The next two targets for this ever changing landscape is that Plan F and C will be disappearing in 2020. Boomer Benefits assures that these Medicare changes won’t affect everyone. People who were eligible for Medicare Plan F prior to January 1, 2020 will still be able to purchase this plan in the future, as well as Plan C.

Are you eligible for Medicare after January 1 2020?

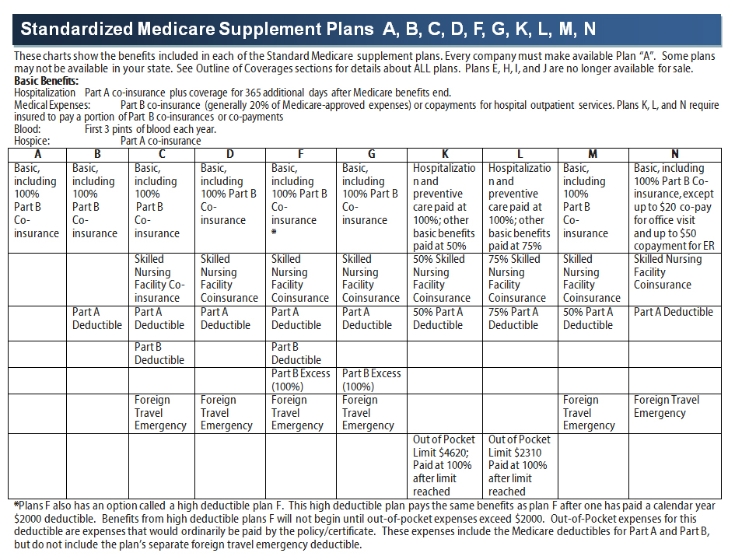

For people eligible for Medicare after January 1, 2020, there are other plans available for you. Plans D, G and High-Deductible Plan G (which is a brand new plan option) will still be available to Medicare beneficiaries after January 1, 2020.

Is Medicare going away any time soon?

In a word—no, Medicare isn’t going away any time soon, and Medicare Advantage plans aren’t being phased out. The Medicare Advantage (Part C) program is administered through Medicare-approved private insurance companies.

Are Medigap plans F and C being phased out?

However, in 2015, Congress passed the Medicare Access and CHIP Reauthorization Act (MACRA) bill. MACRA stops the sale of Medigap Plans F and C for people who joined Medicare in January 2020 or later. Medicare Plans C and F both cover Part B deductible, which is why these are being phased out.

Can I Change my Medicare plan to plan F in 2020?

You’ll still be able to change to a Plan F if you are eligible for Medicare prior to January 1, 2020. But you must qualify for it. Meaning insurance companies can use your health information to exclude you from getting the coverage or to charge you more for it.

Which Medicare plan is being discontinued?

Medigap Plan F and Medigap Plan C are no longer available to people who qualified for Medicare on or after January 1, 2020.

Is plan F going away in 2021?

Changes to Medicare Supplement Plan F in 2020 The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles.

Is Medicare Plan F going to be discontinued?

Is Medicare Plan F Being Discontinued? No, Medicare Plan F is not being discontinued, but it is no longer an option for those who are new to Medicare. The 2015 Medicare Access and CHIP Reauthorization Act (MACRA) prevented Medicare Supplement plans (F and C, specifically) from providing coverage for Part B deductibles.

Is Medicare Part B going away?

According to congress.gov, starting in 2020, Medicare Supplement plans that pay the Medicare Part B deductible will no longer be sold to those newly eligible. This change is part of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA).

Is plan F better than plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

Can I switch from plan F to plan G?

Switching from Plan F to Plan G If you enrolled in Plan F before 2020, you can continue your plan or switch to another Medigap plan, such as Plan G, if you prefer. You may want to make the change to reduce the price of your health insurance.

What is the most popular Medigap plan for 2021?

Medigap Plans F and GMedigap Plans F and G are the most popular Medicare Supplement plans in 2021. Learn more about other popular plans like Plan N and compare your Medigap plan options.

Is there a Medicare Supplement that covers everything?

Medicare Supplement insurance Plan F offers more coverage than any other Medicare Supplement insurance plan. It usually covers everything that Plan G covers as well as: The Medicare Part B deductible at 100% (the Part B deductible is $203 in 2021).

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

What is the Medicare Part B premium for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What changes are coming to Medicare in 2021?

The Medicare Part B premium is $148.50 per month in 2021, an increase of $3.90 since 2020. The Part B deductible also increased by $5 to $203 in 2021. Medicare Advantage premiums are expected to drop by 11% this year, while beneficiaries now have access to more plan choices than in previous years.

What changes are coming to Medicare in 2022?

Changes to Medicare in 2022 include a historic rise in premiums, as well as expanded access to mental health services through telehealth and more affordable options for insulin through prescription drug plans. The average cost of Medicare Advantage plans dropped while access to plans grew.

What is the Medicare Part D donut hole?

The Medicare Part D “donut hole” is a temporary coverage gap in how much a Medicare prescription drug plan will pay for your prescription drug cost...

What happens in the donut hole coverage gap in 2020?

Once you enter the donut hole in 2020, your Part D plan’s coverage becomes more limited. In 2020, you’ll pay no more than 25 percent of the price f...

What happens when the donut hold goes away in 2020?

Once you reach the $6,350 threshold in 2020, you enter the final phase of Part D coverage. This is called catastrophic coverage. During the catastr...

What Is Plan F?

Medicare Plan F is a supplemental plan. Also called Medigap Plan F, this plan is meant to fill any gaps in your Medicare coverage. Along with Original Medicare (Parts A and B), prescription plans, and other supplemental coverage offered through Part C, Plan F offers healthcare benefits that help cover seniors’ needs.

Why Is Plan F Going Away?

Plan F will be no more once 2019 wraps up. But if Plan F is such a popular choice for Medicare recipients, why is it going away?

What Should Medicare Enrollees Do Now?

If you’re worried about Plan F going away, you can take action. There’s still plenty of time to adjust your Medicare coverage, especially if you’re already enrolled.

Does Medicare Supplement Plan F cover coinsurance?

This is largely because it covers all of the deductibles, coinsurance, and copays that would normally be your responsibility after Original Medicare pays its share. Beneficiaries insured with a Plan F policy pay nothing for doctor visits, lab work, surgeries, hospital stays , and much more.

Can you keep Medigap Plan C?

One silver lining in this change is that people who are already insured by a Medigap Plan C or F will be able to keep their coverage. It is only new enrollees who will not have the option to buy it.

What happened to the Medicare donut hole in 2020?

What happened in the donut hole coverage gap in 2020? The Medicare donut hole coverage gap shrunk to its final cost level in 2020. We'll explain more below about what this means for your coverage. The Medicare donut hole is one of four coverage levels (coverage periods) that are in a Part D prescription drug plan.

What is the maximum deductible for Medicare 2021?

In 2021, the maximum deductible allowed by law is $445 for the year. Some Medicare prescription drug plans have a $0 deductible. After you meet your plan deductible, you enter the initial coverage period.

What happens when the donut hole goes away in 2020?

What happened when the donut hole went away in 2020? Once you reach the $6,550 threshold in 2021, you enter the final phase of Part D coverage. This is called catastrophic coverage. During the catastrophic coverage phase, you only pay a small coinsurance or copayment for your covered prescription drugs for the remainder of the year.

How can Medicare help avoid the donut hole?

Medicare beneficiaries may be able to help themselves avoid the donut hole by choosing less expensive generic drugs over brand-name drugs when possible, shopping for prescription drug discounts, buying drugs in bulk through mail-order services and utilizing Medicare Extra Help (see below).

What happens after you meet your Part D deductible?

After you meet your Part D deductible, you enter the initial coverage period. During this phase, you pay a copayment (flat fee) or coinsurance (percentage) for your covered medications. Copayment and coinsurance amounts will vary by plan. Many plans will feature different amounts for generic and brand name drugs.

When did the Medicare donut hole go away?

Did the Medicare Donut Hole Go Away in 2020? The Medicare Donut Hole closed in 2019 for brand name drugs and disappeared in 2020 for generic drugs. Learn how this may affect your Part D costs.

How much will generic drugs cost in 2021?

Once you and your plan combine to spend $4,130 for drugs during the calendar year in 2021, ...

Why does Medicare end?

Your Medicare Advantage plan may end coverage for a variety of reasons: Your plan leaves the Medicare program. Your plan is no longer being offered in your service area. Medicare terminates its contract with your plan. Medicare chooses not to renew your plan’s contract. If your plan is ending coverage, you’ll get a notice from your plan.

What to do if my Medicare Advantage plan is ending?

What are my options if my Medicare Advantage plan is ending? If your Medicare Advantage coverage is no longer available, you have a few options: You can enroll in a different Medicare Advantage plan. If you like your insurance company but your plan is ending, find out if your Medicare Advantage plan offers a similar plan in your service area. ...

What happens if you leave Medicare and don't enroll?

In general, if your plan leaves Medicare and you don’t enroll in a different Medicare Advantage plan, you’ll be automatically returned to Original Medicare. If you had prescription drug coverage as part of your Medicare Advantage plan, it’s important to also enroll in a stand-alone Medicare Prescription Drug Plan, ...

How long does Medicare Advantage last?

If your Medicare Advantage coverage is ending because Medicare ended your plan’s contract, your Special Election Period starts two months before your coverage ends and lasts one full month after your plan’s contact ends.

When is Medicare eligibility month?

For most people, your eligibility month is the month you turn 65 or your 25 th month of disability benefits if you qualify for Medicare through disability. Medicare Advantage and Prescription Drug Plan Annual Election Period (October 15 to December 7): after you’re first eligible, your next chance to make changes is during ...

When is Medicare open enrollment?

Medicare Advantage Open Enrollment Period (January 1 to March 31): during this period, you can disenroll from your Medicare Advantage plan and go back to Original Medicare. You can also, if you return to Original Medicare, enroll in a stand-alone Medicare Prescription Drug Plan. You also can switch Medicare Advantage plans during this period.

When do you get a notice from Medicare?

If your plan is ending coverage, you’ll get a notice from your plan. If your coverage is ending for the upcoming calendar year (starting January 1), you should get this notice by early October. You’ll be eligible for a Special Election Period (SEP) to enroll in a new Medicare Advantage plan, if you choose to do so.