Best-rated Medicare Part D providers

| Rank | Medicare Part D provider | Medicare star rating for Part D plans | Average monthly cost |

| 1 | Kaiser Permanente | 4.9 | $33 |

| 2 | UnitedHealthcare (AARP) | 3.9 | $52 |

| 3 | BlueCross BlueShield (Anthem) | 3.9 | $69 |

| 4 | Humana | 3.8 | $38 |

Full Answer

What is the least expensive Medicare Part D?

Mar 24, 2022 · Which Medicare Part D Drug Plan offers the best prescription medication coverage for your needs? We researched the best Medicare Part D providers based on website ease of use, industry ratings ...

What is the Best Part D drug plan?

Mar 11, 2021 · Best Medicare Part D plans 2022: Find the right prescription drugs plan for you 1. Cigna: Best Medicare Part D Plan overall. Cigna-HealthSpring is a well-priced and reliable option, making it our top... 2. AARP Medicare Rx: Best Medicare Part D plan for seniors. AARP Medicare Rx, with services ...

How to select Medicare Part D plan?

7 rows · The best Medicare Part D prescription drug plans depend on what medications you take and ...

What does Medicare Part D really cost?

Oct 14, 2021 · A Best Insurance Company for Part D Prescription Drug plans is defined as a company whose 2022 plans were all rated as at least three out of five stars by CMS and whose plans have an average rating...

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

How do I choose a Part D plan?

Take your list to the Medicare Plan Finder at Medicare.gov. It can show you which Part D drug plans are available in your area and which of those plans cover your drugs. (You can also use the Plan Finder each year to check your current Part D plan and see if better options are available.)Oct 14, 2021

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

What is the difference between basic and enhanced Medicare Part D plans?

Enhanced plans charge higher monthly premiums than basic plans but typically offer a wider range of benefits. For instance, these plans may not have a deductible, may provide extra coverage during the donut hole, and may have a broader formulary. Some of these plans may also cover excluded drugs.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

Is SilverScript Part D good plan?

Fortunately, the SilverScript SmartRx plan has very low copays on the most common prescriptions. It won't be the best fit for everyone, but it can be a good choice for those on only Tier I generics. The Choice or Plus plan can also be a good fit if you're taking more expensive medications.

What is the max out-of-pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000, while under H.R. 19 and the Senate Finance bill, the cap would be set at $3,100 (both amounts exclude the value of the manufacturer price discount).Jul 23, 2021

Why are Medicare Part D plans so expensive?

If you have a health condition that requires a “specialty-tier” prescription drug, your Medicare Part D costs may be considerably higher. Medicare prescription drug plans place specialty drugs on the highest tier. That means they have the most expensive copayment and coinsurance costs.

Does Medicare Part D have an out-of-pocket maximum?

Medicare Part D plans do not have an out-of-pocket maximum in the same way that Medicare Advantage plans do. However, Medicare Part D plans have what's called a “catastrophic coverage” phase, which works similar to an out-of-pocket maximum.Nov 24, 2021

Which company has the best Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

What is the Best Medicare Plan D for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

Is Medicare Part D worth it?

A prescription drug plan through Medicare Part D is worth it for most people who do not bundle their drug coverage into a Medicare Advantage plan....

What drugs are covered by Medicare Part D?

The list of covered drugs is determined by each insurance provider in what's known as a drug formulary. All companies are required to cover at leas...

How much does Medicare Part D cost?

Consumers pay an average of $33 per month for Medicare Part D plans. However, the amount you pay will vary based on the plan you choose and any inc...

How do you sign up for Medicare Part D?

You can sign up for a Medicare prescription drug plan through Medicare.gov. The online tool will guide you through the plans that are available in...

What is the best Medicare Part D provider?

The best Medicare Part D providers include AARP, Humana Medicare Rx, WellCare, and Cigna-HealthSpring. If you’re eligible for Part D coverage, the three main considerations you’re likely to make are your current health, budget, and any medicine you take.

What is a Part D plan?

The best Medicare Part D plans not only help you manage the cost of prescription drugs, they also play a role in ensuring medicines stay affordable and they can protect against future price hikes. Roughly 70% of Americans signed up for Medicare supplement with a Part D plan, ...

What is the Medicare Part D deductible for 2020?

In 2020, the allowable Medicare Part D deductible is $435. Depending on the provider you choose, plans may either charge the full deductible, a partial, or waive the deductible (zero deductible). You pay the network discounted price for prescription drugs until your plan equals the deductible.

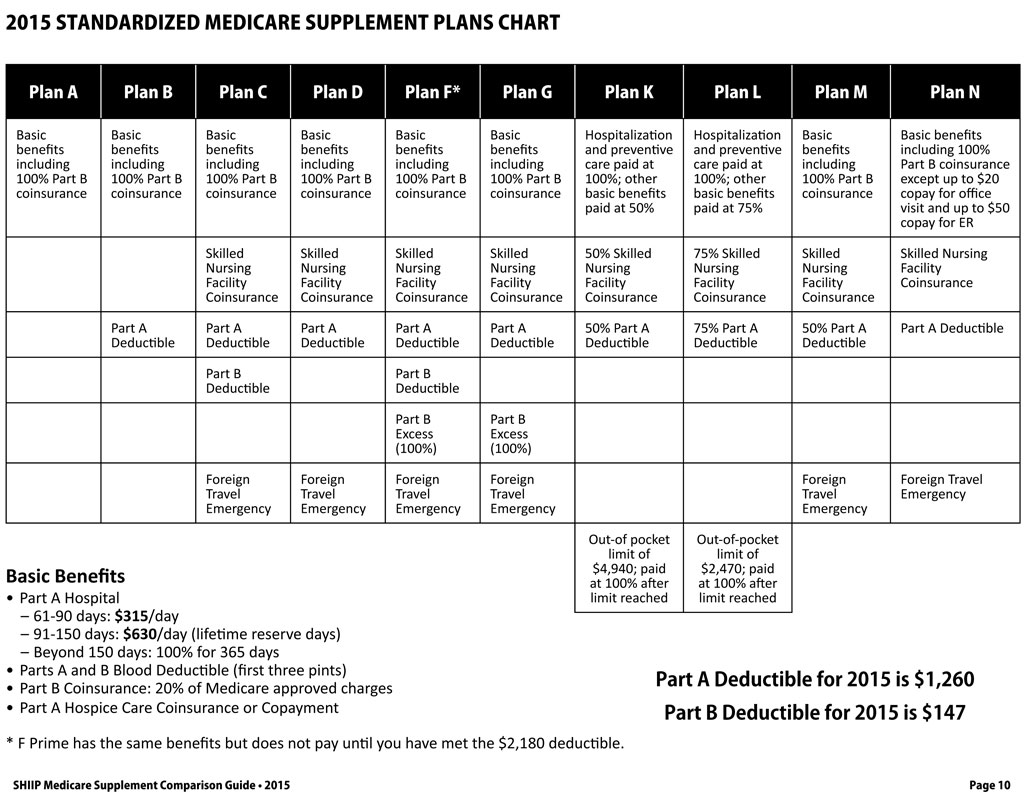

What are the deductibles for Medicare?

Deductibles apply to services covered under Part A and B. Medicare Part C (Medicare Advantage Plans) and Medicare Part D are optional and have their own premiums. If you live in a low income household, you may qualify for a subsidy to reduce the overall cost of Medicare.

How long does Medicare Part D last?

There are three different enrollment periods for Medicare Part D, as follows: Initial enrollment period: This covers a total of seven months - three months before you turn 65, your birthday month itself, and then the three months directly after your 65th birthday. So seven months in total.

Is AARP a good Medicare plan?

AARP Medicare Rx, with services provided by United Healthcare, is an excellent all-round provider of Medicare Part D plans and is the only range of plans backed by AARP. This is the best Medicare Part D plan option for seniors as it mixes low co-pays with competitive premiums and has a network of preferred providers.

Does Medicare Part D have monthly premiums?

Similar to other commercial health insurance plans, Medicare Part D Prescription Drug Plans vary with the monthly premiums, depending on the company and the coverage and the prescriptions you need covered. Expert Advice.

Best-rated Medicare Part D providers

Prescription drug plans, called Medicare Part D, are stand-alone policies purchased from private insurance companies. The plans give you coverage for specific drugs that are not included in your Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) coverages.

Kaiser Permanente: Best value Part D

Top-rated and affordable prescription plans, but only available in select regions.

BlueCross BlueShield (Anthem): Largest network of pharmacies

Expensive plans are well-rated, have a large pharmacy network and offer strong coverage options.

Humana: Best overall

Well-rated and affordable prescription drug plans, but Humana customers complain about slow customer service.

Cigna (Express Scripts): Best low-cost generic drugs

Well-rated and moderately priced Part D plans are available nationwide.

Centene (WellCare): Lowest monthly rates

Affordable and popular prescription drug plans, but many have high deductibles.

How to choose the best Medicare Part D plan for you

Most people will have about 30 Medicare Part D plans to choose from, and it's not always clear which is the best plan for your prescription medication needs. To help you choose your plan, ask yourself these seven questions:

How much is Medicare Part D 2020?

All Medicare Part D plans have a monthly premium. The average nationwide monthly premium for 2020 is around $32.50. However, in most states plans start around $20. So, if you don't have regular prescriptions or your prescriptions are few and common, your cost will be minimal.

Why do people switch Medicare Part D plans?

The most common reason people switch from one plan to another is that their medications change. However, you might also discover that a plan that was a great deal last year is not such a good deal this year.

How long does a prescription last in 2020?

After you've met your plan's deductible, you'll start your initial coverage period. This is where you make a co-payment or coinsurance payment for your prescriptions at the pharmacy. How long you're in the initial coverage period depends on the retail price of your medications and your plan’s benefits structure. With most 2020 plans, your initial coverage period ends when your drug costs reach $4,020. This is the initial coverage limit (ICL).

What is a formulary in a drug plan?

Every drug plan has a unique list of medications called a formulary. The formulary is simply a list of covered medications and pricing tiers. Plans create their formulary using the guidelines set by the United States Pharmacopoeia.

What happens if you don't have Part D coverage?

If you don't enroll in Part D when you are first eligible, and you don't have credible coverage, Medicare will assess a late penalty on top of your Part D premium. It's not a one-time penalty, either. You pay it for as long as you have coverage.

What is an AEP for Medicare?

There is also an Annual Enrollment Period (AEP) for Medicare Advantage and Medicare Part D. Open enrollment. In health insurance, open enrollment is a period during which a person may enroll in or change their selection of health plan benefits. Health plan enrollment is ordinarily subject to restrictions....

How to reduce the cost of prescription drugs?

Medicare.gov suggests six ways to reduce the cost of your prescription drugs. They include: 1 Switching to generics or other lower-cost drugs; 2 Choosing a plan (Part D) that offers additional coverage in the gap (donut hole); 3 Pharmaceutical Assistance Programs; 4 State Pharmaceutical Assistance Programs; 5 Applying for Extra Help; and 6 Exploring national and community-based charitable programs.

What is Medicare Part D?

Medicare Part D plans are private insurance products that provide coverage for your prescription medications. The details of Part D coverage can vary by plan, but Medicare does provide some guidance on basic coverage rules. Review all your options and find out the best time to sign up for a Part D plan before choosing one.

How to choose a Medicare plan?

The first step in choosing a plan once you’ve set up your primary Medicare plan is to consider your needs. You might not be taking many medications when you first become eligible for Medicare. But may have different needs in the future. Consider any current health conditions or those that run in your family.

How many prescriptions are covered by Medicare?

Each prescription drug plan must cover at least two medications in each drug category. Each plan can create their own list of covered drugs, as long as there are two in each medication category.

What to consider when enrolling in Medicare?

Consider your current and future needs, as well as your budget when researching prescription drug plans. Enrolling late could cost you a life-long penalty.

What are the programs that help with medication costs?

State Pharmaceutical Assistance Programs. These state programs can offer help paying for your medications. Community programs. There are also a number of local community programs, like Programs of All-Inclusive Care for the Elderly (PACE), that may offer assistance with medication costs.

What is extra help?

The Extra Help program offers help with premiums, deductibles, coinsurances, and drug costs for people with limited income. Medicare savings programs. There are a number of state-based programs that can help you pay for Medicare premiums. If you’re eligible for one of these programs, you’re also eligible for Extra Help.

Why is Part D so confusing?

Part D plans can be particularly confusing because there are no federal plans, only those offered by private insurance providers. These plans can vary widely in terms of coverage and costs. Read on to find out more about how to select the best Part D plan for you. Share on Pinterest.

What is Medicare Part D?

Medicare Part D is prescription drug coverage offered by private insurance companies. You can get Medicare Part D coverage through a stand-alone plan that works together with Original Medicare (Part A and Part B) or through a Medicare Advantage prescription drug plan. Find affordable Medicare plans in your area.

What is the star rating on Medicare Part D?

The star rating is an indicator of the plan’s quality and performance. Factors that go into the star rating include:

What is the maximum deductible for Medicare Part D in 2021?

In 2021, the maximum deductible is $445. Some Medicare Part D plans don’t charge a deductible. A copayment is a dollar amount you pay every time you fill a prescription drug. A coinsurance is a percentage you pay when you fill a prescription. Copayment and coinsurance amounts vary according to the pricing tier the medication is on.

What is deductible for 2021?

A deductible is the amount you pay for your prescription drugs before your plan begins to pay.

How to know if antineoplastics are covered by Medicare?

To know if your prescription drug is covered by your plan, ask for the plan’s formulary. A formulary is a list of covered prescription medications. If you have a plan that doesn’t cover ...

What is a five star plan?

The plan’s management of chronic conditions. The plan’s provision of screening tests and vaccines. If you a see five-star plan with a higher premium than a 3-star plan, you may consider if the increased monthly cost is worth it for coverage that is rated highly.

Does Medicare Part D affect your income?

Since private Medicare-approved insurance companies offer Medicare prescription drug plans, premiums vary from one plan to another. Your Medicare Part D premium may also be affected by your income. Usually higher-income beneficiaries pay more for Medicare Part D coverage.

How to decide if you need Medicare Part D?

How To Decide If You Need Part D. Medicare Part D is insurance. If you need prescription drug coverage, selecting a Part D plan when you’re eligible to enroll is probably a good idea—especially if you don’t currently have what Medicare considers “creditable prescription drug coverage.”. If you don’t elect Part D coverage during your initial ...

What drugs are covered by Part D?

Drugs covered by each Part D plan are listed in their “formulary,” and each formulary is generally required to include drugs in six categories or protected classes: antidepressants, antipsychotics, anticonvulsants, immunosuppressants for treatment of transplant rejection, antiretrovirals, and antineoplastics.

What is Medicare Part D 2021?

Luke Brown. Updated July 15, 2021. Medicare Part D is optional prescription drug coverage available to Medicare recipients for an extra cost. But deciding whether to enroll in Medicare Part D can have permanent consequences—good or bad. Learn how Medicare Part D works, when and under what circumstances you can enroll, ...

How long can you go without Medicare Part D?

You can terminate Part D coverage during the annual enrollment period, but if you go 63 or more days in a row without creditable prescription coverage, you’ll likely face a penalty if you later wish to re-enroll. To disenroll from Part D, you can: Call Medicare at 1-800-MEDICARE.

How long do you have to be in Medicare to get Part D?

You must have either Part A or Part B to get it. When you become eligible for Medicare (usually, when you turn 65), you can elect Part D during the seven-month period that you have to enroll in Parts A and B. 2. If you don’t elect Part D coverage during your initial enrollment period, you may pay a late enrollment penalty ...

How to disenroll from Medicare?

Call Medicare at 1-800-MEDICARE. Mail or fax a letter to Medicare telling them that you want to disenroll. If available, end your plan online. Call the Part D plan directly; the issuer will probably request that you sign and return certain forms.

What happens if you don't have Part D coverage?

The late enrollment penalty permanently increases your Part D premium. 3. Prescription drug coverage that pays at least ...