portion of a taxpayer's income. The tax is paid on the lesser of (1) the taxpayer's net investment income, or (2) the amount the taxpayer's AGI exceeds the applicable AGI threshold ($200,000 or $250,000).

What percent is the employee charged for Medicare taxes?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

How much Medicare tax do I pay?

1.45%The current Medicare tax rate is 1.45% of your wages and is withheld from your paycheck. Your employer matches your contribution by paying another 1.45%. If you are self-employed, you have to pay the full 2.9% of your net income as the Medicare portion of your FICA taxes.

What is the Medicare earnings limit for 2021?

“The higher premiums are referred to as an Income-Related Monthly Adjustment Amount or IRMAA, and in 2021, IRMAA surcharges apply to individual Medicare beneficiaries who earn more than $88,000, and to couples who earn more than $176,000.

What is the wage base limit for Medicare?

no wageThe Medicare tax rate is 1.45% each for the employee and employer, unchanged from 2021. There is no wage base limit for Medicare tax. Social security and Medicare taxes apply to the wages of household workers you pay $2,400 or more in cash wages in 2022.

What is the additional Medicare tax for 2022?

0.9%2022 updates 2.35% Medicare tax (regular 1.45% Medicare tax plus 0.9% additional Medicare tax) on all wages in excess of $200,000 ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return).

What is the Medicare surtax for 2022?

The 2022 Medicare tax rate is 2.9%. Typically, you're responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%. Your Medicare tax is deducted automatically from your paychecks.

At what income does the 3.8 surtax kick in?

There is a flat Medicare surtax of 3.8% on net investment income for married couples who earn more than $250,000 of adjusted gross income (AGI). For single filers, the threshold is just $200,000 of AGI.

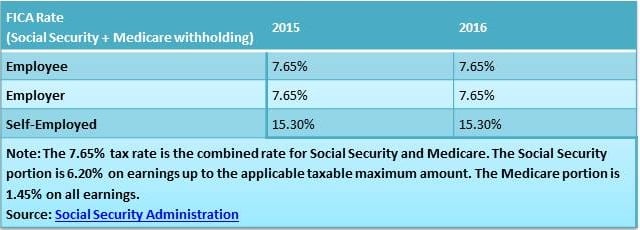

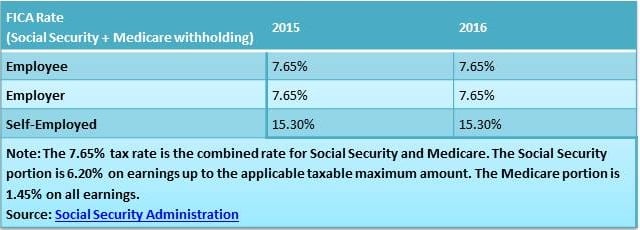

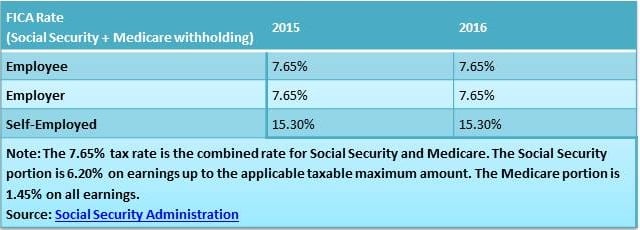

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

How much is Medicare Hospital Insurance tax?

Unlike the Social Security tax—the other component of the Federal Insurance Contributions Act, or FICA, taxes—all of your wages and business earnings are subject to at least the 2.9% Medicare Hospital Insurance program tax. Social Security has an annual wage limit, so you pay the tax only on income ...

What is Medicare contribution tax?

A Medicare contribution tax of 3.8% now additionally applies to "unearned income"—that which is received from investments, such as interest or dividends, rather than from wages or salaries paid in compensation for labor or self-employment income. This tax is called the Net Investment Income Tax (NIIT). 7 .

What is the Medicare tax rate for 2020?

Updated December 07, 2020. The U.S. government imposes a flat rate Medicare tax of 2.9% on all wages received by employees, as well as on business or farming income earned by self-employed individuals. "Flat rate" means that everyone pays that same 2.9% regardless of how much they earn. But there are two other Medicare taxes ...

When was Medicare tax added?

The Additional Medicare Tax (AMT) was added by the Affordable Care Act (ACA) in November 2013. The ACA increased the Medicare tax by an additional 0.9% for taxpayers whose incomes are over a certain threshold based on their filing status. Those affected pay a total Medicare tax of 3.8%.

How much is Social Security taxed in 2021?

Social Security has an annual wage limit, so you pay the tax only on income above a certain amount: $137,700 annually as of 2020 and $142,800 in 2021. 5 . Half the Medicare tax is paid by employees through payroll deductions, and half is paid by their employers. In other words, 1.45% comes out of your pay and your employer then matches that, ...

When did Medicare start?

The Medicare program and its corresponding tax have been around since President Lyndon Johnson signed the Social Security Act into law in 1965 . 2 The flat rate was a mere 0.7% at that time. The program was initially divided up into Part A for hospital insurance and Part B for medical insurance.

Can an employer withhold AMT?

Any shortfall to withholding must be paid by the taxpayer at tax time. Employers can be subject to penalties and interest for not withholding the AMT, even if the oversight was due to understandable circumstances.

What are Medicare taxes for?

Medicare is the federal government’s health insurance plan for Americans over the age of 65 and those with disabilities. It helps pay for essential medical services, including:

Who pays the Medicare tax?

Employers, employees and self-employed individuals are required to pay a tax for Medicare.

Basic Medicare tax rates

The Medicare tax rate is set by the government each year. For 2020 and 2021, the rate is 2.9% of an employee’s gross wages, divided between employer and employee. This means you must:

Additional Medicare Tax rates

When you pay an employee wages and compensation of more than $200,000 in a calendar year, the Additional Medicare Tax levy kicks in. You must deduct an extra 0.9% on gross earnings above this threshold.

Remitting the tax for Medicare

When you’ve withheld taxes from employees’ wages, you’re responsible for paying both the employee and employer share to the U.S. Treasury. This deposit must be made through an electronic funds transfer (EFT).

Frequently asked questions about the Medicare tax

Yes, you’re legally required to collect and pay a tax for Medicare according to the Federal Insurance Contributions Act (FICA). FICA deductions help pay for both Medicare and Social Security programs.

What is the Medicare tax rate?

The Medicare tax rate is 2.9% of the employee's taxable wages, with 1.45% paid by the employee and 1.45% paid by the employer. The Additional Medicare Tax rate is 0.9% for the employee only. The employer doesn't have to pay this additional tax. 1.

What happens if an employee's withholding is miscalculated?

If an employee's withholding is miscalculated and they are owed a refund, the employee must request the refund directly from the IRS. Don't attempt to give the employee a refund or adjust the employee's withholding on a miscalculation of federal income tax or FICA tax.

Is fringe benefit taxable?

Some wages and fringe benefits are taxable to the employee for income tax purposes , but some wages may not be taxable to the employee for Social Security and Medicare taxes, including the Additional Medicare Tax. You must exclude the wages not subject to Social Security and Medicare taxes when you calculate the wages subject to ...

Is there regular withholding for self employment?

There is no regular withholding for self-employment tax, so if you expect that your income might be above the levels above, you may need to increase your estimated tax payments to account for the additional Medicare tax. 2.

Do you have to exclude wages from Medicare?

You must exclude the wages not subject to Social Security and Medicare taxes when you calculate the wages subject to the Additional Medicare Tax as you work on payroll. IRS Publication 15-B Employer's Tax Guide to Fringe Benefits has a list of wages that are exempt from Social Security and Medicare taxes.

Does Medicare tax self employed?

The new Medicare tax also affects self-employed individuals who earn over a specific amount. If you are both an employee and self-employed, all sources of earned income (as opposed to investment income) are combined to reach the levels where the Additional Medicare Tax is applicable.

What is Medicare tax?

The Medicare Program. The Medicare tax deducted from employee wages goes towards the Medicare program provided to Americans over 65 years of age. A line item in an employee pay stub, Medicare tax is implemented under FICA (Federal Insurance Contributions Act) and calculated on the employee’s Medicare taxable wage.

What is the Medicare tax rate on W-2?

Employers are required to withhold Medicare tax on employees’ Medicare wages. This is a flat rate of 1.45%, with employers contributing a matching amount. Medicare tax is reported in Box 5 of the W-2 ...

When was Medicare enacted?

In 1965 , Medicare was enacted into law, with Medicare coverage intending to be an important source of post-retirement health care. Medicare is divided into four parts: Part A, Hospital Insurance: This helps pay for hospice care, in-patient hospital care, and nursing care.

What are the gross earnings?

Gross earnings are made up of the following: Regular earnings . Overtime earnings. Paid time-off earnings. Payouts of time-off earnings (Sick, holiday, and vacation payouts) Non-work time for paid administrative leave, military leave, bereavement, and jury duty. Bonus pay.

When do you have to use the maximum earnings limit?

If you use a tax year other than the calendar year, you must use the tax rate and maximum earnings limit in effect at the beginning of your tax year. Even if the tax rate or maximum earnings limit changes during your tax year, continue to use the same rate and limit throughout your tax year.

How much is Medicare tax for 2021?

The amount increased to $142,800 for 2021. (For SE tax rates for a prior year, refer to the Schedule SE for that year). All your combined wages, tips, and net earnings in the current year are subject to any combination of the 2.9% Medicare part of Self-Employment tax, Social Security tax, or railroad retirement (tier 1) tax.

What is self employment tax?

Self-employment tax is a tax consisting of Social Security and Medicare taxes primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. You figure self-employment tax (SE tax) yourself using Schedule SE (Form 1040 or 1040-SR).

What is the tax rate for self employment?

The self-employment tax rate is 15.3%. The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance). For 2020, the first $137,700 of your combined wages, tips, and net earnings is subject to any combination of the Social Security part of self-employment tax, ...

What is Schedule C for self employed?

If you are self-employed as a sole proprietor or independent contractor, you generally use Schedule C to figure net earnings from self-emplo yment. If you have earnings subject to self-employment tax, use Schedule SE to figure your net earnings from self-employment. Before you figure your net earnings, you generally need to figure your total ...

Does the 1040 affect self employment?

This deduction only affects your income tax. It does not affect either your net earnings from self-employment or your self-employment tax. If you file a Form 1040 or 1040-SR Schedule C, you may be eligible to claim the Earned Income Tax Credit (EITC).

Is self employment tax included in Medicare?

Self-Employment Tax (Social Security and Medicare Taxes) It should be noted that anytime self-employment tax is mentioned, it only refers to Social Security and Medicare taxes and does not include any other taxes that self-employed individuals may be required to file. The list of items below should not be construed as all-inclusive.

How much is Medicare tax?

There is no wage limit for Medicare tax, which is currently 1.45% and applied to all covered wages paid. Both employees and employers have to pay this rate—the self-employed owe all 2.9%. Keep in mind, if you make more than $200,000, your income is subject to an additional 0.9% Medicare tax (employers do not have to pay this additional tax).

Why is the self employed tax rate 12.4%?

For those self-employed, the rate is 12.4% because they have no employer to split the tax. However, the Old Age, Survivors and Disability Insurance (OASDI) program sets a limit on how much of an employee’s income can be taxed in a given year. This limit changes each year and is based on the average wage index.

How much FICA tax will be withheld in 2021?

For 2021, the total amount of FICA tax withheld totals 15.3%, again with most employees paying half, splitting the amount with their employer (unless you’re self-employed, then you have to pay the entire 15.3%).

What is the Social Security tax withholding rate?

Currently, the social security tax withholding rate is 6.2% for both employees and employers.

What is the maximum amount you can make on Social Security in 2021?

The Social Security Wage Base is the maximum gross income on which Social Security tax can be imposed on an employee. The limit is $142,800 for 2021, meaning any income you make over $142,800 will not be subject to social security tax. Given these factors, the maximum amount an ...

What is the average Social Security payout for 2021?

The average monthly Social Security payout for 2021 is $1.540 while the maximum monthly benefit for a worker retiring at full retirement age increased $137 to $3,148. If you work while collecting Social Security, your earnings limit increased for 2021.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

How does Social Security determine IRMAA?

The Social Security Administration (SSA) determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago. For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

Does Medicare change if you make a higher income?

If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change.

What Are Medicare Taxes for?

Who Pays The Medicare Tax?

- Employers, employees and self-employed individuals are required to pay a tax for Medicare. The government sets the tax as a percentage of gross earnings, so the more an employee makes, the more you have to withhold. As an employer, you must also match the employee’s contribution.

Basic Medicare Tax Rates

- The Medicare tax rate is set by the government each year. For 2020 and 2021, the rate is 2.9% of an employee’s gross wages, divided between employer and employee. This means you must: 1. Withhold 1.45% of an employee’s gross wages 2. Contribute a matching 1.45% of an employee’s gross wages Example: The Medicare tax for an employee earning gross income of $2,400 in a p…

Additional Medicare Tax Rates

- When you pay an employee wages and compensation of more than $200,000 in a calendar year, the Additional Medicare Tax levy kicks in. You must deduct an extra 0.9% on gross earnings above this threshold. The Medicare taxes for employees earning over $200,000 are as follows: 1. Earnings up to $200,000: 1.45% 2. Earnings exceeding $200,000: 2.35% (1.4...

Calculating The Additional Medicare Tax on Earnings Over $200,000

- Employers must start deducting the Additional Medicare Tax in the pay periodin which an employee’s wages exceed $200,000. Continue applying this surtax in each subsequent pay period until the end of the calendar year. Example #1: An employee earning $30,000 per pay period makes a total of $180,000 in the first six pay periods of the year. The Additional Medicare Tax a…

Remitting The Tax For Medicare

- When you’ve withheld taxes from employees’ wages, you’re responsible for paying both the employee and employer share to the U.S. Treasury. This deposit must be made through an electronic funds transfer(EFT). You can make the payment yourself or arrange for your tax professional, payroll service or a trusted third-party to make this deposit for you.

Frequently Asked Questions About The Medicare Tax

- Is the Medicare tax mandatory?

Yes, you’re legally required to collect and pay a tax for Medicare according to the Federal Insurance Contributions Act(FICA). FICA deductions help pay for both Medicare and Social Security programs. It’s important to know that penalties can apply to an employer who doesn’t w… - At what income level does the Medicare tax increase?

Once you pay an employee more than $200,000 in a calendar year, you must withhold the Additional Medicare Tax. However, things look different from an employee’s perspective. The tax may or may not apply to them depending on their tax filing statusand income thresholds. Individ…