Medigap Plan F in New Hampshire

| Plan Name | Policy Age |

| AARP Medicare Supplement Plans | May 22 2018 |

| American Retirement Life Insurance | Dec 12 2014 |

| Americo Financial Life and Annuity Insur ... | Jun 01 2017 |

| Anthem Health Plans of New Hampshire Inc | Jul 12 2010 |

Full Answer

What are the top 5 Medicare supplement plans?

Oct 15, 2020 · This dashboard will be updated periodically, as additional company plans and rates are approved. You may also contact the NH Insurance Department's Consumer Services Division at 1-800‐852‐3416 (option #2) to obtain updated plan and rate information. Visit our additional Medicare Supplement consumer shopping tips page for more information.

What are the best Medicare supplement plans?

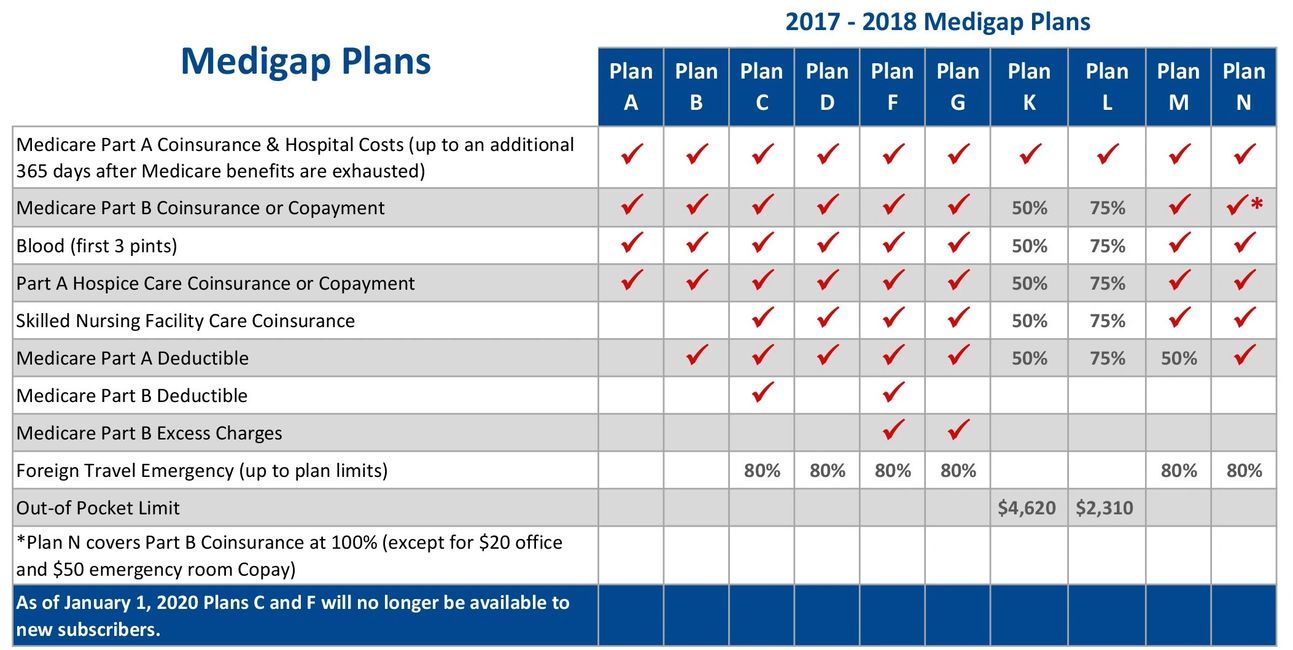

Nov 01, 2018 · Congress made significant changes to the Medicare program in 2015, one of which directly affects Medicare Supplement plans in New Hampshire. As of January 1, 2020, insurers are no longer allowed to sell plans that cover the Part B deductible. This means that two of the most popular plans, Plan C and Plan F, will no longer be available.

What are the best Medicare plans?

18 rows · Jan 07, 2026 · We review Medicare Supplement Plans in New Hampshire head-to-head, statewide. We recommend ...

What are the different Medicare supplement plans?

53759 Anthem Health Plans of New Hampshire (Anthem Inc Group) X X X X 67369 Cigna Health and Life Ins Company (Cigna Health Group) X X X X X 62065 Colonial Penn Life Insurance Company (CNO Financial Group) X X X X X X X X X X X

What are the top 3 most popular Medicare Supplement plans in 2021?

Three plans — Plan F, Plan G, and Plan N — are the most popular (accounting for over 80 percent of all plans sold). Here's an in-depth look at this trio of Medicare Supplement plans, and the reasons so many people choose them.Sep 25, 2021

What is the best Medicare Advantage plan in NH?

Medicare Advantage Plans in New HampshireInsurance companyMedicare ratingA.M. Best ratingBlue Cross Blue Shield4 to 4.5 starsA+Cigna4 starsA-Humana4 starsA-UnitedHealthcare3.5 starsA-1 more row

What states have the cheapest Medicare Supplement plans?

The chart below shows the average monthly premium for Medicare Supplement Insurance Plan G for each state in 2018. Wisconsin, Hawaii and Iowa had the plans with the lowest average monthly premiums, around $102 per month.Feb 15, 2022

What is the most basic Medicare Supplement plan?

Plan A is the most basic of Medigap plans, with the lowest premiums. It is the only Medicare Supplement plan that doesn't cover the Part A deductible.

What is Medicare NH?

Medicare plans in New Hampshire provide healthcare coverage to older adults as well as those with certain health conditions or disabilities in the state.

What states are guaranteed issue for Medicare Supplement?

Only four states (CT, MA, ME, NY) require either continuous or annual guaranteed issue protections for Medigap for all beneficiaries in traditional Medicare ages 65 and older, regardless of medical history (Figure 1).Jul 11, 2018

What is the best and least expensive Medicare plan?

The good news: Medicare Plan F is one of the most popular Medicare Supplemental Plans available, with 45% of those enrolled in Medicare also enrolled in Plan F. 1 It offers the most coverage for hospital stays and specialists for the least cost, which explains its popularity.

Do Medigap premiums vary by state?

Medigap plans are standardized across most states, meaning they offer the same benefits. The exceptions are Wisconsin, Minnesota and Massachusetts. Plans in those states may have options that differ from Medigap plans in other states.

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Does Plan G cover Medicare deductible?

Get online quotes for affordable health insurance Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you won't pay anything out-of-pocket for covered services and treatments after you pay the deductible.

How much are Medicare Supplements per month in New Hampshire?

It all depends. Your age, gender, zip code, use of tobacco, and the exact plan you choose all need to be factored in. You can take advantage of our...

What insurance companies offer Medigap policies in New Hampshire?

Here are your top choices in New Hampshire: Anthem Blue Cross and Blue ShieldAARPAmerico LifeMutual of OmahaColonial Penn You will find the complet...

When can I enroll in a Medicare Supplement in New Hampshire?

Your Individual Enrollment Period (IEP) is the ideal time to get a Medicare Supplement. Your IEP starts on your Medicare Part B effective date and...

What do Medicare Supplement plans in New Hampshire cover?

All Medicare Supplement plans in New Hampshire cover all or part of your Part A coinsurance (plus an additional 365 days of benefits after Medicare runs out), your Part A hospice copayments or coinsurance, your first three pints of blood, and your Part B coinsurance.

When can I enroll in Medicare Supplement plans in New Hampshire?

Medicare Supplement plans in New Hampshire are a bit different than other types of Medicare products; you don’t get to review your plan each year and switch to another during the Annual Election Period.

How much do Medicare Supplement plans in New Hampshire cost?

Premiums are set by the insurance companies themselves, unlike Part A and Part B premiums, which are set at the federal level. Because of this, premiums can vary significantly from plan to plan and company to company.

What else should I know about Medicare Supplement plans in New Hampshire?

Congress made significant changes to the Medicare program in 2015, one of which directly affects Medicare Supplement plans in New Hampshire. As of January 1, 2020, insurers are no longer allowed to sell plans that cover the Part B deductible. This means that two of the most popular plans, Plan C and Plan F, will no longer be available.

What is Medicare Supplement Insurance?

All Medicare Supplement insurance#N#Medicare Supplements are additional insurance policies that Medicare beneficiaries can purchase to cover the gaps in their Original Medicare (Medicare Part A and Medicare Part B) health insurance coverage....#N#carriers in New Hampshire are required to follow both federal and state laws designed to protect you. All Medigap plans must be clearly identified as Medicare Supplement Insurance. Insurance companies must offer the standardized Medicare Plans identified by letters A through N. So, for example, a Plan F from Aetna has exactly the same health coverage as a Plan F from Mutual of Omaha. This is what makes Medigap plans easier to compare vs. an HMO or PPO style plan through Medicare Advantage.

What is Medicare Advantage?

Medicare Advantage (MA), also known as Medicare Part C, are health plans from private insurance companies that are available to people eligible for Original Medicare (Medi care Part A and Medicare Part B).... . At first glance, it looks like Medicare Advantage plans are less expensive and offer more benefits.

What is Medicaid in New Hampshire?

Medicaid is a public health insurance program that provides health care coverage to low-income families and individuals in the United States. ... updates their Medigap cost information annually. We evaluate all Medicare Supplement companies servicing policies in New Hampshire. Our reviews are unbiased.

Is there an open enrollment period for Medicare Supplement?

Unlike Medicare Advantage, there isn't an annual open enrollment period for Medicare Supplement plans. But, in many areas, you only have one chance to apply for a New Hampshire Medigap plan without having to answer any health questions. You can learn more here.

What is sample premium in New Hampshire?

[3] The sample premium is for a 65-year-old, non-smoking, woman living in New Hampshire. The rate was accurate on the date of publication. Rates change frequently and they are priced by county. You must contact a licensed agent to get a current rate for your situation.

What is open enrollment in health insurance?

In health insurance, open enrollment is a period during which a person may enroll in or change their selection of health plan benefits. Health plan enrollment is ordinarily subject to restrictions.... period to enroll or to switch to a new plan.

Is Medicare Supplement Plan G going away?

Medicare Supplement Plan G is rapidly gaining popularity among New Hampshire seniors. With Plan F going away in 2020, it is expected to be the new gold standard. Here are the 10 best Medigap Plan G policies available in New Hampshire based on our reviews (click for details):

What is the most popular Medicare Supplement plan in New Hampshire?

There are 10 Medicare Supplement Plans in New Hampshire to choose from. In New Hampshire, Medicare Supplement Plan G is the most popular plan. Medigap Plans do not use a network, go wherever Original Medicare is excepted. Original Medicare covers the basic benefits of hospital and outpatient services, and Medicare Supplement plans in New Hampshire ...

What happens if you miss the Medigap open enrollment period?

Medigap Open Enrollment Period. This is when you can get the best rates because pre-existing conditions cannot affect the premium amount. If you miss this window to enroll, private insurance companies can charge you more based on current or past health conditions. Outside open enrollment, you can be declined.

What counties in New Hampshire are Medicare Part A?

Merrimack County (147,958) Strafford County (126,552) Grafton County (89,280) The number of New Hampshire residents enrolled in Medicare Part A and Medicare Part B was 286,980 in 2018, according to the Centers for Medicaid Services.

What is the deductible for 2021?

To compensate for the high deductible, premium rates are lower. In 2021, the deductible is $2,370. The plan will cover 100% of the costs after the deductible is met. 5. Best for lowest premiums: High-Deductible Plan G. Same coverage as original Plan G.

When is the F insurance policy restricted?

As in the original F, this insurance policy is restricted to beneficiaries who: Became eligible for Medicare coverage before January 1, 2020 AND. Are not enrolled in a plan. Benefits are the same as the original F, but you must meet a high deductible before benefits are paid.

Does Medicare cover prescriptions in New Hampshire?

Your Medicare Supplement insurance plan in New Hampshire will not include prescription drug coverage. For that, you would need to purchase a Medicare Part D plan. Medicare eligibility to sign up for Medicare begins three months prior to your 65th birthday.

Can you be declined for Medicare Supplement?

Outside open enrollment, you can be declined. Apply the month you turn 65 and are enrolled in Part B. Guaranteed issue rights require insurers to sell Medicare Supplement insurance plans in certain situations outside open enrollment. In that case, you cannot be declined or charged more because of your health condition.

How much does a Medicare Advantage plan cost in New Hampshire?

You’ll find that an Advantage policy can cost you anywhere between $0-$125 each month. In comparison to Medigap, these plans do seem much less expensive. Be sure to choose a plan that carries good ratings.

When will Medigap change to Medigap in New Hampshire?

In 2021, New Hampshire will begin allowing beneficiaries to change from Medigap to Medigap with the same company without worrying about underwriting. The new legislation will allow beneficiaries to make changes during their birthday month.

What is the maximum out of pocket for Medicare?

The Maximum Out of Pocket is an amount beneficiary can’t pay over in the calendar year. Standard Medicare doesn’t offer a Maximum Out of Pocket. This means beneficiaries could spend tens of thousands of dollars during a year of bad health.

What is the benefit of having an Advantage policy instead of Medicare?

An extensive physician network is also a plus. The benefit of having an Advantage policy instead of Medicare is the benefits of a Maximum Out Of Pocket. The Maximum Out of Pocket is an amount beneficiary can’t pay over in the calendar year.

How much does a 65 year old man pay for Plan N?

But, if she goes to the doctor only several times a year, Plan N could bring her more value. Now, a 65-year-old man may end up paying more than $130 a month for Plan N or $150 for Plan G. The idea is the same, if you’re going to be using the coverage frequently, you need more insurance.

Will Medicare change in 2021?

The same legislation allowing beneficiaries to change plans in 2021, will prohibit insurers from charging those under 65 higher Medigap premiums. The new law will give those under 65 access to Medigap coverage at an affordable rate. The change is good news for those on Medicare disability in New Hampshire.

Does New Hampshire have Medicare?

Over 20% of the population in New Hampshire has Medicare. Many New Hampshire enrollees choose to add a Medicare Supplement plan to add additional coverage to their Medicare. Below, we’ll explain how this coverage will work with your benefits.

What happens if you apply incorrectly for health insurance?

• An incorrect application may cause the insurance company to cancel your policy or leave you with unpaid claims. • Do not be misled by agents who tell you your health history does not matter. • Describe your health status completely and accurately.

Where to contact New Hampshire insurance?

• The New Hampshire Insurance Department’s Consumer Division at 800-852 -3416, via email at [email protected] or in writing at 21 South Fruit Street; Suite 14; Concord, NH 03301.

When will Medicare Supplement plans be allowed to cover Part B?

Individuals who are changing plans or who would like to obtain a renewal rate with a specific company should contact the company directly. 4. Starting January 1, 2020 , Medicare Supplement plans sold to new people with Medicare won’t be allowed to cover the Part B deductible.

What to do if you aren't sure if you are on Medicare?

If you aren’t sure whether to enroll in Original Medicare or a Medicare Advantage Plan, a ServiceLink counselor can help. Counselors can also look at your budget and advise you on whether you should purchase Part D drug coverage or a Medigap supplement to reduce your out-of-pocket costs.

What does Medigap cover?

Medigap covers things like Medicare deductibles, coinsurance, and copays.

What is Medicare Supplement Insurance in New Hampshire?

Some New Hampshire residents purchase Medicare Supplement Insurance, commonly referred to as Medigap, to reduce their out-of-pocket health care costs. Medicare Supplement Insurance is only available to beneficiaries with Original Medicare, so you can’t sign up for it if you choose to enroll in Medicare Advantage. If you enroll in a Medicare Supplement Insurance Plan, you’ll pay a monthly premium in addition to the premium you pay for your Original Medicare coverage. Medigap covers things like Medicare deductibles, coinsurance, and copays. Your Medigap plan may even cover the cost of medical services received while you’re traveling outside the United States.

What is a service link?

ServiceLink is the organization that serves as the State Health Insurance Assistance Program for New Hampshire. Trained SHIP counselors provide free, confidential counseling to help Medicare-eligible individuals compare insurance plans. If you aren’t sure whether to enroll in Original Medicare or a Medicare Advantage Plan, a ServiceLink counselor can help. Counselors can also look at your budget and advise you on whether you should purchase Part D drug coverage or a Medigap supplement to reduce your out-of-pocket costs. Once you’re signed up for Medicare, ServiceLink counselors can explain why a claim was denied or whether you should switch from Original Medicare to Medicare Advantage.

What is Medicare in New Hampshire?

Medicare is a federal program that covers health care services for older adults and some younger adults who meet certain eligibility requirements. Original Medicare is broken into Medicare Part A and Medicare Part B, which cover inpatient services (Part A), preventive services (Part B), ...

How does Medicare Part D supplement work?

Medicare Part D supplements Original Medicare by covering a wide variety of prescription drugs. If you decide to buy a Part D supplement, you’ll pay a monthly premium and a copay for each drug. You may also need to pay an annual deductible, but it depends on the terms of your plan.

Which is more restrictive, HMO or PPO?

These plans have different requirements regarding primary care providers and in-network services. HMO plans are the most restrictive, while PPO plans and PFFS plans offer more flexibility. Special-needs plans are limited to beneficiaries with certain health conditions or risk factors for disease.