Medicare Part B Give Back plans are special Medicare Advantage (Medicare Part C) plans that return some or all Part B premiums to beneficiaries. These plans are sometimes called Medicare Buy Back plans or Medicare premium reduction plans. Securing one of these Medicare Advantage plans is a great way to put more money in your pocket each month.

Full Answer

How much does Medicare pay Advantage plans?

Sep 16, 2021 · The Medicare Giveback Benefit is a Part B premium reduction offered by some Medicare Part C (Medicare Advantage) plans. If you enroll in a Medicare Advantage plan with this benefit, the plan carrier will pay some or all of your Part B monthly premium. The amount covered can range from 10 cents to the full Part B premium cost ($148.50 in 2021).

Why should I get a Medicare Advantage plan?

Medicare Give Back Benefit. Seniors on Social Security with Medicare Advantage coverage may qualify for the Medicare Give Back Benefit. Here is what you should know. The maximum benefit for 2022 is $148.50-per-month ($1,782 annually). Give back benefits are for Medicare Advantage plan participants only. NOT all Medicare Advantage plans qualify.

What companies offer Medicare Advantage plans currently?

These are Medicare Advantage Plans that work just like all of the other Advantage plans do. The “give back” is a benefit in these particular Advantage plans that works to reimburse for some or all of your Part B premiums. Sometimes you will hear these plans called “premium reduction plans” or “Medicare buyback plans.” What is a Part B Give Back & How Does it Work? You would …

What do you pay in a Medicare Advantage plan?

In order to enroll in a Medicare Advantage plan, you'll need to be enrolled in or eligible for both Medicare Part A and B. To receive the Medicare give back benefit, you'll need to enroll in a plan...

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Be a Medicare beneficiary enrolled in Part A and Part B,Be responsible for paying the Part B premium, and.Live in a service area of a plan that has chosen to participate in this program.Nov 24, 2020

Which Medicare Advantage plans give you money back?

The Medicare Giveback Benefit is a Part B premium reduction offered by some Medicare Part C (Medicare Advantage) plans. If you enroll in a Medicare Advantage plan with this benefit, the plan carrier will pay some or all of your Part B monthly premium.Sep 16, 2021

Is Medicare giving money back?

In order to enroll in a Medicare Advantage plan, you'll need to be enrolled in or eligible for both Medicare Part A and B. To receive the Medicare give back benefit, you'll need to enroll in a plan that offers to pay your Part B monthly premium.

How does the Give Back program work?

If you pay your Medicare Part B premium through Social Security, you'll see the reimbursed amount given back in your Social Security check. If you pay Medicare directly, once you are enrolled in your plan that offers the Medicare Give Back Benefit, you'll pay Medicare the reduced amount.Aug 20, 2021

Do you still pay Medicare Part B with an Advantage plan?

Who Pays the Premium for Medicare Advantage Plans? You continue to pay premiums for your Medicare Part B (medical insurance) benefits when you enroll in a Medicare Advantage plan (Medicare Part C). Medicare decides the Part B premium rate.Nov 8, 2021

Which company has the best Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Will Social Security get a $200 raise?

While each person's Social Security benefit will depend on their earnings and amount of years worked, there is a small group who will be receiving an extra $200 or more per month in their benefit check.Jan 6, 2022

Why did I get an extra Social Security payment this month 2021?

According to the CMS, the increases are due to rising prices and utilization across the healthcare system, as well as the possibility that Medicare may have to cover high-cost Alzheimer's drugs like Aduhelm.Jan 12, 2022

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

What is a Part B premium buyback?

A Part B Premium Giveback is the carrier's coverage of a designated portion of an enrollee's Part B premium. The carrier notifies the Centers for Medicare & Medicaid Services (CMS) and Social Security Administration of this agreement to take on the cost of the specified amount.Feb 18, 2020

What is a Medicare Part B reimbursement?

The Medicare Part B Reimbursement program reimburses the cost of eligible retirees' Medicare Part B premiums using funds from the retiree's Sick Leave Bank. The Medicare Part B reimbursement payments are not taxable to the retiree.

What is Medicare Part B give back?

Part B Premium Reduction Give Back Plans. The Medicare Part B give back plan, or premium reduction plan is a feature of Medicare Advantage. Yet, only some Medicare Advantage plans offer this benefit, and it isn’t available in all areas. Those with this plan may see a higher amount on their Social Security check, ...

How many states will have Medicare Advantage in 2021?

In 2021, there will be 48 states offering a Medicare Advantage plan with a Part B premium reduction. So, it’s fair to say the popularity of these plans is increasing.

What is a Part B premium reduction plan?

The Part B premium reduction plan is just like it sounds. You enroll in the policy, and the carrier pays either part or the whole premium for your outpatient coverage. In the summary of benefits or evidence of coverage , you’ll see a section that says Part B premium buy-down; this is where you can see how much of a reduction you’ll get.

How much does Part B premium cost?

These plans reduce your Part B premium up to the full standard amount of $148.50 each month and add the money to your Social Security check.

Can Medicare Advantage pay Part B?

The Medicare Advantage insurance company can pay either the whole or a portion of the Part B premium for enrollees. Since the Advantage plan handles your claim instead of Medicare, these plans make more sense than a standard Part C policy. How can Medicare Advantage plans give you back some of your Part B premium money?

Is Part B reduction worth it?

Many beneficiaries are unaware of the many limitations that come with Advantage plans. A Part B reduction may not be worth the additional cost-sharing . Beneficiaries on a budget should consider High Deductible Plan G or High Deductible Plan F. The premiums are more affordable than the standard versions.

Who is eligible for Part B buy down?

Who is Eligible for the Part B Buy-Down Plan? Those that pay their own Part B premium will be eligible for the Part B buy-down. But, anyone with Medicaid or other forms of assistance that could pay the Part B premium can’t enroll in these plans.

What Is The Medicare Part B Give Back Benefit?

The Give Back benefit is a benefit offered by some Medicare Advantage plan carriers that can help you reduce your Medicare Part B premium. You should know, however, that the Give Back benefit is not an official Medicare program. This benefit is provided as part of some Medicare Part C plans as a way to encourage participation in a specific plan.

Who Is Eligible For The Medicare Part B Give Back Benefit?

It is pretty easy to qualify for the Medicare Give Back benefit as the eligibility criteria are straightforward. First, you must be enrolled in Original Medicare. You need to have both Medicare Part A and Medicare Part B coverage. Next, you must pay your own monthly Part B premium.

Applying For A Medicare Part B Give Back Benefit

So, what is the enrollment process for the Give Back benefit? Many people are looking to save as much money as possible when it comes to their health care costs, so they want to know how to get signed up for this program. The process is quite simple, so here is how to do it.

The Bottom Line

Since most people on Medicare are receiving Social Security benefits, finding a way to reduce the cost of your health insurance is always a plus. The Medicare Give Back program can do just that by paying for a portion or even all of your Medicare Part B premium.

What is the deadline for Medicare give back benefit?

There is no deadline to qualify for the give back benefit. You must already be enrolled in Medicare Part A and Part B, and you must pay your own monthly Part B premium. You then simply need to enroll in a Medicare Advantage plan that offers this benefit.

What is Medicare Advantage?

Also known as Medicare Part C, Medicare Advantage combines your Original Medicare Part A and Part B benefits into one plan. Many Medicare Advantage plans also include additional benefits, such as prescription drug coverage , dental and vision coverage and fitness programs. R.

What are the benefits of Aetna?

Aetna Medicare Advantage plans take a total approach to your health and wellness.#N#With Aetna Medicare Advantage plans, you get: 1 Health coaching and fitness memberships 2 Hospital, medical and prescription drug coverage in one simple plan 3 Low plan premiums, some as low as $0/month* 4 Doctors and hospitals you know and trust

What is the Part B premium reduction benefit?

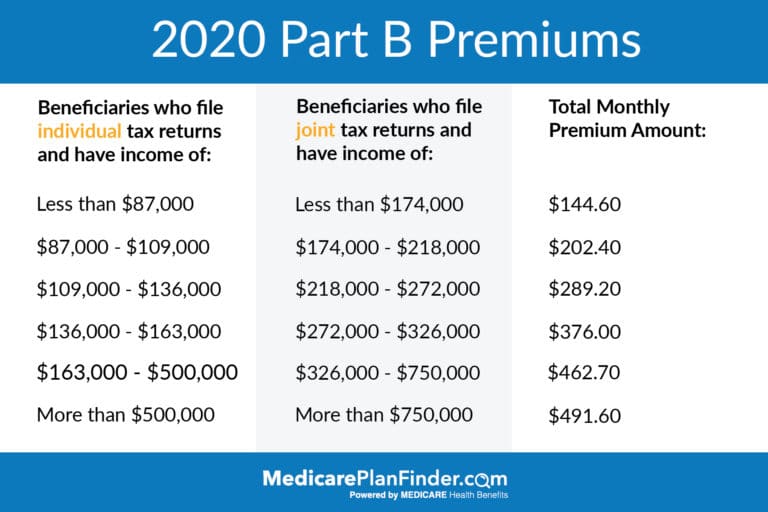

When you're enrolled in Medicare Part B, you must pay a monthly premium of $170.10. The giveback benefit, or Part B premium reduction, is when the Part C Medicare Advantage (MA) plan reduces the amount you pay toward that premium. Your reduction could range from less than $1 to the full premium amount.

How do I receive the giveback benefit?

If you enroll in a plan that offers a giveback benefit, you'll find a section in the plan's summary of benefits or evidence of coverage (EOC) that outlines the Part B premium buy-down. Here, you'll see how much of a reduction you'll get. Or, you can contact the plan directly.

How to find plans that offer the giveback benefit

Not all MA plans offer this benefit, so you must find a plan that does to take advantage of the savings opportunity.

Downsides to the Medicare giveback benefit

While the giveback benefit can help save you money, there are a few things to be aware of when considering enrolling in an MA plan that offers it.

How to qualify for Medicare premium reduction?

To qualify for a premium reduction, you must: Be a Medicare beneficiary enrolled in Part A and Part B, Be responsible for paying the Part B premium, and. Live in a service area of a plan that has chosen to participate in this program.

What happens if you call Medicare?

However, if you call (as noted in the commercial’s small print), your call will be transferred to a licensed insurance agent who may or may not sell plans in your area. And, if there is no plan in your area, you may hear about other plans that are available to you. The best place to start is the Medicare Plan Finder.

What is a reduction in Part B premium?

This is a reduction in the Part B premium you must pay. For example, if a beneficiary is on Social Security, the Part B premium comes out of the monthly benefit before it hits the individual’s bank account. The reduction in the plan’s payment reduces that premium, which means more money in the individual’s bank account.

Does SNP include prescription drug coverage?

A few of these plans do not include prescription drug coverage. Some Special Needs Plans (SNP) also offer this benefit. But, in these cases, the beneficiary may not qualify. For example, there is a SNP for those residing in nursing homes.

What is Medicare Part B give back?

Designed for people that prefer a plan with a set, guaranteed monthly premium refund, WellCare Give Back plans are best for those who believe they have stable health care needs that want a savings they can count on. With Give Back plans, you have the freedom to use your funds for other items as you see fit. It’s a flexible way to think about your healthcare coverage.

How does a give back plan work?

How Give Back plans work. Give Back plans, also known as a dividend, are plans designed to reduce your costs by “giving back” some or all of your Part B premium. The dividend is delivered directly on your Social Security check or appears as a credit on your Medicare Part B Premium Statement.

What is Wellcare Give Back?

What’s more, WellCare Give Back plans come with valuable extras, like dental, vision, hearing, fitness and more - to help you take care of your well-being. Give Back plans are available in select WellCare markets.