Two EGWP Medicare Plans Options There are two choices for self funded organizations that presently have enrolled in the CMS sponsored retiree drug subsidy (RDS) program and wish to take advantage of more favorable savings provided by Employer Group Waiver Plans. 800-Series Employer Group Waiver Plan First, there is the 800-Series EGWP.

Full Answer

Does an EGWP qualify for Medicare subsidies?

With an EGWP there is no subsidy filing required for the group sponsor. Normally EGWP’s are administered through a pharmacy benefit manager or insurer that contracts directly with the Centers for Medicare & Medicaid Services ( CMS ). Plan options are available that close the gap in retiree Medicare coverage, known as the doughnut hole.

What are employer group Medicare Advantage plans (EGWP)?

These Group Medicare Advantage plans are also called employer group waiver plans (EGWP), which insurance experts call “egg-whip.” Many employers offer them to their retired or retiring employees.

What are the different types of Medicare Advantage plans in Florida?

Types of Florida Medicare Advantage plans. There are four main types of Medicare Advantage Plans: Health Maintenance Organization (HMO) Plans: With an HMO plan, you must go to a doctor or hospital that is in your provider network (except in the case of an emergency).

Where can I get EGWP information?

EGWPInfo.com is a consortium of knowledgeable pharmacy benefits consultants who can answer your need for EGWP Information. Whether you are a plan broker or a plan sponsor, our experts can help you sort out how your situation can be helped by implementing an EGWP.

What is Medicare EGWP?

Group Medicare Advantage plans are also called employer group waiver plans (EGWP), pronounced “egg-whips.” EGWPs are a type of Medicare Advantage plan offered by some employers to employees and retirees of some companies, unions, or government agencies.

Is an EGWP a Medicare Advantage Plan?

Employer Group Waiver Plans (EGWPs), also known as employer retiree Medicare Advantage health plans are a type of health plan offered by a public or private employer to its retiree population. There are currently 4.1 million retirees in EGWPs out of nearly 20 million Medicare Advantage beneficiaries.

What is the difference between RDS and EGWP?

As a general rule of thumb, EGWP coverage provides a higher base subsidy than RDS plans and even come with catastrophic reinsurance which kicks in when out of pocket costs exceed $5100 or a total of $8140 in total drug costs.

What is EGWP Rx?

An EGWP, commonly referred to in retiree benefit plan parlance as an “egg whip”, is a group Medicare Part D prescription drug plan option that is offered to retirees who have been promised prescription drug coverage as part of their Other Post-Employment Benefits (OPEB).

What is an EGWP wrap plan?

What is EGWP/wrap? EGWP/wrap is an official Medicare Part D program containing a wraparound provision that ensures that retired employees will receive benefits at least equal to those of the plan that the employer currently offers.

What is an EGWP subsidy?

An Employer Group Waiver Plan, known as an EGWP or “Egg Whip,” is program offered by the federal government that will increase federal subsidies for prescription drugs for the retiree health trust. This is an administrative change to how pharmacy benefits are managed for Medicare-eligible retirees and dependents.

How do EGWP plans work?

Employer Group Waiver Plans provide flexibilities that allow customized coverage to support each employer's retiree benefit commitments. Many employers and unions provide Medicare Part D (prescription drug) coverage to eligible retirees through dedicated plans known as Employer Group Waiver Plans (EGWPs).

What is an 800 series EGWP?

800-Series Employer Group Waiver Plan First, there is the 800-Series EGWP. This is when a third party administrator holds the contract with the CMS on the plan sponsor's behalf.

What does PDP mean in Medicare?

Medicare Prescription Drug PlanMedicare Cost Plan Join a Medicare Prescription Drug Plan (PDP).

What are the different types of Medicare Advantage plans?

There are four main types of Medicare Advantage Plans: 1 Health Maintenance Organization (HMO) Plans: With an HMO plan, you must go to a doctor or hospital that is in your provider network (except in the case of an emergency). 2 Preferred Provider Organization (PPO) Plans: With a PPO Plan, you pay less if you go to doctors and hospitals in your provider network, but you have the option to go out of network and pay a higher price. 3 Private Fee-for-Service (PFFS) Plans: With a PFFS Plan, Medicare pays a set amount every month to your insurance company to provide you with health care coverage. The insurance company (not Medicare) decides how much you pay for services. Your provider can choose whether or not to agree to the terms and conditions of your plan. 4 Special Needs Plans (SNPs): Special Needs Plans are limited to people with certain diseases or characteristics.

How to contact Medicare Advantage?

Not have End-Stage Renal Disease (ESRD) If you meet the above requirements, you can reach out to a licensed insurance agent at. 1-800-557-6059. 1-800-557-6059TTY Users: 711.

What is EGWP contract?

Under a directly contracted EGWP, employers and union groups contract direct with CMS to supply plan benefits and receive subsidy payments directly from the CMS. The subsidy, which is pre-tax is determined by the national average bid amount, which is less than the part D base beneficiary amount.

What is EGWP + wrap?

This consists of a EGWP without gap coverage for brand name drugs plus a commercial wrap product to provide the missing coverage. In this way, the 50% discount is applied to the gross cost of the drug for all EGWP plans, greatly increasing the discount impact. EGWP +wrap plans are becoming the most used alternative to traditional Medicare Part D RDS subsidies for retiree prescription benefits plans.

Is CMS sponsoring RDS?

There are two choices for self funded organizations that presently have enrolled in the CMS sponsored retiree drug subsidy (RDS) program and wish to take advantage of more favorable savings provided by Employer Group Waiver Plans.

What is EGWP in Medicare?

Group Medicare Advantage plans are also called employer group waiver plans (EGWP), pronounced “egg-whips.”. EGWPs are a type of Medicare Advantage plan offered by some employers to employees and retirees of some companies, unions, or government agencies. EGWPs may offer more benefits than traditional Medicare Advantage plans. EGWPs are often PPOs.

What is EGWP insurance?

These Group Medicare Advantage plans are also called employer group waiver plans (EGWP), which insurance experts call “egg-whip.”. Many employers offer them to their retired or retiring employees. These Advantage plans may offer extra benefits to you as well as more relaxed enrollment guidelines. Keep reading to find out more about EGWPs, benefits ...

What are the benefits of EGWP?

Benefits of an EGWP. Group Medicare Advantage plans may offer services to their members that go beyond traditional Medicare Advantage plans. Some examples include: lower out-of-pocket costs. health education. extra benefits. Medicare grants special waivers to insurance companies and their Group Medicare Advantage plans.

What are EGWPs covered by?

EGWPs cover the same services as Medicare parts A, B, and D: hospitalization, doctor visits, prescription drugs, testing, and other healthcare. They may also offer other benefits, such as dental, eye exams, foot care, or wellness classes.

How many stars does Medicare Advantage have?

The Medicare Advantage Star Ratings program rates Medicare Advantage plans on a scale of up to five stars. Medicare Advantage considers plans that earn four or five stars to be high-quality. Other Medicare Advantage plan options.

What is a PPO?

A PPO is a type of insurance in which you pay the lowest fees if you use preferred providers or in-network doctors, hospitals, and other healthcare providers. You can still use out-of-network providers, but you will have to pay more.

What to do if your company offers you an EGWP?

If your company (or former company) offers you an EGWP, you may need to talk to the company’s insurance representative. Some things to consider about EGWPs include: Your insurance coverage needs. Be sure to consider the medications you take and doctors you see.

The market

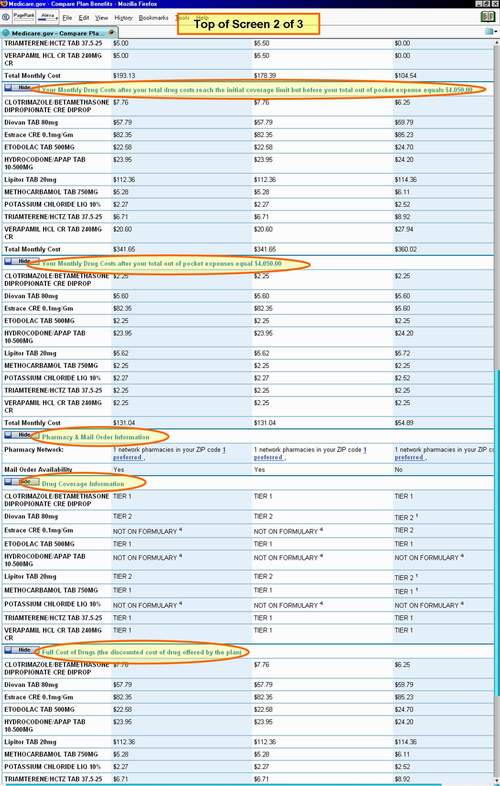

As of June 2021, about 9.6 million Medicare beneficiaries were enrolled in EGWP products. The graph in Figure 1 shows the composition of the market. 2

The basics

Information about EGWPs can be difficult to find so we have listed three valuable resources below:

Pricing considerations

The projection of risk scores can be one of the most challenging assumptions in developing group premium rates, mainly when trying to procure a new group. The challenges vary depending on the structure of the retiree medical plan.

The opportunity

Employers, especially public ones, typically issue requests for proposals (RFPs) for EGWPs. The RFP outlines the employer’s current situation, challenges, and goals, and then gives health plans an opportunity to “put their best foot forward” and showcase their abilities to serve the group. The RFP can also include the following types of provisions:

Why are employers turning to EGWPs?

Employers have turned to EGWPs to provide more affordable options than Medicare Supplement Insurance policies for beneficiaries. These types of Medicare Advantage (MA) plans are profitable for larger populations such as local and state governments, industries and unions.

Is EWGP a PPO or HMO?

Therefore, EWGP requires providers nationwide and most plans are PPO (Provider Organizations) rather than HMO (Health Maintenance Organizations). Retiree coverage those include a range of benefits for beneficiaries such as risk adjustment, cost protection, benefit design, quality and value and beneficiaries right.

Does Egg Whip cover Medicare?

Egg Whip plans like other MA plans cover all Medicare Part A and Part B benefits in addition to supplemental benefits, vision, dental, out-of-pocket cost protections, and innovations to enhance beneficiaries care. Employers provide uniform plan designs to administer coverage to their retirees.

What is EGWP Medicare?

Because of recent healthcare reform initiatives, an EGWP is the most cost-effective way for organizations to provide retiree prescription drug coverage. An EGWP, commonly referred to in retiree benefit plan parlance as an “egg whip”, is a group Medicare Part D prescription drug plan option that is offered to retirees who have been promised ...

What is EGWPInfo.com?

EGWPInfo.com is a consortium of knowledgeable pharmacy benefits consultants who can answer your need for EGWP Information. Whether you are a plan broker or a plan sponsor, our experts can help you sort out how your situation can be helped by implementing an EGWP.

What is Medicare RDS?

Under the Retiree Drug Subsidy (RDS), the government was paying up to 28% of the covered Medicare-eligible retirees maintenance drug program (MDP) expenses directly to the participating enterprises. The RDS subsidy was tax free to the employer.

What is the doughnut hole in Medicare?

Plan options are available that close the gap in retiree Medicare coverage , known as the doughnut hole. Under the EGWP there are three substantial subsidies and discounts that lower the cost of prescription drugs for plan sponsors and their members. 1.

What is the 80% reinsurance for Medicare?

3. Catastrophic Insurance – Medicare provides 80% reinsurance for the highest utlizers. The Medicare Part D law was passed in 2003 and took effect in 2006. The federal government created two methods that gave employers impressive subsidies and tax incentives to keep retired employees on their prescription drug plans.

Is the RDS affected by PPACA?

The original Retiree Drug Subsidy (RDS) has been adversely affected by the 2013 Patient Protection and Affordable Care Act (PPACA) for self-funded employers. Effective January of 2013, the PPACA wipes out the full value of the tax deduction of those retiree drug expenses. This is now causing self-funded retiree drug benefit plan providing companies ...

Does Medicare Part D require a subsidy?

Medicare Part D subsidies and discounts are used to reduce the fully insured premium. With an EGWP there is no subsidy filing required for the group sponsor.