If Medicare is your only coverage, you definitely need both parts of Original Medicare – Parts A and B. You must have both of these parts to be eligible to enroll in either a Medicare supplement plan or a Medicare Advantage plan. Most people need Part D as well.

Full Answer

What is the difference between Medicare Part an and Part B?

Summary:

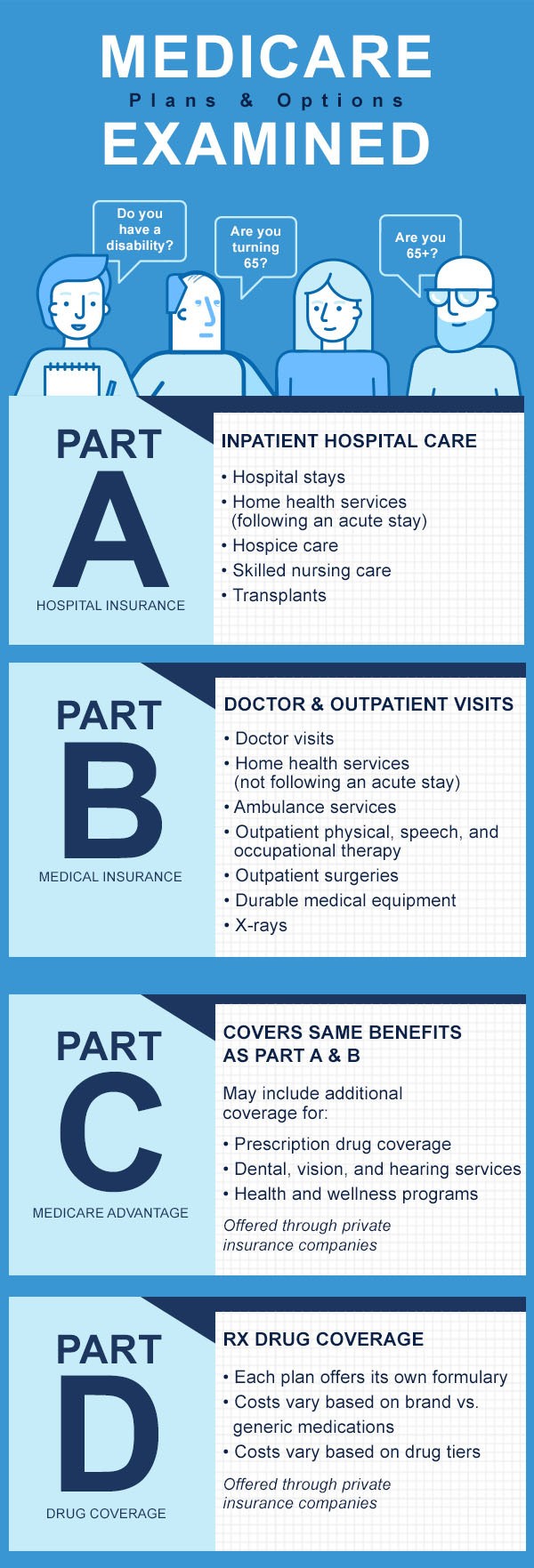

- Both Medicare Part A and B are federally funded plans that come with different coverages.

- Part A is free, and the patients need not pay a premium for the coverage. People have to pay some premium for availing themselves of the Part B coverage.

- Part A can be called hospital insurance whereas Part B can be termed as medical insurance.

What are the four parts of Medicare?

Medicare is the federal health insurance program for:

- People who are 65 or older

- Certain younger people with disabilities

- People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

What do Medicare Parts A, B, C, D mean?

Medicare parts A and B together are known as original Medicare. Medicare Part C plans cover everything that original Medicare does and often include additional coverage options. Medicare Part D is prescription drug coverage.

What items are covered by Medicare?

- Durable medical equipment (DME)

- Prosthetic devices

- Leg, arm, back and neck braces (orthoses) and artificial leg, arm and eyes, including replacement (prostheses)

- Home dialysis supplies and equipment

- Surgical dressings

- Immunosuppressive drugs

- Erythropoietin (EPO) for home dialysis patients

- Therapeutic shoes for diabetics

- Oral anticancer drugs

What parts of Medicare do I need?

Part A provides inpatient/hospital coverage. Part B provides outpatient/medical coverage. Part C offers an alternate way to receive your Medicare benefits (see below for more information). Part D provides prescription drug coverage.

Is Medicare Part A and B good enough?

It's worthwhile to have Medicare Part A alongside Medicare Part B coverage to help pay for the complex, expensive care associated with hospital, rehab and skilled nursing stays. Like Medicare Part B, Part A services typically require you to pay deductibles and coinsurance or copayments.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

How do I know which Medicare plan is right for me?

To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.

Is Medicare Part B worth the cost?

Is Part B Worth it? Part B covers expensive outpatient surgeries, so it is very necessary if you don't have other coverage coordinating with your Medicare benefits.

Which service is not covered by Part B Medicare?

But there are still some services that Part B does not pay for. If you're enrolled in the original Medicare program, these gaps in coverage include: Routine services for vision, hearing and dental care — for example, checkups, eyeglasses, hearing aids, dental extractions and dentures.

How much does Medicare Part C cost monthly?

For 2022, the average cost of a Medicare Part C plan with prescription drug coverage is $33 per month....What's the average cost of Medicare Part C?Medicare Part C plan type# of plans offeredAverage monthly costRegional PPO29$805 more rows•Jun 7, 2022

Do you have to pay for Medicare Part C?

Medicare Part C premiums vary, typically ranging from $0 to $200 for different coverage. You still pay for your Part B premium, though some Medicare Part C plans will help with that cost.

What does Medicare Part C cover for dental?

Dental, Vision, and Other Extra Benefits Depending on the plan selected, Medicare Part C may cover fillings, tooth extractions, cleanings, dentures, and other dental services. Covered vision services may include eye exams, glasses, or contact lenses.

What will Medicare not pay for?

In general, Original Medicare does not cover: Long-term care (such as extended nursing home stays or custodial care) Hearing aids. Most vision care, notably eyeglasses and contacts. Most dental care, notably dentures.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

How many Medicare Parts are there?

There are only 4 Medicare Parts. All the other letters are Medigap plans. Medigap plans are optional supplemental coverage that you can buy to fill in the gaps in Medicare. You don’t enroll in these at the Social Security office.

What does Medicare cover?

Medicare Part A. Medicare Part A covers your room and board while in the hospital. Part A of Medicare is your hospital insurance. This helps you cover common hospital expenses for things such as the cost of a semi-private room for stays, hospice, home health care and even skilled nursing facility stays. This part of Medicare also covers blood ...

What is Medicare Advantage?

Medicare Advantage plans are private health plans that you can choose instead of Medicare. You would get your Part A, Part B, and sometimes also Part D all from one insurance carrier. Advantage plans usually have a network of providers from whom you will seek your care. Part C plans can often have lower premiums than Medigap plans.

Is Medicare mandatory for Social Security?

So while technically, Medicare is not mandatory. Also, once you enroll in Social Security income benefits, you will automatically be enrolled in Medicare Part A. You cannot collect Social Security without having Part A – the two are linked.

Does Medicare cover blood transfusions?

This part of Medicare also covers blood transfusions requiring more than 3 pints of blood. Part A is also free for most people as long as they have worked at least 10 years in the U.S. or are married to someone who is at least 62 and has worked those quarters.

Part A: Hospital Services

Medicare Parts A and B are run by a federal agency called the Centers for Medicare and Medicaid Services. Together, these two parts are known as Original Medicare. With Original Medicare, you can see any doctor or hospital anywhere in the country -- as long as they participate in the program and are accepting new Medicare patients.

Part B: Medical Services

Part B is Medicare’s coverage for doctor visits, tests, and other outpatient services. It covers medically necessary services and some preventive ones, like checkups. It also may pay for:

Part C: Medicare Advantage

If you want extra services like those -- and are willing to pay more to get them -- Part C, or a Medicare Advantage plan, may be for you.

Part D: Prescription Drugs

Maybe you don't want to sign up for a Medicare Advantage plan, or the plans in your area don't offer the kind of drug coverage you need. You’ve got one more option to explore: a private insurance company’s Part D plan.

Medicare Supplement Plans (Medigap)

Medigap, or Medicare supplement, plans are extra insurance to pay for all or part of the deductibles, coinsurance, and copayments you have with Original Medicare. You buy them from private insurance companies.

How To Sign Up For Medicare Supplement Insurance Plans: When Can I Enroll

Medicare Supplement insurance plans are voluntary, additional coverage that helps fills the gaps in coverage for Original Medicare.

Medicare Advantage Plan Types

Medicare Advantage plans generally have networks of providers that accept their plan. That network might be just in one or two counties or occasionally we see them include a whole state. You agree to treat with those providers according to the plans rules.

Enrolling In Medicare Part D

The first opportunity for Medicare Part D enrollment is when youre initially eligible for Medicare during the seven-month period beginning three months before the month you turn 65, or during the seven-month period beginning three months before your 25th month of disability.

Medicare Supplement Plan G: How It Works

In order to purchase a Plan G, you must be signed up for Medicare Part A and B. If you have a Medicare Advantage Plan, you cannot purchase a Medicare Supplement.

Does Medicare Cover The Shingles Vaccine

En español | Unlike some common vaccines, like those for the flu, hepatitis B and pneumonia, shingles shots are not covered under Medicare Part B, the component of original Medicare that includes doctor visits and outpatient services. Part A, which deals with hospital costs, doesnt cover shingles shots either.

Is Part B Needed

Medicare Part B is optional, but there are penalty fees for signing up after the initial enrollment period. Its important to note that Part B can help pay for care thats not covered by your VA benefits. So, while its not a requirement, it is good to enroll once you qualify.

Medicare Advantage Vs Medigap

People who only have Medicare Parts A, B, and D may incur sizable bills not covered by Medicare. To close these gaps, recipients can enroll in some form of Medigap insurance or in a Medicare Advantage plan .

What is Medicare Part D?

Medicare Part D helps cover the specific costs of prescription drugs. All plans cover a wide variety of prescriptions, including drugs in protected classes like cancer or HIV/AIDS meds.

How do I get Medicare Part D?

When you turn 65, you will have an enrollment period that allows you to sign up for Medicare. Medicare Part D can be added to your Original Medicare coverage, which includes Part A (hospital) and Part B (medical).

What is a late-enrollment penalty?

If you don’t sign up for a Part D plan, your premium goes up if you change your mind later. This is referred to as the late enrollment penalty.

Conclusion

If you are unsure whether or not a Medicare Part D plan is right for your circumstances, don’t be afraid to reach out. Call us for a free drug plan comparison!

How much is Medicare Part A deductible in 2021?

Medicare Part A covers up to 60 days of hospitalization, but you pay a deductible of $1,484 in 2021.

How much does Medicare pay for ER visits?

Then Part B Medicare only pay 80% of approved services. This means you are responsible for paying 20% of all your doctor visits, your ER visits, blood tests, X-rays, surgeries, durable medical equipment and even high-priced things like chemotherapy.

What happens if you don't have Medicare Supplement?

The gaps in Medicare are substantial, leaving you to pay for expensive deductibles and 20% of all your outpatient coverage. If you don’t have a Medicare Supplement plan, often referred to as Medigap coverage, or a Medicare Advantage Plan, you’ll have to come up with the difference yourself.

How long does it take to open enrollment for Medicare?

You will be given a ONE-TIME open enrollment period to enroll in any Medigap plan with no health questions. Your open enrollment period is the first six months from the first day you signed up for Medicare Part B. During open enrollment, you can sign up for any supplemental plan and you are guaranteed coverage.

Is Medicare Advantage a good plan?

For those who may find that the premium for a Medigap plan does not fit within their budget, a Medicare Advantage Plan is a good alternative. In fact, these plans were specifically created to provide Medicare beneficiaries like yourself with an alternative to Original Medicare + Medigap.

Is Part B deductible out of pocket?

Many people don’t mind paying the Part B deductible out of pocket in return for the lower premiums that Plan G and Plan N can give them. For a closer look at the comparison between Medicare Plan F and Plan G, visit this post I wrote for Forbes. It is important to note that Plan F was phased out at the end of 2019.

Is Medicare Part B free?

When Americans reach retirement age and start their Medicare coverage, many are shocked to realize that Medicare is not free. If you didn’t know to save for Medicare Part B premiums during your retirement, you may find that money is tight.

Why Do I Need Supplement Insurance with Medicare?

Original Medicare Parts A & B don’t cover all medical benefits necessary for seniors, such as prescription medication and vision and dental care.

What Are The Gaps in Original Medicare?

As you may well know by this point, it is impossible to ignore the existing gaps in Original Medicare coverage. For a federal program that has so many coverage policies, there are two main forms of coverage where it usually fails to provide benefits.

Deciding On Whether You Need Supplemental Insurance

Now that we have covered all that there is to know about Medigap and Medicare, it is important you utilize this information in order to make an informed decision about your Medicare coverage. If you would like more information on either Medigap, Medicare Advantage, or Part D plans, give us a call.