What is the maximum penalty for not having health insurance?

· Now, we round to the nearest $0.10, so your Part D penalty would be $38 per month. In all of these examples, your final calculation should be rounded to the nearest 10 cents. This is the fee you’ll have to pay in addition to your regular Part D premium each month. This fee does not go away for the life of the policy.

Can you be penalized for not enrolling in Medicare?

· The penalty to be paid is 10% of your premium for every 12 months in which you were eligible for Medicare Part B but delayed signing up. For example, if you sign up two years after your eligibility date, you will be required to pay your Part B monthly premium plus an additional 20% of the premium (10% x 2 years) for as long as you have Medicare Part B.

Why is there a penalty for not having health insurance?

· Yes. If you aren’t covered by one of the exceptions listed below, you can be charged up to 10 percent more for Medicare Part B — the part of Medicare that provides …

Is there a penalty for not signing up for Medicare?

· The Medicare Part A late enrollment penalty is 10 percent of the Part A premium, which must be paid for twice the number of years for which you were eligible for Part A but did …

What Is the Medicare Part D Penalty?

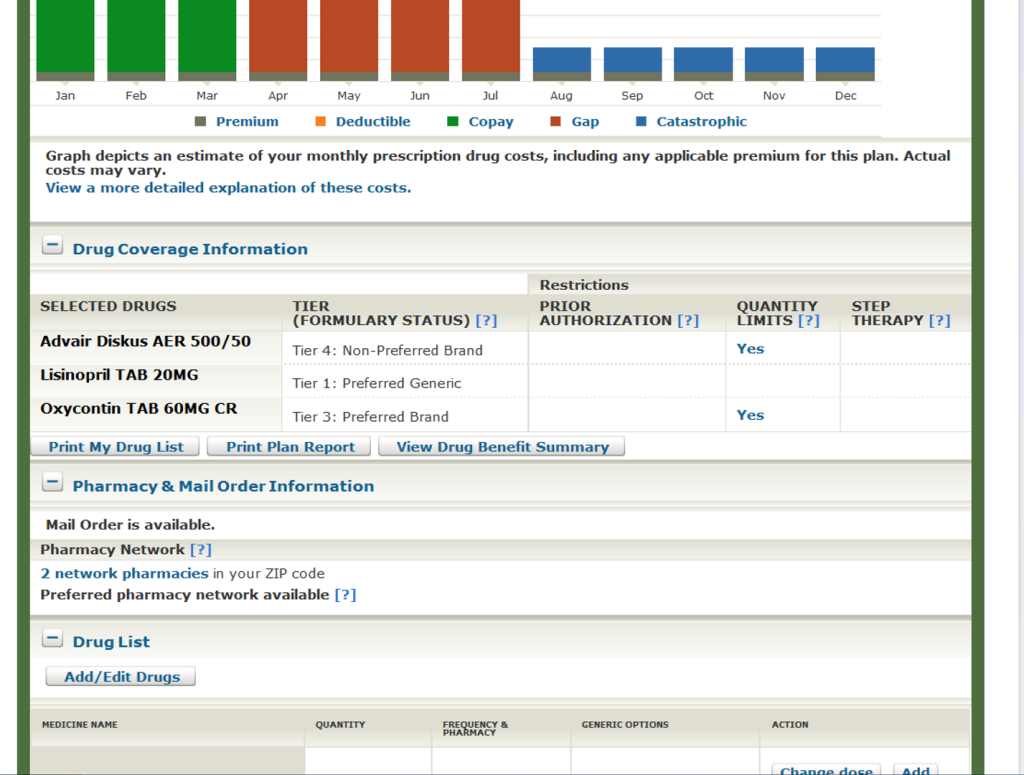

For starters, Medicare Part D, also called your prescription drug plan, is a health insurance plan that helps pay for prescriptions.

Medicare Part D Penalty For Late Enrollment

If you’re looking for a Part D penalty calculator, Amplicare has a useful one. Simply put in your birthday, and it will calculate how many months you've gone without coverage. You'll see the penalty addition to your Part D premium without having to do any calculations yourself.

Do I Have a Part D Penalty?

If you’re unsure about whether you will end up owing a penalty, you can contact us at any time.

Avoiding the Medicare Part D Penalty

In order to avoid the Medicare Part D penalty, don’t go without creditable drug coverage.

How to Compare Drug Plan Costs

Comparing drug plan costs can seem challenging, but the Medicare Part D Cheat Sheet gives you the power to do it on your own.

When to apply for Medicare

It is typically best to enroll in Medicare when you first become eligible as signing up late usually attracts a penalty which will lead to avoidable extra expenses. This is not always the case though.

When do you become eligible?

Work history: Individuals who have worked (or whose spouses have worked) for at least 10 years and have been paying Medicare taxes through their employment are eligible for premium-free Medicare Part A. If this is your case, you should be automatically enrolled into Part A of Medicare.

What are the Penalties for Late Enrollment?

Late enrollment penalties vary depending on several factors including how long the individual was without coverage but eligible, the reason for the lack of coverage, and the type of penalty (i.e. Part B or Part D.)

What happens if you don't tell Medicare about your prescription?

If you don’t tell your Medicare plan about your previous creditable prescription drug coverage, you may have to pay a penalty for as long as you have Medicare drug coverage.

How long can you go without Medicare?

Your plan must tell you each year if your non-Medicare drug coverage is creditable coverage. If you go 63 days or more in a row without Medicare drug coverage or other creditable prescription drug coverage, you may have to pay a penalty if you sign up for Medicare drug coverage later. 3. Keep records showing when you had other creditable drug ...

How to avoid Part D late enrollment penalty?

3 ways to avoid the Part D late enrollment penalty. 1. Enroll in Medicare drug coverage when you're first eligible. Even if you don’t take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little ...

What is creditable prescription drug coverage?

Prescription drug coverage (for example, from an employer or union) that's expected to pay, on average, at least as much as Medicare's standard prescription drug coverage.

How long do you have to be on Medicare if you are not on Social Security?

If you wish to do so, contact the SSA . If you are not yet on Social Security, you have an initial window of seven months , sandwiched around your 65th birthday, to enroll in Medicare. Updated December 28, 2020.

How long can you delay Part B?

In this case, you can delay signing up for Part B until your employment ends. When that happens, you have eight months to sign up without incurring the penalty.

What is the Medicare rate for 2021?

Medicare Part A, which covers hospitalization, comes at no cost for most recipients, but Part B carries premiums. The base rate in 2021 is $148.50 a month.

What is the penalty for late enrollment in Medicare?

There are special circumstances that could exempt beneficiaries from a penalty. The Medicare Part A late enrollment penalty is 10 percent of the Part A premium, which must be paid for twice the number of years for which you were eligible for Part A but did not sign up. For example, if you were eligible for Part A for two years before finally ...

What happens if you don't sign up for Medicare?

If you don’t sign up for Medicare when you first become eligible, you may face a late enrollment penalty. Learn how much these penalties are and how you can avoid them.

How much does Medicare add to your premium if you owe a late fee?

If you owe the standard Medicare Part B premium but sign up for Part B a year after you were initially eligible, the late enrollment fee can add another $14.85 per month to your Part B premium.

How much is Medicare Part A 2021?

In 2021, Medicare Part A premiums are either $259 or $471 per month, depending on the amount of Medicare taxes you paid during your lifetime. The 2021 Part A late enrollment penalty can be as high as $26 or $47 per month, depending on your Medicare Part A premium cost.

How long does Medicare enrollment last?

When you first become eligible for Medicare, you have an Initial Enrollment Period. This is a seven-month period that begins three months before you turn 65 years old, includes the month of your birthday, and then continues for three more months thereafter.

What happens if you go 63 days without Medicare?

If you go 63 consecutive days without “creditable drug coverage” after your Initial Enrollment Period is over, you could face a Part D late enrollment penalty if you eventually choose to sign up for a plan. Creditable drug coverage can include: A Medicare Part D plan. A Medicare Advantage plan that offers drug coverage.

What happens if you wait too long to enroll in Medicare?

If you wait too long after your Initial Enrollment Period to sign up for Medicare Part A (hospital insurance), Part B (medical insurance) or Part D (Medicare prescription drug plans), you could be subject to a Medicare late enrollment penalty.

Is it true that Original Medicare has no prescription drug coverage?

Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) make up Original Medicare, and may cover certain prescription drugs in specific cases only.

How would I get a Medicare Prescription Drug Plan?

You can decide to skip prescription drug coverage, because it’s optional under Medicare – only you can decide if this is the right choice for you. But enrolling in a Medicare Prescription Drug Plan is usually easy to do.

If I have no Medicare Prescription Drug Plan, will the Part D late-enrollment period affect me?

If you decided to skip Medicare prescription drug coverage when you were first eligible for it, and then decided to sign up for a Medicare Prescription Drug Plan later, it’s possible that you’ll face the Part D late-enrollment penalty.

How can I avoid the Medicare Part D late-enrollment penalty?

Here are some ways you might avoid the Part D late-enrollment penalty:

How much is the penalty for Part B?

Your Part B premium penalty is 20% of the standard premium, and you’ll have to pay this penalty for as long as you have Part B. (Even though you weren't covered a total of 27 months, this included only 2 full 12-month periods.) Find out what Part B covers.

When will Part B coverage start?

You waited to sign up for Part B until March 2019 during the General Enrollment Period. Your coverage starts July 1, 2019. Your Part B premium penalty is 20% of the standard premium, and you’ll have to pay this penalty for as long as you have Part B. (Even though you weren't covered a total of 27 months, this included only 2 full 12-month periods.)

What happens if you don't sign up for Medicare?

Penalties for not signing up for Medicare: Believe it or not, there are penalties for not signing up for Medicare. Now, it’s not like the federal government is forcing you to enroll in Medicare. But, if you don’t sign up during your eligibility window, you are going to face some pretty significant fees. To put it plain and simple, your Medicare is going to cost you more. This can get confusing, so if you have any questions, please give us a call at 844-528-8688.

How long do you have to pay a penalty on Medicare Part D?

Specifically, Medicare law states that you will need to pay a penalty on your Part D premium if you go 63 days after your initial enrollment period without a qualifying prescription plan. Qualifying plans include Part D, a Medicare Advantage Plan, and outside prescription coverage that is at least as good as Medicare Part D (such as from a former employer or union).

How long does the 10% penalty stay in place?

This penalty will remain in place for twice as long as the time you delayed enrolling in Medicare Part A. For example, if you wait three years to enroll in Medicare, you’ll be paying the 10% free for six years.

What happens if you enroll in Medicare Part D late?

If you enroll in Medicare Part D late, you will pay an extra fee on your premiums: 1% of the “national base beneficiary premium” times the number of months for which you deferred enrolling.

How long do you have to wait to enroll in Medicare?

Whether you opt for Original Medicare (Parts A and B) or a Medicare Advantage Plan (Part C), make sure that you do everything that you need to do to get enrolled as soon as you are eligible. Although you have a seven month window, delaying until the end just leaves room for mistakes that could hold things up.

How to contact Medicare if you don't sign up?

Our services are free of charge, and we would love to hear from you. Give us a call at 844-528-8688 or use our easy online contact form to get in touch today.

What to do if you can't make a decision on Medicare?

If you find the enrollment process confusing or intimidating—or if you just can’t make a decision on the right plan for you—talk to a qualified Medicare agent. Our Medicare Solutions Team, for example, can help you find the best plan for you and get enrolled in time. And, our services are 100% free.