Medicare Advantage (also known as “Part C”) is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. Most plans offer extra benefits Original Medicare doesn’t cover–like vision, hearing, dental, and more.

Full Answer

What does Medicare Advantage cover?

Most Medicare Advantage Plans offer coverage for things Original Medicare doesn't cover, like fitness programs (like gym memberships or discounts) and some vision, hearing, and dental services. Plans can also cover even more benefits.

How many drugs do Medicare Advantage plans cover?

Consult this list of 300 drugs that some Medicare Advantage plans and Medicare Part D prescription drug plans may or may not cover.

What are the different types of Medicare Advantage plans?

Medicare Advantage plans can come in a variety of types: 1 Private Fee-For-Service (PFFS) 2 Health Maintenance Organization (HMO) 3 Preferred Provider Organization (PPO) 4 Medical Savings Accounts (MSA) 5 Special Needs Plans (SNP)

Where can I find information about Medicare Advantage plans?

Medicare Advantage plans are offered by private insurance companies. Plan availability varies from state to state. Click on your state on the map or from the list of states to find Medicare Advantage information and resources for your state. What types of Medicare Advantage plans are available?

How much does Medicare cover in the donut hole?

What is prior authorization for Medicare?

What is the post deductible stage?

About this website

Does Medicare cover Lanreotide injections?

No. In general, Medicare prescription drug plans (Part D) do not cover this drug. Be sure to contact your specific plan to verify coverage information. A limited set of drugs administered in a doctor's office or hospital outpatient setting may be covered under Medical Insurance (Part B).

Does Medicare cover Semaglutide?

Ozempic (semaglutide) is used to improve blood sugar control in adults with type 2 diabetes. There are currently no generic alternatives for Ozempic. Ozempic is covered by most Medicare and insurance plans, but some pharmacy coupons or cash prices could help offset the cost.

Can you have a Medicare Advantage plan and a stand alone drug plan?

Plans can now cover more of these benefits. You can join a separate Medicare drug plan (Part D) to get drug coverage. Drug coverage (Part D) is included in most plans. In most types of Medicare Advantage Plans, you don't need to join a separate Medicare drug plan.

Is everolimus covered by Medicare?

Do Medicare prescription drug plans cover everolimus? Yes. 100% of Medicare prescription drug plans cover this drug.

What is a cheaper alternative to Ozempic?

Other GLP-1 agonist medications similar to Ozempic include Trulicity, Victoza, Bydureon, and Adlyxin. How much does Ozempic cost? The lowest GoodRx price for the most common version of Ozempic is about $810.

How do I get Ozempic for $25 a month?

If you have commercial or private insurance, you may PAY AS LITTLE AS $25 for a 1-month, 2-month, or 3-month supply of Ozempic® for up to 24 months. To receive offer, prescription must be for a 1-, 2-, or 3-month supply.

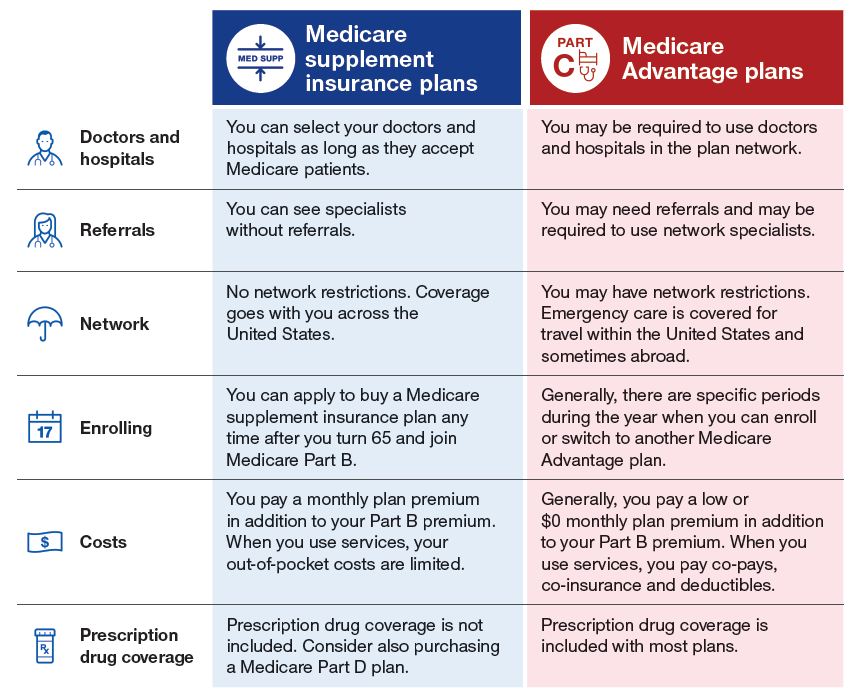

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Can you use GoodRx If you have a Medicare Advantage plan?

While you can't use GoodRx in conjunction with any federal or state-funded programs like Medicare or Medicaid, you can use GoodRx as an alternative to your insurance, especially in situations when our prices are better than what Medicare may charge.

What are 4 types of Medicare Advantage plans?

Below are the most common types of Medicare Advantage Plans.Health Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

Do Medicare Advantage plans cover chemotherapy?

Because chemotherapy is covered under Medicare Part D, a Medicare Advantage plan with Part D included will cover chemotherapy treatments. “When chemo and radiation are administered, the most a Medicare Advantage plan can charge in coinsurance is 20 percent.

What is the price of everolimus?

The cost for everolimus oral tablet 2.5 mg is around $13,779 for a supply of 28, depending on the pharmacy you visit. Prices are for cash paying customers only and are not valid with insurance plans.

Does Medicare B cover oral chemotherapy drugs?

Medicare parts A, B, or D may provide coverage. Part A covers oral and IV chemotherapy when a person receives it as an inpatient in a hospital. Part B pays for some oral chemotherapy medications. It may also cover IV chemotherapy that a person receives in a doctor's office or freestanding clinic.

What is Medicare Advantage?

Most Medicare Advantage Plans offer coverage for things that aren't covered by Original Medicare, like vision, hearing, dental, and wellness programs (like gym memberships). Plans can also cover more extra benefits than they have in the past, including services like transportation to doctor visits, over-the-counter drugs, adult day-care services, ...

What happens if you have a Medicare Advantage Plan?

If you have a Medicare Advantage Plan, you have the right to an organization determination to see if a service, drug, or supply is covered. Contact your plan to get one and follow the instructions to file a timely appeal. You also may get plan directed care.

How much is Medicare Advantage 2021?

In addition to your Part B premium, you usually pay a monthly premium for the Medicare Advantage Plan. In 2021, the standard Part B premium amount is $148.50 (or higher depending on your income). If you need a service that the plan says isn't medically necessary, you may have to pay all the costs of the service.

What is Medicare health care?

Health care services or supplies needed to diagnose or treat an illness, injury, condition, disease, or its symptoms and that meet accepted standards of medicine. under Medicare. If you're not sure whether a service is covered, check with your provider before you get the service.

Is Medicare Advantage covered for emergency care?

In all types of Medicare Advantage Plans, you're always covered for emergency and. Care that you get outside of your Medicare health plan's service area for a sudden illness or injury that needs medical care right away but isn’t life threatening.

Does Medicare cover hospice?

Medicare Advantage Plans must cover all of the services that Original Medicare covers. However, if you’re in a Medicare Advantage Plan, Original Medicare will still cover the cost for hospice care, some new Medicare benefits, and some costs for clinical research studies. In all types of Medicare Advantage Plans, you're always covered for emergency and Urgently needed care.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

What is an HMO plan?

Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis). A network is a group of doctors, hospitals, and medical facilities that contract with a plan to provide services. Most HMOs also require you to get a referral from your primary care doctor for specialist care, so that your care is coordinated.

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

What is Medicare Advantage Plan?

Medicare Advantage plans (Medicare Part C) are a form of private health insurance that provide the same coverage as Medicare Part A and Part B (Original Medicare) and may include additional benefits such as dental, vision and prescription drug coverage. Medicare Advantage plans are widely used in the United States.

How many people will be in Medicare Advantage in 2021?

Medicare Advantage plans are widely used in the United States. In 2021, more than 24 million people are enrolled in Medicare Advantage plans, according to the Kaiser Family Foundation (KFF).1.

What is Medicare Part C?

2. They are an alternative way to get Medicare coverage through private insurance companies instead of the federal government. 3. They provide the same benefits as Original Medicare and may include additional benefits such as dental, vision, prescription drug and wellness programs coverage. ...

How much did Medicare premiums drop in 2020?

In the video below, Medicare expert John Barkett explains that Medicare Advantage premiums dropped by around 14 percent in 2020. If playback doesn't begin shortly, try restarting your device. Videos you watch may be added to the TV's watch history and influence TV recommendations.

What is a HMO plan?

Health Maintenance Organizations (HMOs) These plans feature a network of participating health care providers. With a Medicare HMO, you typically select a primary care physician (PCP). Your PCP coordinates your care and makes referrals to specialists within your plan network when you need additional care.

When is the Medicare open enrollment period?

You also may be able to join or switch plans during the Annual Election Period (AEP, also commonly called the Fall Medicare Open Enrollment Period for Medicare Advantage plans), which runs from October 15 to December 7 every year.

When can I join Medicare for the first time?

If you are enrolling for the first time, you may be able to join a plan during your Initial Enrollment Period, which occurs around your 65th birthday, or around your 24th month of disability (if you’re under 65 and eligible for Medicare).

What is Medicare Advantage?

A Medicare Advantage plan offers the same coverage as Medicare Part A and Part B , and some Medicare Advantage plans may also offer benefits such as vision, hearing and dental coverage. Some plans may also cover prescription drugs. Medicare Advantage plans are offered by private insurance companies. Plan availability varies from state to state.

How many people will be on Medicare in 2021?

Close to 63 million Americans are enrolled in Medicare in 2021, and this number will only continue to rise as members of the baby boomer generation continue to join the 65-and-over demographic. 1

What is a PPO plan?

Preferred Provider Organization (PPO) plans provide a little more freedom by offering some coverage for out-of-network care and not requiring members to obtain a referral before visiting a specialist. PPO plans can come in the form of either regional PPOs or local PPOs .

Does Alaska offer Medicare Advantage?

Alaska. Compare Alaska Medicare plans online, or get assistance from the state resources below. Alaska does not offer Medicare Advantage plans (Part C), but there are still other options for you to explore your Medicare coverage options and have your questions answered. AARP Public Benefits Guide.

Does Medicare cover HMO?

There is no coverage for care received outside of the plan’s network.

Does Maine have Medicare?

Medicare beneficiaries in Maine have a number of resources at their fingertips. The Pine Tree State offers options for those with low incomes to help pay for their Medicare benefits, as well as resources to help pay for prescription drug costs and to help those with disabilities. State of Maine Bureau of Insurance.

What is Medicare Advantage Plan?

A Medicare Advantage Plan is intended to be an all-in-one alternative to Original Medicare. These plans are offered by private insurance companies that contract with Medicare to provide Part A and Part B benefits, and sometimes Part D (prescriptions). Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, ...

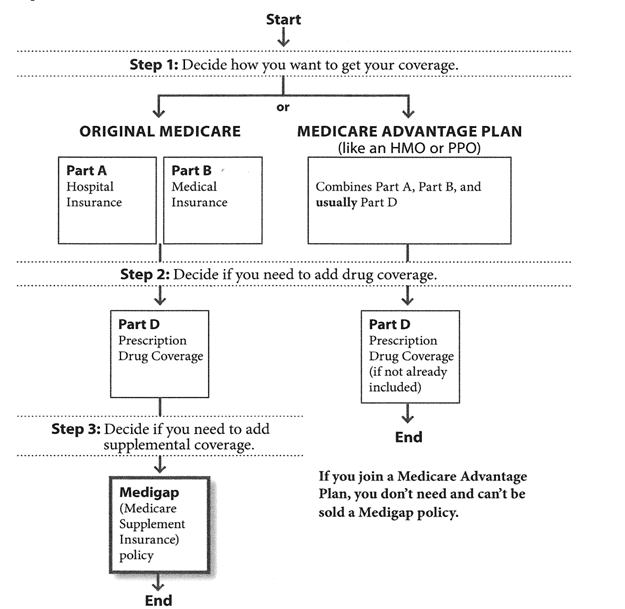

What is Medicare Part A?

Original Medicare. Original Medicare includes Part A (hospital insurance) and Part B (medical insurance). To help pay for things that aren't covered by Medicare, you can opt to buy supplemental insurance known as Medigap (or Medicare Supplement Insurance). These policies are offered by private insurers and cover things that Medicare doesn't, ...

Can you sell a Medigap plan to a new beneficiary?

But as of Jan. 2, 2020, the two plans that cover deductibles—plans C and F— cannot be sold to new Medigap beneficiaries.

Do I have to sign up for Medicare if I am 65?

Coverage Choices for Medicare. If you're older than 65 (or turning 65 in the next three months) and not already getting benefits from Social Security, you have to sign up for Medicare Part A and Part B. It doesn't happen automatically.

Does Medicare cover vision?

Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, and dental. You have to sign up for Medicare Part A and Part B before you can enroll in Medicare Advantage Plan.

Does Medicare automatically apply to Social Security?

It doesn't happen automatically. However, if you already get Social Security benefits, you'll get Medicare Part A and Part B automatically when you first become eligible (you don't need to sign up). 4. There are two main ways to get Medicare coverage: Original Medicare. A Medicare Advantage Plan.

Do I need Part D if I don't have Medicare?

Be aware that with Original Medicare and Medigap, you will still need Part D prescription drug coverage, and that if you don't buy it when you first become eligible for it—and are not covered by a drug plan through work or a spouse—you will be charged a lifetime penalty if you try to buy it later. 5.

Medicare Advantage

You can go to any doctor or hospital that takes Medicare, anywhere in the U.S.

Medicare Advantage

Out-of-pocket costs vary – plans may have different out-of-pocket costs for certain services.

Medicare Advantage

Original Medicare covers most medically necessary services and supplies in hospitals, doctors’ offices, and other health care facilities. Original Medicare doesn’t cover some benefits like eye exams, most dental care, and routine exams.

Are there any restrictions on coverage?

Some Medicare prescription drug plans have restrictions on coverage of deferasirox that may include:

What drug tier is deferasirox typically on?

Medicare prescription drug plans typically list deferasirox on Tier 5 of their formulary. Generally, the higher the tier, the more you have to pay for the medication. Most plans have 5 tiers.

How much does Medicare cover in the donut hole?

Therefore, you may pay more for your drug. Copay Range. $3 – $912. In the Post-Donut Hole (also called Catastrophic Coverage) stage, Medicare should cover most of the cost of your drug.

What is prior authorization for Medicare?

Most Medicare prescription drug plans have prior authorization rules that will require your prescriber to contact your plan before you can get your medication. This is to show that the drug is medically necessary.

What is the post deductible stage?

After your deductible has been satisfied, you will enter the Post-Deductible (also called Initial Coverage) stage, where you pay your copay and your plan covers the rest of the drug cost. In the Donut Hole (also called the Coverage Gap) stage, there is a temporary limit to what Medicare will cover for your drug.