A cafeteria plan is also referred to as a flexible benefits plan or Section 125 plan. 1 Key Takeaways Cafeteria plans allow employees to choose from a variety of pre-tax benefits. These plans are often more flexible than others.

Full Answer

What are the different types of cafeteria insurance plans?

Cafeteria plan selections include insurance options such as health savings accounts (HSAs) contributions, group term life insurance, and disability insurance. Other popular selections include adoption assistance plans, flexible spending accounts, and cash benefits. 1

Can Medicare Part B premiums be reimbursed under a cafeteria plan?

I have seen companies with a separate Premium Reimbursement account under a cafeteria plan allow Part B premiums to be reimbursed. As descibed elsewhere Medicare is the primary insurance for small companies (< 20 employees), so why could it not be reimbursed like regular individual helath premiums?

Is a cafeteria plan covered by ERISA?

Because cafeteria plans are covered under ERISA, they are subject to the same documentation, reporting, and administration requirements as all other ERISA plans. These include 401 (k), 401 (a), and 403 (b) plans, simplified employee pension (SEP) plans, and profit-sharing plans.

What is a cafeteria plan?

A cafeteria plan is an employee benefit plan that allows staff to choose from a variety of pretax benefits. A Cafeteria plan also refers to as a "flexible benefit plan" or Section 125 plan.

Which plan is referred to as a cafeteria plan?

A cafeteria plan, also known as a section 125 plan, is a written plan that offers employees a choice between receiving their compensation in cash or as part of an employee benefit.

What benefits fall under cafeteria plan?

In a section 125 plan or cafeteria plan, employees can pay qualified medical, dental, or dependent-care expenses on a pretax basis, which has the effect of reducing their taxable income as well as their employer's Social Security (FICA) liability, federal income and unemployment taxes, and state unemployment taxes ...

Why is Section 125 called cafeteria plan?

It's called a Cafeteria Plan because, much like choosing from a menu, an employer may provide a selection of benefits from which the employee can choose from. Common examples of Section 125 Cafeteria Plans include: Contributions to a Health Savings Account (HSA)

What are the four categories of cafeteria plans?

What is a cafeteria plan?Flex Account. One of the most common cafeteria plans is a flex account, or flexible spending account (FSA). ... POP Plan. Next is a Premium Only Plan (POP). ... Dependent Care Account. Finally, the last type of cafeteria plan is a Dependent Care flexible spending account.

What is the difference between a premium only plan and a cafeteria plan?

One of the most common (if not the most common) forms of Section 125 plans is a premium-only plan (aka "Section 125 POP", "POP plan", "Premium-only Cafeteria Plans"). A Section 125 premium-only-plan (POP), is a cafeteria plan which allows employees to pay their health insurance premiums with tax-free dollars.

What is a cafeteria plan for dummies?

Cafeteria plans are benefit plans that offer employees a choice of benefits based on cost. Employees can pick and choose from those benefits and put together a benefit package that works best for them within the established cost structure.

What does Cafe 125 include?

Benefits provided by plans covered under section 125 include adoption and dependent care assistance, health insurance, 401k and group term life insurance policies. They are called cafeteria plans because employees are given a list of benefits to choose from, similar to a cafeteria-style menu.

What is a Section 105 plan?

An IRS Section 105 plan, sometimes known as a Health Reimbursement Arrangement (HRA), is employer-sponsored and reimburses employees for medical care expenses that are substantiated by a third party. Employees can be reimbursed for their medical care expenses, including: Current employees.

Is s125 and sec125 the same thing?

That's there for informational purposes only. It doesn't impact your tax return. It's Section 125 or cafeteria plan amount.

Is a 125 plan same as FSA?

A Flexible Spending Account (FSA), sometimes referred to as a 'Cafeteria Plan' or 'Section 125 Cafeteria Plan', helps you keep more of your paycheck by reducing your Federal and state taxes. It allows you to pay certain expenses before taxes are deducted from your paycheck.

What is cafeteria style benefits?

What are cafeteria style benefits? Cafeteria style benefits allow employees to choose the benefits they want (prior to payroll taxes) from a list of predetermined options offered by you, their employer, and governed by the IRS.

Is an HSA a cafeteria plan?

It's called a cafeteria plan because employees choose the benefits they want, just as they choose the items they want from the company cafeteria. Funding a health savings account, commonly referred to as an HSA, may be an option under a cafeteria plan.

What is a cafeteria plan?

A cafeteria plan is a health insurance plan that lets employees make their choice from various categories of health benefits. This is why it is called a cafeteria plan. You can choose different ‘items’ for your health insurance like you do with food options in a cafeteria. The employee can decide what they want to insure while considering ...

What is cafeteria health insurance?

The health insurance option of a cafeteria plan is one of many benefits available. It is different from other health insurance policies in that it is fully able to be customized. This customization is one of the hallmarks of cafeteria plans in general.

What is flexible spending arrangement?

Flexible spending arrangements are one of the benefits an employee may choose for their cafeteria plan. Flexible spending arrangements, also known as FSAs, are funded through salary reduction and compensates employees for specific qualifying benefits.

Why do employers provide cafeteria plans?

Employers provide the cafeteria plans so that their employees do not have to commit to a traditional group health insurance plan. Such plans are hard to change and this is one of the main reasons why some companies prefer cafeteria plans.

What is the difference between cafeteria and health insurance?

When you compare a cafeteria plan to a standard individual health insurance plan, the main difference is that you do not have your benefits chosen for you. You can determine which benefits are the most useful for your situation.

How long do cafeteria benefits last?

Typically, this period takes place at the end of the year. These benefits remain in place for the next 12 months.

What are qualifying events?

Qualifying events are typically rare and serious events that do not take place often in an employee’s life. Death, marriage, divorce, childbirth, and adoption are some examples of those events labeled as qualifying events. Once the benefits have begun for the year, such events are the only way to change them.

What is a cafeteria plan?

A cafeteria plan is a separate written plan maintained by an employer for employees that meets the specific requirements and regulations of Section 125 of the Internal Revenue Code. It provides participants an opportunity to receive certain benefits on a pretax basis. Participants in a cafeteria plan must be permitted ...

How many taxable benefits are allowed in a cafeteria plan?

Participants in a cafeteria plan must be permitted to choose among at least one taxable benefit (such as cash) and one qualified benefit. Learn more about cafeteria plans. Back to Glossary Index.

What is cafeteria plan?

A cafeteria plan is a separate written plan maintained by an employer for employees that meets the specific requirements of and regulations of section 125 of the Internal Revenue Code. It provides participants an opportunity to receive certain benefits on a pretax basis.

What is qualified benefit?

A qualified benefit is a benefit that does not defer compensation and is excludable from an employee’s gross income under a specific provision of the Code, without being subject to the principles of constructive receipt. Qualified benefits include the following:

Can an FSA be cumulative?

An FSA cannot provide a cumulative benefit to the employee beyond the plan year. A town has a cafeteria plan (section 125 plan), which offers dependent care assistance. The benefits received by an employee exceed $5,000.

Is a cafeteria plan subject to FICA?

Generally, qualified benefits under a cafeteria plan are not subject to FICA, FUTA, Medicare tax, or income tax withholding. However, group-term life insurance that exceeds $50,000 of coverage is subject to social security and Medicare taxes, but not FUTA tax or income tax withholding, even when provided as a qualified benefit in a cafeteria plan.

Can you get reimbursed for a cafeteria?

No. Employees can only be reimbursed for allowable, documented expenses incurred during the plan year, after the expenses have been substantiated. A town has a cafeteria plan which offers health care benefits to domestic partners.

Can a cafeteria offer health insurance?

Cafeteria plans can offer health insurance to employees, their spouses and their dependents. The domestic partner and dependents in this case may not be participants in a cafeteria plan because they are not employees, but the plan may provide benefits to them. For example, a domestic partner may not be given the opportunity to select or purchase benefits offered by the plan, but the domestic partner may benefit from the employee’s selection of family medical insurance coverage or of coverage under a dependent care assistance program.

What is a cafeteria plan?

For federal tax purposes, a cafeteria plan is any employer-sponsored arrangement that allows employees to pay for certain types of benefits on a pretax basis through salary reduction. As the name “flex” suggests, cafeteria plans can provide considerable flexibility to employers when designing a plan and to employees when choosing from ...

Why do employers use cafeteria plans?

Many employers use cafeteria plans to allow employees to pay for supplemental coverage on a pretax basis , often along with offering other types of qualified benefits . Still, using a cafeteria plan model carries additional administrative and compliance issues.

What is ERISA in cafeteria?

Application of ERISA. Most benefits offered by private employers to employees through a cafeteria plan are subject to the Employee Retirement Income Security Act of 1974 (ERISA). For more information on the requirements for the voluntary safe harbor under ERISA as applied to supplemental benefits, see ...

What is a qualified benefit?

Qualified benefits include coverage under the employer’s group health plan. Employees can use a cafeteria plan to pay for individual health and disability insurance policies where premiums are list billed by the employer. Other common types of qualified benefits include health flexible spending arrangements or accounts (FSAs), ...

What are the types of benefits that are considered qualified?

Other common types of qualified benefits include health flexible spending arrangements or accounts (FSAs), dependent care (including dependent care FSAs) and contributions to health savings accounts (HSAs). Additional requirements may apply, depending on the type of benefits offered. The plan must have a plan year.

What is a 125 plan?

Section 125 imposes a number of different compliance requirements, such as a written plan document and irrevocable elections, in exchange for this favorable tax treatment.

Can a partnership sponsor a cafeteria plan?

For example, although a partnership can sponsor a cafeteria plan for its common-law employees, the partners themselves cannot participate in the plan.

What are the options for a cafeteria plan?

Options for cafeteria plans may include health savings accounts (HSAs), adoption assistance, group life insurance, and cash benefits. 2.

What is the role of ERISA?

ERISA also sets up minimum standards including vesting periods, funding, and benefit accrual. 3 The act also provides a number of protections for cafeteria plan benefits, including the preemption of state escheatment laws.

Is a cafeteria covered by ERISA?

Because cafeteria plans are covered under ERISA, they are subject to the same documentation, reporting, and administration requirements as all other ERISA plans. These include 401 (k), 401 (a), and 403 (b) plans, simplified employee pension (SEP) plans, and profit-sharing plans. ERISA requires all participating employees to be provided ...

Is a cafeteria plan subject to FICA?

6. In general, qualified cafeteria plan benefits are not subject to FICA or other taxes.

How many parts are there in Medicare?

There are four different parts of Medicare: Part A, Part B, Part C, and Part D — each part covering different services. Understanding how these parts and services work (together and separately) is the key to determining which ones fit your unique health care needs and budget. There are two main paths for Medicare coverage — enrolling in Original ...

What is Medicare Advantage?

Medicare Advantage (Part C) is an alternative to Original Medicare. It allows you to receive Part A and Part B benefits — and in many cases, other benefits — from a private health insurance plan. At the very least, your Medicare Advantage plan must offer the same benefits as Original Medicare. The only exception is hospice care, which is still ...

What are the benefits of Medicare Advantage Plan?

Additional benefits that many Medicare Advantage plans include are: Vision coverage. Hearing coverage. Dental coverage. Medicare Part D prescription drug coverage. If you’re eligible for Medicare Part A and Part B, and do not have ESRD, you can join a Medicare Advantage Plan. Medicare beneficiaries have the option of receiving health care benefits ...

How long do you have to be on Medicare if you are 65?

For those younger than 65, you are only eligible to receive Medicare benefits if you: Have received Social Security or Railroad Retirement Board (RRB) disability benefits for 24 months.

When do you get Medicare for ALS?

If you’re under 65, it’s the 25th month you receive disability benefits. ALS patients are automatically enrolled in Medicare coverage when their Social Security disability benefits begin, regardless of age. If you have end-stage renal disease (ESRD), you must manually enroll.

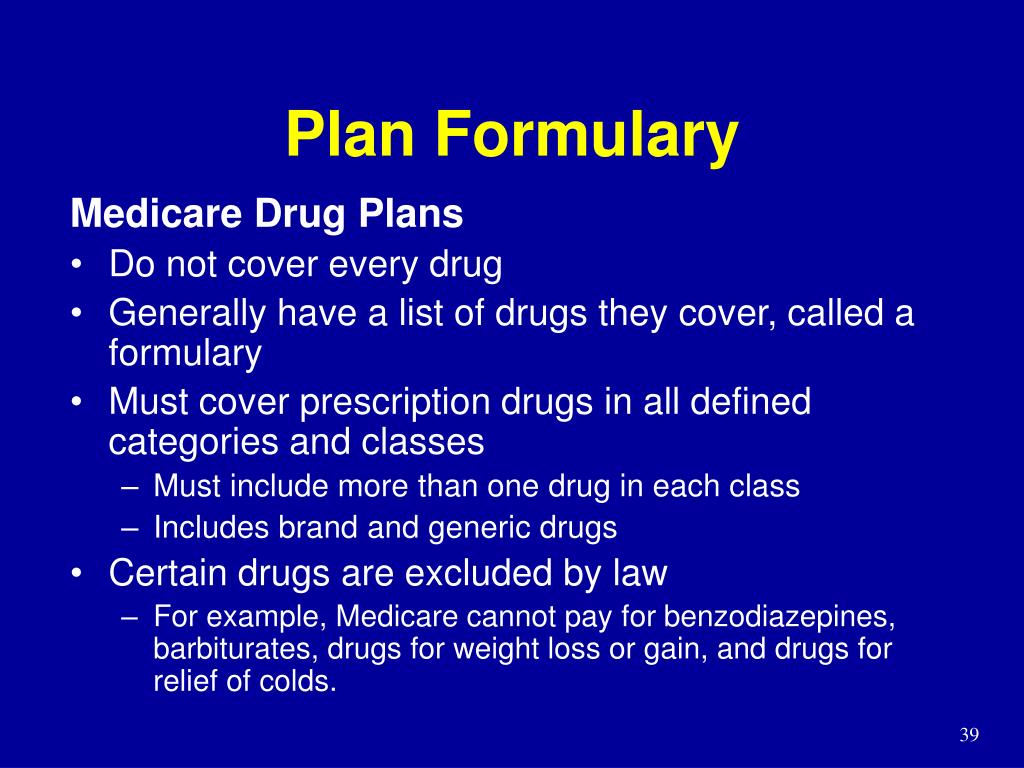

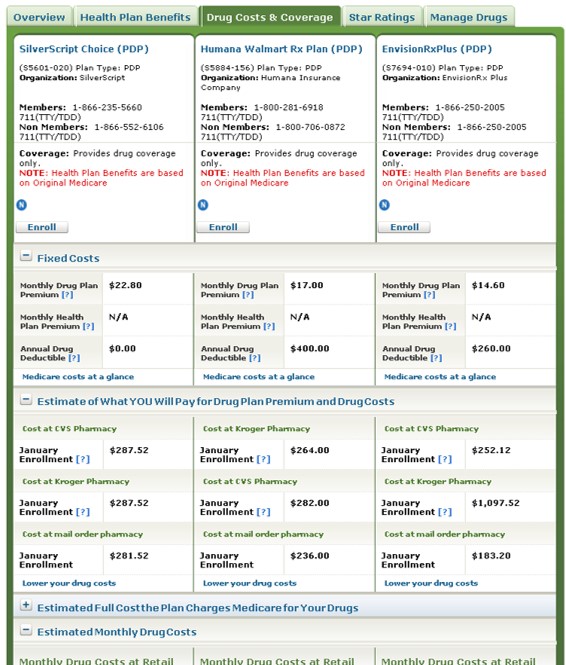

Does Medicare Advantage include Part D?

Many Medicare Advantage plans also include Part D coverage. If you're looking for Medicare prescription drug coverage, you can consider enrolling in a Medicare Advantage plan that includes drug coverage, or you can consider enrolling in a Medicare Part D plan. You can compare Part D plans available where you live and enroll in a Medicare ...