The cost-sharing for this plan is divided as follows: Tier 1 (Preferred Generic) contains 156 drugs and has a co-payment of $1.00. Tier 2 (Generic) contains 684 drugs and has a co-payment of $4.00.

Full Answer

How much does Medicare Part D cost?

Medicare Part D costs vary by policy, based on the list of covered drugs, also known as the plan’s formulary. Policies that cover prescription drugs usually put covered drugs into cost tiers, with individual cost-sharing for the medications on each tier. How Much is Medicare Part D? The average premium for Medicare Part D is around $40 a month.

What is the Medicare Part D coverage gap and how does it work?

What is the Medicare Part D Coverage Gap? The coverage gap is known as the donut hole. It begins once you reach your Medicare Part D costs plan’s initial coverage limit and ends when you spend a total of $7,050. Part D enrollees will receive a 75% discount on the total cost of their brand-name drugs purchased while in the donut hole.

What is extra help for Medicare Part D?

Extra Help is an assistance program that helps lower income individuals more easily afford Medicare Part D. Extra Help helps pay for Part D premiums, deductibles and copayments/coinsurance.

What Medicare plans does Walmart offer?

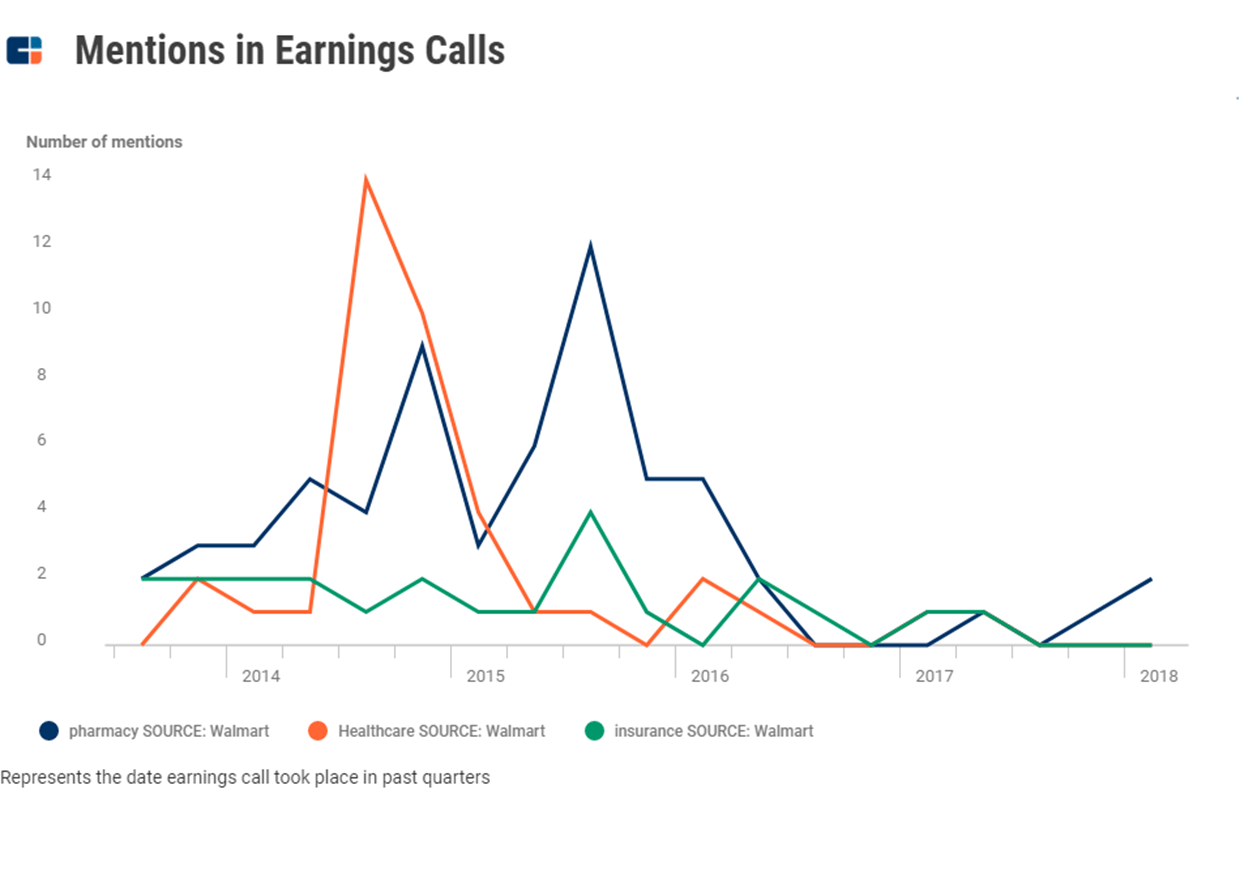

At launch, Walmart Insurance Services will provide Medicare plans (Part D, Medicare Advantage and Medicare Supplement plans) offered by Humana, UnitedHealthcare, Anthem Blue Cross Blue Shield, Amerigroup, Simply Health, Wellcare (Centene), Clover Health and Arkansas Blue Cross and Blue Shield.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

Does Walmart have a Medicare Part D plan?

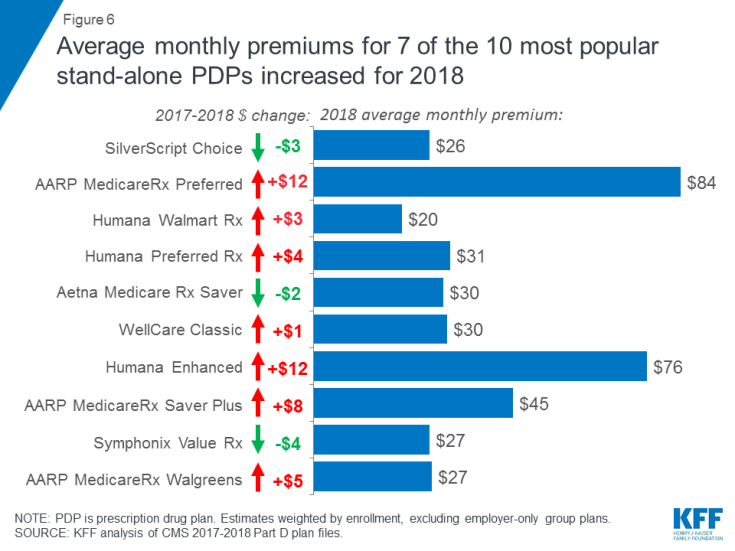

Humana and Walmart Announce Innovative Medicare Part D Prescription Drug Plan with Lowest National Monthly Premium Offered in all 50 States and D.C.

What is the difference between preferred and standard cost-sharing?

What is the difference between a preferred cost-share and standard cost-share pharmacy? Answer: Preferred cost-share pharmacies may provide prescriptions for our Medicare members at a lower cost (for example, copayments) than standard in-network cost-share pharmacies, depending on the plan.

What are two options for Medicare consumers getting Part D?

You may have the choice of two types of Medicare plans—a stand-alone Medicare Part D Prescription Drug Plan or a Medicare Advantage Prescription Drug plan. Your Part D coverage choices are generally: A stand-alone Medicare Part D Prescription Drug Plan, if you have Medicare Part A or Part B or both.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the cost of Medicare Part D for 2022?

$33Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

What does standard cost sharing mean?

The share of costs covered by your insurance that you pay out of your own pocket. This term generally includes deductibles, coinsurance, and copayments, or similar charges, but it doesn't include premiums, balance billing amounts for non-network providers, or the cost of non-covered services.

What does standard cost sharing pharmacy mean?

Preferred cost sharing is a term that refers to lower out-of-pocket costs (often reduced co-pays) for prescription drugs when a beneficiary uses a designated subset of pharmacies in the network.

What is Humana Walmart Value Rx plan?

Humana Walmart Value Rx Plan (PDP) offers a pharmacy network with preferred cost sharing at select pharmacies. You may pay more at other pharmacies. Get more from your plan — with extra services and resources provided by Humana! If you receive premium assistance, your plan premium may be reduced.

What is the maximum out of pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000 (beginning in 2024), while under the GOP drug price legislation and the 2019 Senate Finance bill, the cap would be set at $3,100 (beginning in 2022); under each of these proposals, the out-of-pocket cap excludes the value of the manufacturer price ...

What drugs are not covered by Medicare Part D?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

Do you have to renew Medicare Part D every year?

Do I have to reenroll in my Medicare Part D prescription drug plan every year? En español | No. If you like your current Part D drug plan, you can keep it without doing anything additional. You don't have to reenroll or inform the plan that you're staying.

How much does Medicare Part D cost?

The average premium for Medicare Part D is around $40 a month. The premiums do vary by location and plan. Medications that fall on the higher tiers attract higher coinsurance costs and co-payments compared to those on the lower tiers.

How much is the deductible for Part D in 2021?

The initial deductible for Part D is $445 in 2021. In 2022, the initial deductible will be $480.

What is the Medicare donut hole?

The coverage gap is known as the donut hole. It begins once you reach your Medicare Part D costs plan’s initial coverage limit and ends when you spend a total of $6,550. Part D enrollees will receive a 75% discount on the total cost of their brand-name drugs purchased while in the donut hole. The 75% discount paid by the brand-name drug ...

What is Medicare Part D 2021?

Medicare Part D costs include the initial deductible, initial coverage limit, out-of-pocket threshold, and the coverage gap, also known as the donut hole.

How much discount do you get for a brand name drug?

The 75% discount paid by the brand-name drug manufacturer will apply to get out of the donut hole. For example: if you reach the donut hole and purchase a brand-name medication with a retail cost of $100, you will pay $25 for the medication, and receive $95 credit toward meeting your total out-of-pocket spending limit.

What are not covered prescriptions?

Not Covered Prescriptions: Drugs for cosmetic purposes. Medicines for anorexia, weight gain, or weight loss. Drugs meant to relieve colds and coughs. Medications for erectile dysfunction. Individual outpatient drugs. Over-the-counter medications. Minerals or vitamin drugs except those noted in the formulary.

Do you have to pay a coinsurance for Medicare Part D?

If you receive extra help paying your Part D Medicare costs. One major cost that you should consider is the monthly premium. Stand-alone Part D policies and Medicare Advantage policies have a monthly premium. Other than the monthly premiums, you may have to pay an annual deductible and a co-payment/coinsurance.

Who sells Medicare Part D?

Medicare Part D plans are sold by private insurance companies . These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing.

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

What is coinsurance and copayment?

Copayments and coinsurance are the amounts that you must pay once your plan’s coverage does begin. A copayment is usually a fixed dollar amount (such as $5) while coinsurance is most often a percentage of the cost (such as 20 percent). Plans might have different copayment or coinsurance amounts for each tier of drugs.

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

What is the average Medicare Part D premium for 2021?

The average Part D plan premium in 2021 is $41.64 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

How much will Part D cost in 2021?

You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021. Once you reach the coverage gap, you will pay up to 25 percent of the cost of covered brand name and generic drugs until you reach total out-of-pocket spending of $6,550 for the year in 2021.