Some of the items and services Medicare doesn't cover include:

- Long-term care (also called Custodial care )

- Most dental care

- Eye exams related to prescribing glasses

- Dentures

- Cosmetic surgery

- Acupuncture

- Hearing aids and exams for fitting them

- Routine foot care

What role does Medicare play in long term care?

There seems to be quite a bit of confusion about how Medicare and Medicaid play a role in long-term care situations. Medicare is health insurance for those who have reached the age of 65. Medicare does not pay long-term care costs. Medicaid is the safety net program for impoverished people who have no means of paying for care. Medicaid does cover long-term care costs. However, the majority of care provided is for end-of-life care in a facility.

Are you expecting Medicare to pay for long-term care?

Those expecting Medicare to cover all of their LTC expenses need to re-evaluate how they will pay for long-term care should the need ever arise. Medicare is unlikely to pay for their LTC. There are multiple ways to pay for long-term care. An individual should compare all the options and develop a plan to pay for LTC.

Does Medicaid cover long term care?

Medicaid does not require the sale of homes before granting eligibility ... A large part of insurance coverage of long-term care consists of Medicare supplemental insurance payments for skilled nursing facility copayments. While Medicare will pay for ...

What is the average cost of long term care?

That’s not the case with long term care costs. Over the last twenty years, long term care costs have risen at a rate faster than some income sources have kept up with. That presents a unique challenge, as many of these costs are largely unavoidable ...

Which services are not typically covered by Medicare?

Some of the items and services Medicare doesn't cover include:Long-Term Care. ... Most dental care.Eye exams related to prescribing glasses.Dentures.Cosmetic surgery.Acupuncture.Hearing aids and exams for fitting them.Routine foot care.

What is excluded in a long-term care policy?

Some of the more common exclusions in policies covering long term care services are: Mental illness, however, the policy may NOT exclude or limit benefits for Alzheimer's Disease, senile dementia, or demonstrable organic brain disease. Intentionally self-inflicted injuries. Alcoholism and drug addiction.

Which of the following is not a benefit trigger under long-term care policies?

Which of the following is not a benefit trigger under long-term care policies? Financial need is not a benefit trigger for long-term care policy benefits.

What service is not paid under Medicare Part B?

Medicare will not pay for medical care that it does not consider medically necessary. This includes some elective and most cosmetic surgery, plus virtually all alternative forms of medical care such as acupuncture, acupressure, and homeopathy—with the one exception of the limited use of chiropractors.

Which of the following is not provided under Part A of Medicare?

Part A does not cover the following: A private room in the hospital or a skilled nursing facility, unless medically necessary. Private nursing care.

Which of the following provisions is not required to be included in qualified long-term care policies?

Which of the following is not a requirement for qualified long-term care plans? Long-term care policies cannot accrue cash value. The correct answer is: Policies must accrue cash value.

Which of the following types of LTC is not provided in an institutional setting?

Which of the following types of LTC is NOT provided in an institutional setting? Home health care is given in the home, but skilled nursing, intermediate, and custodial care may all be provided in an institutional setting.

What triggers a long-term care claim?

Answer: Most long-term-care insurance policies require two kinds of benefit triggers before they'll pay – either you need help with two out of six activities of living (which generally include bathing, dressing, toileting, eating, transferring and continence) or you have severe cognitive impairment.

Does Medicare cover long-term care?

Medicare doesn't cover long-term care (also called custodial care) if that's the only care you need. Most nursing home care is custodial care, which is care that helps you with daily living activities (like bathing, dressing, and using the bathroom). You pay 100% for non-covered services, including most long-term care.

Which of the following services is not covered under Medicare Part B quizlet?

Which of the following is not covered by Medicare Part B? Medicare Part B covers outpatient services, rehab services, medical equipment (but not adaptive equipment), diagnostic tests, and preventative care. Eye, hearing and dental services are not covered by any part of Medicare and require supplemental insurance.

What isn't paid by Medicare Part B while the patient is in a SNF?

Screening and preventive services are not included in the SNF PPS amount but may be paid separately under Part B for Part A patients who also have Part B coverage. Screening and preventive services are covered only under Part B.

What diagnosis codes are not covered by Medicare?

Non-Covered Diagnosis CodesBiomarkers in Cardiovascular Risk Assessment.Blood Transfusions (NCD 110.7)Blood Product Molecular Antigen Typing.BRCA1 and BRCA2 Genetic Testing.Clinical Diagnostic Laboratory Services.Computed Tomography (NCD 220.1)Genetic Testing for Lynch Syndrome.More items...•

What does Part B of Medicare pay for?

Medicare Part B helps cover medically-necessary services like doctors' services and tests, outpatient care, home health services, durable medical equipment, and other medical services. Part B also covers some preventive services. Look at your Medicare card to find out if you have Part B.

What is not covered by Medicare in Australia?

Medicare does not cover: ambulance services; most dental examinations and treatment; most physiotherapy, occupational therapy, speech therapy, eye therapy, chiropractic services, podiatry or psychology services; acupuncture (unless part of a doctor's consultation);

Does Medicare Part B pay for prescriptions?

Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. covers a limited number of outpatient prescription drugs under certain conditions.

What type of care is not covered by Medicare quizlet?

Medicare Part A does not cover custodial or long-term care. Following is a breakdown of Part A SNF coverage, and the cost-sharing amounts that must be paid by the enrolled individual: -During the first 20 days of a benefit period, Medicare pays for all approved charges.

What services does Medicare cover?

Dentures. Cosmetic surgery. Acupuncture. Hearing aids and exams for fitting them. Routine foot care. Find out if Medicare covers a test, item, or service you need. If you need services Medicare doesn't cover, you'll have to pay for them yourself unless you have other insurance or a Medicare health plan that covers them.

Does Medicare cover everything?

Medicare doesn't cover everything. Some of the items and services Medicare doesn't cover include: Long-Term Care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

Does Medicare pay for long term care?

Medicare and most health insurance plans don’t pay for long-term care. (also called. custodial care. Non-skilled personal care, like help with activities of daily living like bathing, dressing, eating, getting in or out of a bed or chair, moving around, and using the bathroom.

How long does it take to get discharged from a long term care hospital?

You’re transferred to a long-term care hospital directly from an acute care hospital. You’re admitted to a long-term care hospital within 60 days of being discharged from a hospital.

What is Medicare Part A?

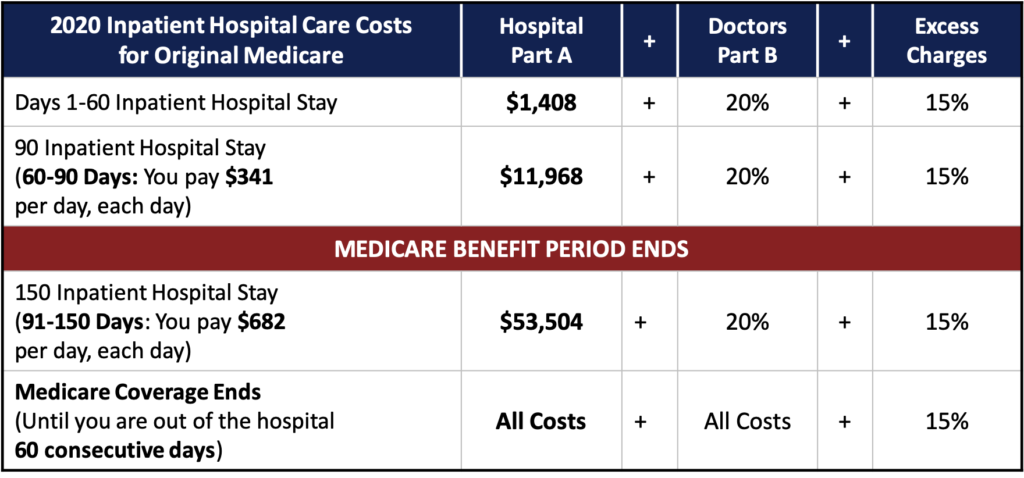

Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. covers the cost of long-term care in a. long-term care hospital. Acute care hospitals that provide treatment for patients who stay, on average, more than 25 days.

When does the benefit period end?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins. ...

How long does an acute care hospital stay?

Acute care hospitals that provide treatment for patients who stay, on average, more than 25 days. Most patients are transferred from an intensive or critical care unit. Services provided include comprehensive rehabilitation, respiratory therapy, head trauma treatment, and pain management. .

Do you have to pay a deductible for long term care?

Each day after the lifetime reserve days: All costs. *You don’t have to pay a deductible for care you get in the long-term care hospital if you were already charged a deductible for care you got in a prior hospitalization within the same benefit period.

Does Medicare Pay For A Skilled Nursing Facility?

Medicare does not cover the full amount of time in a skilled nursing facility beyond what is required by its regulations. Medicare covers SNF care as follows:

Does Medicare Pay For Home Health Care Coverage?

Medicare covers the expenses of having an agency give part-time or intermittent health care services in the patient’s home, but this coverage is limited, and the patient must need skilled assistance. The following conditions must be met to qualify for Medicare’s home health care benefit:

Medigap Does Not Pay For Long-Term Care

Medigap plans, like Medicare, only cover a portion of long-term care services. Medigap policies are meant to fill in the gaps in Medicare caused by the numerous deductibles, co-payments, and other similar restrictions. These plans strive to fill in where Medicare leaves off.

How To Pay For Long-Term Care At A Fraction Of The Cost

A long-term care annuity is a hybrid annuity that is set up to assist in paying for various long-term care services and facilities without causing retirement funds to be depleted. To create a tax-free long-Term Care Insurance benefit, an LTC annuity doubles (200%) or triples (300%) the investment (based on medical records).

What is Medicaid for low income?

Medicaid pays for health care services for those individuals with low income and assets who may incur very high medical bills.

What is a Medicaid certified nursing home?

Medicaid certified nursing homes deliver specific medically indicated care , known as Nursing Facility Services , including: Medicaid coverage for Nursing Facility Services only applies to services provided in a nursing home licensed and certified as a Medicaid Nursing Facility (NF).

How long does a person live with hospice?

You have elected to no longer seek a cure. Your life expectancy is six months or less. Hospice care may be received in your home, in a nursing home, or a hospice care facility. Short-term hospital stays and inpatient care may also be approved for Medicare payment (for caregiver respite).

How long can you stay in an SNF?

If your stay in an SNF exceeds 100 days, or your ability to pay co-pays ends before the 100th day is reached, you may no longer be eligible to stay in the Medicare-certified SNF under Medicare coverage.

What does the VA pay for?

The VA may also pay for long-term care services required by veterans who do not have service-related disabilities but are incapable of paying for essential care. In these cases, services may require a sliding scale co-pay based on patient income level.

Can you recover Medicaid for nursing home?

If you received Medicaid coverage for long-term care services, the state can choose to recoup Medicaid costs. Federal law provides states with the ability to recover any or all costs incurred by Medicaid for long-term care services, including nursing home, home, or community-based services.

Does Medicare pay for physical therapy?

Provided you meet the above conditions, Medicare will pay a portion of the costs during each benefit period for a limited number of days.

What is long term care?

Long-term care, often called custodial care, is a range of services and support to meet health or personal care needs over an extended period of time. This is non-medical care provided by non-licensed caregivers.

How many years of nursing home care is needed at 65?

20% of those turning 65 will need care for longer than five years. About 35% of people who reach age 65 are expected to enter a nursing home at least once in their lifetime.

What is considered qualified medical expenses?

According to the IRS, qualified medical expenses “also include amounts paid for qualified long-term care services and limited amounts paid for any qualified long-term care insurance contract.”. Qualified long-term care services include maintenance and personal care services that a chronically ill individual requires.

What is a combination life insurance?

Combination or hybrid products–life insurance with a long-term care rider. Consumers tend to worry that they will lose the money they spend on long-term care insurance if they don’t use it. In recent years, insurance companies have taken steps to ease these concerns.

Why don't people qualify for medicaid?

Those who don’t qualify for Medicaid because their assets are too high have to pay for long-term care. Then, once their assets are low enough, they can qualify for Medicaid coverage. Every state has its own enrollment process, qualification criteria and policies.

How many people are expected to enter nursing homes at 65?

About 35% of people who reach age 65 are expected to enter a nursing home at least once in their lifetime. The need for long-term care comes into play when the aging process begins to take effect and one loses the ability to perform activities of daily living (ADL).

Why is a person in a nursing home?

The person is in a nursing home because she is not safe at home and needs help with ADL. It doesn’t take a nurse to bathe a person in her home. Contrast that to skilled care. The person who had a stroke goes to a nursing home for rehabilitation.