What is the most popular Medicare supplement plan?

Feb 26, 2020 · Medicare Supplement Plan G is the best overall plan that provides the most coverage for seniors and Medicare enrollees. Plan G will cover almost everything except the Part B deductible. This means that you would be responsible for paying the entire Medicare Part B deductible — $233 for 2022 — before insurance benefits will begin to pay for your health care.

What is the cheapest Medicare supplement to get?

Mar 24, 2022 · Medicare Supplement Insurance helps you pay for the gaps in Medicare coverage. Once Medicare pays its share of the services you are receiving, Medigap will help you pay the rest. If your Part B policy says it covers 80% of a doctor’s visit, Medicare will pay that. Medigap kicks in for the other 20%.

How do I choose the best Medicare supplement policy?

Nov 04, 2016 · Plan F is the highest level Medicare Supplement plan available, but there’s a variation called the High Deductible Plan F . This plan pays the same benefits as the regular plan F after the person has paid out $2,370 during the calendar year of 2021. You’ll pay the 20% that Medicare doesn’t for all expenses that would normally be paid under plan F for Medicare Part A …

How does Medicare supplement insurance work with Medicare?

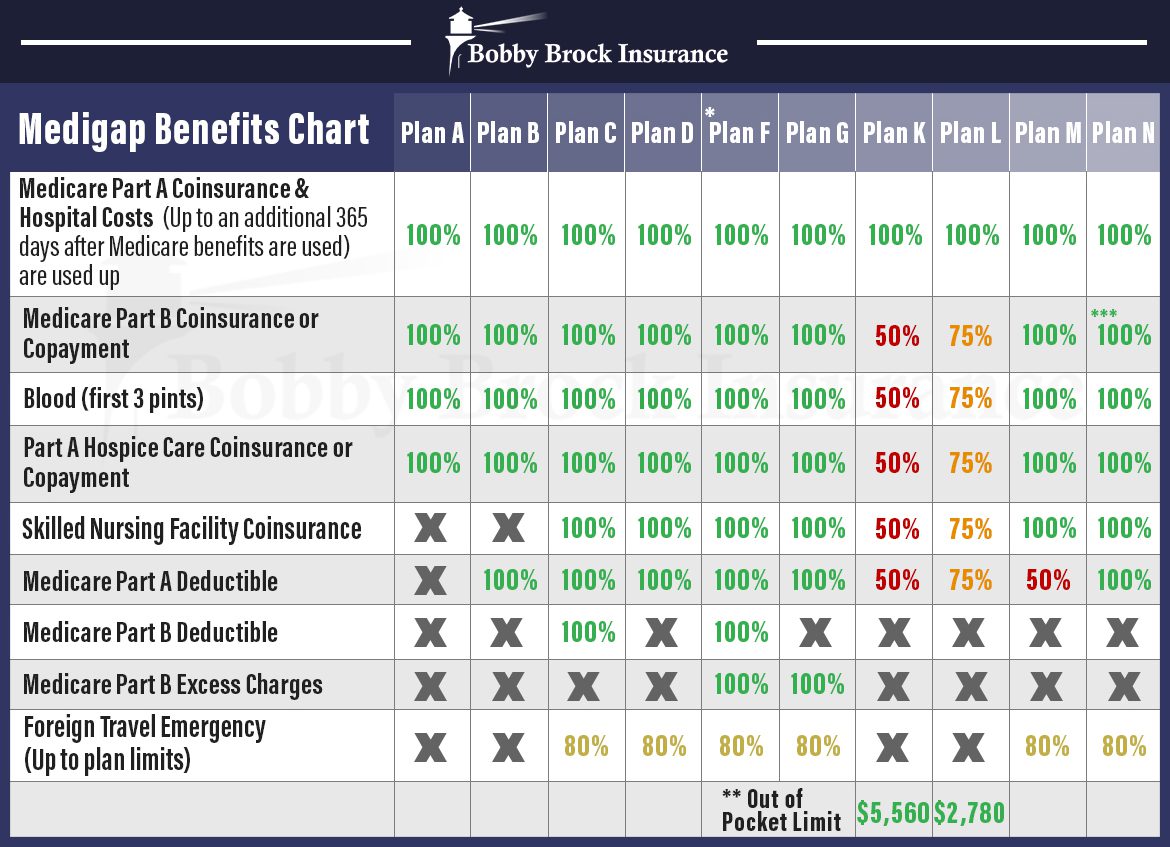

Sep 13, 2019 · All Medicare Supplement plans typically cover: Your Medicare Part A hospital coinsurance, plus an additional full year of benefits after your Medicare benefits are exhausted. Some or all of your Medicare Part B coinsurance. Some or all of your Part A hospice coinsurance. Some or all of your first three pints of blood.

Which Medicare Supplement plan is the most comprehensive?

Medigap Plan FMedigap Plan F is the most comprehensive Medicare Supplement plan. Also referred to as Medicare Supplement Plan F, it covers both Medicare deductibles and all copays and coinsurance, leaving you with nothing out-of-pocket. This post has been updated for 2022.

Is Plan G the best?

Medicare Plan G is currently the most comprehensive Medicare Supplement plan in terms of the coverage it offers. If you desire stability and knowing what to expect from your health care costs (and if you can afford the premium), Medicare Plan G may be the best option for you.

What is the difference between Medigap plan G and N?

When you compare Medicare Supplement Plan G vs Plan N, you'll see that Plan G comes with more coverage. However, Medicare supplement Plan N will come with a lower monthly premium. In exchange for a lower monthly premium, you agree to pay small copays when visiting the doctor or hospital.

Do all Medicare Supplement plans pay the same?

In most states, Medigap insurance plans have the same standardized benefits for each letter category. This means that the basic benefits for a Plan A, for example, is the same across every insurance company that sells Plan A, regardless of location.

Does AARP Offer Plan G?

Medicare Supplement Insurance benefits are standardized by the federal government. That means Medigap Plan G purchased through AARP will feature the same basic benefits as a Plan G purchased through a different carrier.Sep 21, 2021

Should I switch from F to G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Can I switch from Plan N to Plan G?

Yes, you can. However, it usually still requires answering health questions on an application before they will approve the switch. There are a few companies in a few states that are allowing their members to switch from F to G without review, but most still require you to apply to switch.Jan 14, 2022

Is Plan G cheaper than Plan F?

Even though it has similar coverage, Medigap Plan G's monthly premiums are typically much less expensive than those for Plan F. In some cases, the difference in premiums between the two plans may be so large that you could save money by choosing Plan G, even after the Part B deductible.

What is the deductible for Medicare Supplement plan g?

$233Plan G has nearly the same level of coverage as Plan F. With Plan G, you are responsible for the Part B deductible of $233. Otherwise, coverage is exactly the same as Plan F.

Who is the best Medicare Supplement provider?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Pricing: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

What is the plan g deductible for 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Who regulates Medicare Supplement Insurance?

Medicare Supplement Insurance plans are tightly regulated by the Centers for Medicare and Medicaid Services (CMS), a government agency. CMS determines what each letter plan will cover, and it requires each insurance company to offer the plan as is, without modifications.

How long does a Supplement 1 plan cover?

The Supplement 1 plan covers 120 days of mental health hospitalization and the state-mandated benefits, plus the deductibles for Medicare Part A and Part B, co-insurances for services at a skilled nursing facility under Part A, and emergency medical costs when traveling outside of the U.S.

What is a Medigap plan?

Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share. Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020. Sign up for Medigap during Open Enrollment to lock in the best premium for your plan. Our Approach.

What is covered by Plan A?

Plan A also covers 100% of coinsurances or copayments for hospice care services, 100% of Medicare Part B coinsurances or copayments for medical outpatient services, and 100% of the cost of the first three pints of blood you are administered during a procedure.

How much does Medicare pay for a doctor's visit?

Here’s an example with numbers: if the doctor’s visit had a Medicare-approved cost of $100, Medicare would pay $80, your Medigap would pay $15, and you would only have to pay $5.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

What happens if you don't enroll in Medicare?

If you don’t enroll in Part A (inpatient hospital services) when you initially qualify, you may find yourself saddled with a 10% late enrollment penalty on your Part A premium. Says the Medicare website, “You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.”

What is the highest level of Medicare Supplement?

You’ll pay the 20% that Medicare doesn’t for all expenses that would normally be paid under plan F for Medicare Part A and B expenses until you hit $2,300. Then you’re covered at 100%. It’s a cost effective way to have the best coverage if you’re willing to pay a little along the way.

Is high deductible F better than Medicare Advantage?

The High Deductible F plan can also be a better option for people who are considering a Medicare Advantage plan. Some Medicare Advantage plans cost $50 to $100 per month plus you still have copays, deductibles and cost sharing up to $6,000 or $10,000 for out of pocket expenses.

How many Medicare Supplement Plans are there?

There are four “parts” of Medicare, and there are up to 10 lettered, standardized Medicare Supplement plans in most states.

How long does Medicare Supplement open enrollment last?

Your Medicare Supplement Open Enrollment Period (OEP) typically begins the month you are both age 65 or over and enrolled in Part B, and lasts for six months. If you think you will ever want coverage, it’s important to buy it during the OEP.

What is Medicare Part A coinsurance?

Your Medicare Part A hospital coinsurance, plus an additional full year of benefits after your Medicare benefits are exhausted. Some or all of your Medicare Part B coinsurance. Some or all of your Part A hospice coinsurance. Some or all of your first three pints of blood. Medicare Supplement Plan A is the most basic of the standardized, ...

What is community rated Medicare?

Medicare Supplement insurance companies can use one of three ways to rate, or price, their policies: Community-rated, which means everyone pays the same premium regardless of age. Issue-age rated, which means your premium is based on your age at the time you buy the policy.

Is there an annual enrollment period for Medicare Supplement?

Unlike with Medicare Advantage and Medicare Part D prescription drug plans, there is no annual enrollment period for Medicare Supplement plans. You can apply for a plan anytime you want, as long as you’re enrolled in Medicare Part A and Part B.

Does Medicare Supplement cover out of pocket expenses?

Out-of-pocket costs with Part A and Part B can pile up, especially if you have a chronic health condition or a medical emergency. Medica re Supplement plans help cover those out-of-pocket Medicare costs so it’s easier to budget for your health care.

Is community rated Medicare the least expensive?

Although the premium for a community-rated plan may be higher at first, it may be least expensive over time. Attained-age Medicare Supplement plans usually start with a low premium, but the increases at different age milestones can be steep.

Does Medigap coverage vary by state?

No, Medigap coverage does not vary by state and neither does Medigap cost. That being said, the coverage and cost from one Medicare Supplement plan to the next can vary. Each of the eight Medigap plans provides a different level of benefits, but all plans are required to cover basic benefits such as:

Medigap Plan Costs by State

While Medigap rates don’t vary by state, they do vary from plan-to-plan. Monthly premiums for Medicare Supplement Plans are set by the private insurance companies who offer them and are based on age, health, gender, and a number of other factors such as location. Learn more about the different Medicare Supplement Plans below.

State Specific Enrollment for Medicare Supplement Plans

Although Medicare is a Federal program, there are some states that have different terms and rules for enrollment, guaranteed issue rights, excess charges, availability, and more. Learn more about state specific enrollment for Medicare Supplemental insurance below.

Compare Medicare Advantage Plans Near Me

Insurance isn’t easy, but at Health Plan Solution, we’ll do the leg work for you. In just minutes, we can shop Medicare Supplement Plans from some of the most trusted insurance companies at no cost to you. There’s never an obligation to enroll. Compare Medigap Plans for free with Health Plan Solution today.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

Which Medicare Supplement Plan has the best coverage?

Which Medigap plan has the best coverage? If you turned 65 before Jan. 1, 2020, Medicare Supplement Plan F has the highest level of coverage. It covers 100% of all the above items besides the foreign travel policy (80% coverage). If you are turning 65 in 2020 or later, the best plan will be Plan G moving forward.

What is Medicare Supplement Plan?

Medicare Supplement Plans. Medicare Supplement Plans, also known as Medigap, are private healthcare policies that pay for Medicare’s leftover costs. It DOES NOT replace Original Medicare. Here’s how it works:

How many lettered Medicare Supplements are there?

Your Medicare Supplement pays the excess amount per the plan’s terms. There are 10 lettered Medigap plans (A through N) that cover certain percentages of different benefits. However, the plans are standardized. So, the only difference between the same plan at different companies will be the price.

Is Medicare Part B deductable?

Medicare Part B Deductible*. Medicare Part B Excess Charges. Foreign Travel Emergency (up to plan limits) * Those who turned 65 on January 1, 2020 or later will not be allowed to purchase Medicare Supplements that cover this cost.

Is 20% a lot?

But medical professionals consistently charge thousands of dollars for routine healthcare. So, 20% becomes a lot. Especially if you make several visits a year. Here are the costs that may be covered by a supplement plan: Medicare Part A Coinsurance and Hospital Costs. Medicare Part B Coinsurance or Copayment.

Can I enroll in Part B insurance at any time?

Depending on your state, you may have future guaranteed-issue enrollment dates. If not, once this one-time open en rollment is over, insurance companies are then allowed to deny your application based on health. After your Part B plan is in effect, you can enroll at any time.

Medicare Supplements

Medicare Supplement Plans, aka Medigap, are policies that help cover Medicare’s excess charges. These costs include things like your deductibles and coinsurance, or copayments.

Medigap Benefits

Medicare Supplement plans are totally optional. However, many Medicare beneficiaries encounter extensive out-of-pocket costs that they can’t afford because they must pay 20% of outpatient expenses. Thus, millions of Americans purchase Medigap to save on costs and to have peace of mind.

What Are the Different Plans?

The different Medicare Supplement plans are marked with a different letter between A through N. Right now you will not be able to find a Plan E, H, I, or J.

Which Medigap Plan Should I Choose?

The choice is really up to you. Some beneficiaries don’t want to worry about out-of-pocket expenses, so they opt for a plan that covers everything. Others, meanwhile, just want some of their deductibles and copays covered, but they are mostly concerned about low premiums.

Which Policy Has the Highest Coverage?

Medicare Supplemental Plan F has the highest coverage level. You have zero out-of-pocket expenses. The second-best, in terms of coverage, is Plan G. With Plan G, you still pay the Part B deductible once a year. It keeps your Medigap premium lower and may save you money over time.

Brad Rhodes Medicare Supplement Advisory

If you have questions or just need a second opinion on your current Medicare Supplement plan, Brad Rhodes Medicare Supplement Advisory can help. We never get tired of saving people money on their Medicare Supplement. Call (800) 529-1359 today. We look forward to talking with you!

What is Medicare Part B based on?

Medicare Part B (medical insurance) premiums are based on your reported income from two years prior. The higher premiums based on income level are known as the Medicare Income-Related Monthly Adjustment Amount (IRMAA).

When will Medicare Part B and Part D be based on income?

If you have Part B and/or Part D benefits (which are optional), your premiums will be based in part on your reported income level from two years prior. This means that your Medicare Part B and Part D premiums in 2021 may be based on your reported income in 2019.

How much is the 2021 Medicare Part B deductible?

The 2021 Part B deductible is $203 per year. After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

Does Medicare Part D cover copayments?

There are some assistance programs that can help qualified lower-income beneficiaries afford their Medicare Part D prescription drug coverage. Part D plans are sold by private insurance companies, so additional costs such as copayment amounts and deductibles can vary from plan to plan.

Does income affect Medicare Part A?

Medicare Part A costs are not affected by your income level. Your income level has no bearing on the amount you will pay for Medicare Part A (hospital insurance). Part A premiums (if you are required to pay them) are based on how long you worked and paid Medicare taxes.

Does Medicare Part B and D have to be higher?

Learn more about what you may pay for Medicare, depending on your income. Medicare Part B and Part D require higher income earners to pay higher premiums for their plan.

Does Medicare Advantage have a monthly premium?

Some of these additional benefits – such as prescription drug coverage or dental benefits – can help you save some costs on your health care, no matter what your income level may be. Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations.

What are the different Medicare Supplement plans?

Several Medicare Supplement insurance plans provide an international coverage benefit. Six plans — Med igap plans C, D, F, G, M, and N — include the benefit. Plans E , H , I , and J , which are no longer available for sale but are still valid for use, also provide this benefit.

How much does Medigap pay for emergency care?

The Medigap plan will pay for 80% of the billed charges for certain medically necessary emergency care received outside of the U.S. You are responsible for the remaining 20% cost. You must meet a $250 deductible each year when using the benefit. Additionally, there is a $50,000 lifetime limit for international care.

Does Medicare Part C have international coverage?

If you have a Medicare Advantage plan (Medicare Part C), your plan must provide at least the same level of international care coverage as Original Medicare. Some plans may provide additional levels of coverage, but not in all situations.

Where does Medicare cover?

Original Medicare covers beneficiaries living in the continental United States, and in the unincorporated territories of Puerto Rico, Guam, the U.S. Virgin Islands, the Northern Mariana Islands, and American Samoa.

Does Medicare cover medical expenses abroad?

If you are enrolled in Medicare and planning a vacation abroad, you should review what international medical services are covered under Medicare and Medigap. Original Medicare health insurance provides limited international medical coverage. If you need health care coverage outside of the United States, you may want to consider a Medicare ...

Does Medicare cover dialysis?

Medicare will not cover any prescriptions drugs or non-emergency dialysis care. You are still responsible for co-insurance, co-payments, and deductibles. Foreign hospitals are not required to file Medicare claims. You may be required to submit the medical claim directly to Medicare.

Does Medicare cover foreign hospitals?

hospital that can treat your medical condition, regardless of it being an emergency. In the 3 situations above, Medicare only covers the Medicare-approved service and only pays for its share of services.