How much is Medicare Plan B?

Most people pay a monthly premium for Medicare Part B. The standard premium is $148.50 in 2021. You could pay more than that if your income is higher than a certain amount, and less if you qualify for state-based help if your income is lower than a certain amount. A Part B deductible applies to some covered services.

Is Medicare Part B worth the cost?

Yes is the short answer, but there are a few exceptions and details. Part B coverage (physician and outpatient coverage) is a good deal overall. The basic premium you pay only covers about one-fourth of the cost; the federal government pays the rest through general revenue.

Does Medicare Part B cost money?

• Part B Medicare Part B has a monthly premium. The amount you pay depends on your yearly income. Most people pay the standard premium amount of $144.60 (as of 2020) because their individual income is less than $87,000.00, or their joint income is less than $174,000.00 per year.

What does Part B of Medicare pay for?

Medicare Part B pays 100% of the Medicare-approved amount for any covered preventive screening examination appropriately prescribed by a physician. Medicare pays the full 100% of its approved charges for these vaccinations, and the yearly deductible does not apply.

Does Medicare Part B pay everything?

Original Medicare (Parts A & B) covers many medical and hospital services. But it doesn't cover everything. Many people are surprised to learn that Original Medicare doesn't cover prescription drugs. You can buy drug coverage through Medicare Part D, but it's not provided by Part A or Part B.

Does Medicare Part A and B cover 100 percent?

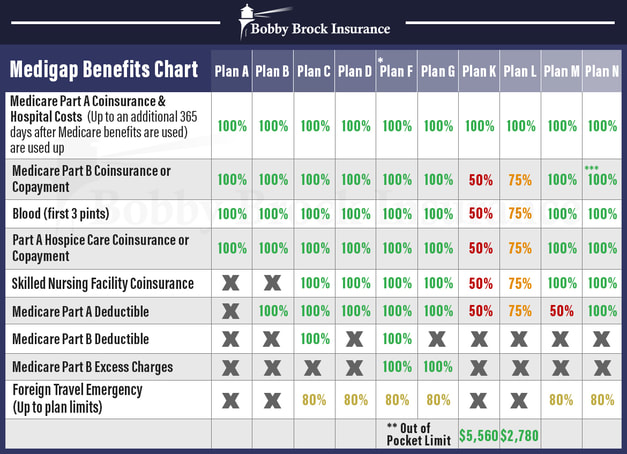

All Medicare Supplement insurance plans generally pay 100% of your Part A coinsurance amount, including an additional 365 days after your Medicare benefits are used up. In addition, each pays some or all of your: Part B coinsurance. first three pints of blood.

What expenses will Medicare Part B pay for?

Part B covers things like:Clinical research.Ambulance services.Durable medical equipment (DME)Mental health. Inpatient. Outpatient. Partial hospitalization.Limited outpatient prescription drugs.

What is difference Medicare Part A and B?

Part A is hospital coverage, while Part B is more for doctor's visits and other aspects of outpatient medical care. These plans aren't competitors, but instead are intended to complement each other to provide health coverage at a doctor's office and hospital.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What services are not covered by Medicare Part B?

Treatment That Is Not Medically Necessary. ... Vaccinations and Immunizations. ... Prescription Drugs You Take at Home. ... Nonprescription Drugs. ... Eyesight and Hearing Exams, Glasses, and Hearing Aids. ... General Dental Work. ... Long-Term Care. ... Supplementing Part B Medical Insurance.

What is covered by Medicare Part C?

Medicare Part C outpatient coveragedoctor's appointments, including specialists.emergency ambulance transportation.durable medical equipment like wheelchairs and home oxygen equipment.emergency room care.laboratory testing, such as blood tests and urinalysis.occupational, physical, and speech therapy.More items...

Does Medicare Part B cover doctor visits?

Medicare Part B pays for outpatient medical care, such as doctor visits, some home health services, some laboratory tests, some medications, and some medical equipment. (Hospital and skilled nursing facility stays are covered under Medicare Part A, as are some home health services.)

Does Medicare cover eye exams?

Medicare doesn't cover eye exams (sometimes called “eye refractions”) for eyeglasses or contact lenses. You pay 100% for eye exams for eyeglasses or contact lenses.

What is not covered by Medicare Part A?

A private room in the hospital or a skilled nursing facility, unless medically necessary. Private nursing care. A television or telephone in your room, and personal items like razors or slipper socks, unless the hospital or skilled nursing facility provides these to all patients at no additional charge.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

How do you get Medicare Part C?

To be eligible for a Medicare Part C (Medicare Advantage) plan:You must be enrolled in original Medicare (Medicare parts A and B).You must live in the service area of a Medicare Advantage insurance provider that's offering the coverage/price you want and that's accepting new users during your enrollment period.

What Do Medicare Part A and Part B Premiums Cover?

Medicare has different parts and plans, but the most common is Original Medicare (Parts A and B). Parts A and B are available to all Americans 65 y...

How Much Does Medicare Part A Cost?

The cost of Medicare Part A premiums depends on whether you or your spouse paid income taxes, and for how long. Most individuals won’t pay a Part A...

How Much Does Medicare Part B Cost?

Your monthly premiums and annual deductible help make up the cost of Medicare Part B. These payment amounts answer the question, “How much is Medic...

What Else Should I Consider?

Original Medicare (Parts A and B) is most common and has remained popular over the years. There are, however, other options that you may want to co...

Does my health play any role in my costs?

No. If you’re enrolled in Original Medicare (Parts A and Part B), your health won’t play a role in how much you pay for your Medicare coverage. Par...

What if I can't afford Part B?

If you’re at least 65 and can’t afford your Medicare Part B premium or deductible, there may be help. Medicare Savings Programs Medicare Savings Pr...

When can I enroll in Plan A and Plan B?

Your first chance to sign up for Original Medicare is during your Initial Enrollment Period (IEP) The Initial Enrollment Period (IEP) is the seven-...

What is Medicare Part A and B?

What Is Original Medicare Part A and B? Part A and Part B are often referred to as “Original Medicare.”. Original Medicare is one of your health coverage choices as part of the Medicare program managed by the federal government. Unless you choose a Medicare health plan, you will be enrolled in Original Medicare.

What is the number to call to find out if Medicare covers a service?

To find out if Medicare covers a service you need, visit medicare.gov and select “What Medicare Covers,” or call 1-800-MEDICARE (1-800-633-4227).

What is fee for service?

It is fee-for-service coverage, meaning that, generally, there is a cost for each service. You generally pay a set amount for your health care (deductible) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (coinsurance / copayment) for covered services and supplies. You usually pay a monthly premium for Part B.

Does Medicare cover everything?

Original Medicare doesn’t cover everything. If you need certain services that Medicare does not cover, you will have to pay out–of-pocket unless you have other insurance to help cover the costs. Even if Medicare covers a service or item, you generally have to pay deductibles, coinsurance, and copayments. Items and services that Medicare does not ...

Do you pay Medicare premiums if you are on Medicare?

You usually do not pay a monthly premium for Part A coverage if you or your spouse paid Medicare taxes while working. For Part B, most people pay a standard monthly premium, but some people may pay a higher Part B premium based on their income.

Does Medicare cover dental care?

Items and services that Medicare does not cover include, but are not limited to, cosmetic surgery, health care you get while traveling outside of the United States (except in limited cases), hearing aids and exams for fitting hearing aids, long-term care, most eyeglasses, routine dental care, dentures, and acupuncture.

Does Medicare cover prescription drugs?

Generally, Original Medicare does not cover prescription drugs, also called Part D, although it does cover some drugs in limited cases such as immunosuppressive drugs (for transplant patients) and oral anti-cancer drugs.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How long does Medicare take to pay for disability?

A person who is entitled to monthly Social Security or Railroad Retirement Board (RRB) benefits on the basis of disability is automatically entitled to Part A after receiving disability benefits for 24 months.

What is the income related monthly adjustment amount for Medicare?

Individuals with income greater than $85,000 and married couples with income greater than $170,000 must pay a higher premium for Part B and an extra amount for Part D coverage in addition to their Part D plan premium. This additional amount is called income-related monthly adjustment amount. Less than 5 percent of people with Medicare are affected, so most people will not pay a higher premium.

How long do you have to be on Medicare if you are disabled?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

How long does it take to get Medicare if you are 65?

For someone under age 65 who becomes entitled to Medicare based on disability, entitlement begins with the 25 th month of disability benefit entitlement.

When do you have to be on Medicare before you can get Medicare?

Individuals already receiving Social Security or RRB benefits at least 4 months before being eligible for Medicare and residing in the United States (except residents of Puerto Rico) are automatically enrolled in both premium-free Part A and Part B.

What is MEC in Medicare?

Medicare and Minimum Essential Coverage (MEC) Medicare Part A counts as minimum essential coverage and satisfies the law that requires people to have health coverage. For additional information about minimum essential coverage (MEC) for people with Medicare, go to our Medicare & Marketplace page.

How long does Part A coverage last?

If the application is filed more than 6 months after turning age 65, Part A coverage will be retroactive for 6 months. NOTE: For an individual whose 65th birthday is on the first day of the month, Part A coverage begins on the first day of the month preceding their birth month.

How much is Medicare Part B 2021?

Medicare Part B premium 2021: $148.50. Your income plays a part in your Part B premium. For 2021, individuals making $88,000 per year or less, and couples making $176,000 or less, pay the standard monthly amount of $148.50 each.

What is Medicare Part A?

Medicare Part A is part of Original Medicare.

What is Medicare Part A coinsurance?

You’re responsible for a daily coinsurance. Coinsurance is the percentage of your medical costs that you pay after you meet your deductible.

How much does Medicare Part A coinsurance increase?

Part A coinsurance increases when your length of stay in a facility increases: 0 to 60 days. 61 to 90 days. You have a lifetime limit of reserve days to use if your stay lasts longer than 90 days. Medicare Part A daily coinsurance rates: Days 0-60: $0. Days 61-90: $371 per day. Lifetime Reserve Days: $742 per day.

What is Medicare Part A deductible?

Medicare Part A Deductible. Most Part A costs come from the inpatient. Inpatient refers to medical care that requires admission to the hospital, usually overnight. hospital deductible. Inpatient care provided at a hospital or skilled nursing facility.

What is disability insurance?

A disability is an illness or injury that limits daily activities. Disability insurance may be part of your health plan, or you may buy it to supplement your health plan. Disability coverage usually pays for some or all of your salary if you can't work. .

Does Medicare Part A and Part B increase premiums?

Not enrolling on time can increase your premium amount. Medicare Part A and Part B cover most of your healthcare. Healthcare is the industry dedicated to maintaining or improving health and well-being. services (hospital and medical). You can add supplemental insurance to help cover the costs of Original Medicare (Parts A and B)

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What services does Medicare cover?

Dentures. Cosmetic surgery. Acupuncture. Hearing aids and exams for fitting them. Routine foot care. Find out if Medicare covers a test, item, or service you need. If you need services Medicare doesn't cover, you'll have to pay for them yourself unless you have other insurance or a Medicare health plan that covers them.

Does Medicare cover everything?

Medicare doesn't cover everything. Some of the items and services Medicare doesn't cover include: Long-Term Care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

Does Medicare pay for long term care?

Medicare and most health insurance plans don’t pay for long-term care. (also called. custodial care. Non-skilled personal care, like help with activities of daily living like bathing, dressing, eating, getting in or out of a bed or chair, moving around, and using the bathroom.

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.