What is the earliest age you can get Medicare?

You may apply for Medicare at any age if you meet one of the following criteria:

- your receive Social Security disability or Railroad Retirement Board (RRB) disability insurance

- you have specific medical conditions, such as amyotrophic lateral sclerosis (ALS) or end stage renal disease (ESRD)

- a family member is enrolled in Medicare

What is the minimum age to qualify for Medicare?

Medicare is a federal health insurance program for older Americans and people with certain disabilities. At what age do you qualify for Medicare? In most cases, the minimum age for Medicare is 65. People who are younger than age 65 may also qualify in certain circumstances. It’s important to know that qualifying for Medicare is not automatic.

What is the age to begin madicare or Medicaid?

While most beneficiaries are people aged 65 or older, others receive these services at a younger age due to a qualifying disability. Medicare is the U.S. national health insurance program for those 65 and older or with qualifying disabilities.

How to enroll in Medicare if you are turning 65?

- You have no other health insurance

- You have health insurance that you bought yourself (not provided by an employer)

- You have retiree benefits from a former employer (your own or your spouse’s)

- You have COBRA coverage that extends the insurance you or your spouse received from an employer while working

Do I automatically get Medicare when I turn 65?

You automatically get Medicare when you turn 65 Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care. Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

What happens if you don't enroll in Medicare Part A at 65?

The Part A penalty is 10% added to your monthly premium. You generally pay this extra amount for twice the number of years that you were eligible for Part A but not enrolled. For example, suppose that: You were eligible for Medicare in 2020, but you didn't sign up until 2022.

Will the Medicare age be raised to 67?

3 The retirement age will remain 66 until 2017, when it will increase in 2-month increments to 67 in 2022. Several proposals have suggested raising both the normal retirement age and the Medicare eligibility age.

What part of Medicare is required at 65?

You should enroll in Part A and Part B when you turn 65. In this case, Medicare pays before your employer insurance. This means that Medicare is the primary payer for your health coverage.

How much does Medicare cost at age 62?

Reaching age 62 can affect your spouse's Medicare premiums He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

Can you decline Medicare coverage?

Declining Medicare completely is possible, but you will have to withdraw from your Social Security benefits and pay back any Social Security payments you have already received.

Is Medicare dropping to age 60?

Regardless of the outcome, the eligibility age for Medicare will not change overnight. Lowering the eligibility age is no longer part of the U.S. Government's budget for Fiscal Year 2022. So, the Medicare eligibility age will not see a reduction anytime in the next year.

Is it better to take Social Security at 62 or 67?

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.

What age is full retirement for 1955?

66 and 2 monthsIf you were born between 1955 your full retirement age is 66 and 2 months (En español) If you start receiving benefits at age 66 and 2 months you get 100 percent of your monthly benefit. If you delay receiving retirement benefits until after your full retirement age, your monthly benefit continues to increase.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

How many months before I turn 70 should I apply for Social Security?

four monthsYou need to apply for benefits. You can do this starting four months before the date that you want your benefits to begin. To get the maximum amount, you'll want the benefits to start the month you turn 70.

Is Medicare Part A free?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

Do I Automatically Get Medicare When I Turn 65?

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift...

What if I’m Not Automatically Enrolled at 65?

If your Medicare enrollment at 65 is not automatic, but you want to enroll, here are some more magic numbers.

Is Medicare Free at Age 65?

While Medicare Part B has a standard monthly premium, 99 out of 100 people don’t have to pay a premium for Medicare Part A. Still, no part of Medic...

How Much Does Medicare Cost at Age 65?

The standard premium for Part B modestly increases year over year. Part A costs also can increase, including the annual deductible and other coinsu...

Can You Get on Medicare at Age 62?

No, but while the standard age of eligibility remains 65, some call for lowering it. In a recent GoHealth survey, among respondents age 55 and olde...

Can a 55-Year-Old Get Medicare?

While 65 has always been Medicare’s magic number, there are a few situations where the Medicare age limit doesn’t apply, and you may be able to get...

What is Medicare Part A?

Medicare is a public health insurance program designed for individuals age 65 and over and people with disabilities. The program covers hospitalization and other medical costs at free or reduced rates. The hospitalization portion, Medicare Part A, usually begins automatically at age 65. Other Medicare benefits require you to enroll.

What happens if you decline Medicare?

Declining. Late enrollment penalties. Takeaway. If you do not want to use Medicare, you can opt out, but you may lose other benefits. People who decline Medicare coverage initially may have to pay a penalty if they decide to enroll in Medicare later. Medicare is a public health insurance program designed for individuals age 65 and over ...

Is there a penalty for not signing up for Medicare Part B?

If you choose not to sign up for Medicare Part B when you first become eligible, you could face a penalty that will last much longer than the penalty for Part A.

Does Medicare Advantage have penalties?

Medicare Part C (Medicare Advantage) is optional and does not have penalties on its own, but penalties may be included for late enrollment in the parts of Medicare included within your Medicare Advantage plan.

Is Medicare mandatory at 65?

While Medicare isn’t necessarily mandatory, it is automatically offered in some situations, and may take some effort to opt out of.

Is Medicare Part D mandatory?

Medicare Part D is not a mandatory program, but there are still penalties for signing up late. If you don’t sign up for Medicare Part D during your initial enrollment period, you will pay a penalty amount of 1 percent of the national base beneficiary premium multiplied by the number of months that you went without Part D coverage.

Do You Have to Sign up For Medicare if You Are Still Working?

The most common reason for people not signing up for Medicare when they turn 65 is because they are still working. Because they’re still working, they’re likely covered under their employer’s health insurance plan and are also unlikely to be collecting Social Security retirement benefits.

Can I Get Social Security and Not Sign up for Medicare?

Yes and no. Medicare Part B is optional. If you’re automatically enrolled in Medicare Part A, you will be automatically enrolled in Part B and then given the option of opting out. You may still continue to receive your Social Security benefits without having Part B.

How long do you have to pay Medicare taxes to get premium free?

You will qualify for premium-free Medicare Part A benefits if you worked and paid Medicare taxes for at least 10 full years (40 quarters).

What happens if you don't sign up for Medicare?

If you do not sign up for Medicare Part A or Part B when you first become eligible, you may be subject to a late enrollment penalty if you choose to sign up later on. The Part A late enrollment penalty is only applicable to beneficiaries who do not qualify for premium-free Part A (which we’ll outline below).

What is the cost of Medicare Part B in 2021?

Most beneficiaries pay the standard Part B premium of $148.50 per month in 2021. Some higher income-earners will pay more for their Part B coverage.

How much will Medicare pay in 2021?

You will pay $259 per month in 2021 for Medicare Part A if you paid Medicare taxes for between 30 and 39 quarters. If you paid Medicare taxes for fewer than 30 quarters, your Part A premium will be $471 per month in 2021. If you do not qualify for premium-free Part A, you will need to manually enroll in Medicare Part A.

Is it mandatory to enroll in Medicare Advantage?

It is not mandatory to enroll in Medicare Advantage plans or Medicare Part D prescription drug plans. However, Part D plans also have late enrollment penalties if you choose not to sign up but decide you want a plan later.

Is Medicare mandatory for seniors?

Health Insurance Coverage Options for Seniors. Medicare is not mandatory, but you could face late enrollment penalties for not signing up when you’re first eligible. Learn more about Medicare enrollment and how it affects you. More than 61.2 million people in the United States are Medicare beneficiaries, making it one of ...

Can you delay Medicare enrollment?

Late enrollment penalties do not apply to everyone who delays coverage, however. For example, if you delay enrollment because you have employer-provi ded health insurance coverage , you may be able to enroll in Medicare Part A and/or Part B at a later date without facing a late enrollment penalty.

Answer a few questions to find out

These questions don’t apply if you have End-Stage Renal Disease (ESRD).

Do you have health insurance now?

Are you or your spouse still working for the employer that provides your health insurance coverage?

How old do you have to be to get Medicare?

Medicare eligibility at age 65. You must typically meet two requirements to receive Medicare benefits: You are at least 65 years old. You are a U.S. citizen or a legal resident for at least five years. In order to receive premium-free Part A of Medicare, you must meet both of the above requirements and qualify for full Social Security ...

How long do you have to be a resident to qualify for Medicare?

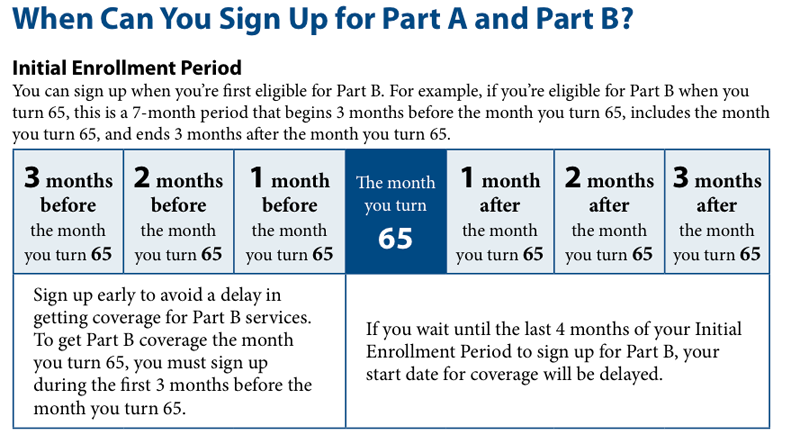

Medicare eligibility chart - by age. - Typically eligible for Medicare if you're a U.S. citizen or legal resident for at least 5 years. - If you won't be automatically enrolled when you turn 65, your Initial Enrollment Period begins 3 months before your 65th birthday.

How much is Medicare Part A 2020?

In 2020, the Medicare Part A premium can be as high as $458 per month. Let’s say Gerald’s wife, Jessica, reaches age 62 and has worked for the required number of years to qualify for premium-free Part A once she turns 65. Because Jessica is now 62 years old and has met the working requirement, Gerald may now receive premium-free Part A.

What is the Social Security retirement rate at 65?

Your Social Security retirement benefits will be reduced to 93.3% if you take them at age 65. - Not typically eligible for Medicare, unless you receive SSA or RRB disability benefits or have ALS or ESRD.

Can a 65 year old spouse get Medicare?

When one spouse in a couple turns 62 years old, the other spouse who is at least 65 years old may now qualify for premium-free Medicare Part A if they haven’t yet qualified based on their own work history. For example, Gerald is 65 years old, but he doesn’t qualify for premium-free Part A because he did not work the minimum number ...

Who can help you compare Medicare Advantage plans?

If you have further questions about Medicare eligibility, contact a licensed insurance agent today. A licensed agent can help answer your questions and help you compare Medicare Advantage plans (Medicare Part C) that are available where you live.

Is Medicaid based on income?

Yes. Medicaid qualification is based on income, not age. While Medicaid eligibility differs from one state to another, it is typically available to people of lower incomes and resources including pregnant women, the disabled, the elderly and children. Learn more about the difference between Medicare and Medicaid.

Do I need to sign up for Medicare when I turn 65?

It depends on how you get your health insurance now and the number of employees that are in the company where you (or your spouse) work.

How does Medicare work with my job-based health insurance?

Most people qualify to get Part A without paying a monthly premium. If you qualify, you can sign up for Part A coverage starting 3 months before you turn 65 and any time after you turn 65 — Part A coverage starts up to 6 months back from when you sign up or apply to get benefits from Social Security (or the Railroad Retirement Board).

Do I need to get Medicare drug coverage (Part D)?

You can get Medicare drug coverage once you sign up for either Part A or Part B. You can join a Medicare drug plan or Medicare Advantage Plan with drug coverage anytime while you have job-based health insurance, and up to 2 months after you lose that insurance.