What Medicare plans does UnitedHealthcare offer?

With over 12 million Medicare members and a partnership with AARP, UnitedHealthcare provides Medicare beneficiaries with other types of Medicare coverage. UnitedHealthcare’s coverage includes Medicare Advantage plans, stand-alone Medicare Prescription Drug Plans (Part D), and Medicare Supplement (Medigap) plans.

Is United Healthcare good health insurance?

UnitedHealthcare ranks in the top ten health insurance companies. This high ranking shows that UnitedHealthcare is a reliable health insurer. While it could have a higher star rating, it's star rating is average for the industry. Customer Review: Kimberly from Hurlock, Maryland "United Health Care is definitely my choice for health care.

What is Medicare complete by United Healthcare?

UnitedHealthcare offers Medicare coverage for medical, prescription drugs, and other benefits like dental — and we offer the only Medicare plans with the AARP name. Here are the different types of medicare plans you can choose from — and what they cover. Plan type. What it covers. Original Medicare (Parts A & B)

What does plan N cover in Medicare?

Plan N covers basic Medicare benefits including:

- Hospitalization: pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end

- Medical Expenses: pays Part B coinsurance excluding $20 copay for office visits and $50 copay for ER—generally 20% of Medicare-approved expenses—or copayments for hospital outpatient services

- Blood: pays for the first 3 pints of blood each year

What is United Healthcare plan N?

What does Plan N cover? Plan N covers the Medicare Part A deductible of $1,556, coinsurance for Parts A and B, three pints of blood and 80% of medical costs incurred during foreign travel. Plan N does not provide coverage for the Medicare Part B deductible ($233 in 2022).

Is plan n Better Than G?

Plan G and Plan N premiums are lower to reflect that. Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

What's the difference between plan G and N?

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we'll cover next.

What is the difference between plan F and N?

Plan N premiums are typically lower than Plan F premiums, meaning, you spend less out of pocket monthly with Plan N than you will with Plan F. However, Plan F covers more out-of-pocket expenses. If you know that you will have many medical expenses throughout the year, Plan F may be a better choice.

Is plan N guaranteed issue?

While Plan N does have a potential of fees that the patient is responsible for, its rate increase history has and will remain low as it is not a guaranteed issue plan. This secures your client in a stable plan for a longer amount of time.

Can I switch from plan N to plan G?

You can switch from Plan N to Plan G any time during the year, but if you are outside your 6-month Open Enrollment window, then you may have to answer health questions to switch. Your approval is not guaranteed.

What is the most comprehensive Medicare Supplement plan?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

Is plan G as good as plan F?

Ultimately, Plan G has the same benefits as the Plan F, except for coverage for the Part B deductible ($233 for 2022). Once you pay the Part B deductible, the coverage is the same for both plans.

Which Medigap plans are no longer available?

The federal government standardizes all Medigap plans. Medicare Supplement Plan H, Plan I, and Plan J are no longer available. These plans were discontinued when the Medicare Modernization Act of 2003 became a law, introducing Medicare Part D.

What are plan n copays?

With Plan N, you are responsible for copayments up to $20 when you visit the doctor's office (or up to $50 for emergency room visits). You are also responsible for any excess charges, the additional amount a doctor may charge for services above what Medicare covers.

Does Medicare Plan N cover prescriptions?

Like all Medigap plans, Medicare Supplement Plan N coverage does not include prescription drugs. If you want prescription coverage you can purchase Medicare Part D. Medicare Plan N also does not cover dental, vision, or hearing. If you want coverage for these services, consider a Medicare Advantage plan.

Can you switch from plan N to plan G without underwriting?

You can change Medigap carriers, while keeping the same level of coverage, during the months surrounding your Medigap anniversary. For example, you can switch from a Plan G to a Plan G without underwriting, but not from a Plan G to a Plan N.

What is Medicare Plan N?

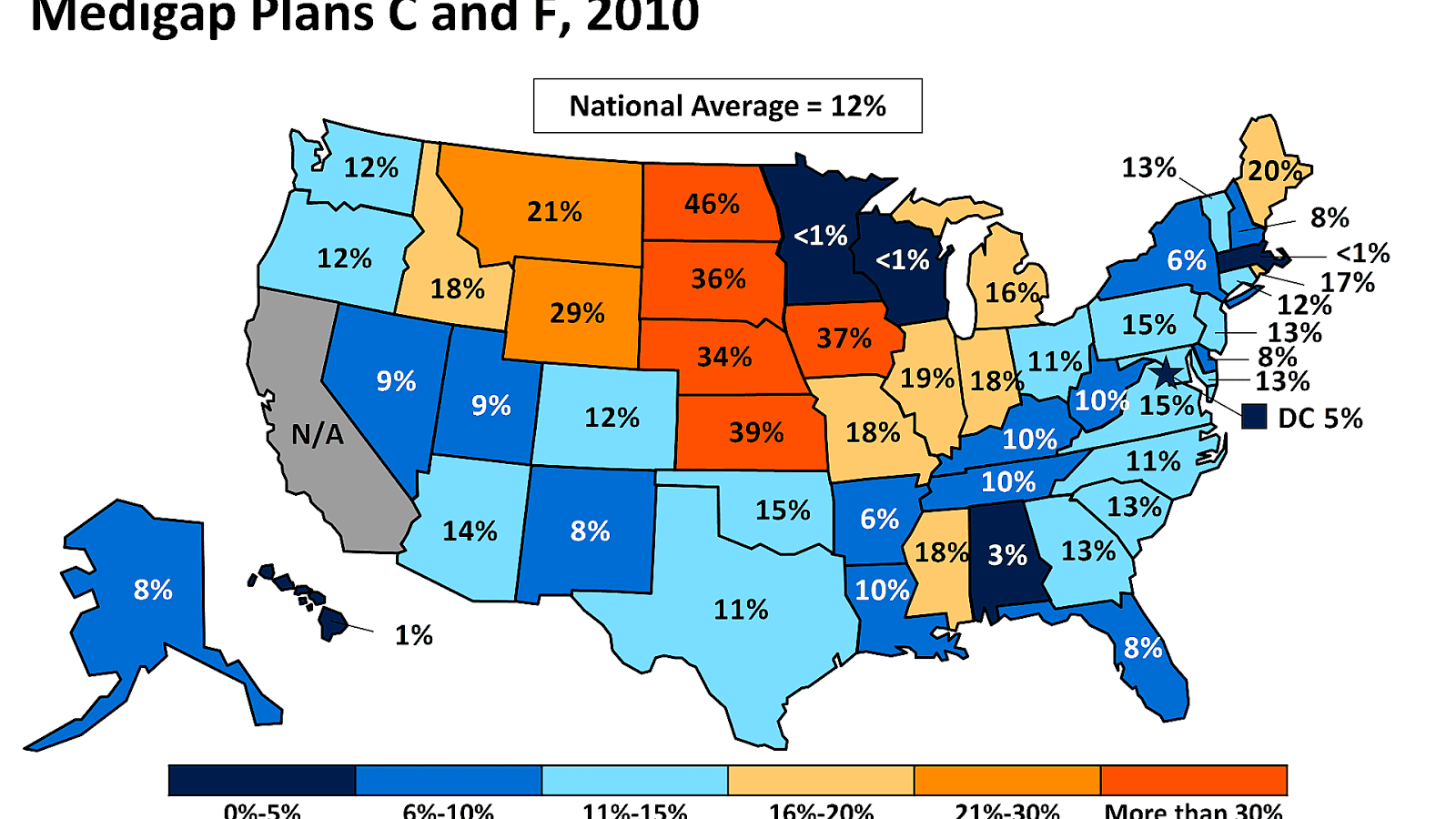

Medicare Plan N is coverage that helps pay for the out-of-pocket expenses not covered by Medicare Parts A and B . It has near-comprehensive benefits similar to Medigap Plans C and F (which are not available to new enrollees), but Medicare Plan N has lower premiums. This makes it an attractive option to many people.

How much does Medicare Supplement cost in Florida in 2021?

As a general reference, in 2021, a non-smoking 65-year-old woman living in Florida’s 32162 ZIP code would pay between $123 and $181 for Medicare Supplement Plan N monthly premiums. 2.

How old do you have to be to get Medicare Supplement?

You are eligible to purchase a Medicare supplement insurance plan if you are 65 years old or older and enrolled in Medicare Part B. If you are under 65 and disabled, you will likely be limited as to which Medigap plan you can purchase. There are 10 Medigap plan options in total. But we are going to focus on Medicare Supplement Plan N.

When does Medigap plan N end?

Enrollment begins the first day of the month you turn 65 and are covered under Medicare Part B and ends six months after your birthday month. Applying for benefits during this time is the most beneficial, as insurance companies are not permitted to use medical underwriting.

Does Medicare cover a doctor's office?

Medigap Plan N does not cover the Medicare Part B deductible or excess charges, which are the difference in cost between what a health provider charges for a medical service and the Medicare-approved amount. Medicare Plan N will not cover the copay or coinsurance for doctor’s office and emergency room visits.

Does Medicare cover all medical expenses?

Original Medicare (Parts A and B) will cover some, but not all, of your medical expenses. The portion not covered is often referred to as a “gap.”. Medicare Supplement plans, also called Medigap plans, are policies sold by private insurance companies to help pay for the expenses Medicare does not cover.

Can you compare Medicare Plan N to Plan B?

You want to be make certain you are comparing a Medigap Plan N from one company to a Medicare Plan N from another company. You don’t want to compare Plan N at one company to Plan B at another because you won’t get a clear comparison between the prices and benefits.

How many Medigap plans are there?

Depending on where you live, there may be up to 10 Medigap plans available, and benefits are standardized across most states ...

What is a plan F?

Plan F also comes in a high-deductible version, where you’ll be responsible for all Medicare-covered costs until you reach the plan deductible amount (which may change from year to year). After you reach the deductible, Plan F will begin to cover costs. Plan F covers: All Plan C benefits.

What is a plan C in California?

In other words, a Plan C in California offers the exact same coverage as a Plan C in New York (although the monthly premiums may differ by location). You’re eligible for Medicare Supplement ...

Is Plan L the same as Plan K?

Plan L covers the same benefits as Medigap Plan K, except that the benefits covered at a partial amount are covered at a higher amount (75% instead of 50%). Plan L includes a lower annual out-of-pocket cap than Plan K, which may vary from year to year.

What are the benefits of UnitedHealthcare?

When you enroll in a UnitedHealthcare Medicare Supplement policy, you get benefits like: 1 Early enrollment 2 Household discounts 3 No application fees 4 You can visit any Medicare doctor in the United States 5 Coverage can’t be canceled for health issues 6 30-day free look period 7 Peace of mind with a top A-rated company 8 In select areas, Silver Sneakers gym membership

What is Part D insurance?

Part D is your prescription drug coverage. When you fill your prescriptions at a preferred retail pharmacy, you can be eligible for members-only savings. Like with most Part D Plans, when you choose the convenience of Preferred Mail Home Delivery pharmacies, you can save even more.

Is there a Medicare Advantage plan?

Medicare Advantage plans will have a network of providers, verifying that your physician participates in the plan’s network is very important.

Is Plan F first dollar?

Plan F is considered first-dollar coverage . This is because it will pay for all of your cost-sharing. All you have to pay is the monthly premium. This makes your medical expenses predictable knowing you’ll pay zero out of pocket when you use your benefits.

Is Plan G cheaper than Plan F?

The benefits are more comprehensive, as well as more affordable than Plan F in most states. Plan G covers everything except the annual Part B deductible. If you find Plan G in your area that is cheaper than Plan F, then it may be in your best interest to enroll.

Is UnitedHealthcare a good company?

Millions of people nationwide have supplemental Medicare coverage through UnitedHealthcare, and their approval rating stands at 96&. A.M. Best gives UnitedHealthcare an A rating; they are an excellent company. Also, many UnitedHealthcare Medigap plans include a SilverSneakers fitness program as a benefit.

What is Medicare Supplement?

Medicare Supplement insurance, also known as Med-Supp or Medigap, was created by the federal government and is regulated by state Insurance Departments. It is offered by private insurance companies to cover some of the out-of-pocket costs not covered by Original Medicare.

How much is a 2021 F and G deductible?

1 Plans F and G also have a high deductible option which requires first paying a plan deductible of $2,370 in 2021 before the plan begins to pay. Once the plan deductible is met, the plan pays 100% of covered services for the rest of the calendar year.

Does high deductible plan G cover Medicare Part B?

High deductible plan G does not cover the Medicare Part B deductible. However, high deductible plan G counts your payment of the Medicare Part B deductible toward meeting the plan deductible. 2 Plans K and L pay 100% of covered services for the rest of the calendar year once you meet the out-of-pocket yearly limit.

Does Medicare cover all of the costs?

Original Medicare covers some of the healthcare costs, but not all. *Denotes plan available from United American Insurance Company. Plan availability varies by state. Only applicants first eligible for Medicare before 2020 may purchase Plans C, F, and high deductible F.

What does Medicare Supplement Plan G cover?

Medicare Supplement Plan G and Plan N both cover many of the larger costs leftover from your Original Medicare coverage. For instance, they both cover: Neither Plan G nor Plan N cover the Part B deductible, which is $203 in 2021. Medicare Part B covers your outpatient services, like visits to your doctor’s office.

What does Plan N cover?

Plan N doesn’t cover: 1 Excess Charges: This an additional cost that some providers charge. Most healthcare providers that accept Medicare also accept Medicare assignment, which is the cost that Medicare states they’ll pay for a given service. If the provider wants to be paid more, they can bill you for excess charges, which can only be up to an additional 15% of the original cost. 2 Copayments: With Plan N, you’ll be responsible for copays of up to $20 for some office visits, or up to $50 if you go to the emergency room but aren’t admitted as an inpatient.

What is the deductible for Medicare Part A in 2021?

Medicare Part A deductible ($1,484 in 2021) Foreign travel emergency. Neither Plan G nor Plan N cover the Part B deductible, which is $203 in 2021. Medicare Part B covers your outpatient services, like visits to your doctor’s office.

Does Medicare Supplement cover gaps?

Medicare Supplement insurance can help you cover the gaps in Medicare, but many people have difficulty deciding which plan is right for them. If you’re unsure which plan to choose, you aren’t alone. Fortunately, Medicare Supplement Plan G and Medicare Supplement Plan N, two of the most popular plans, are relatively simple to compare.

Does Plan N cover excess charges?

Plan N doesn’t cover: Excess Charges: This an additional cost that some providers charge. Most healthcare providers that accept Medicare also accept Medicare assignment, which is the cost that Medicare states they’ll pay for a given service.

Is Plan G or N better for copays?

If you visit the doctor regularly or prefer not to have to budget for copays, Plan G may be the best option for you. Plan N may be a good fit if you’d like to save money on premiums, you’re in great health, and rarely need to visit the doctor.

Is Plan G more expensive than Plan N?

In addition to the differences in coverage between Plan N and Plan G, the cost of the plans tends to vary as well. Premiums for each plan can vary by the carrier that offers it, but Plan G is typically more expensive than Plan N because it offers a higher level of coverage. However, while Plan G usually has higher premiums, ...