- The Qualified Medicare Beneficiary (QMB) program is one of the four Medicare savings programs.

- The QMB program helps those with limited income and resources pay for costs associated with Medicare parts A and B (original Medicare).

- To enroll in the QMB program, you must be eligible for Medicare Part A and meet certain income and resource limits.

What is the Qualified Medicare Beneficiary (QMB) program?

The Qualified Medicare Beneficiary (QMB) program is one of them. The QMB program can help pay for Medicare costs including premiums, deductibles, coinsurance, and copays. Despite these benefits, it’s estimated that only 33 percent of people who are eligible for the QMB program are enrolled in it.

Does QMB pay for dental care?

Does QMB Pay for Dental Care? Because standard dental care such as cleanings, fillings, extractions and dentures aren't typically covered by Medicare, unless required during a hospital stay, these expenses aren't covered by the QMB program. You may be eligible for the Qualified Medicare Beneficiary program if you:

What is the income limit for the Qualified Medicare beneficiary program?

The income limit for the Qualified Medicare Beneficiary (QMB) Program is 100 percent of the federal poverty level. The QMB helps pay Medicare Part A premiums, Medicare Part B premiums, Medicare deductibles, coinsurance, and co-payments.

What is a QMB MSP?

The QMB program is one of four MSPs. These programs are aimed at helping those with limited income and resources pay their Medicare out-of-pocket costs. These covered costs include premiums, deductibles, coinsurance, and copays associated with Medicare parts A and B.

What is QMB in Medicare?

The Qualified Medicare Beneficiary ( QMB) program provides Medicare coverage of Part A and Part B premiums and cost sharing to low-income Medicare beneficiaries. In 2017, 7.7 million people (more than one out of eight people with Medicare) were in the QMB program.

Can a QMB payer pay Medicare?

Billing Protections for QMBs. Federal law forbids Medicare providers and suppliers, including pharmacies, from billing people in the QMB program for Medicare cost sharing. Medicare beneficiaries enrolled in the QMB program have no legal obligation to pay Medicare Part A or Part B deductibles, coinsurance, or copays for any Medicare-covered items ...

What is QMB in Medicare?

Qualified Medicare Beneficiary (QMB) Program. If you’re a Medicare beneficiary, you know that health care costs can quickly add up. These costs are especially noticeable when you’re on a fixed income. If your monthly income and total assets are under the limit, you might be eligible for a Qualified Medicare Beneficiary program, or QMB.

What is QMB insurance?

The QMB program pays: The Part A monthly premium (if applicable) The Part B monthly premium and annual deductible. Coinsurance and deductibles for health care services through Parts A and B. If you’re in a QMB program, you’re also automatically eligible for the Extra Help program, which helps pay for prescription drugs.

What is a qualified Medicare beneficiary?

The Qualified Medicare Beneficiary program is a type of Medicare Savings Program (MSP). The QMB program allows beneficiaries to receive financial help from their state of residence with the costs of Medicare premiums and more. A Qualified Medicare Beneficiary gets government help to cover health care costs like deductibles, premiums, and copays.

How much money do you need to qualify for QMB?

To be eligible for a QMB program, you must qualify for Part A. Your monthly income must be at or below $1,084 as an individual and $1,457 as a married couple. Your resources (money in checking and/or savings accounts, stocks, and bonds) must not total more than $7,860 as an individual or $11,800 as a married couple.

Can QMB members pay for coinsurance?

Providers can’t bill QMB members for their deductibles , coinsurance, and copayments because the state Medicaid programs cover these costs. There are instances in which states may limit the amount they pay health care providers for Medicare cost-sharing. Even if a state limits the amount they’ll pay a provider, QMB members still don’t have to pay Medicare providers for their health care costs and it’s against the law for a provider to ask them to pay.

Does Medicare Advantage cover dual eligibility?

A Medicare Advantage Special Needs Plan for dual-eligible individuals could be a fantastic option. Generally, there is a premium for the plan, but the Medicaid program will pay that premium. Many people choose this extra coverage because it provides routine dental and vision care, and some come with a gym membership.

Is Medigap coverage necessary for QMB?

Medigap coverage isn’t necessary for anyone on the QMB program. This program helps you avoid the need for a Medigap plan by assisting in coverage for copays, premiums, and deductibles. Those that don’t qualify for the QMB program may find that a Medigap plan helps make their health care costs much more predictable.

How does Medicaid QMB work?

In addition to covering Medicare premiums for eligible QMB recipients, one of the benefits of the QMB program is having protection from improper billing. Improper billing refers to when health care providers inappropriately bill a beneficiary for deductibles, copayments or coinsurance.

Who is eligible for QMB?

You must be eligible for both Medicare and Medicaid to be eligible for QMB benefits. While Medicare’s eligibility requirements are federally mandated, each state may set its own qualifying restrictions for Medicaid.

What are other Medicare and Medicaid assistance programs?

QMB is not the only program available to dual-eligible beneficiaries. Others include:

What is QMB in Medicare?

Takeaway. The Qualified Medicare Beneficiary (QMB) program is one of the four Medicare savings programs. The QMB program helps those with limited income and resources pay for costs associated with Medicare parts A and B (original Medicare). To enroll in the QMB program, you must be eligible for Medicare Part A and meet certain income ...

What are the eligibility criteria for QMB?

QMB eligibility. There are three different eligibility criteria for the QMB program. These include Medicare Part A eligibility, income limits, and resource limits. You can receive QMB benefits whether you have original Medicare (parts A and B) or a Medicare Advantage plan.

What is Medicare savings program?

Medicare savings programs (MSPs) help people with limited income and resources pay for the costs of Medicare. There are four different MSPs available. The Qualified Medicare Beneficiary (QMB) program is one of them. The QMB program can help pay for Medicare costs including premiums, deductibles, coinsurance, and copays.

What is extra help?

This is a program that helps to pay for the costs associated with a Medicare prescription drug plan ( Medicare Part D ). Extra Help covers things like: monthly premiums. deductibles.

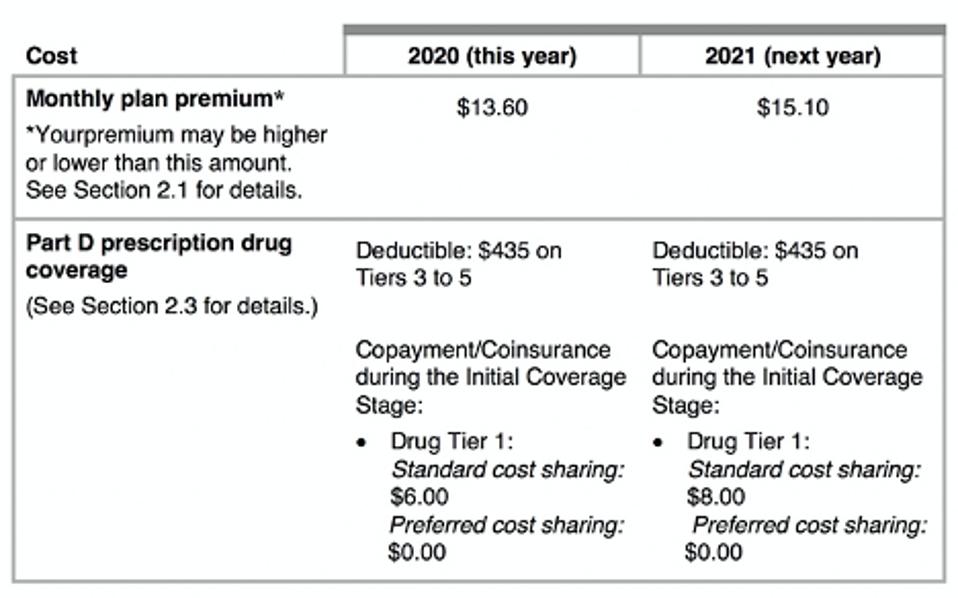

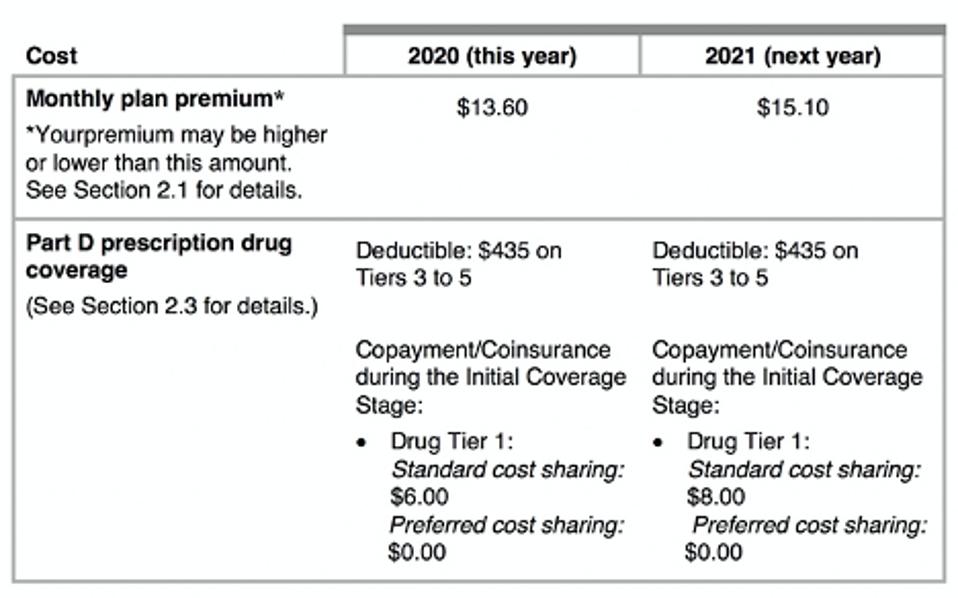

How much is the extra help for Medicare Part D 2021?

copays for prescriptions. Some pharmacies may still charge a small copay for prescriptions that are covered under Part D. For 2021, this copay is no more than $3.70 for a generic drug and $9.20 for each brand-name drug that is covered. Extra Help only applies to Medicare Part D.

What is the income limit for QMB 2021?

For 2021, the monthly income limits for the QMB program are: Individual: $1,094 per month. Married: $1,472 per month. Monthly income limits are higher in Alaska and Hawaii. Because of this, people living in these states may still be eligible for the QMB program, even if their monthly incomes are higher.

When does the SSA review extra help?

Once you’re enrolled in Extra Help, the SSA will review your income and resource status each year, typically at the end of August. Based on this review, your Extra Help benefits for the upcoming year may stay the same, be adjusted, or be terminated.

How much does QMB pay for Medicare?

It can pay deductibles that can total more than $1,400 per year for Part A and more than $190 for Part B. The QMB can also pay copays that apply to services used by participants. The overall amount of these payments depends on upon the services used.

What is QMB for Medicare?

For those that qualify, the QMB is a valuable costs savings program for Medicare participants. It holds a potential to save significant amounts and particularly for those that use a moderate to heavy amount of services.

What is the deductible for qualified Medicare?

The annual Medicare cycle includes a deductible which was approximately $1,408.00 in 2020. Coinsurance and copays can build into the thousands very easily given even a short hospital stay and outpatient follow-up.

What is QMB program?

The QMB Program is the Qualified Medicare Beneficiary program; Medicaid pays premiums for Part A and for Part B. It pays deductibles, coinsurance, and copays for Part B. The program accepts applicants with incomes as high as 100 percent of the federal poverty guideline. The QDWI Program is the qualified disabled and working individuals program;

What is a QMB?

The QMB is a Medicare Savings Program for low-income individuals and families that can save a lot of money. It is one of four Medicare Savings Programs.

What is QMB eligibility?

Eligibility for QMB. The keys are participation in Medicare Part A and income in the range of the federal poverty guideline. Applicants must be Medicare beneficiaries. The income must be in the range of the federal poverty guideline as adjusted by the review standards.

What percentage of Medicare Part B is covered by QMB?

In Medicare Part B, there is a common relationship of 80 percent coverage by Medicare and 20 percent by the client. The QMB program can pay part of the prescription drug costs for participants in a Medicare Part D: Prescription Drugs plan.

What Medicare Costs Are Paid For by QMB?

QMB is one is of four Medicare Savings Programs designed to assist those with limited financial resources to more easily access Medicare coverage. These programs are federally funded and administered through state-run Medicaid agencies.

Qualifying for the QMB Program

You may be eligible for the Qualified Medicare Beneficiary program if you:

How Does the Program Work?

Once you're enrolled in the QMB program, you're no longer legally obligated to pay for deductibles, coinsurance or co-payments for any services or items covered by Medicare Part A or B.

Is QMB a Medicaid Program?

While QMB is administered by your state Medicaid agency, it's a separate program from Medicaid and provides different coverage. For example, Medicaid covers vision and dental, but QMB doesn't. Qualifying for QMB does not mean you automatically qualify for Medicaid.

How to Apply for QMB

To apply for the Qualified Medicare Beneficiary program, contact your state Medicaid agency. Medicare encourages you to fill out an application if you think you might be eligible, even if your resources exceed the limits posted on their website.

What is QMB insurance?

The QMB program is just one way to get help paying your premiums, deductibles, and other costs. You must fall below income and asset limits to participate in the QMB program. If you think you make or own too much, try applying anyway. Many assets and income sources aren’t included when calculating your eligibility.

What is QMB program?

Since the QMB program aims to help individuals with low income, it places limits on the monthly income and financial resources available to you. If you exceed these limits, you may not be eligible for the program. Generally, participation is limited to individuals who meet the federal poverty level.

How to enroll in QMB?

To enroll in the QMB program, you first need to be enrolled in Medicare Part A. The next step is to review your income and assets to see if you fall below the limits set by Medicare. But remember there are exceptions to those limits, and you’re encouraged to apply even if your income or assets exceed them.

How long does it take to get a QMB denial?

Once you submit your application, you should receive a confirmation or denial within about 45 days. If you’re denied, you can request an appeal. Enrollment in any of the MSPs must be renewed each year. Even when your QMB is active, you may at times be wrongfully billed for items or services that it covers.

Does Medicare cover out of pocket costs?

The takeaway. Medicare is meant to provide affordable healthcare coverage for older adults and other individuals in need. Even so, out-of-pocket costs can add up . A number of programs can help you pay for your share of Medicare costs.

Do you have to be a resident to qualify for QMB?

You must be a resident of the state in which you’re applying for the QMB program, and you must already be enrolled in Medicare Part A. Assets that aren’t counted when you apply for the QMB program include: your primary home.