The hospitalization portion, Medicare Part A, usually begins automatically at age 65. Other Medicare benefits require you to enroll. If you keep working beyond age 65, you may have health insurance through your employer or have purchased a plan outside of Medicare.

How much will Medicare cost me at age 65?

Feb 01, 2021 · Technically, it is not mandatory to sign up for Medicare at 65 or at any age, for that matter. But it’s important to consider the situations in which you might decide not to enroll in Medicare at 65 so that you can make sure not to have any lapse in health insurance coverage or face a Medicate late enrollment penalty.

Do you automatically get Medicare at 65?

coverage (as defined by the IRS.) If it’s not, sign up for Medicare when you turn 65 to avoid a monthly Part B late enrollment penalty . If the employer has less than 20 employees: You might need to sign up for Medicare when you turn 65 so you don’t have gaps in your job-based health insurance. Check with the employer. If you have COBRA

What to do before you turn 65 Medicare?

If you decide to enroll in BOTH Part A AND Part B when you turn 65, decide whether to get coverage such as Medicare supplement insurance or a Medicare Advantage Plan. People with both Part A and Part B have options for their Medicare coverage. Some . people choose Medicare Advantage Plans (such as HMOs and PPOs) for their Medicare . coverage.

Do I automatically get Medicare at 65?

Nov 24, 2021 · Medicare is a public health insurance plan in the United States for retired people over the age of 65 and non-retired people with permanent disabilities. HowStuffWorks explains that to be eligible for Medicare benefits, seniors must have worked at least 10 years in a job that withheld Social Security from their pay.

How do I decline Medicare Part B?

Call the Social Security Administration at 800-772-1213 and ask if you can decline Part B without any penalties. Write down who you spoke with, when you spoke to them and what they said. should write a letter to the Social Security Administration declining Part B. Keep a copy of the letter for yourself.

What happens if I opt out of Medicare Part B?

Canceling Part B because you were automatically enrolled But beware: if you opt out of Part B without having creditable coverage—that is, employer-sponsored health insurance from your current job that's as good or better than Medicare—you could face late-enrollment penalties (LEPs) down the line.Jun 5, 2020

What happens if you don't enroll in Medicare Part A at 65?

If you don't have to pay a Part A premium, you generally don't have to pay a Part A late enrollment penalty. The Part A penalty is 10% added to your monthly premium. You generally pay this extra amount for twice the number of years that you were eligible for Part A but not enrolled.

Is Medicare Part A automatic at 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

What parts of Medicare are mandatory?

There are four parts to Medicare: A, B, C, and D. Part A is automatic and includes payments for treatment in a medical facility. Part B is automatic if you do not have other healthcare coverage, such as through an employer or spouse.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

What is Part B Medicare for?

Medicare Part B (Medical Insurance) Part B helps cover medically necessary services like doctors' services, outpatient care, and other medical services that Part A doesn't cover. Part B also covers many preventive services.

Can you decline Medicare?

While you can decline Medicare altogether, Part A at the very least is premium-free for most people, and won't cost you anything if you elect not to use it. Declining your Medicare Part A and Part B benefits completely is possible, but you are required to withdraw from all of your monthly benefits to do so.

How do you pay for Medicare Part B if you are not collecting Social Security?

If you have Medicare Part B but you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a “Notice of Medicare Premium Payment Due” (CMS-500). You will need to make arrangements to pay this bill every month.

How old do I have to be to collect Social Security?

age 62 or olderYou can receive Social Security benefits based on your earnings record if you are age 62 or older, or disabled or blind and have enough work credits.

Are you automatically enrolled in Medicare Part B?

Medicare will enroll you in Part B automatically. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If you're not getting disability benefits and Medicare when you turn 65, you'll need to call or visit your local Social Security office, or call Social Security at 1-800-772-1213.

When must you apply for Medicare?

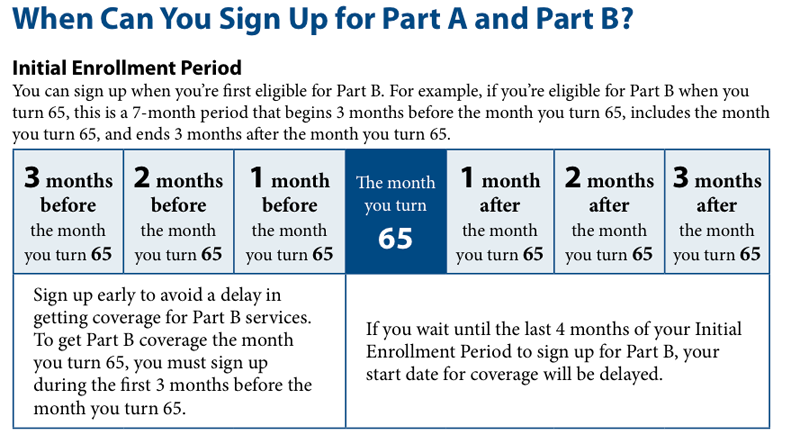

Generally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application.

Do I need to sign up for Medicare when I turn 65?

It depends on how you get your health insurance now and the number of employees that are in the company where you (or your spouse) work.

How does Medicare work with my job-based health insurance?

Most people qualify to get Part A without paying a monthly premium. If you qualify, you can sign up for Part A coverage starting 3 months before you turn 65 and any time after you turn 65 — Part A coverage starts up to 6 months back from when you sign up or apply to get benefits from Social Security (or the Railroad Retirement Board).

Do I need to get Medicare drug coverage (Part D)?

You can get Medicare drug coverage once you sign up for either Part A or Part B. You can join a Medicare drug plan or Medicare Advantage Plan with drug coverage anytime while you have job-based health insurance, and up to 2 months after you lose that insurance.

Get Someone On Your Side With Medicare

If youre able to answer the questions above, you will be equipped with the knowledge to answer whether it is mandatory to sign up for Medicare at age 65.

I Am About To Turn 65 My Spouse Is 60 And Still Working We Are Both Covered Under Her Employers Health Plan Do I Have To Do Anything With Regard To Medicare This Year

A person with group health coverage through a current employer may be able to delay enrolling in Part A and Part B until that coverage ends, and wont face penalties for enrolling later, but only if the employer has 20 or more employees.

Medicare As Secondary Insurance Costs Money

Now Part B is not premium-free. You will pay a monthly premium for Part B based on your income. Some people who are eligible for Medicare and employer group health coverage choose to delay enrolling in Medicare Part B and Part D while still covered on their group health coverage .

What Is The Medicare Part D Late

If youve gone 63 consecutive days without creditable prescription drug coverage, either because you didnt enroll when you were first eligible or because you lost your creditable coverage and didnt get new coverage in time, then you may have to pay a late-enrollment penalty when you do enroll into Medicare Part D.

How Does Medigap Serve Or Help Me

Medicare coverage lasts for the rest of your life. As you age, doctor visits and hospitalizations may increase. But, it is impossible to project your future healthcare needs.

What Do Medicare Supplement Plans Cover

Part A coinsurance and hospital costs up to an extra 365 days after Medicare benefits are used up.

Reasons To Delay Medicare Part B

You may want to delay Medicare Part B to postpone paying the monthly premium that comes with it. Pay attention to timing when youre ready to enroll, though. Part B charges a late enrollment penalty unless you qualify for a Special Enrollment Period. You may qualify if you have through an employer or union.

What happens if you fail to enroll in Medicare?

If you fail to enroll in Medicare when you become eligible while working for a company that has less than 20 employees, you will incur late enrollment penalties. Medicare is primary when you work for a small company, so you need both Parts A and B.

Is Medicare a secondary plan?

Medicare would be secondary. If you were to have both Medicare and group coverage, your Medicare would supplement your group plan and may reduce some health spending. However, that might only be important to you if you have some health care spending going on and you just want more robust overall coverage.

Can you delay Medicare if you retire?

Many people enroll in Part A and delay Parts B and D until they retire. However, you may not want to delay Medicare.

Can you enroll in Medicare if you never enroll?

With that said, if you were to never enroll in Medicare, you wouldn’t end up paying those penalties. However, lasting your entire life without ever needing to sign up for Medicare is unlikely.

Is it mandatory to sign up for Medicare Part A?

It is mandatory to sign up for Medicare Part A once you enroll in Social Security. The two are permanently linked. However, Medicare Parts B, C, and D are optional and you can delay enrollment if you have creditable coverage. So…the straightest answer I can give you is yes and no.