Usually a person cannot be enrolled in a Medicare Advantage plan that does not include drug coverage and then add a separate stand-alone Medicare Part D

Medicare Part D

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs through prescription drug insurance premiums. Part D was originally propo…

Medical savings account

In the United States, a medical savings account refers to a medical savings account program, generally associated with self-employed individuals, in which tax-deferred deposits can be made for medical expenses. Withdrawals from the MSA are tax-free if used to pay for qualified medical expenses. The MSA must be coupled with a high-deductible health plan. Withdrawals from MSA go toward paying the …

Full Answer

What do Medicare Part D drug plans cover?

What Medicare Part D drug plans cover. All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan’s list of covered drugs is called a “formulary,” and each plan has its own formulary.

How does Medicare Part D work with other insurance?

How Part D works with other insurance. What Medicare Part D drug plans cover. All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan’s list of covered drugs is called a “formulary,” and each plan has its own formulary.

When should I enroll in a Medicare Part D drug plan?

Whether you choose a stand-alone Part D drug plan or a Medicare Advantage plan, you must enroll during a designated enrollment period: Your initial enrollment period (IEP), which runs for seven months, of which the fourth is the month of your 65th birthday. A special enrollment period (SEP), which you’re entitled to in certain circumstances:

What is the Medicare Part D Special Enrollment Period?

This period allows for Medicare Part D enrollment as well. You can also switch from one prescription drug plan to another during this time. Special Enrollment Periods or SEPs offer the chance for Medicare Part D enrollment when certain events happen in your life. Those events might include changing where you live or losing your current coverage.

Can you get a stand-alone Part D plan?

The plan can be a “stand-alone” Part D drug plan — one that offers only drug coverage and is the type that can be used by people enrolled in the original Medicare program. Or it can be a Medicare Advantage plan (such as an HMO or PPO) that offers Part D drug coverage as well as medical coverage in its benefits package.

Can Medicare Part D be offered alone?

Medicare Part D, the prescription drug benefit, is the part of Medicare that covers most outpatient prescription drugs. Part D is offered through private companies either as a stand-alone plan, for those enrolled in Original Medicare, or as a set of benefits included with your Medicare Advantage Plan.

Which plan type allows enrollment into a stand-alone prescription drug plan?

Medicare Part D plansIn most cases, stand-alone prescription drug coverage refers to Medicare Part D plans that Medicare beneficiaries purchase to supplement Original Medicare (or to supplement a Medicare Advantage plan that doesn't already come with built-in Part D coverage, but 90 percent of Medicare Advantage plans do include Part D ...

What type of Medicare Advantage plan can you add a separate Part D plan to if it does not include drug coverage?

If your PFFS plan doesn't offer drug coverage, you can join a separate Medicare drug plan to get coverage. A Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes.

Which consumer is eligible for a stand-alone Medicare prescription drug plan?

A stand-alone Medicare Part D Prescription Drug Plan, if you have Medicare Part A or Part B or both. Medicare Advantage Prescription Drug plan, if you have both Medicare Part A and Part B. If you choose a Medicare Advantage Prescription Drug plan, you get your Part A and Part B coverage through the plan.

Is SilverScript a good Part D plan?

All of Aetna's PDPs have a Medicare star quality rating of 3.5 out of five stars. CVS/Aetna's SilverScript Smart RX plan has the lowest average monthly premium in 2022, and CVS is one of four main providers of stand-alone Part D prescription drug plans in the United States.

What is a standalone Part D plan?

STANDALONE PART D PLAN A standalone plan provides coverage just for your prescription drugs. You would enroll in this type of plan if: You use Original Medicare for your health care needs and want prescription drug coverage. You have a Medicare Supplement plan.

What is a stand-alone PDP plan?

A PDP is often referred to as a “stand-alone prescription drug plan” because it is separate prescription drug coverage that Medicare beneficiaries can purchase – through private insurers – usually to supplement Original Medicare.

What is a stand-alone plan?

Stand-Alone Plan means any plan of reorganization or plan of liquidation for which the Investor or an Affiliate of the Investor is not the sponsor, including without limitation any such plan for which any of the Companies is the sponsor or there is no sponsor.

Can I have a Medicare Advantage plan and a Part D plan?

Summary: Some Medicare Advantage Plans allow you to choose your own standalone Medicare Part D Prescription Drug plans, while others include a predetermined plan. You cannot have a standalone Medicare Part D plan if your Medicare Advantage plan already includes prescription coverage.

Can I add Medicare Part D anytime?

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is a Part D plan?

Part D plans are sold by private insurance companies that contract with Medicare and cover Medicare-approved medications prescribed by Medicare-contracted doctors. Their cost structure includes premiums, copayments, and coinsurance. They can be purchased as a stand-alone Part D Prescription Drug Plan (PDP) or included in a Medicare Advantage – Prescription Drug Plan (MA-PD).

How long do you have to enroll in Medicare PDP?

It is essential that you enroll in a Medicare PDP within 63 days of leaving a group plan and losing your creditable company prescription drug coverage. If you leave or lose your group coverage and fail to sign up for Medicare drug coverage in a timely manner, your penalty is not calculated from when you retired but from when you turned 65.

What is MA-PD in Medicare?

1. Medicare Advantage plans with drug coverage (MA-PD) require that the enrollee have both Parts A and B of Medicare active for the entire time covered.

How long does it take to enroll in Part D?

A. You can enroll in any Part D plan during your Initial Enrollment Period (IEP), the seven-month period beginning three months before turning 65 and ending three months after turning 65.

What is a MA-PD?

2. A Medicare Advantage plan with drug coverage (MA-PD), like an HMO or PPO.

Is it important to enroll in Medicare?

The importance of timely enrollment in all areas of Medicare cannot be overstated. Not only can it cost you late penalties, but late enrollment can also cause a delay in coverage.

Can you use a PDP with Medicare?

Stand-a lone PDP plans are available from private insurance companies and can be used with your Medicare supplement plan, some Medicare Advantage plans, and many groups plans that do not cover prescription drugs. If you have a group plan, be sure to check with your human resources administrator to affirm that a PDP will not force you off their group coverage.

What does Medicare Part D cover?

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan’s list of covered drugs is called a “formulary,” and each plan has its own formulary.

What is a drug plan's list of covered drugs called?

A plan’s list of covered drugs is called a “formulary,” and each plan has its own formulary. Many plans place drugs into different levels, called “tiers,” on their formularies. Drugs in each tier have a different cost. For example, a drug in a lower tier will generally cost you less than a drug in a higher tier.

What happens if you don't use a drug on Medicare?

If you use a drug that isn’t on your plan’s drug list, you’ll have to pay full price instead of a copayment or coinsurance, unless you qualify for a formulary exception. All Medicare drug plans have negotiated to get lower prices for the drugs on their drug lists, so using those drugs will generally save you money.

How many prescription drugs are covered by Medicare?

Plans include both brand-name prescription drugs and generic drug coverage. The formulary includes at least 2 drugs in the most commonly prescribed categories and classes. This helps make sure that people with different medical conditions can get the prescription drugs they need. All Medicare drug plans generally must cover at least 2 drugs per ...

Why does Medicare change its drug list?

Your plan may change its drug list during the year because drug therapies change, new drugs are released, or new medical information becomes available.

How many drugs does Medicare cover?

All Medicare drug plans generally must cover at least 2 drugs per drug category, but plans can choose which drugs covered by Part D they will offer. The formulary might not include your specific drug. However, in most cases, a similar drug should be available.

What are the tiers of Medicare?

Here's an example of a Medicare drug plan's tiers (your plan’s tiers may be different): Tier 1—lowest. copayment. An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug.

What is Medicare Part D?

Medicare Part D enrollment provides you with choices of plans in most service areas. All plans are required by Medicare to offer a standard level of coverage. Some plans may offer additional benefits beyond this standard. The cost of plans may include monthly premiums, deductibles, copayments, and coinsurance.

What is Medicare Part D enrollment?

Medicare Part D enrollment is the first step in getting the coverage you need for your prescription medications. With multiple plans to choose from, it is helpful to compare plans carefully to find the right plan for you. You can start by entering your zip code on this page.

How long can you go without Medicare Part D?

However, if you go without Medicare Part D or other creditable prescription drug coverage for a continuous period of 63 days or longer after your IEP is over, you could be subject to a Part D late enrollment penalty. Coverage could come from a stand-alone prescription drug plan, a Medicare Advantage plan with prescription drug coverage (Part C), ...

What is Medicare Advantage Plan?

A Medicare Advantage plan is an alternative way to get your Original Medicare (Part A and Part B) benefits. These plans might also offer coverage for additional services like routine vision or dental care, and prescription medications.

How much is Part D late enrollment penalty?

The amount of the Part D late enrollment penalty depends on how long you went without prescription drug coverage. Medicare calculates the amount by multiplying the number of months you didn’t have prescription drug coverage by 1% of the national base beneficiary premium. In 2021, the national base beneficiary premium is $33.06.

How long can you go without prescription drug coverage?

You can avoid this penalty by ensuring you don’t go without creditable prescription drug coverage for 63 days or longer .

What is a SEP in Medicare?

Special Enrollment Periods or SEPs offer the chance for Medicare Part D enrollment when certain events happen in your life. Those events might include changing where you live or losing your current coverage. If your current plan changes its contract with Medicare or you have an opportunity to get other coverage, you might also qualify for an SEP.

What is a Part D plan?

The plan can be a “stand-alone” Part D drug plan — one that offers only drug coverage and is the type that can be used by people enrolled in ...

Is Medicare Advantage a PPO?

Or it can be a Medicare Advantage plan (such as an HMO or PPO) that offers Part D drug coverage as well as medical coverage in its benefits package. Within these two broad categories are many individual plans, each of which has different costs and benefits. Each plan has its own formulary — the list of drugs it covers — and sets ...

What happens if you don't sign up for Part D?

If you fail to sign up during one of these time frames, you face two consequences. You will be able to enroll in a Part D plan only during open enrollment, which runs from Oct. 15 to Dec. 7, with coverage beginning Jan. 1. And you will be liable for late penalties, based on how many months you were without Part D or alternative creditable coverage since turning 65, which will be added to your Part D drug premiums for all future years.

When does Medicare start?

A general enrollment period (Jan. 1 to March 31 each year), if you missed your deadline for signing up for Medicare (Part A and/or Part B) during your IEP or an SEP. In this situation Medicare coverage will not begin until July 1 of the same year in which you enroll.

When is open enrollment for Medicare?

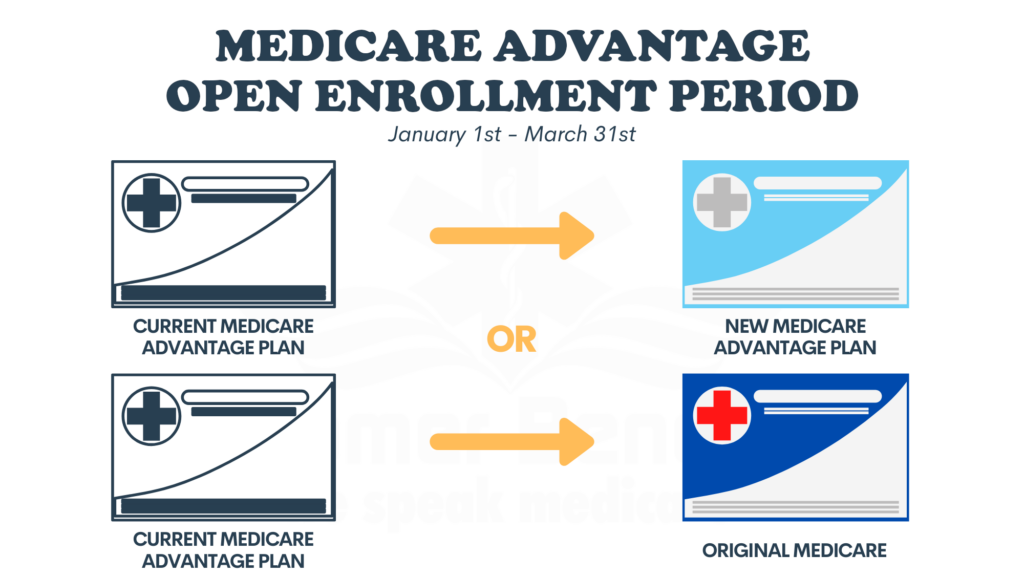

The annual open enrollment period (Oct. 15 to Dec. 7 each year) when you can join a drug plan for the first time if you missed your deadlines for your IEP or a SEP, or switch from original Medicare to a Medicare Advantage plan, or switch from one Medicare Advantage plan to another, or switch from one Part D drug plan to another.

What is Medicare Part D?

Medicare Part D is an optional benefit offered to all Medicare beneficiaries. The program provides prescription drug coverage and gives enrollees a discount on prescription drug medication.

What is the Medicare Part D coverage gap?

The Medicare Part D coverage gap, also known as the donut hole, is the coverage phase with a temporary limit on drug coverage.

What is the formulary for insurance?

The insurer’s formulary includes both brand-name prescription drugs and generic drugs. In addition, at least two drugs in the most commonly prescribed categories are included in the formulary to help people with different medical conditions access the medication they need.

What is deductible for Medicare Part D?

The deductible is the amount of money you must pay each year for prescriptions before your Medicare Part D plan begins to pay its share. Just like premiums, deductibles vary from plan to plan.

How much does Medicare pay for generic drugs?

Medicare will pay 75% for generic drugs during the coverage gap, and you will pay the remaining 25%. Unlike brand-name drugs, only the amount you pay will count toward getting you out of the coverage gap. Therefore, with generic drugs, it will take much longer to get out of the coverage gap.

What is the Medicare premium for 2022?

According to CMS, the average basic premium for Medicare Part D will be $33 in 2022, a 4.9% increase from the $31.47 average premium in 2021.

When is the annual election period for Medicare?

The Annual Election Period is your annual opportunity to enroll or make changes to your Medicare Part D coverage (October 15 to December 7) . During this time, you can enroll in a Medicare Prescription Drug Plan or Medicare Advantage Prescription Drug plan for the first time, switch Medicare plans, or disenroll from your plan.