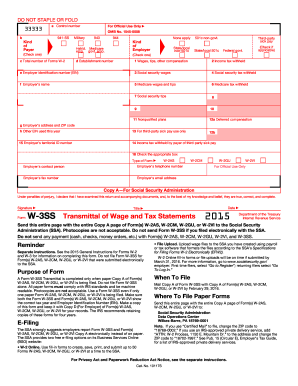

The FICA Tax Rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2015 (or 8.55 percent for taxable wages paid in excess of the applicable threshold). The information in the following table shows the changes in Social Security and Medicare withholding limits from 2014 to 2015.

What is the maximum Social Security tax for 2015?

What is the FICA rate for 2015?

Is Medicare taxed on self employment?

About this website

What was the payroll tax in 2015?

For 2015: The portion of the Social Security FICA tax that employees pay remains unchanged at the 6.2 percent withholding rate up to the taxable maximum. Correspondingly, the portion of the tax that employers cover also remains at 6.2 percent of employee wages up to the taxable maximum.

How much is Social Security and Medicare tax combined?

7.65%NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below).

What was the maximum Social Security earnings in for 2015?

$ 780/mo. Maximum Social Security Benefit: Worker Retiring at Full Retirement Age: 2014 2015 $2,642/mo.

What was the Medicare tax rate in 2014?

1.45 percentFor 2014, the social security tax rate is 6.2 percent, and the Medicare tax rate is 1.45 percent.

What percentage is Social Security tax?

6.2 percentSocial Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $147,000 (in 2022), while the self-employed pay 12.4 percent.

How much of Social Security is taxable calculator?

For the 2021 tax year (which you will file in 2022), single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

What is the maximum amount of earnings that are subject to Social Security tax in 2014?

For 2014, the maximum limit on earnings for withholding of Social Security (Old-Age, Survivors, and Disability Insurance) Tax is $117,000.00. The maximum limit is changed from last year. The Social Security Tax Rate remains at 6.2 percent. The resulting maximum Social Security Tax for 2014 is $7,254.00.

What is the Social Security cap for 2016?

$118,500Maximum Taxable Earnings Each YearYearAmount2016$118,5002017$127,2002018$128,4002019$132,9004 more rows

What was the maximum Social Security benefit in 2014?

$2,642 a monthFor workers retiring at full retirement age, the maximum Social Security payment will increase from $2,533 a month to $2,642 a month.

Does federal tax rate include Medicare and Social Security?

FICA is not included in federal income taxes. While both these taxes use the gross wages of the employee as the starting point, they are two separate components that are calculated independently. The Medicare and Social Security taxes rarely affect your federal income tax or refunds.

Is Social Security and Medicare federal tax?

FICA is a U.S. federal payroll tax. It stands for the Federal Insurance Contributions Act and is deducted from each paycheck. Your nine-digit number helps Social Security accurately record your covered wages or self- employment. As you work and pay FICA taxes, you earn credits for Social Security benefits.

Why do I pay Social Security and Medicare tax?

If you work as an employee in the United States, you must pay social security and Medicare taxes in most cases. Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment.

How many people will pay Social Security taxes in 2015?

Of the estimated 168 million workers who will pay Social Security taxes in 2015, about 10 million will pay higher taxes because of the increase in the taxable maximum, the SSA said. Social Security and Medicare payroll withholding are collected together as the Federal Insurance Contributions Act (FICA) tax.

What is the tax rate for Medicare and Social Security?

Note: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion is 6.20% on earnings up to the applicable taxable maximum amount. The Medicare portion is 1.45% on all earnings.

How much is Medicare tax?

For most Americans, the Medicare portion of the FICA tax remains at 2.9 percent, of which half ( 1.45 percent) is paid by employees and half by employers. Unlike Social Security, there is no limit on the amount of earnings (which includes salary and bonus income) subject to the Medicare portion of the tax. This results, for most American wage ...

What is the FICA tax rate?

This results, for most American wage earners, in a total FICA tax of 15.3 percent (Social Security plus Medicare), half of which is paid by employees and half by employers. Again, self-employed individuals are responsible for the entire FICA tax rate of 15.3 percent (12.4 percent Social Security plus 2.9 percent Medicare).

What is the additional Medicare tax?

The Additional Medicare Tax raises the wage earner’s portion on compensation above the threshold amounts to 2.35 percent ; the employer-paid portion of the Medicare tax on these amounts remains at 1.45 percent. The IRS has posted responses to frequently asked questions regarding the Additional Medicare Tax.

Will Social Security increase in 2016?

On Oct. 15, 2015, the Social Security Administration announced that there will be no increase in monthly Social Security benefit payments in 2016, and that the amount of wages subject to Social Security taxes will also remain unchanged at $118,500 in 2016. See the SHRM Online article Social Security Payroll Tax Threshold Unchanged for 2016.

Is Medicare a payroll tax?

The IRS has posted responses to frequently asked questions regarding the Additional Medicare Tax. Net Investment Income Tax. Although it is not a payroll tax, HR professionals also should be aware of the net investment income tax (NIIT) that high earners must pay when they file their income tax returns.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is the percentage of Social Security tax?

So, the total Social Security tax rate percentage is 12.4%. Only the employee portion of Social Security tax is withheld from your paycheck.

How much Medicare tax is withheld from paycheck?

There’s no wage-based limit for Medicare tax. All covered wages are subject to Medicare tax. If you receive wages over $200,000 a year, your employer must withhold a .9% additional Medicare tax. This will apply to the wages over $200,000.

What is the wage base limit for 2020?

The 2020 wage-base limit is $118,500. If you earn more than that with one employer, you should only have Social Security taxes withheld up to that amount. If you have more than one employer and you earn more than that amount, you’ll receive an adjustment of any overpaid Social Security taxes on your return. The employee tax rate for Medicare is ...

Do you have to file Medicare taxes if you are married?

If you’re married, you might not have enough Medicare taxes withheld. If you’re married filing jointly with earned income over $250,000, you’re subject to an additional tax. This also applies to married filing separately if your income is over $125,000.

Is self employment taxed as wages?

Self-Employment Tax. Self-employment income is income that arises from the performance of personal services, but which cannot be classified as wages because an employer-employee relationship does not exist between the payer and the payee.

Do you pay Social Security taxes to one country?

The agreements generally make sure that social security taxes (including self-employment tax) are paid only to one country. You can get more information on the Social Security Administration's Web site.

Do non-residents pay taxes on self employment?

However, nonresident aliens are not subject to self-employment tax. Once a nonresident alien individual becomes a U.S. resident alien under the residency rules of the Internal Revenue Code, he/she then becomes liable for self-employment taxes under the same conditions as a U.S. citizen or resident alien. Note: In spite of the general rules ...

Do Social Security and Medicare taxes apply to wages?

social security and Medicare taxes apply to payments of wages for services performed as an employee in the United States, regardless of the citizenship or residence of either the employee or the employer.

Can you make Social Security payments if no taxes are due?

Your employer should be able to tell you if social security and Medicare taxes apply to your wages. You cannot make voluntary social security payments if no taxes are due.

Do you have to deduct taxes on Social Security?

Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment. Your employer must deduct these taxes even if you do not expect to qualify for social security or Medicare benefits.

How much is Medicare payroll tax?

Medicare Payroll Tax. The Medicare payroll tax is 1.45% and is based on each employee's earnings without limit. The Medicare tax is withheld from each employee's earnings and is also matched by the employer. This makes the total Medicare tax equal to 2.9% on every dollar of earnings.

What is the Social Security payroll tax rate for 2021?

In the calendar year 2021, the Social Security payroll tax rate of 6.2% is applied to each employee's earnings up to the maximum of $142,800. The 6.2% that is withheld from the employee is also matched by the employer. As a result, the total Social Security tax in 2021 for an employee is equal to 12.4% of each employee's annual earnings up ...

What is the FICA rate?

FICA Payroll Tax. The combination of Social Security taxes and Medicare taxes is referred to as FICA. We often refer to the FICA tax rate as 7.65% (6.2% Social Security + 1.45% Medicare) of each employee's first $137,700 of annual earnings in 2020 and the first $142,800 of annual earnings in 2021. Each employee's earnings in excess ...

What is the maximum Social Security tax for 2015?

The Social Security Tax Rate remains at 6.2 percent. The resulting maximum Social Security Tax for 2015 is $7,347.00. There is no limit on the amount of earnings subject to Medicare (Hospital Insurance) Tax.

What is the FICA rate for 2015?

The FICA Tax Rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2015 (or 8.55 percent for taxable wages paid in excess of the applicable threshold).

Is Medicare taxed on self employment?

All wages, self-employment income, and other compensation that are subject to regular Medicare Tax and are paid in excess of the applicable threshold are subject to the additional Medicare Tax.