Generally, if you are approved for Social Security disability insurance (SSDI

Social Security Death Index

The Social Security Death Index is a database of death records created from the United States Social Security Administration's Death Master File Extract. Most persons who have died since 1936 who had a Social Security Number and whose death has been reported to the Social Security Administration are listed in the SSDI. For most years since 1973, the SSDI includes 93 percent to 96 percent of deaths of i…

Supplemental Security Income

Supplemental Security Income is a United States means-tested federal welfare program that provides cash assistance to individuals residing in the United States who are either aged 65 or older, blind, or disabled. SSI was created by the Social Security Amendments of 1972 and is incorporated in Title 16 of the Social Security Act. The program began operations in 1974.

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

Can I get Medicaid if I Am approved for SSI?

Whether SSI recipients are automatically eligible for and enrolled in Medicaid depends on the state that the recipient lives in. Most states automatically grant Medicaid when you get approved for SSI based on disability.

Do people on SSI usually get Medicare too?

Those who qualify for Supplemental Security Income (SSI) are eligible for Medicaid, while those who receive Social Security Disability Insurance (SSD or SSDI) qualify for Medicare. However, SSD recipients won’t receive medical benefits from Medicare until two years after their application has been approved. Those who receive SSI don’t have to wait before receiving Medicaid.

Does SSI qualify for Medicare?

No benefits are paid for partial disability or short-term disability, she said. The requirements to qualify depend upon your age, income history and other factors, so check the Social Security websiteto learn more about the specific details.

How to get paid to care for someone on SSI?

Medicaid and veterans programs can help alleviate the financial burden of family caregiving

- For Medicaid recipients. All 50 states and the District of Columbia offer self-directed Medicaid services for long-term care.

- For military veterans. Veterans have four plans that they may qualify for. ...

- Getting paid by a family member. ...

- Long-term care insurance. ...

Does SSI cover Medicare?

Will a beneficiary get Medicare coverage? Everyone eligible for Social Security Disability Insurance (SSDI) benefits is also eligible for Medicare after a 24-month qualifying period. The first 24 months of disability benefit entitlement is the waiting period for Medicare coverage.

Does Medicare automatically come with disability?

If you're on SSDI benefits, you won't have to pay a Medicare Part A premium. If you are eligible for Medi-Cal and Medicare, you will automatically be enrolled in Medicare Part D.

How much does Medicare take from SSI?

If your 2020 income was $91,000 to $408,999, your premium will be $544.30. With an income of $409,000 or more, you'll need to pay $578.30. If you receive Social Security benefits, your monthly premium will be deducted automatically from that amount.

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

How do I get Plan B Medicare?

Contact Social Security to sign up for Part B:Fill out Form CMS-40B (Application for Enrollment in Medicare Part B). ... Call 1-800-772-1213. ... Contact your local Social Security office.If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

Who pays for Medicare Part A?

Most people receive Medicare Part A automatically when they turn age 65 and pay no monthly premiums. If you or your spouse haven't worked at least 40 quarters, you'll pay a monthly premium for Part A.

How much is Medicare Part A?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

Supplemental Nutrition Assistance Program (Formerly "Food Stamps")

The Supplemental Nutrition Assistance Program (SNAP) provides help for low-income households to buy the food needed for good health. In most states...

Temporary Assistance For Needy Families (TANF)

The TANF program provides cash block grants to states. TANF gives states the flexibility to determine TANF eligibility rules and to set TANF paymen...

Affordable Health Insurance For Children Who Need It

Medicaid provides free health coverage to most low-income children through state children's health insurance programs. Contact your local state or...

State Or Local Assistance Based on Need

Some states offer state or local assistance based on need to aged, blind, and disabled people through the state welfare department. The state may r...

Social Security, Medicaid and Medicare

Many people receive both SSI and Social Security benefits.Medicaid is linked to receipt of SSI benefits in most States. Medicare is linked to entit...

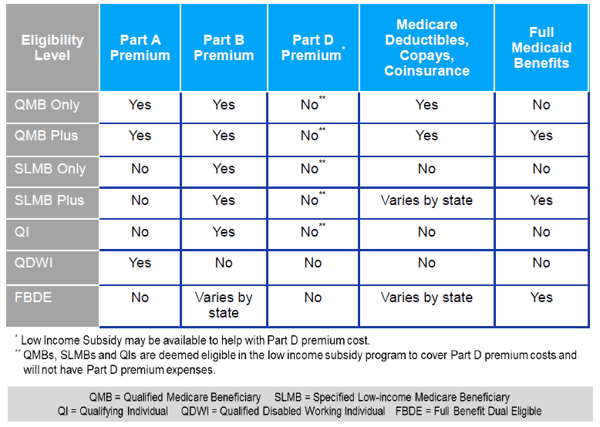

State Programs That Help With Medicare Costs

You may qualify for help with certain Medicare costs under the programs below if:you receive Medicare;your income and resources are limitedThese li...

When Doesmedicare Or Medicaid Start?

SSDI recipients aren't eligible to receive Medicare benefitsuntil two years after their date of entitlement to SSDI (this is the date theirdisabili...

in Which Statesis Medicaid Enrollment Automatic?

The Social Security Administration handles Medicaid enrollmentfor the many states in which Medicaid eligibility is automatic for SSIrecipients. You...

Which Statesmake Medicaid Decisions Based on SSI Standards?

Some states use the same eligibility standards as the federalSSI program but insist on making their own Medicaid decisions. In these states,enrollm...

Which Statesuse Their Own Criteria For Granting Medicaid?

Theremaining states do not automatically grant Medicaid to persons withdisabilities who qualify for SSI because they use their own criteria fordete...

What If Iwas Approved For SSI but Denied Medicaid?

If you receive SSI but were denied Medicaid benefits in a 209(b)state – or any state for that matter, you should appeal the decision to yourstate’s...

What happens if you approve for SSI?

If we approve you for SSI, your State or local public assistance payments will usually stop. Your State may be entitled to collect part of your retroactive SSI benefits as repayment for the money they paid you while we processed your SSI claim.

What is Supplemental Security Income?

SUPPLEMENTAL SECURITY INCOME (SSI) AND ELIGIBILITY FOR OTHER GOVERNMENT AND STATE PROGRAMS. Many people who are potentially eligible for SSI benefits do not know how receiving SSI affects their benefits or payments from other government and State programs.

What is QMB Medicare?

The QMB program helps low-income Medicare beneficiaries by paying Medicare Part A and/or Part B premiums. Medicare providers are not allowed to bill you for Medicare deductibles, coinsurance, and copayments.

How to get a phone number for Medicaid?

To get the phone number for your State Medicaid office, visit Medicare.gov/contacts online. First, choose your state under “Choose your location for contact information,” and then, under “Choose an organization OR topic of interest,” select “State Medical Assistance Office” at the bottom of the list of options.

Can you get Medicare and Social Security?

SOCIAL SECURITY, MEDICAID AND MEDICARE. Many people receive both SSI and Social Security benefits. Medicaid is linked to receipt of SSI benefits in most States. Medicare is linked to entitlement to Social Security benefits. It is possible to get both Medicare and Medicaid. States pay the Medicare premiums for people who receive SSI benefits ...

Can I apply for medicaid if I have SSI?

In most States, if you are an SSI recipient, you may be automatically eligible for Medicaid; an SSI application is also an application for Medicaid. In other States, you must apply for and establish your eligibility for Medicaid with another agency. In these States, we will direct you to the office where you can apply for Medicaid.

Does QDWI pay Medicare?

The QDWI program will pay Medicare Part A premiums only. If you are under age 65, disabled and no longer entitled to free Medicare Hospital Insurance Part A because you successfully returned to work, you may be eligible for a State program that helps pay your Medicare Part A monthly premium.

What is considered income for SSI?

Income, for the purposes of SSI includes: money you earn from work; money you receive from other sources, such as Social Security benefits, workers compensation, unemployment benefits, the Department of Veterans Affairs, friends or relatives; and. free food or shelter.

How long can I get SSI?

You may receive SSI for a maximum of 7 years from the date DHS granted you qualified alien status in one of the following categories, and the status was granted within seven years of filing for SSI: Refugee admitted to the United States (U.S.) under section 207 of the Immigration and Nationality Act (INA);

What is a non-citizen on SSI?

the non–citizen must be in a qualified alien category, and. meet a condition that allows qualified aliens to get SSI benefits. A non–citizen must also meet all of the other requirements for SSI eligibility, including the limits on income, resources, etc.

Why does my SSI stop?

For example, your SSI will stop if you lose your status as a qualified alien because there is an active warrant for your deportation or removal from the U.S. If you are a qualified alien but you no longer meet one of the conditions that allow SSI eligibility for qualified aliens, then your SSI benefits will stop.

What is CAL disability?

Compassionate Allowances (CAL) are a way to quickly identify diseases and other medical conditions that, by definition, meet Social Security’s standards for disability benefits. These conditions primarily include certain cancers, adult brain disorders, and a number of rare disorders that affect children.

How long can you be ineligible for Social Security if you give away a resource?

If you give away a resource or sell it for less than it is worth in order to reduce your resources below the SSI resource limit, you may be ineligible for SSI for up to 36 months.

What are resources for SSI?

Resources, for the purposes of SSI, are things you own such as: cash; bank accounts, stocks, U.S. savings bonds; land; vehicles; personal property; life insurance; and. anything else you own that could be converted to cash and used for food or shelter. We do not count the value of all of your resources for SSI.

How long after Social Security disability is Medicare free?

You are eligible for Medicare two years after your entitlement date for Social Security disability insurance (SSDI). (This is the date that your backpay was paid from; see our article on when medicare kicks in for SSDI recipients ). Medicare isn't free for most disability recipients though.

How much does Medicare cost if you have a low Social Security check?

But some people who have been on Medicare for several years will pay slightly less (about $145) if their Social Security checks are low (due to a hold harmless provision). And some people will pay more. If your adjusted gross income is over $88,000 (or $176,000 for a couple), the monthly premium can be over $400.

How to save money on Medicare?

You can often save money on Medicare costs by joining a Medicare Advantage plan that offers coverage through an HMO or PPO. Many Medicare Advantage plans don't charge a monthly premium over the Part B premium, and some don't charge copays for doctor visits and other services.

How many quarters do you have to work to be fully insured?

Generally, being fully insured means having worked 40 quarters (the equivalent of 10 years) in a job paying FICA taxes. Many disability recipients aren't fully insured because they became physically or mentally unable to work before getting enough work credits.

Does Medicare go up every year?

There are premiums, deductibles, and copays for most parts of Medicare, and the costs go up every year. Here are the new figures for 2021, and how you can get help paying the costs.

Is Medicare expensive for disabled people?

Medicare can be quite expensive for those on disability who aren't fully insured, but if you are eligible to be a Qualified Medicare Beneficiary (QMB) because of low-income, a Medicare Savings Program will pay your Part A premium, and possibly other costs as well.

What is SSI disability?

Supplemental Security Income (SSI) Disability & Medicaid coverage. Waiting for a disability status decision and don’t have health insurance. No disability benefits, no health coverage. The Marketplace application and disabilities. More information about health care for people with disabilities.

How long do you have to wait to get Medicare if you have Social Security Disability?

Social Security Disability Insurance (SSDI) & Medicare coverage. If you get Social Security Disability Income (SSDI), you probably have Medicare or are in a 24-month waiting period before it starts. You have options in either case.

Can I enroll in a Medicare Marketplace plan if I have Social Security Disability?

You’re considered covered under the health care law and don’t have to pay the penalty that people without coverage must pay. You can’t enroll in a Marketplace plan to replace or supplement your Medicare coverage.

Can I keep my Medicare Marketplace plan?

One exception: If you enrolled in a Marketplace plan before getting Medicare, you can keep your Marketplace plan as supplemental insurance when you enroll in Medicare. But if you do this, you’ll lose any premium tax credits and other savings for your Marketplace plan. Learn about other Medicare supplement options.

Can I get medicaid if I have SSDI?

You may be able to get Medicaid coverage while you wait. You can apply 2 ways: Create an account or log in to complete an application. Answer “ yes” when asked if you have a disability.

Can I get medicaid if I'm turned down?

If you’re turned down for Medicaid, you may be able to enroll in a private health plan through the Marketplace while waiting for your Medicare coverage to start.

When will Medicare be available for seniors?

July 16, 2020. Medicare is the government health insurance program for older adults. However, Medicare isn’t limited to only those 65 and up—Americans of any age are eligible for Medicare if they have a qualifying disability. Most people are automatically enrolled in Medicare Part A and Part B once they’ve been collecting Social Security Disability ...

What conditions are considered to be eligible for Medicare?

Even though most people on Social Security Disability Insurance must wait for Medicare coverage to begin, two conditions might ensure immediate eligibility: end-stage renal disease (ESRD) and Lou Gehrig’s disease (ALS).

What is ESRD in Medicare?

ESRD, also known as permanent kidney failure, is a disease in which the kidneys no longer work. Typically, people with ESRD need regular dialysis or a kidney transplant (or both) to survive. Because of this immediate need, Medicare waives the waiting period. 2

What to do if your income is too high for medicaid?

If your income is too high to qualify for Medicaid, try a Medicare Savings Program (MSP), which generally has higher limits for income. As a bonus, if you qualify for an MSP, you automatically qualify for Extra Help, which subsidizes your Part D costs. Contact your state’s Medicaid office for more information.

How long does it take to get Medicare if you appeal a decision?

The result: your wait for Medicare will be shorter than two years.

How long does a disability last?

The government has a strict definition of disability. For instance, the disability must be expected to last at least one year. Your work history will also be considered—usually, you must have worked for about 10 years but possibly less depending on your age.

Does Medicare cover ALS?

Medicare doesn’t require a waiting period for people diagnosed with ALS, but they need to qualify based on their own or their spouse’s work record. 3