What are the top 5 Medicare supplement plans?

Aug 27, 2021 · Here’s a rundown of the top Medicare Advantage plans in 2022. Best for size of network: UnitedHealthcare. Best for extra perks: Aetna. Best for member satisfaction: Kaiser Permanente. Best for ...

Which Medicare Prescription Plan is best?

Kaiser Medicare Advantage Plans. Kaiser Permanente is one of the top Medicare Advantage plan companies for the following states - California, Hawaii, …

How do I choose the best Medicare Advantage plan?

Feb 11, 2022 · MoneyGeek’s top pick for the best overall Medicare Advantage option is Blue Cross Blue Shield's preferred provider organization plans. To identify the best Medicare Advantage plan, MoneyGeek looked at insurance companies that offer benefits in at least 25 states, provide robust coverage options and earn high-quality ratings from the Centers for Medicare and …

Which Medicare Part B plan is best?

5 rows · Choosing the best Medicare plan for your insurance needs is about more than just cost. Find out ...

Which Medicare plan offers the best coverage?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

What are the top 3 Medicare Supplement plans?

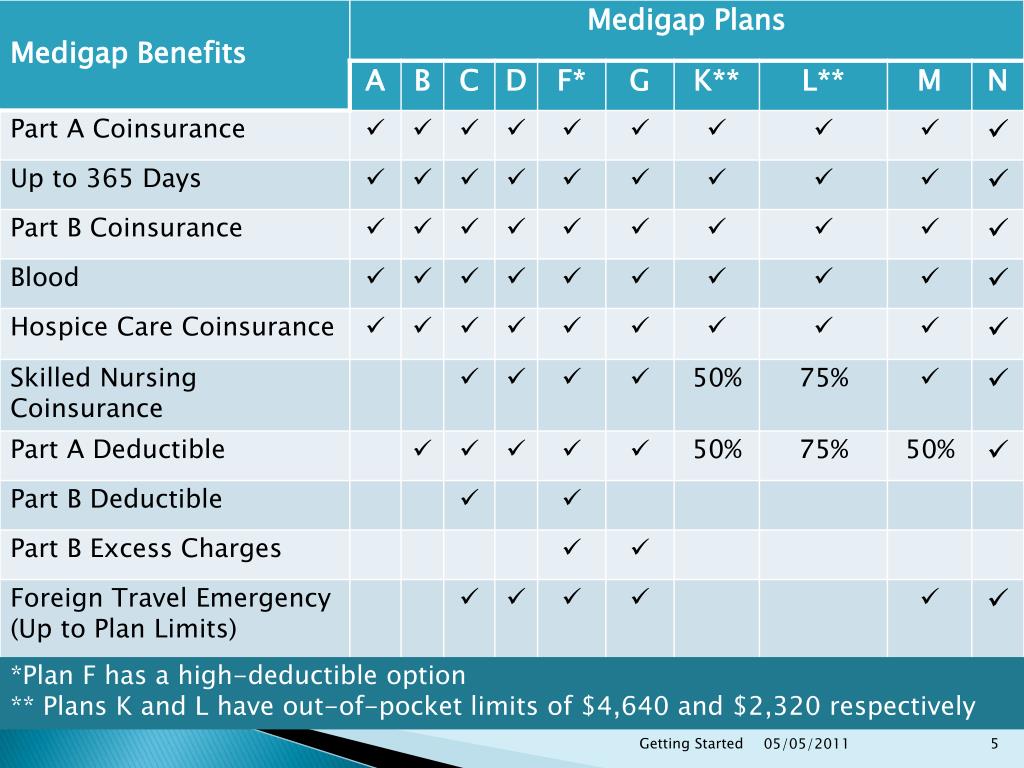

Three plans — Plan F, Plan G, and Plan N — are the most popular (accounting for over 80 percent of all plans sold). Here's an in-depth look at this trio of Medicare Supplement plans, and the reasons so many people choose them.Sep 25, 2021

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

What is the difference between Medicare Part B and Medicare Advantage plan?

Original Medicare covers inpatient hospital and skilled nursing services – Part A - and doctor visits, outpatient services and some preventative care – Part B. Medicare Advantage plans cover all the above (Part A and Part B), and most plans also cover prescription drugs (Part D).

What is the most popular Medicare Supplement plan for 2022?

Plan GPlan G will cover almost everything except the Part B deductible. This means that you would be responsible for paying the entire Medicare Part B deductible — $233 for 2022 — before insurance benefits will begin to pay for your health care. Plan G is the most popular Medicare Supplement for new enrollees.Mar 16, 2022

What is the most expensive Medicare Supplement plan?

Because Medigap Plan F offers the most benefits, it is usually the most expensive of the Medicare Supplement insurance plans.

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What are disadvantages of Medicare?

No vision, dental, hearing or retail prescription drug coverage. Medicare Part A and Part B cover a wide range hospital and medical benefits, but they still leave many things not covered. Original Medicare doesn't typically cover items or services such as: Prescription drugs.Dec 8, 2021

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

Can you switch back and forth between Medicare and Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

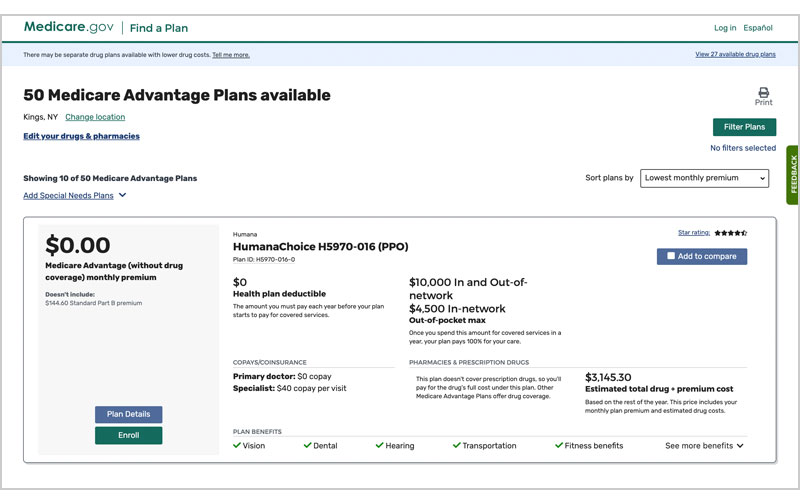

Why does zip code affect Medicare?

Because Medicare Advantage networks of care are dependent upon the private insurer supplying each individual plan, the availability of Medicare Advantage Plans will vary according to region. This is where your zip code matters in terms of Medicare eligibility.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

Best of the Blues: Highmark

Service area: Available in Delaware, New York, Pennsylvania and West Virginia.

How to shop for Medicare Advantage plans

The right Medicare Advantage plan for you will depend on your health history, prescription medications and where you live, among other things. Here are some strategies for selecting the best plan:

What is the Medicare program for retirees?

Your Medicare Coverage. Most retirees receive health insurance through Medicare, the federal government's health insurance program for people age 65 and older. To maximize the value of the health plan, make sure to sign up at the correct time and take advantage of the free and low-cost services Medicare provides.

Can Medicare beneficiaries enroll in Medicare Advantage?

MEDICARE-ELIGIBLE beneficiaries can enroll in a Medicare Advantage plan or a Part D Prescription Drug plan from a private insurance company. U.S. News provides a tool for Medicare-elig ible beneficiaries to find the right Medicare plans for their needs. U.S. News analyzed insurance companies’ offerings in each state based on their 2021 CMS star ...

The Best Overall Medicare Advantage Provider

MoneyGeek’s top pick for the best overall Medicare Advantage option is Blue Cross Blue Shield's preferred provider organization plans.

The Best Medicare Advantage Provider for HMO Plans

Among Medicare Advantage HMOs available in at least 25 states, MoneyGeek’s pick for the best carrier overall is UnitedHealthcare based on Medicare Star Ratings and the availability of robust extra benefits.

The Best Medicare Advantage Provider for Plans Without Drug Coverage

Prescription drug coverage is optional for Medicare members and is not included in Original Medicare. Though many Medicare Advantage plans include prescription drug coverage, you can choose a Medicare Advantage plan without drug benefits.

Best Medicare Advantage Provider for Low Out-of-Pocket Cost Plans

Medicare Advantage plans can be relatively low-cost, many with zero premiums. But the trade-off can come in the form of higher out-of-pocket costs. When evaluating the price of a plan, consider all the costs, not just the premiums.

What to Know About the Best Medicare Advantage Plans

It can be hard to determine which Medicare Advantage plan is right for you. Though there are standard quality ratings, the best plan for you will depend on your specific needs.

How to Get The Best Medicare Advantage Plan for You

More than 26 million people — 42% of all Medicare beneficiaries — enrolled in a Medicare Advantage plan in 2021, more than double the number enrolled a decade ago. There are only more Medicare Advantage options for people in 2022.

Original Medicare is a two-part plan offered by the federal government

Part A covers inpatient stays at a hospital, hospice or skilled nursing facility

Which Medicare plan is right for you?

You need to look at your whole picture to choose the best Medicare plan: Your health, your financial situation and even your travel plans in retirement. While you can use Original Medicare anywhere in the country, most Medicare Advantage plans require you to use a provider network for all but emergency care.

Most Medicare Advantage plans have a single deductible that covers both inpatient and outpatient services

Coinsurance under Original Medicare is based on the actual cost of your services. The coinsurance for Part B is 20% of the allowable charges. Medicare Advantage plans typically charge a flat copayment at the time of service, regardless of the total cost of the visit.

Things to consider when choosing your Medicare plan

The best Medicare plan is one that fits with your lifestyle and finances, so it’s important to keep these points in mind before you decide:

What Is Medigap?

Medigap, or Medicare Supplement, is a private insurance policy purchased to help pay for what isn’t covered by Original Medicare (which includes Part A and Part B). These secondary coverage plans only apply with Original Medicare—not other private insurance policies, standalone Medicare plans or Medicare Advantage plans.

How to Choose the Right Medicare Supplement Plan for You

What are my health care needs now and possibly in the future? Consider your current health status as well as your family history.

Best Medicare Supplement Providers

Many health insurance companies offer various Medigap plans, but not all providers issue policies in all 50 states or boast high rankings from rating agencies like A.M. Best.

How to Sign Up for Medigap Plans

Signing up for a Medigap plan is easy. “Medicare supplements may be bought through an agent or from the carrier directly,” says Corujo. Since there’s no annual open enrollment period, you may join at any time.

Is Original Medicare Enough?

The short answer is that Original Medicare alone can leave you open to large medical bills. Unlike traditional health insurance, Medicare does not limit your maximum out-of-pocket medical costs.

The Medicare Advantage Plan is a Great Solution

They are a great solution because they provide excellent coverage, cap you maximum out of pocket expenses and generally have a zero premium. In some cases there may be small premium. But it will be significantly lower than a Medicare Supplement Plan G.

How Do I Choose a Medicare Advantage Plan?

Choosing an Advantage Plan isn’t really that difficult. First, retirees on a shoestring budget, you will want a plan with a zero, or a very low premium. And if available in your area, a plan with a Part B give-back is even better.

The Unique Medical Savings Account Advantage Plan

This plan combines a high deductible health plan with a Medical Savings Account. And it is my favorite plan for any reasonably healthy retiree. But it is a perfect solution to a retiree on a shoestring budget.

What is the Best Medicare Plan for Retirees on a Shoestring Budget?

Retirees on a shoestring budget who want to have an amazing, fun-filled retirement need every dollar that they can get their hands on. Paying $150 a month for a Plan G and a prescription drug plan is unnecessary and a waste of money. For a couple this equals $300 a month. That is a lot of eating out and/or travel.

What percentage of people in Medicare have an Advantage plan?

Medicare Advantage. Roughly 31 percentTrusted Source of people enrolled in Medicare have a Medicare Advantage plan. While most Advantage plans can cost more up front, they can also help to save money in the long run. There are other factors to consider when choosing whether to enroll in Medicare Advantage.

What is Medicare Advantage?

Most Medicare Advantage plans are either HMO or PPO plans, both of which have some provider limitations. Other plan offers may also come with additional provider limitations. State-specific coverage. Medicare Advantage plans cover you within the state you enrolled, typically the state you live in.

What is single coverage?

Single coverage. It is a single-user policy, which means that your spouse won’t be covered. If you and your spouse both require supplemental insurance, you’ll need to enroll in separate plans.

What are the advantages of Medicare Part D?

Advantages of Medicare Part D. Standardized coverage . When you enroll in a Part D plan, each plan must follow a set amount of coverage defined by Medicare. No matter how much your medications cost, you can rest assured that your plan will cover a set amount.

How much is Medicare Part B in 2021?

The monthly premium for Medicare Part B starts as low as $148.50 in 2021. If you receive Social Security payments, your monthly Medicare costs can be automatically deducted. Provider freedom. With original Medicare, you can visit any provider that accepts Medicare, including specialists.

What are the disadvantages of Medicare?

Disadvantages of original Medicare. Lack of additional coverage. Original Medicare only covers hospital and medical services. This can lead to coverage gaps for services such as vision, dental, and more. No out-of-pocket maximum. Original Medicare has no yearly out-of-pocket maximum cost.

Is Medigap a private insurance?

It is a supplemental private insurance option which can help pay for Medicare costs i.e deductibles, copays, and coinsurance. Medigap isn’t necessarily an alternative to Medicare Advantage. It is a cost-effective alternative for those who choose not to enroll in Medicare Advantage.