Original Medicare

- Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance).

- If you want drug coverage, you can join a separate Medicare drug plan (Part D).

- You can use any doctor or hospital that takes Medicare, anywhere in the U.S.

What are the best Medicare plans?

The amount you must pay for health care or prescriptions before Original Medicare, your Medicare Advantage Plan, your Medicare drug plan, or your other insurance begins to pay. ) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (. coinsurance. An amount you may be required to pay as your share of the cost ...

What is the most comprehensive Medicare supplement plan?

Apr 08, 2022 · Original Medicare is a fee-for-service plan that allows you to go to any doctor or hospital that accepts Medicare. It only pays for 80% of services received, which may not be cost effective if you need a lot of healthcare. In this case, you may choose to supplement your Original Medicare with a Medigap plan.

What is the advantage of traditional Medicare?

Mar 07, 2022 · Original Medicare a federal health insurance program for Americans aged 65 and older and others with qualifying disabilities. It has two parts - Part A and Part B. Each part covers specific health care services. Medicare Part A Medicare Part A covers inpatient care and services.

Are there different Medicare plans?

Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and …

Is Medicare a primary or group plan?

Medicare pays first and your group health plan (retiree) coverage pays second . If the employer has 100 or more employees, then the large group health plan pays first, and Medicare pays second .

Is traditional Medicare the same as Original Medicare?

Original Medicare covers inpatient hospital and skilled nursing services – Part A - and doctor visits, outpatient services and some preventative care – Part B. Medicare Advantage plans cover all the above (Part A and Part B), and most plans also cover prescription drugs (Part D).

What does the term original Medicare mean?

Original Medicare – or “traditional Medicare” – is the fee-for-service program in which the government pays for health care costs you incur. The coverage – which includes Medicare Part A and Medicare Part B – allows you to see a doctor anywhere in the country (as long as the doctor treats Medicare patients).

How do I know if I have Original Medicare?

You will know if you have Original Medicare or a Medicare Advantage plan by checking your enrollment status. Your enrollment status shows the name of your plan, what type of coverage you have, and how long you've had it. You can check your status online at www.mymedicare.gov or call Medicare at 1-800-633-4227.

Can you have Original Medicare and a Medicare Advantage plan?

If you're in a Medicare Advantage Plan (with or without drug coverage), you can switch to another Medicare Advantage Plan (with or without drug coverage). You can drop your Medicare Advantage Plan and return to Original Medicare. You'll also be able to join a Medicare drug plan.

What is not covered by Original Medicare?

Generally, Original Medicare does not cover dental work and routine vision or hearing care. Original Medicare won't pay for routine dental care, visits, cleanings, fillings dentures or most tooth extractions. The same holds true for routine vision checks. Eyeglasses and contact lenses aren't generally covered.

Which program added prescription medication coverage to the original Medicare plan?

Part D adds prescription drug coverage to: Original Medicare. Some Medicare Cost Plans. Some Medicare Private-Fee-for-Service Plans.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

What is Medicare Part B?

Medicare Part B refers to the “medical insurance” portion of Medicare, so it covers doctor’s visits, certain outpatient care like X-rays and lab tests, outpatient surgery, emergency services, some medical supplies, and preventative care, like a yearly wellness check.

How much is Medicare Part B premium 2020?

There is a monthly premium fee you will have to pay with Medicare Part B. In 2020, the monthly premium cost is $144.60. However, the exact monthly fee you will pay is based on your income. If your yearly gross income exceeds a certain amount, you will be required to pay both the monthly premium and an Income Related Monthly Adjustment Amount ...

Who is Ron Elledge?

Ron Elledge is a seasoned Medicare consultant and author of “Medicare Made Easy.”. As a Medicare expert, he regularly consults beneficiaries on Medicare rules, regulations, and strategies.

Does Medicare Advantage cover dental?

Medicare Advantage plans (also known as Part C) are set up like an HMO or PPO with yearly maximum out-of-pocket costs, and may also provide coverage for dental, vision, and hearing needs, which Original Medicare doesn’t cover. Part D plans cover prescription drugs.

What is Medigap insurance?

Medigap insurance is supplemental private health insurance that is specifically offered to cover the “gaps” in Original Medicare coverage. For example, it can help cover the costs of deductibles (except your deductible for Part B for those born after January 1, 2020), copayments, and coinsurance.

Who is Caren Lampitoc?

Caren Lampitoc is an educator and Medicare consultant for Medicare Risk Adjustments and has over 25 years of experience working in the field of Medicine as a surgical coder, educator and consultant.

Does Medicare cover long term care?

Additionally, Original Medicare will not cover the following health-related needs: Long-term care, also called custodial care. Custodial care is considered care for normal activities of daily life, such as getting dressed, using the restroom, or getting dressed.

What is Medicare Part A?

Medicare Part A. Medicare Part A covers inpatient care and services. This is the care you receive when you are admitted to a hospital or skilled nursing facility.

Does Medicare Part B cover deductibles?

Medicare Part B charges a monthly premium based on your yearly income, as well as deductibles, copays and coinsurance. Medicare Part B doesn’t manage costs on benefit periods but as you use covered health services.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What is covered by Part B?

In general, Part B coverage includes things like doctor visits and services (even in the hospital), some preventative screenings and services, ambulance services, outpatient surgery services and mental health care, some durable medical equipment and medically necessary tests like X-rays, MRIs, CT scans and EKGs.

What are the benefits of Medicare Advantage?

Medicare Advantage (also known as Part C) 1 Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. 2 Plans may have lower out-of-pocket costs than Original Medicare. 3 In many cases, you’ll need to use doctors and other providers who are in the plan’s network and service area for the lowest costs. 4 Most plans offer extra benefits that Original Medicare doesn’t cover—like vision, hearing, dental, and more.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

How long does it take to get Medicare if you are 65?

If you are under 65 and get disability benefits, the Social Security Administration will enroll you in Medicare after you have received benefits for 24 months. — Read Full Answer.

Where can I find Medicare Advantage plans?

To begin your search for a plan, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, or contact your local State Health Insurance Assistance Program (or SHIP) at www.shiptacenter.org. — Read Full Answer. Q: How are Medicare Advantage plans different ...

Can I choose Medicare Advantage or Original?

You can choose Original Medicare. This is the traditional fee-for-service plan provided by Medicare. Or, you can choose Medicare Advantage (also known as Part C). You can also get Medicare prescription drug coverage to help cover some of the costs of your prescription drugs. AARP’s Medicare Question and Answer Tool is a starting point ...

How much did you pay for drugs in 2017?

When you and the drug plan have paid a total of $3,700 for drugs in 2017, you enter the coverage gap or doughnut During this second phase, you will pay no more than 40 percent of the plan's price for a brand-name drug and 51 percent for a generic drug. — Read Full Answer.

When can I change my Medicare plan?

A: You can change plans or join original Medicare once a year during the annual open enrollment period, from Oct. 15 through Dec. 7, and your new coverage will begin Jan. 1 of the following year. — Read Full Answer.

Does Medicare pay for Part A?

Medicare will pay its share of the charge for each service it covers.

How much will you pay for prescriptions after the doughnut hole is closed?

A: Once the doughnut hole is closed in 2020, you will pay approximately 25 percent of the cost of your prescriptions until you reach the last phase or catastrophic coverage level. — Read Full Answer

What are the different types of Medicare Advantage plans?

There are several different types of Medicare Advantage plans. The two most popular are: 1 Health Maintenance Organizations (HMOs). HMOs have closed provider networks and you generally must get all but emergency care within your plan’s network. You choose a primary care doctor who oversees all your medical care. Your plan may require you to get a referral for specialist care and prior authorization for certain tests and procedures. HMO plans almost always include Part D prescription drug coverage. 2 Preferred Provider Organizations (PPOs). These plans also have provider networks, but you can still use any provider that accepts Medicare. You’ll pay a lot less out-of-pocket if you stay in your network, however. You don’t have to choose a primary care doctor or need a specialist referral. Most PPO plans also include Part D coverage.

Why is it so hard to give a snapshot of your Medicare Advantage plan?

It’s difficult to give a snapshot of your costs with a Medicare Advantage plan because each one is different . Each company that offers a plan can choose what to charge for premiums, deductibles, and copayment amounts.

What are the two parts of Medicare?

Original Medicare benefits include two parts, Part A and Part B , that provide your hospital and medical insurance. If you have a qualifying work history, your Part A benefits are premium-free. Medicare Part B premiums are set each year by the federal government and most people pay the same standard rate.

Does Medicare cover prescription drugs?

You pay the same amount for covered services from any of these providers, no matter which one you choose for your medical care. There is no coverage for prescription drugs under Original Medicare, but you can enroll in a private Part D plan.

Is there a limit to how much you can pay out of pocket?

There is one thing to keep in mind if you choose Original Medicare benefits. There is no limit to how much you pay out-of-pocket each year. For example, if you need chemotherapy, your 20% responsibility could be an awful lot. For this reason, most people who choose Original Medicare will also buy a Medigap plan.

Does Medicare Advantage have a deductible?

Some Medicare Advantage plans have a deductible and others don’t. Deductibles may apply to inpatient services, outpatient services or Part D. About half of all Medicare Advantage plans with Part D benefits don’t have a Part D deductible.

What is Medicare Supplement?

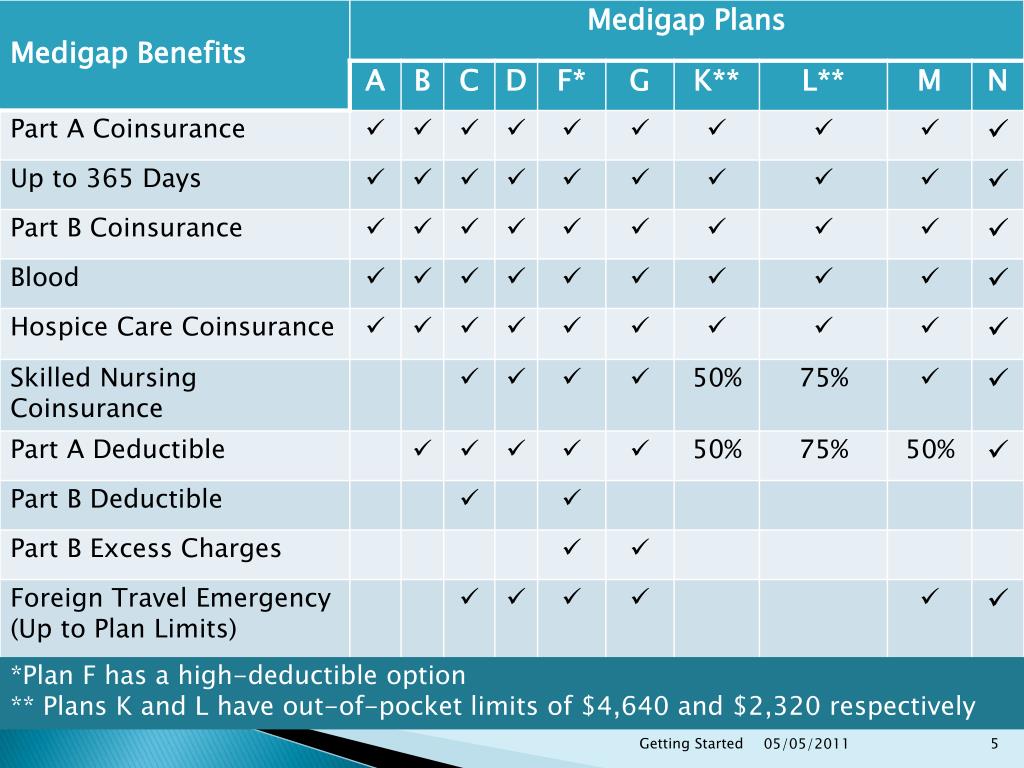

Medicare Supplement insurance plans, also commonly referred to as Medigap plans, help with gaps in coverage from Medicare Parts A and B, including copayments, coinsurance, and deductibles. Medicare Supplement plans generally cover Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted. Additionally, they generally cover: 1 At least 50% of Medicare Part B coinsurance or copayment 2 The first three pints of blood received in a medical procedure 3 Part A hospice care coinsurance or copayment

What is the best Medicare plan?

The best Medicare plans are the ones that fit your needs and budget. Original Medicare covers hospital insurance (Part A) and medical insurance (Part B). Medicare Advantage plans (Part C) are an alternative to Original Medicare, and in addition to covering Part A and Part B, Medicare Advantage plans usually cover prescription drugs, too.

How much does Medicare Supplement cover?

Medicare Supplement plans generally cover Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted. Additionally, they generally cover: At least 50% of Medicare Part B coinsurance or copayment. The first three pints of blood received in a medical procedure.

Does Medicare cover prescriptions?

Prescription medications you take at home are not typically covered by Original Medicare. And if you are wanting prescription drug coverage through a Medicare plan, you have two options: Enroll in a stand-alone Medicare Part D plan (Prescription Drug plan) that works alongside Original Medicare.

What are the different types of Medicare plans?

Types of Medicare Plans: Medicare Advantage Plans. Medicare Advantage plans are offered by private health insurance companies that are approved by Medicare, and in addition to covering hospital (Part A) and medical insurance (Part B), many Medicare Advantage plans also include prescription drug coverage.

Does Medicare Advantage cover prescription drugs?

As you consider a Medicare prescription drug plan, pay attention to the formulary—a list of covered prescription drugs. If you are already taking prescription medications, be sure to check that your prescription is covered before you sign up for a plan.

What is Medicare Part B deductible?

Medicare Part B deductible. Medicare Part B excess charges. Foreign travel emergencies up to plan limits. In terms of cost for Medicare Supplement insurance plans, most have a monthly premium that’s set by the private insurance companies who offer these plans.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is Medicare Part D?

This plan provides prescription drug coverage for a monthly premium, which a person pays in addition to premiums for any other type of Medicare plan they have. A Part D plan’s coverage depends on its cost, drug formulary, and the insurance provider.

Does Medicare cover outpatient services?

Medicare does not typically cover 100% of medical costs, and most plans require that a person meets a deductible before Medicare pays for medical services. Part B also charges a 20% coinsurance on many outpatient services, such as doctor consultations and physical therapy.

What is a Medicare savings account?

Medicare savings accounts (MSA) MSAs consist of two parts, a high-deductible plan and a tax-free savings account dedicated to healthcare costs. The deductible depends on the individual plan, and a person must purchase Medicare Part D to receive prescription drug coverage.

Does Medicare Advantage cover coinsurance?

Those enrolled in Medicare Advantage should not have a Medigap plan. A person cannot use their Medigap policy to pay their Medicare Advantage Plan copayments, deductibles, and premiums.

What is POS in healthcare?

Some plans may have Point of Service (POS) options in which the individual can receive out-of-network treatment. Preferred Provider Organizations (PPOs): A PPO allows people to visit any doctor or hospital they want in most situations. This applies to both in-network and out-of-network healthcare providers.

What is a power of attorney?

A power of attorney permits an individual to conduct business and make decisions on behalf of the insured person. This enables them to pay bills, file taxes, collect Social Security benefits, and choose or change healthcare plans on an individual’s behalf. An alternative is naming a person as a healthcare proxy.

What is an HMO and PPO?

HMO (Health maintenance Organization) PPO (Preferred Provider Organization) SNP (Special Needs plan) These types of plans have different rules about seeing providers in-network and choosing a primary care physician. They also may have different costs and qualifications.

How many types of Medicare Advantage Plans are there?

There are three major types of Medicare Advantage plans. Not all types may be available in your area. You also may not be eligible for all types, such a Special Needs Plans. You may be familiar with some types of Medicare Advantage plans as they are like employer-sponsored plans.

Do PPOs require referrals?

Unlike an HMO, PPO health plans typically don’t require a referral for care by a specialist. However, if you use out-of-network health care providers or specialists, you may be required to pay a higher portion of the cost for covered services.

What is Medicare Advantage?

Medicare Advantage (also called Part C) plans are a way to get your Original Medicare benefits from a private insurance company. Most Medicare Advantage plans offer extra benefits, such as prescription drug coverage, routine dental, routine hearing, routine vision, and fitness benefits.

Do I need a referral to see a specialist?

Need referral to see specialist: yes. Need to use network providers to be covered: generally yes except emergencies and out of area dialysis. Less common plan options include PFFS (Private Fee for Service) HMO Point-of-Service (HMO POS) and Medical Savings Account (MSA) plans.

What is a SNP plan?

SNP (Special Needs plan) People who qualify for Special Needs Plans must meet certain qualifications. Special Needs plans are generally only for: People with certain chronic conditions. For example, some SNPs are for people with diabetes. In most cases, SNPs, like HMOs, require you to have a primary care doctor.

Can I see a doctor with PFFS?

People with PFFS plans can see any Medicare-approved doctor or provider that accepts the plans payment terms. Not all providers will. You don’t need to choose a primary care doctor and you don’t have to get a referral to see a specialist. PFFs plans are generally less commonly available than HMOs and PPOs.