In addition to traditional Medicare and Medicare supplemental plans, Emory Healthcare

Emory Healthcare

Emory Healthcare, part of Emory University, is the largest health care system in the state of Georgia. It comprises ten hospitals, the Emory Clinic and more than 250 provider locations. The Emory Healthcare Network, established in 2011, is the largest clinically integrated network in Georgia wi…

Full Answer

What Medicare Advantage plans does Emory Healthcare accept?

supplemental plans, Emory Healthcare accepts the following Medicare Advantage plans: Traditional Medicare Part A & Part B Aetna Medicare Advantage HMO Aetna Medicare Advantage PPO AllWell by PeachState Medicare Adv HMO (D-SNP) BCBS Medicare Advantage HMO BCBS Medicare Advantage PPO Cigna HealthSpring Medicare Advantage HMO & PPO

Does Emory Healthcare participate in the public health insurance exchange?

Emory Healthcare participates in many public federal exchange plans. Please call your insurance provider directly to confirm whether you will be covered at Emory and to clarify the coverage provided by your specific policy.

Does Emory Healthcare accept Kaiser Permanente?

Emory Healthcare partners with Kaiser Permanente offering collaborative integrated care. Emory Healthcare participates in many public federal exchange plans. Please call your insurance provider directly to confirm whether you will be covered at Emory and to clarify the coverage provided by your specific policy.

Where can I find more information about retirement benefits at Emory?

Helpline serviced by MedicareCompareUSA. Retired Emory employees and those considering retiring from Emory should contact the Human Resource benefits department for more information regarding specific health benefit programs available to you. For more information on COVID-19, please visit the resources below.

Does Emory accept Medicare Advantage?

***For United Healthcare Medicare Advantage health plans, Emory Healthcare participates with all plan types except for the following: Dual Eligible Plans-Medicare Advantage, Private Fee-For-Service Benefit Plans, Medicare Advantage Medical Savings Account Benefit Plans.

Is Emory in network with United Healthcare?

Some of the hospitals remaining in our network in the area include: Children's Hospital of Atlanta* Emory hospitals. Northeast Georgia Medical Center*

Does Emory take Medicaid?

Federal and State Government Programs (Champus, Medicare, Medicaid) If you are covered by one of the governmental programs, we will collect co-pays and deductibles at the time of service — please remember to bring your insurance card.

Is Emory covered by Blue Cross Blue Shield?

Emory Healthcare has signed an agreement with Anthem Blue Cross and Blue Shield to offer access of its facilities, physicians and services to the members of Anthem health plans in Georgia, US.

Does Emory accept Kaiser?

With Kaiser, you have to use Kaiser Permanente providers – there are no out-of-network benefits and you cannot use Emory providers.

Are Wellstar and United Healthcare still negotiating?

Wellstar reneged on a deal we recently made in summer 2020 and terminated our contract. It's unfortunate Wellstar continues to inexplicably maintain its egregious demands given we just renewed our hospital contract with the health system in the summer of 2020.

How do I waive my Emory health plan?

Select the "Health" tile on the Applicant homepage or the Student homepage. Select "Submit Health Insurance Waiver" and the follow the five steps to complete the process. Upload your health insurance ID card via your Student Patient Portal at www.shspnc.emory.edu.

What is a charity patient?

Charity care is free or discounted medically necessary health care that many hospitals offer to people who cannot afford to pay for treatment otherwise. It includes both inpatient and emergency room services.

How do I cancel my Emory appointment?

Please call (404) 727-7551 and select Option 1 (day or night) or go online via Your Patient Portal to cancel your appointment.

Does Emory use Epic?

October 1, 2022, Emory Healthcare will go live with Epic as its electronic medical record. With this transition, a new web portal called Emory Healthcare Link will also be available for external health care entities (e.g., referring providers).

We Understand How Confusing Medicare Can Be

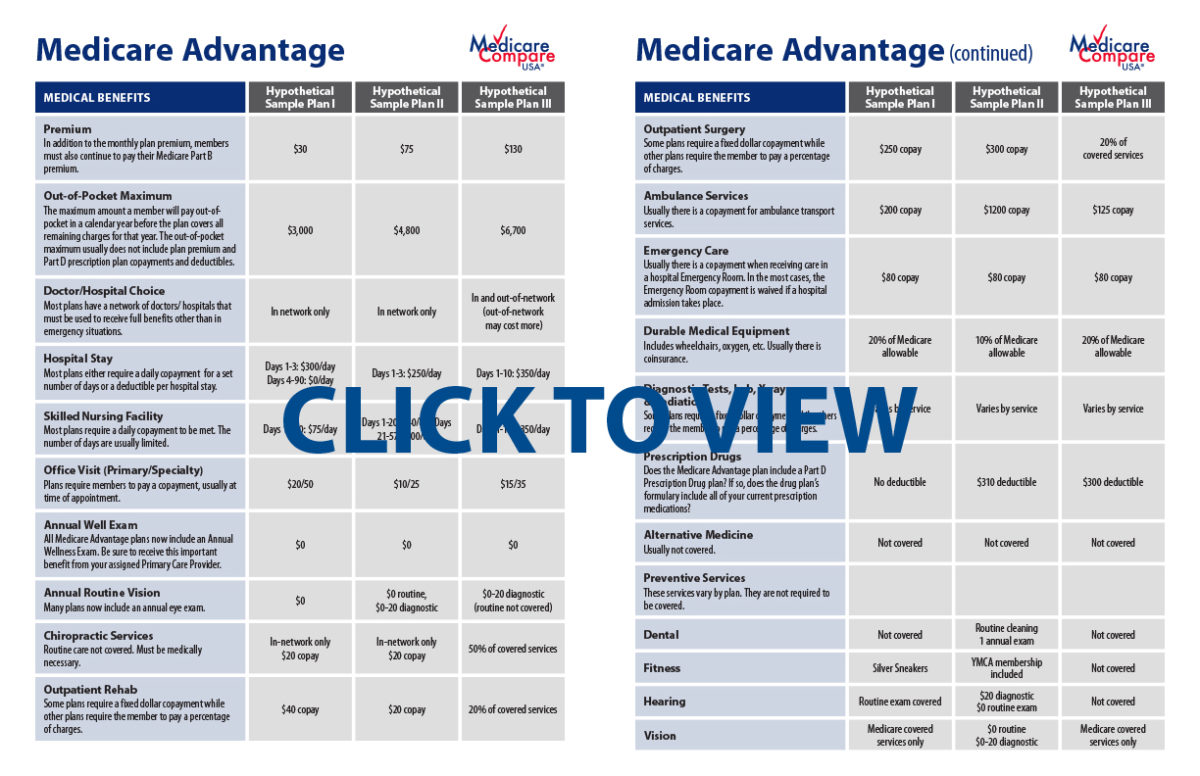

There are many different types of Medicare insurance available, including Medicare Advantage, Supplements, and Prescription Drug plans. There are dozens of insurance companies offering Medicare insurance and to further complicate matters, healthcare providers do not accept all Medicare plans.

Turning 65?

If you’re an Emory Healthcare patient who is turning 65, we’d like your help. Please take a few moments to complete our Medicare Patient Questionnaire. This information helps us better serve you as you transition to Medicare.

Meet with an Agent

Schedule a phone consultation and follow along on your computer, as your local agent reviews a Medicare slide presentation. This is a beneficial avenue to get all your Medicare questions answered, and compare Medicare plans that best meet your healthcare needs, preferences, and budget.

Retiring Emory Healthcare or Emory University Employees

Retired Emory employees and those considering retiring from Emory should contact the Human Resource benefits department for more information regarding specific health benefit programs available to you.

Additional Medicare Resources

The following resources provide a broader range of information about Medicare and Medicare Advantage plans. Both are free and unbiased sources. However, keep in mind, representatives may not have specific information about plans Emory Healthcare accepts.

What is employer sponsored Medicare?

This type of insurance may be a plan that works secondary to Medicare or it may function as a Medicare Advantage plan. Oftentimes, employer-sponsored Medicare plans feature premiums that are considerably more expensive than comparable Medicare plans that are available to the general Medicare popula-tion. If you are considering cancelling an employ-er-sponsored Medicare plan and joining a regular Medicare Supplement or Medicare Advantage plan, be sure to carefully consider your options, as employers often will not allow retirees to return to the plan after cancelling coverage.

What is an OEP in Medicare?

During the Medicare Open Enrollment Period (OEP), also known as Annual Election Period, Medicarebeneficiaries are able to add, drop or change Medicare Advantage or Part D Prescription Drug plan coverage.

What is Medicare Supplement?

This refers to individuals who have Original Medi-care (Part A and Part B), and who also purchase a Medicare Supplement to help insure the ap-proximate 20% of health care expenses that are not covered by Original Medicare. Medicare Supplements provide coverage that is secondary to Medicare; meaning Medicare pays first and the Medicare Supplement pays second (see pages 8-9 for more information on Medicare Supplements).

How does Medicare Advantage work?

The insurance companies sponsoring Medicare Advantage plans are paid directly by Medicare to assume full responsibility for your health care . The private insurance company then pays ap-proved claims to health care providers according to the benefit design of the Medicare Advantage plan. Medicare Advantage plans are closely monitored and each plan must be approved annually by the Centers for Medicare & Medicaid Services (CMS) before being marketed during the Medicare Open Enrollment Period (OEP), also known as Annual Election Period (see Key Dates, page 17 for more information about OEP).

What is Medicare Part A?

Part A helps to pay for hospital and skilled nursing facility, home health, and hospice care. In most cases, if you had a Medicare deduction from your paycheck while you were working, you will not have a Medicare Part A premium. Medicare Part A coverage begins automatically when you become eligible for Medicare at age 65 or if you have been drawing Social Security for 24 months because of a disability.

How long does Medicare enrollment last?

The Medicare Initial Enrollment Period is a seven month period that begins on the third month before you turn age 65 and ends the third month past your 65th birthday. If you sign up for Medicare Part B during the Initial En-rollment Period, there is no late enrollment penalty. However, for Part B coverage to start by your 65th birthday, you must sign up during the three months prior to your birthday (Note: if you become eligible for Medicare due to a disability, your eligibility begins on the 25th month of receiving Social Security Disability Insurance).

How to get a copy of Medicare and You?

You can request a copy by calling 1-800-MEDICARE (TTY 877-486-2048) or download a copy by go-ing to: www.medicare.gov/pubs/pdf/10050-Medicare-and-You.pdf

What happens if I don't use UnitedHealthcare?

What happens if I don’t use a UnitedHealthcare Medicare network provider? Using network providers may save you money. Your UnitedHealthcare Medicare network provider typically must accept your copayment or coinsurance amount as payment in full for your share of your medical care.

Do you need prior authorization for out of network care?

Choosing a network provider may also save you time. In some cases, you may be required to get prior authorization from your plan before it will cover out-of-network care. Learn more about Medicare Advantage plans and Medicare Part D Prescription Drug Plans, including eligibility requirements and enrollment periods.