Code N - Uncollected Medicare tax on the taxable cost of group-term life insurance over $50,000 (former employees only). When entered correctly on the W-2 entry window, these amounts will be designated with the code UT on Line 8c of Schedule 2 (Line 62 of Schedule 4 in tax year 2018, and Form 1040 Line 62 for tax years 2017 and prior).

What are the tax codes for uncollected Social Security?

Code A - Uncollected Social Security or RRTA tax on tips. Code B - Uncollected Medicare tax on tips. Code M - Uncollected Social Security or RRTA tax on the taxable cost of group-term life insurance over $50,000 ( former employees only ).

What form do I use to report uncollected Social Security and Medicare?

INFORMATION FOR... Use Form 8919 to figure and report your share of the uncollected social security and Medicare taxes due on your compensation if you were an employee but were treated as an independent contractor by your employer. None at this time.

Where do I find uncollected Medicare taxes on my tax return?

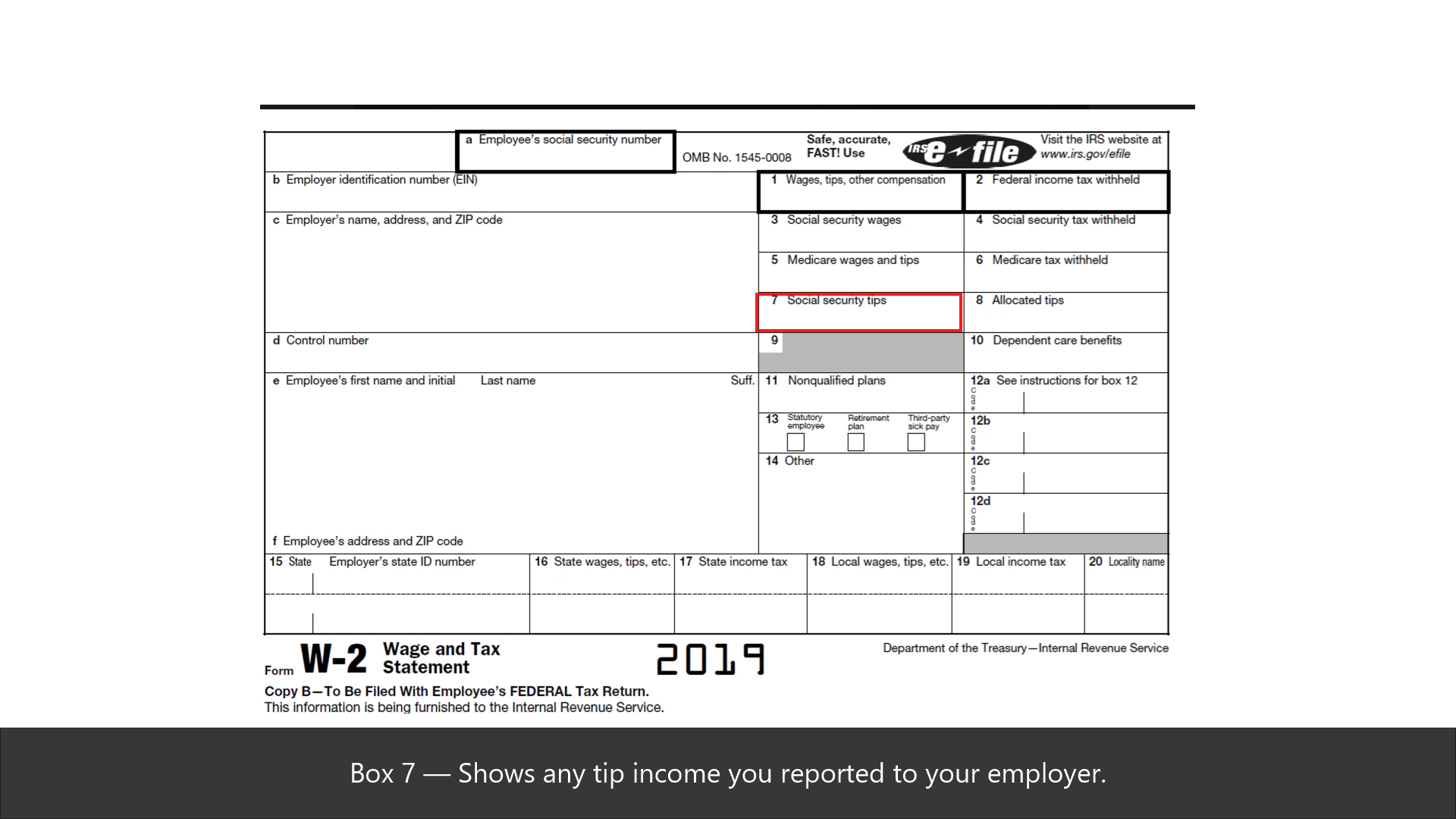

This can result in uncollected Medicare taxes. Examine the W-2 form you received from your employer. Uncollected Medicare taxes will be shown in Box 12 and identified by the code "B."

Where do I find uncollected taxes on Form W-2?

If an employer could not collect all the Social Security tax, Medicare tax, or Railroad Retirement tax on either tips or the taxable cost of group term life insurance, the uncollected taxes will be shown in Box 12 of Form W-2 with codes A, B, M, or N as follows: Code A - Uncollected Social Security or RRTA tax on tips.

What does Uncollected Medicare tax mean?

A - Uncollected social security or RRTA tax on tips. You'll have an amount here if you had tips and your employer didn't withhold social security tax on the tips. B - Uncollected Medicare tax on tips. You'll have an amount here if you had tips and your employer didn't withhold medicare tax on the tips.

Why do I owe Medicare tax?

The Additional Medicare Tax applies to wages, railroad retirement (RRTA) compensation, and self-employment income over certain thresholds. Employers are responsible for withholding the tax on wages and RRTA compensation in certain circumstances.

Do you get Medicare back on taxes?

You must complete and submit IRS Form 843 to claim a refund of Social Security and Medicare taxes. When you apply for a refund from the IRS, include either: A letter from your employer stating how much you were reimbursed.

Where does Medicare go on tax return?

If you're self-employed, the self-employed health insurance deduction — putting your Medicare premiums on Schedule 1 of your 1040 — is the most direct way to reduce your tax burden.

Does everyone pay Medicare tax?

There is no minimum income limit, and all individuals who work in the United States must pay the Medicare tax on their earnings.

Why is Medicare taken out of my paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital Insurance tax is a required payroll deduction and provides health care to seniors and people with disabilities.

How do I get my Medicare premium refund?

Call 1-800-MEDICARE (1-800-633-4227) if you think you may be owed a refund on a Medicare premium. Some Medicare Advantage (Medicare Part C) plans reimburse members for the Medicare Part B premium as one of the benefits of the plan. These plans are sometimes called Medicare buy back plans.

How do I get my Social Security and Medicare refund?

Ask your employer to refund the erroneously withheld FICA taxes and if a W-2 was already issued, to give you a corrected Form W-2c for that year. If your employer refuses to refund the taxes, you can file Form 843 (for instructions see here) and the IRS will refund the money to you.

Does Social Security and Medicare count as federal tax?

The Social Security tax is a tax on earned income, and it is separate from federal income taxes. The Social Security tax only applies to earned income, like your wages, salaries and bonuses, but not to unearned income like interest, dividends or capital gains.

Do you get a 1095 for Medicare?

If you were enrolled in Medicare: For the entire year, your insurance provider will not send a 1095 form. Retirees that are age 65 and older, and who are on Medicare, may receive instructions from Medicare about how to report their health insurance coverage.

Do I need a 1095 B to file my taxes?

You do not need 1095-B form to file taxes. It is for your records. IRS 1095-B form is your proof of the month(s) during the prior year that you received qualifying health coverage.

What makes a worker an "employee"

A business may hire a worker as an independent contractor, but the worker may be classified as a paid employee by the Internal Revenue Service, depending on how their position is structured.

When to use Form 8919

Perform services for a company that aren’t those of an independent contractor as defined by the IRS, and Social Security and Medicare taxes were not withheld from your pay

Don't use Form 4137

Prior to the introduction of Form 8919, workers may have used Form 4137 to report Social Security and Medicare amounts. Since 2008, usually only tipped employees use Form 4137 to report Social Security and Medicare amounts on allocated tips and those not reported by their employers.

What is a 8919?

Uncollected Social Security and Medicare Tax - Form 8919. Form 8919, Uncollected Social Security and Medicare Tax on Wages, will need to be filed if all of the following are true: The taxpayer performed services for an individual or a firm (whether for-profit, not-for-profit, or a government entity); The taxpayer believes their pay was ...

Did the individual or firm withhold Social Security and Medicare taxes from the taxpayer's pay?

The individual or firm didn’t withhold Social Security and Medicare taxes from the taxpayer's pay; One of the following is true: The taxpayer filed Form SS-8 with the IRS and and is waiting for a response; The taxpayer filed Form SS-8 and received a determination letter stating that they are an employee of the individual or firm;

How are uncollected FICA SS & Medicare Taxes collected?

Client needs to issues a $0 check and wants to include benefits so they are reported correctly for W2 purposes. Some of the benefits are taxable which causes FICA SS & Medicare taxes to be calculated as uncollected.

How are uncollected FICA SS & Medicare Taxes collected?

Tina, everything that I have found points me to believe that these uncollected taxes are stored in GP as liabilities and are automatically withheld on the employee's next paycheck. That is, assuming their next pay run is in the same calendar year. If in a different calendar year I would think the logic would be different.

How are uncollected FICA SS & Medicare Taxes collected?

Uncollected FICA and SS taxes are paid to the IRS by the employee when they file their annual personal tax return. Generally, this only applies to tipped employees where their reported tips far exceed their hourly wages and thus, there is insufficient dollars in the check to cover the FICA taxes.

How are uncollected FICA SS & Medicare Taxes collected?

The wages are included in Box 1, 3 & 5 of the W-2. Uncollected SS/Med tax is included in Box 12 of the W-2 (Code A for SS and Code B for Med tax). Hope this helps!